Programming Language Training Market Size 2024-2028

What will be the size of the Market During the Forecast Period?

To learn more about this report, Download Report Sample

Market Dynamic

In the digital era, the landscape of software programs and scripts is enriched by versatile languages like C, Python, Ruby, PHP, and Java. These languages serve as foundational tools for developing everything from basic scripts to sophisticated applications. With the rise of machine learning and AI technologies, these languages play pivotal roles in building intelligent systems that automate processes and enhance decision-making. Cloud solutions further enable scalability and accessibility, supporting seamless deployment and management of applications globally. From computer-assisted learning to mobile-assisted language learning via cell phones, these tools offer personalized learning experiences. Self-assessment modules gauge progress, while software-enabled technology enhances interactivity and engagement. This integrated approach not only empowers learners but also caters to diverse educational needs, bridging language barriers and fostering global communication. As demand grows for flexible, tech-driven learning solutions, this market continues to innovate, shaping the future of language education worldwide.

Key Market Driver

The increased emphasis on blended learning is notably driving market growth. Blended learning has many benefits both in academic and corporate training. It helps companies and colleges cut their training costs. It also provides learners with real-time access and allows them the benefits of live learning. It gives more control to learners and allows them to learn at their own pace. It provides the training institutes with a consistent medium of training; in the corporate training scenario, it can lead to higher employee retention. As a result, many companies have significant scope to develop various learning technology solutions that can be effectively implemented in the blended learning framework.

Moreover, the blended learning model involves learning from traditional activities in the classroom along with web-enabled courses. Blended learning blends face-to-face learning with online learning and is becoming an attractive model in the higher education sector, especially in programming. Increasing emphasis on online training is one of the factors driving the growth of this model. Corporate companies are adopting the blended learning model to train their employees. The major reason for the adoption of the blended model of programming language training is the flexibility and convenience that the model provides to learners. As programming language training involves extensive practical learning methods, integrating new learning technologies has only made the overall learning process more effective. With these new learning frameworks, students understand concepts faster, providing them the flexibility to learn more advanced levels in the same subjects. The blended learning model is expected to grow during the forecast period due to its increased adoption in the academic as well as non-academic sectors leading to market growth.

Significant Market Trend

Increased integration of e-learning is a major trend in the market. In its early stages, e-learning relied heavily on desktop computers and networks. However, currently, it has evolved into systems that encompass a variety of channels, such as wireless communications and technologies, such as smartphones, AR, VR, and wearables. E-learning provides organizations with the convenience of flexible timings for training schedules, which can be accessed anytime and anywhere, with just an Internet connection.

Moreover, this helps the employees to incorporate training into their work schedule as opposed to participating in programs that clash with work projects that require both time and travel. In addition, online learning can be updated as and when information or technology changes, unlike printed books and manuals. One of the key benefits of online training is the cost-saving associated with delivering training modules. Thus, e-learning is expected to have a greater prospect in the market during the forecast period.

Major Market Challenge

The inconsistency in training is a major challenge impeding market growth. When it comes to the market, there are many risks associated with inconsistent training. Every service may be different, and standardization of the training offerings poses a huge challenge. The crucial aspect here is to identify the specific needs of learners and cater to those needs. When it comes to corporate training, different companies will have different requirements and different needs. Further, the demand for programming language has increased only in the past 3-4 years owing to the high application of analytics in various industries. As a result, potential learners have little understanding of the best programming language course they can pursue.

However, the degree of expertise that students have in a language will vary, and their exposure level to the new programming languages may differ. Hence, it becomes difficult to cater to all the different needs of clients with a standardized model. Apart from this, as there are many companies at the disposal of the client, training institutes have lower bargaining power. In the academic scenario, each student has different levels of learning, and the main challenge that programming language training companies encounter is to ensure that students with lower learning abilities understand the programming language. Such factors will negatively impact the growth of the market during the forecast period.

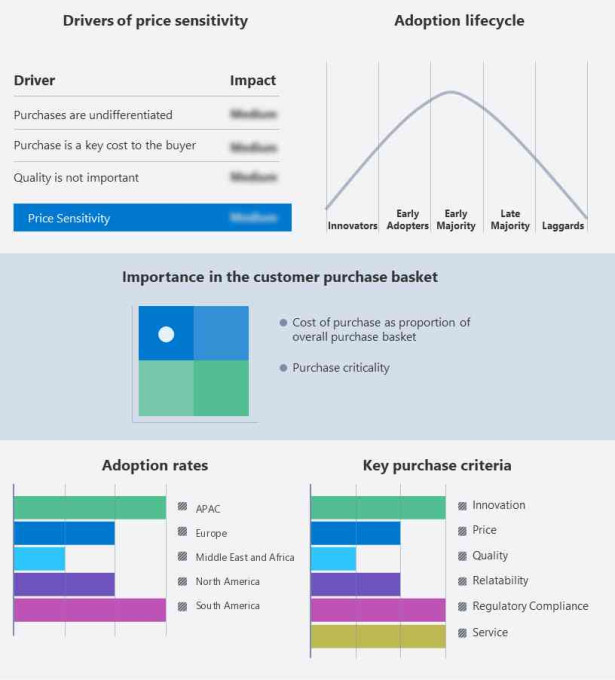

Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Coursera - The company?offers certifications for single courses, specializations, and catalog-wide subscriptions. The company's key offerings include programming language training.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Barcelona Code School

- DataCamp Inc.

- Dataquest Labs Inc.

- Eduonix Learning Solutions Pvt. Ltd

- edX LLC

- Global Knowledge Training LLC

- Learning Tree International Inc.

- LinkedIn Corp.

- Online Consulting Inc.

- PTR

- Simplilearn Solutions Pvt. Ltd.

- Udacity Inc.

- Udemy Inc.

- Aptech Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

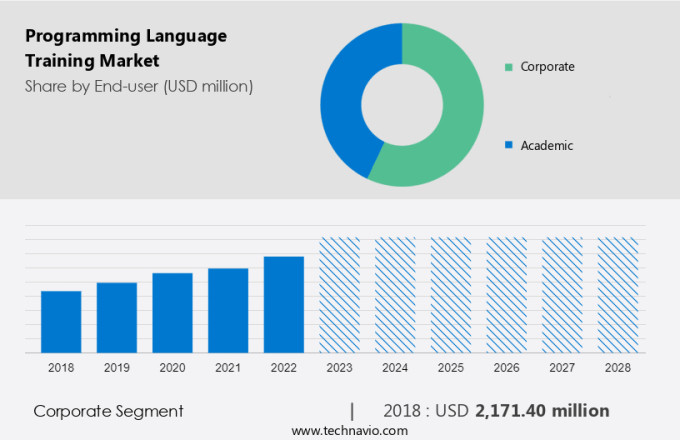

What is the Fastest-Growing Segment in the Market?

The market share growth by the corporate segment will be significant during the forecast period. The major contribution to the market is from the corporate sector, which consists of programming language training provided to employees.

Get a glance at the market contribution of various segments Request a PDF Sample

The corporate segment shows a gradual increase in the market share of USD 2.17 billion in 2018. Traditionally, programming language training was primarily provided to the employees either in-house or at the training institute's premises. But in the current scenario, blended learning has become the need of the hour and is gaining traction. In this model, there is a mixture of both online and offline activities. This is one of the major contributions to the growth of the market. Another contribution to this market has been the discovery of Big Data software such as R and Scala. With the increased use of Big Data, the demand for candidates who excel in analytical software is increasing. Big Data is being used in all fields of procurement to measure the company's performance. Hence, companies are heavily investing in Big Data analytics and are training their employees on it. Such factors will contribute to the growth of the corporate segment in the market during the forecast period.

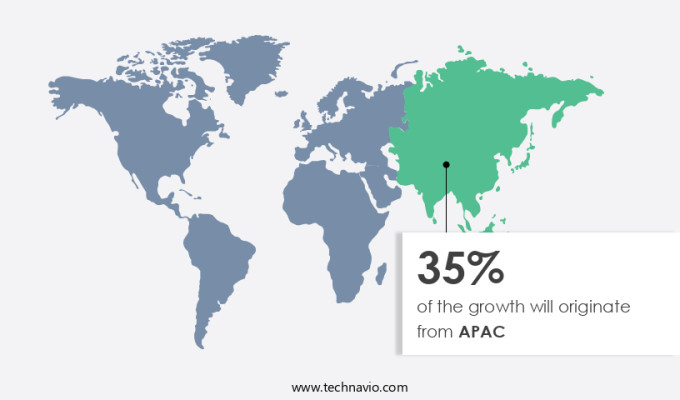

Which are the Key Regions for the Market?

For more insights on the market share of various regions Request PDF Sample now!

APAC is projected to hold a share of 35% by 2028. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market has experienced significant growth due to the increasing demand for advanced languages in Corporate offices and IT sectors. PyTorch and TensorFlow, being open-source machine learning libraries, have gained traction due to their ease of use and flexibility. Overall, the language segment is expected to continue its growth trajectory in the coming years.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- End-user Outlook

- Corporate

- Academic

- Product Outlook

- Online

- Classroom

- Bootcamp

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Brazil

- Argentina

- North America

Market Analyst Overview

The JavaScript language continues to be pivotal in the artificial intelligence market by enabling interactive and dynamic web-based applications. In tandem, computational simulations leverage JavaScript's capabilities for real-time modeling and analysis across various domains, including manufacturing industries and academic institutions. Online learning Bootcamp courses cater to the IT industry, equipping professionals with language proficiency in emerging technologies like Python (PYPL) and advanced frameworks such as PyTorch and TensorFlow for machine learning.

Further, these courses blend computer-assisted learning and automation to streamline education delivery, supported by data and analytics insights from platforms like Stack Overflow and TIOBE. Moreover, the JavaScript ecosystem thrives with developer-friendly features enhancing automation in corporate offices and educational institutions alike. As demand for language segment expertise grows, JavaScript's versatility and adaptability continue to drive innovation in the IT landscape, shaping the future of digital transformation and computational advancements.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.31% |

|

Market Growth 2024-2028 |

USD 8.53 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.95 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 35% |

|

Key countries |

US, China, Canada, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aptech Ltd., Barcelona Code School, Coding Blocks Pvt. Ltd., Coursera Inc., DataCamp Inc., Dataquest Labs Inc., Eduonix Learning Solutions Pvt. Ltd, edX LLC, Firebrand Training Ltd., Global Knowledge Training LLC, Learning Tree International Inc., LinkedIn Corp., NetCom Learning, NIIT Ltd., Online Consulting Inc., PTR, Simplilearn, Udacity Inc., and Udemy Inc. |

|

Market dynamics |

Parent market growth analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Forecast Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch