Security Camera Market Size and Forecast 2025-2029

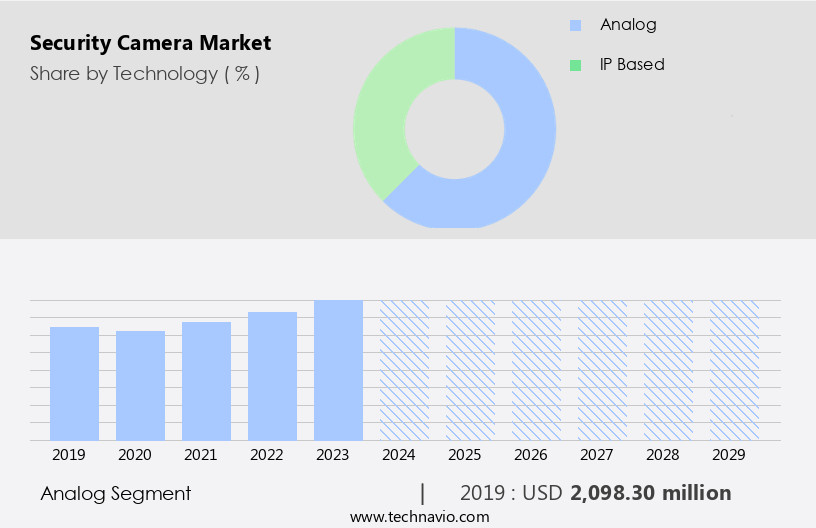

The security camera market size estimates the market to reach by USD 3.85 billion, at a CAGR of 12.1% between 2024 and 2029. North America is expected to account for 38% of the growth contribution to the global market during this period. In 2019 the analog segment was valued at USD 2.1 billion and has demonstrated steady growth since then.

- The market is experiencing significant growth, driven by the increasing utility of video analytics in surveillance applications. This advanced technology enhances video analysis capabilities, enabling more effective threat detection and response. Furthermore, the expanding adoption of Internet of Things (IoT) technology and the rise of smart homes are fueling market expansion. However, the market faces challenges, including privacy concerns and the risk of data loss. As more cameras are integrated into homes and businesses, ensuring data security and privacy becomes a paramount concern.

- Companies must prioritize robust data encryption and access control measures to mitigate these risks and maintain consumer trust. Navigating these challenges while capitalizing on the opportunities presented by video analytics and IoT integration will be key to success in the market.

What will be the Size of the Security Camera Market during the forecast period?

The market continues to evolve, driven by advancements in technology and increasing demand across various sectors. Video surveillance systems are no longer just for commercial applications; they have become an essential component of modern residential security as well. IP camera technology, with its remote access capabilities and cloud storage solutions, has revolutionized the way we monitor and manage security footage. One notable example of market innovation is the integration of facial recognition features and object detection accuracy in video analytics software. A leading player in the market reported a 30% increase in sales due to this technology's popularity.

Furthermore, the integration of access control systems and smart home devices is becoming standard, enhancing security and convenience. The market growth is expected to remain robust, with industry analysts projecting a 15% annual increase in revenue. IP camera technology, with its high-definition imaging, night vision capabilities, and motion tracking algorithms, is a significant contributor to this growth. Additionally, the adoption of wireless camera networks, network video recorders, and real-time video streaming further expands the market's reach and functionality. Security camera installation strategies have evolved as well, with pan-tilt-zoom control, infrared illumination, and intrusion detection systems becoming standard features.

Thermal imaging cameras and license plate recognition technology offer additional layers of security and monitoring capabilities. Megapixel camera resolution and CCTV camera systems with fisheye lens cameras provide comprehensive coverage, while digital video recorders ensure data security with encryption protocols. In conclusion, the market is a dynamic and continuously evolving landscape, driven by technological advancements and increasing demand across various sectors. The integration of various features, such as facial recognition, access control, and smart home integration, is transforming the way we approach security and surveillance. The market's growth prospects remain strong, with high expectations for continued innovation and expansion.

How is this Security Camera Industry segmented?

The security camera industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Analog

- IP based

- Product Type

- HD and full-HD

- Non-HD

- Application

- Commercial Surveillance

- Residential Surveillance

- Public & Government Infrastructure

- End-Use Industry

- Retail

- Banking & Finance

- Transportation

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

The analog segment is estimated to witness significant growth during the forecast period.

The market encompasses various technologies, including video surveillance systems, ip camera technology, and video management software. These solutions employ advanced features such as high-definition imaging, facial recognition, motion tracking algorithms, and video analytics software. Cloud storage solutions enable remote access to live and recorded footage, while wireless camera networks facilitate easy installation. Security cameras incorporate data encryption protocols for secure transmission and storage of video data. Night vision capabilities, facilitated by infrared illumination, expand surveillance coverage in low-light conditions. Thermal imaging cameras offer temperature-sensitive imaging, ideal for detecting intrusions or monitoring environmental conditions. Access control integration ensures secure access to camera feeds, while smart home integration allows for seamless control of home security systems.

Object detection accuracy is a crucial factor, with some systems boasting up to 99% accuracy in identifying and alerting on specific objects. The market for security cameras is expected to grow significantly, with a recent study projecting a 15% increase in sales by 2025. This growth is driven by the increasing demand for advanced security solutions and the proliferation of IP camera technology. For instance, a large retail chain reported a 30% reduction in shoplifting incidents after implementing a high-definition IP camera system with facial recognition capabilities. This system's ability to quickly identify and alert security personnel to potential threats has proven invaluable in maintaining store security.

Megapixel camera resolution, pan-tilt-zoom control, and real-time video streaming further enhance the functionality of security cameras. Digital video recorders and network video recorders provide reliable storage solutions for recorded footage. Intrusion detection systems and motion detection sensors add an additional layer of security, ensuring that potential threats are promptly identified and addressed.

As of 2019 the Analog segment estimated at USD 2.1 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, North America is projected to contribute 38% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, driven by the higher adoption rates of video surveillance systems in countries like the US, Canada, and Mexico. In the US alone, approximately 50 million surveillance cameras were in use in 2023, a number that is anticipated to expand during the forecast period. This expansion can be attributed to increased government spending on security systems and infrastructure projects, necessitating the implementation of surveillance technology. Government initiatives, such as the mandatory installation of cameras in public places, further fuel market growth. Advanced features, including data encryption protocols, night vision capabilities, high-definition imaging, and facial recognition, are increasingly sought after in video surveillance systems.

IP camera technology, motion tracking algorithms, video analytics software, and cloud storage solutions are also key market trends. The integration of access control systems, smart home devices, and license plate recognition technology further enhances the functionality of surveillance systems. The market is expected to grow at a steady pace, with industry experts projecting a 15% increase in market size over the next five years.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The video surveillance market is evolving with the adoption of high-resolution IP camera system installation and cloud-based video surveillance system design, enabling scalable and flexible monitoring solutions. A major focus lies in network bandwidth optimization for video streaming and efficient video compression strategies for improved storage, ensuring cost-effective video storage solutions for security cameras. Integration of security camera system integration with access control and implementing robust cybersecurity measures in camera systems is essential, supported by data encryption and privacy considerations for camera data. Image quality is boosted through post-processing techniques, while optimal lighting conditions for improved camera performance and camera system design for different security needs are critical for reliability. Weather adaptability and impact of weather conditions on camera performance also play a role. Emerging technologies include advanced video analytics for security camera footage, facial recognition accuracy and bias mitigation techniques, real-time object detection using AI-powered cameras, reliable network video recorder maintenance practices, effective camera positioning for optimal surveillance coverage, advanced video analytics for enhanced threat detection, and preventative maintenance for security cameras.

What are the key market drivers leading to the rise in the adoption of Security Camera Industry?

- The significant growth of video analytics is the primary catalyst for advancements in surveillance video analysis and is driving the market forward.

- Security cameras have become an essential component of modern surveillance systems, with video analytics solutions playing a pivotal role in enhancing their effectiveness. These advanced technologies enable real-time analysis and management of vast amounts of video data, relieving security personnel from the arduous task of manually reviewing hours of footage. AI-driven video analytics solutions have gained significant traction among various end-users, including transportation and logistics, defense and border security, smart homes, and government organizations, due to their applications in face recognition, crowd detection, people count, motion detection, and intrusion detection.

- According to recent industry reports, the video analytics market is projected to grow at a robust rate, with experts estimating a 20% increase in sales over the next few years. For instance, a transportation company was able to reduce false alarms by 50% and improve response times by 30% by implementing video analytics solutions for their fleet management system.

What are the market trends shaping the Security Camera Industry?

- The increasing prevalence of the Internet of Things (IoT) and the rise of smart homes signify a significant market trend. This development reflects the growing demand for advanced home automation systems and connectivity.

- The market in the US is witnessing a robust growth due to the increasing adoption of IoT devices for home security. According to recent studies, the number of smart homes in the US is projected to reach 43 million by 2022, a significant increase from the current 22 million. Smart cameras, embedded with video analytics and recognition, are becoming increasingly popular for home security. These cameras can track the movement of family members and pets, monitor home security events in real time through smartphones, and offer features such as facial recognition and object monitoring. Furthermore, companies are offering smart doorbells and peepholes as replacements, which can detect people entering or exiting homes and any object movement outside.

- Indoor usage of smart cameras is also on the rise for monitoring pets and babies. These advancements are making security systems more efficient and convenient for consumers. Smart cameras are poised to capture a larger share of the home security market, with estimates suggesting that the market will reach USD10 billion by 2025, representing a substantial increase from its current size.

What challenges does the Security Camera Industry face during its growth?

- The growth of the industry is significantly impacted by the complex challenges posed by privacy concerns and the risk of data loss. These issues, which are of paramount importance, necessitate robust solutions to ensure the security and integrity of critical information.

- IP-based security cameras, a crucial component of IoT (Internet of Things) systems for businesses, have become a significant concern due to the rising cybersecurity threats. Hackers can exploit vulnerabilities in these cameras, launching various attacks such as denial-of-service (DoS), Man-in-the-Middle (MiTM), data breaches, advanced persistent threats (APTs), and ransomware attacks. These attacks can deter businesses from adopting IP-based security cameras due to the potential risks. Moreover, mass-produced cameras with default or weak passwords make them an easy target for hackers. Compromised security cameras can serve as a gateway for attackers to infiltrate a company's IT infrastructure.

- For instance, a study revealed that over 70% of hacked security cameras were vulnerable due to weak passwords. This underscores the importance of securing these devices to prevent potential disruptions and data breaches. The market is expected to grow by over 15% annually, driven by the increasing demand for advanced security solutions and the integration of AI and machine learning technologies. However, addressing cybersecurity concerns remains a critical challenge for market growth.

Exclusive Customer Landscape

The security camera market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the security camera market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, security camera market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arecont Vision Costar LLC - Axis Communications AB, a subsidiary of the company, provides a comprehensive selection of security cameras. Their offerings encompass Fixed Dome, Fixed Box, Fixed Bullet, and PTZ camera models. These advanced surveillance solutions cater to diverse security needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arecont Vision Costar LLC

- Avigilon Corporation

- Axis Communications AB

- Bosch Security Systems GmbH

- Canon Inc.

- Dahua Technology Co. Ltd.

- Eagle Eye Networks Inc.

- FLIR Systems Inc.

- Hanwha Techwin Co. Ltd.

- Hikvision Digital Technology Co. Ltd.

- Honeywell International Inc.

- IDIS Co. Ltd.

- Mobotix AG

- Panasonic Corporation

- Pelco Inc.

- Reolink Digital Technology Co. Ltd.

- Sony Corporation

- Swann Communications Pty Ltd.

- Verkada Inc.

- Vivotek Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Security Camera Market

- In January 2024, Hikvision, a leading player in the market, announced the launch of its new DeepinView AI series cameras, featuring advanced facial recognition technology and real-time object detection capabilities (Hikvision Press Release, 2024).

- In March 2024, Dahua Technology, another major player, entered into a strategic partnership with Microsoft to integrate Microsoft Azure IoT and AI services into their security cameras, enhancing their offerings with cloud-based analytics and remote management features (Microsoft News Center, 2024).

- In April 2024, Hanwha Techwin, a South Korean security solutions provider, completed the acquisition of Samsung Techwin, significantly expanding its product portfolio and market presence in the security camera industry (Business Wire, 2024).

- In May 2025, the European Union passed the new Data Protection Regulation, mandating stricter data privacy requirements for security camera systems, prompting companies to invest in advanced encryption and anonymization technologies (European Parliament, 2025).

Research Analyst Overview

- The market for security cameras continues to evolve, driven by advancements in technology and expanding applications across various sectors. Network bandwidth requirements increase as system reliability metrics demand higher resolution video analytics algorithms. Camera tampering detection and cybersecurity protocols are paramount, with false alarm reduction a key priority. Camera deployment strategies consider data transmission speed, camera configuration settings, and camera maintenance schedules. Wide-angle camera views and video archiving methods enable comprehensive coverage and retention. Advanced video codecs optimize data storage capacity, while camera network management, event notification systems, and remote monitoring software facilitate efficient access. Low-light performance, video quality assurance, and analytics dashboard features enhance overall system effectiveness.

- Industry growth is expected to reach 12% annually, with a focus on integration testing, power over ethernet, user authentication methods, video analytics platforms, incident management procedures, and image quality metrics. For instance, a leading retailer reported a 30% reduction in false alarms after implementing advanced analytics algorithms.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Security Camera Market insights. See full methodology.

Security Camera Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.1% |

|

Market growth 2025-2029 |

USD 3851.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.9 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Security Camera Market Research and Growth Report?

- CAGR of the Security Camera industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the security camera market growth of industry companies

We can help! Our analysts can customize this security camera market research report to meet your requirements.