Portable Power Tools Market Size 2025-2029

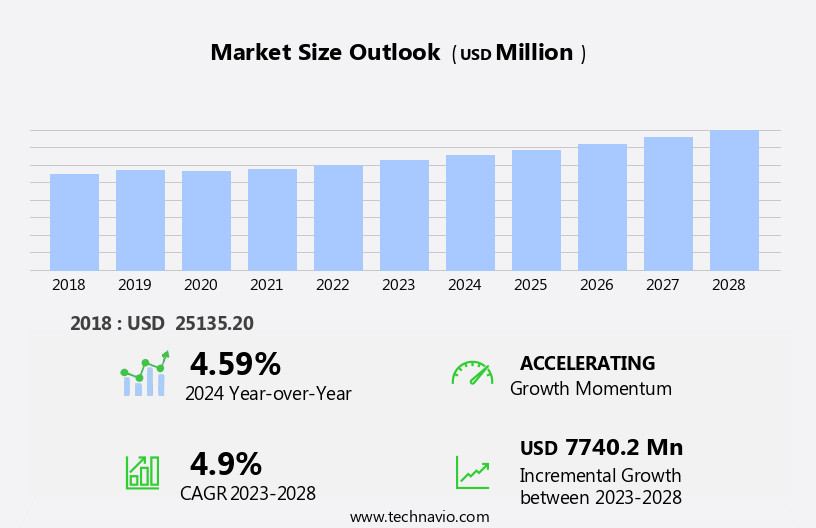

The portable power tools market size is forecast to increase by USD 8.4 billion, at a CAGR of 5.1% between 2024 and 2029.

- The market is driven by the growing demand for DIY building projects and the integration of smart technologies into these tools. The increasing popularity of home renovation and improvement projects, particularly in developed regions, is fueling the demand for portable power tools that offer convenience, efficiency, and advanced features. These tools enable users to complete projects independently, reducing reliance on professional services and saving costs. However, the market faces challenges in expanding its reach in developing and emerging countries due to the low penetration of portable power tools. Despite the potential for significant growth in these markets, the high upfront costs and limited awareness of the benefits of portable power tools remain significant barriers to entry.

- Additionally, the increasing competition from corded power tools and other hand tools, which are often more affordable, further complicates market expansion efforts. Companies seeking to capitalize on market opportunities must focus on developing innovative, cost-effective solutions that cater to the unique needs of these markets while navigating the challenges posed by competition and affordability concerns.

What will be the Size of the Portable Power Tools Market during the forecast period?

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Applications span various sectors, including home improvement and construction. Tools, such as welding machines, offer tool-free adjustments for increased efficiency. Run time and power output are crucial factors for cordless drills and power compressors, while lithium-ion batteries ensure longer usage. Variable speed grinding machines and power shears offer precision and versatility, while staple guns and nail guns streamline fastening processes. Smart features, such as app integration and Bluetooth connectivity, enhance user experience. Circular saws and table saws deliver accurate cuts with digital readouts and cutting guides.

Power hammers and power wrenches provide increased torque and control. Safety features, including hearing protection and safety glasses, ensure user safety. Brushless motors offer improved efficiency and longer motor life. Power tool accessories, tool carts, and tool belts cater to the evolving needs of professionals. Power generators and power cutters extend the reach of portable power tools, enabling work in remote locations. Dust collection systems ensure a cleaner work environment. Sanding sheets and LED lights offer added convenience. The ongoing market dynamics continue to unfold, with continuous innovation shaping the future of portable power tools.

How is this Portable Power Tools Industry segmented?

The portable power tools industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Cordless tools

- Corded tools

- Application

- Commercial

- Consumer

- Distribution Channel

- Offline

- Online

- Price

- Mid-range

- Economy

- Premium

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The cordless tools segment is estimated to witness significant growth during the forecast period. In the realm of power tools, cordless models have gained significant traction due to their mobility and versatility. These tools cater to various applications, such as drilling, grinding, polishing, sanding, and screw driving, which were once the exclusive domain of corded tools. Professionals, including electricians, plumbers, auto mechanics, and service engineers, increasingly prefer cordless tools for their convenience, as they eliminate the need for a constant power source. The evolution of cordless power tools has been marked by the widespread adoption of lithium-ion (Li-ion) batteries. These batteries offer extended runtimes and greater charge storage capacity compared to the traditional nickel-cadmium (NiCd) batteries.

Moreover, Li-ion batteries are more environmentally friendly, as they do not contain toxic heavy metals. Tool-free adjustments and quick-change systems have streamlined the use of cordless power tools, making them even more appealing to professionals. Impact drivers, power compressors, and circular saws are among the popular cordless tools that benefit from these features. Furthermore, advancements in technology have led to the integration of smart features, such as app connectivity and digital readouts, enhancing user experience. Power output and battery life have become crucial factors in the selection of cordless power tools. Grinding machines, welding machines, and power hammers demand high power output, while tools like drill presses and reciprocating saws require long battery life.

The Cordless tools segment was valued at USD 17.55 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, with the US being the leading contributor. This expansion is driven by increasing demand from both professional and individual customers in the US, as well as in other North American economies like Mexico and Canada. The construction industry's substantial drilling, cutting, and sawing requirements, along with the automotive and aerospace and defense industries' numerous assembly operations and metalwork, are key factors fueling the market's growth. Portable power tools' popularity is on the rise due to their convenience and versatility. Tool-free adjustments, power nut drivers, and quick-change systems are becoming increasingly preferred for their time-saving benefits.

Cordless drills, impact drivers, and circular saws are among the most commonly used portable power tools in the construction industry. In the automotive and aerospace and defense industries, power screwdrivers, power wrenches, and grinders are widely utilized. Power compressors, welding machines, and power generators are also essential portable power tools for various applications. Lithium-ion batteries have become a popular choice due to their long battery life and high power output. Safety features, such as hearing protection, safety glasses, and digital readouts, are increasingly being integrated into portable power tools to ensure user safety. Smart features, such as app integration and Bluetooth connectivity, are also gaining popularity, providing users with added convenience and control.

Power tool accessories, tool belts, tool bags, and tool chests are essential for organizing and transporting portable power tools. Cutting guides, speed control, and variable speed are features that enhance the functionality and precision of portable power tools. The market in North America is witnessing substantial growth, driven by the construction, automotive, and aerospace and defense industries' demands for portable power tools. Tool-free adjustments, smart features, and safety features are becoming increasingly important for users, while lithium-ion batteries and brushless motors are preferred for their power and efficiency. The market is expected to continue growing as the demand for portable power tools increases across various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Portable Power Tools Industry?

- The significant demand for DIY building products serves as the primary market driver. The DIY trend is experiencing significant growth globally, particularly in developed markets. This trend is driven by the scarcity of labor and the high costs associated with hiring professionals for home repairs and improvements. The proliferation of the Internet and online retailing has increased awareness and accessibility of DIY building products, even in emerging economies. As a result, more individuals are engaging in DIY activities for small repairs and home improvements, contributing to the expansion of the building products market. Home improvement projects, including woodwork, plumbing, electrical work, and HVAC utility repairs, represent the largest segment of the global DIY market.

- The convenience and cost savings associated with DIY activities have made them increasingly popular for various home improvement projects. Additionally, the availability of a wide range of DIY tools and resources online has further facilitated this trend. The DIY market is experiencing robust growth due to the increasing popularity of DIY activities and the ease of access to tools and resources. Home improvement projects continue to dominate this market, as individuals seek to save costs and take on home repairs and improvements themselves.

What are the market trends shaping the Portable Power Tools Industry?

- Smart technologies are increasingly being integrated into portable power tools, representing a significant market trend. One of the key trends shaping this industry is the increasing preference for cordless, lithium-ion battery-powered tools. Professionals in various industries are embracing this innovation for its efficiency, convenience, and advanced features. The market is witnessing significant growth due to the integration of advanced technologies, enhancing tool functionality and user experience. Tool-free adjustments and quick-change systems in power tools enable users to make adjustments easily and quickly, increasing productivity. Power nut drivers and impact drivers offer high power output and extended battery life, making them popular choices for home improvement projects. Moreover, the introduction of smart technologies, such as Bluetooth connectivity, in portable power tools has revolutionized the industry. This innovation allows users to monitor tool status and ensure safety through tool tracking and battery disabling features. The integration of Industry 4.0 solutions, including artificial intelligence, analytics, and industrial automation, is transforming the industry.

- Tool carts and laser guides facilitate easy transportation and precise sanding, respectively. Power compressors and tool belts are essential accessories that provide additional convenience and functionality. The market is experiencing a shift towards digital connectivity, with established brands introducing innovative solutions to cater to the evolving needs of consumers. This trend is expected to continue, further enhancing the performance and functionality of portable power tools.

What challenges does the Portable Power Tools Industry face during its growth?

- The limited adoption of portable power tools in developing and emerging nations poses a significant challenge to the industry's expansion. The market generates significant revenue from developed countries due to the higher adoption rate among professionals. These tools, including welding machines, grinding machines, power shears, staple guns, lithium-ion batteries, cordless drills, and other variants, offer increased productivity, accuracy, and income for professionals. The higher wages in developed countries enable these professionals to invest in advanced power tools, which are often more expensive than their manual counterparts. These tools provide features such as run time, dust collection, variable speed, smart features, and app integration, making them indispensable for professionals.

- Lithium-ion batteries, for instance, offer longer run times and quicker charging, while smart features and app integration enhance tool functionality and convenience. Overall, the market is driven by the demand for advanced tools that improve productivity, accuracy, and income for professionals in developed countries.

Exclusive Customer Landscape

The portable power tools market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the portable power tools market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, portable power tools market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in providing a range of portable power tools, including the 3M Perfect-It random orbital polisher.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- ANDREAS STIHL AG and Co. KG

- Atlas Copco AB

- C. and E. Fein GmbH

- Draper Tools Ltd.

- Emerson Electric Co.

- Festool GmbH

- Hilti AG

- Husqvarna AB

- Ingersoll Rand Inc.

- J C Bamford Excavators Ltd.

- Koki Holdings Co. Ltd.

- Makita Corp.

- Panasonic Holdings Corp.

- PATTA International Ltd. Taiwan

- Robert Bosch GmbH

- Snap On Inc.

- Stanley Black and Decker Inc.

- Techtronic Industries Co. Ltd.

- YAMABIKO CORP.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Portable Power Tools Market

- In March 2023, Bosch Power Tools introduced its new Cordless Xtreme Max X2 120V Max SDS-max Rotary Hammer, marking a significant advancement in cordless power tools. This innovation allows users to work with heavy-duty rotary hammers without the need for a power cord (Bosch Press Release, 2023).

- In August 2024, Stanley Black & Decker and MTD Products, a leading outdoor power equipment manufacturer, announced a strategic partnership to expand their respective product offerings. The collaboration aims to integrate Stanley Black & Decker's portable power tools into MTD's lawn and garden equipment, providing customers with a more comprehensive solution for their outdoor projects (Stanley Black & Decker Press Release, 2024).

- In January 2025, Milwaukee Tool Corporation raised USD 1.3 billion in a funding round, making it one of the largest investments in the portable power tools industry. The company plans to use the funds for research and development, expanding its product line, and increasing its global presence (Milwaukee Tool Corporation Securities and Exchange Commission Filing, 2025).

Research Analyst Overview

- The market is characterized by continuous innovation, with manufacturers investing heavily in research and development to create more efficient, ergonomic, and versatile tools. Simultaneously, the demand for power tool repairs and certifications is on the rise, as businesses prioritize safety and compliance with regulations. Power tool recycling initiatives are gaining traction, addressing environmental concerns and reducing the carbon footprint of construction sites and workshops. Tool safety training is essential for operators, ensuring they can use power tools effectively and avoid accidents. Power tool applications span various industries, from construction to manufacturing, with each sector requiring specific tool sets and storage solutions.

- Power tool maintenance is crucial for maximizing tool life and efficiency, leading to cost savings in the long run. Regulations governing the use of power tools are becoming increasingly stringent, necessitating regular inspections and certifications. Ergonomic designs are becoming standard, addressing the physical demands of using power tools and reducing user fatigue. Power tool efficiency is a key consideration for businesses, with energy-efficient tools and batteries becoming increasingly popular. Overall, the market is dynamic and evolving, driven by innovation, safety, and sustainability concerns. The Portable Power Tools Market is growing with demand for efficient power tool sets and smart tool storage solutions. Advancements in power tool innovation enhance performance and durability. Compliance with power tool regulations ensures safety and reliability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Portable Power Tools Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 8.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.7 |

|

Key countries |

US, China, Germany, UK, Canada, Japan, France, Brazil, India, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Portable Power Tools Market Research and Growth Report?

- CAGR of the Portable Power Tools industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the portable power tools market growth of industry companies

We can help! Our analysts can customize this portable power tools market research report to meet your requirements.