Rigid Recycled Plastics Market Size 2025-2029

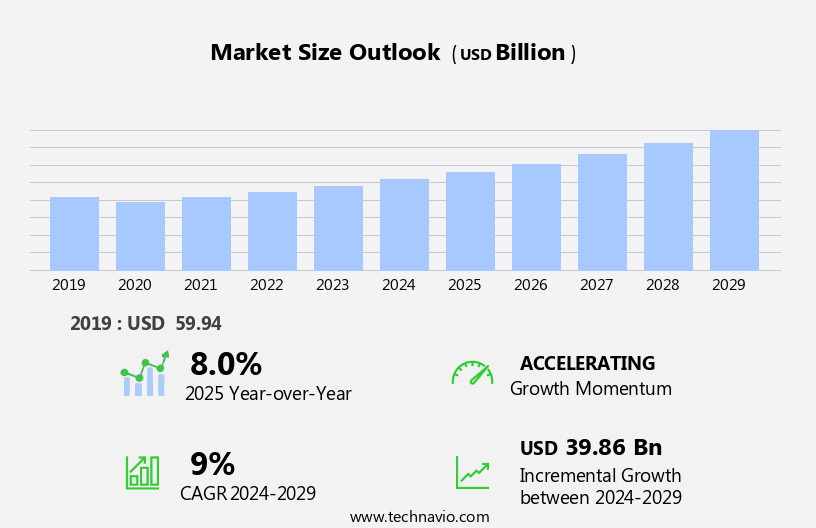

The rigid recycled plastics market size is forecast to increase by USD 39.86 billion at a CAGR of 9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for eco-friendly solutions and the automotive industry's shift towards sustainable manufacturing. Recycled plastics offer a viable alternative to virgin materials, reducing the carbon footprint and addressing environmental concerns. In the automotive sector, the use of recycled plastics in manufacturing components such as interior parts and exterior panels is on the rise, due to cost savings and regulatory compliance. However, market expansion is not without challenges. Strict government regulations governing the use of recycled plastics in various applications necessitate stringent quality control measures.

- Compliance with these regulations can be costly and complex, requiring significant investment in technology and infrastructure. Nevertheless, companies that successfully navigate these challenges stand to gain a competitive edge in the market. By focusing on innovation, sustainability, and regulatory compliance, businesses can capitalize on the growing demand for recycled plastics and secure long-term growth opportunities.

What will be the Size of the Rigid Recycled Plastics Market during the forecast period?

- The recycled plastic market encompasses a diverse range of applications, including toys, blends for various industries, siding, insulation, fibers, alloys, roofing, furniture, textiles, apparel, filaments, compounds, footwear, decking, resins, foams, lumber, composites, and electronics. This market is experiencing significant growth as businesses and consumers increasingly prioritize sustainability. Recycled plastic blends offer cost savings and reduced environmental impact, making them an attractive alternative to virgin materials. For instance, recycled plastic siding and insulation can lower construction costs and energy consumption. In the automotive sector, recycled plastic composites are being used to manufacture components, such as interior panels and exterior parts.

- Additionally, recycled plastic filaments are gaining popularity in the 3D printing industry due to their versatility and environmental benefits. The trend towards circular economy solutions is propelling the recycled plastic market forward, with various industries embracing this eco-friendly material for innovative applications.

How is this Rigid Recycled Plastics Industry segmented?

The rigid recycled plastics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- PET

- HDPE

- PP

- LDPE

- Others

- End-user

- Packaging

- Construction

- Automotive

- Electrical and electronic components

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- France

- Germany

- UK

- North America

- US

- Canada

- Middle East and Africa

- South America

- Brazil

- APAC

By Type Insights

The pet segment is estimated to witness significant growth during the forecast period.

The market encompasses the production and utilization of recycled plastic pellets derived from post-consumer and post-industrial waste. These pellets are manufactured from recycled polyethylene terephthalate (PET), a resin created by combining modified ethylene glycol and purified terephthalic acid. After being extracted from waste streams, PET flakes are processed into pellets through various stages, including washing, separation, and melting. Recycled PET pellets offer several advantages, such as cost-effectiveness, lightweight properties, and the ability to be resealed and shatterproof. Additionally, they exhibit high tensile strength, thermostability, and transparency, making them suitable for a wide range of applications. In the consumer goods sector, recycled PET is used to manufacture bottles and containers for beverages and perishable foods.

It also finds use in the production of mouthwash containers, furniture, and winter clothing fibers. Industry associations and government regulations play a crucial role in promoting recycling rates and ensuring the quality control and material traceability of recycled plastic pellets. Mechanical and chemical recycling processes are employed to transform waste plastics into pellets, reducing the carbon footprint and the reliance on virgin plastics. The circular economy model, which prioritizes the reuse and recycling of materials, is gaining momentum in various industries, including building and construction, packaging, and consumer goods. Recycled plastic pellets are also used in the production of recycled high-density polyethylene (HDPE) and recycled polypropylene (PP) pellets, which are utilized in various applications, such as injection molding, blow molding, and extrusion processes.

New technologies, such as advanced recycling and compostable plastics, are being explored to further expand the market and address the environmental concerns associated with plastic waste. The recycling infrastructure and supply chain transparency are essential components of the recycled plastic market, ensuring that the recycled pellets meet the required standards and specifications. The use of recycled plastic pellets not only contributes to a more sustainable production process but also offers price competitiveness compared to virgin plastics. As the demand for eco-friendly and cost-effective solutions continues to grow, the market is expected to experience significant growth and innovation.

Get a glance at the market report of share of various segments Request Free Sample

The PET segment was valued at USD 34.00 billion in 2019 and showed a gradual increase during the forecast period.

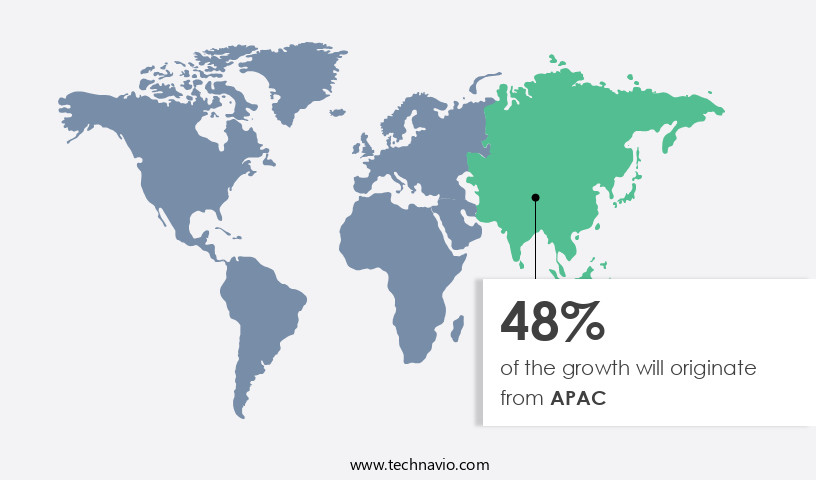

Regional Analysis

APAC is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific (APAC) holds a substantial share in the global market due to the region's expanding automotive production, textile industry, and construction sector. In particular, the automotive industry is a significant consumer of rigid recycled plastics due to their superior mechanical properties, including high tensile strength, stiffness, creep resistance, and excellent wear resistance. These properties enable vehicles to reduce overall mass and improve fuel efficiency, making them indispensable in the automotive industry. China, being the largest automobile producer in APAC, significantly contributes to the demand for rigid recycled plastics in the region.

Additionally, the textile industry utilizes recycled plastics for producing fibers and filaments, while the construction sector employs recycled plastic pipes and profiles. The circular economy concept, which s waste reduction and resource conservation, further propels the demand for recycled plastics in various industries. Government regulations and industry associations are also promoting the use of recycled plastics to minimize carbon footprint and enhance sustainability. The recycling infrastructure in APAC is evolving, with advancements in mechanical and chemical recycling techniques, enabling the production of high-quality recycled plastic granules, pellets, flakes, and sheets. The price competitiveness of recycled plastics, coupled with their performance characteristics, makes them a viable alternative to virgin plastics in various applications, including consumer goods, building and construction, and non-durable and durable goods.

New technologies, such as plastics-to-fuel conversion and advanced recycling, are also gaining traction, offering potential growth opportunities in the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Rigid Recycled Plastics Industry?

- Environment-friendly nature of recycled plastics is the key driver of the market.

- Rigid recycled plastics have emerged as a viable alternative to conventional plastics, which have long been a source of environmental concern. According to , the production of rigid recycled plastics results in a lower environmental impact compared to conventional plastics, which are typically manufactured using natural gas or petroleum. Technological advancements have driven plastic manufacturers to prioritize sustainability and eco-friendliness in their production processes. Companies such as Unilever Group, Procter and Gamble Co., and The Coca-Cola Co. Are leading the charge by emphasizing closed-loop cycles for their products. This approach not only enhances their social responsibility and sustainability efforts but also reduces their carbon footprint.

- The shift towards eco-friendly plastic manufacturing is a significant trend in the industry, with numerous plastic manufacturers modifying their processes accordingly. This transition not only benefits the environment but also caters to growing consumer demand for sustainable products. As the market for rigid recycled plastics continues to evolve, it is expected to offer numerous opportunities for growth and innovation.

What are the market trends shaping the Rigid Recycled Plastics Industry?

- Increasing demand for recycled plastics in automotive industry is the upcoming market trend.

- Rigid recycled plastics play a significant role in the production of lightweight automotive components, making up a substantial portion of plastics and composites used in the industry. These materials are employed in various applications, including structural, powertrain, exterior and interior, and electronic and electrical components. Automakers prioritize the use of lightweight, fuel-efficient, and eco-friendly materials to comply with environmental regulations and meet consumer demand for sustainable vehicles. China, Germany, India, France, Italy, South Korea, Japan, and the United States are among the countries producing automotive components with recycled plastics.

- The expansion of economic activity in emerging nations, resulting in an increase in per capita income, further fuels the demand for these components. Rigid recycled plastics contribute to reducing vehicle weight, fuel consumption, and greenhouse gas emissions, making them an essential component in the automotive industry's shift towards sustainability.

What challenges does the Rigid Recycled Plastics Industry face during its growth?

- Stringent government regulations associated with use of recycled plastics is a key challenge affecting the industry growth.

- The European Food Safety Authority (EFSA) and the Food and Drug Administration (FDA) regulate the use of rigid recycled plastics in food packaging. Through programs like the Food Contact Notification Program and the Food Additive Regulations, these organizations ensure the safety of materials used in food packaging. While the FDA does not mandate a special regulatory review for recycled food contact materials, they must adhere to the same regulatory specifications as conventional materials.

- Compliance with the FDA Good Manufacturing Practices (GMP) for food contact materials (21 CFR Section 174) is mandatory. These regulations ensure the production of safe and sanitary food contact materials, maintaining consistency and integrity for both conventional and recycled plastics.

Exclusive Customer Landscape

The rigid recycled plastics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rigid recycled plastics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rigid recycled plastics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amcor Limited - The company specializes in manufacturing high-performance rigid plastics, including lightweight bottles crafted from post-consumer recycled HDPE. This eco-friendly approach not only contributes to sustainability objectives but ensures consistent product quality. By utilizing recycled materials, we reduce waste and promote circular economy principles. Our product line caters to diverse industries, delivering reliable and sustainable solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Limited

- DS Smith Plc

- Sonoco Products

- Envision Packaging

- ALPLA Group

- Berry Global Group, Inc.

- KW Plastics

- MBA Polymers Inc.

- B and B Plastics Inc.

- Covestro AG

- Custom Polymers

- HAHN Kunststoffe GmbH

- Indorama Ventures Public Co. Ltd.

- Silgan Holdings Inc.

- SUEZ Recycling & Recovery

- B. Schoenberg & Co., Inc.

- Veolia Environment SA

- J and A Young Leicester Ltd.

- NaturaPCR

- PET Processors LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of applications, with packaging being a significant sector. The demand for chemically resistant recycled plastics is on the rise due to their ability to withstand various environmental conditions and prolong the shelf life of packaged products. Supply chain transparency is becoming increasingly important in the market, as consumers and businesses seek to ensure the ethical sourcing and production of these materials. The environmental impact of plastic waste and the need for sustainable solutions have brought recycled plastics to the forefront of industry discussions. Mechanical properties such as strength, durability, and flexibility are crucial considerations in the production of recycled plastic bottles, profiles, pipes, and sheets.

Industry associations play a vital role in setting recycled plastic standards and promoting best practices within the market. Recycling rates for rigid plastics have seen steady growth, with post-industrial recycled plastics leading the way due to their consistent quality and material traceability. The price competitiveness of recycled plastics compared to virgin materials has also contributed to their increasing adoption. Chemical recycling and advanced recycling technologies offer new opportunities for the processing of recycled plastic granules, pellets, and flakes. These methods enable the production of high-quality recycled polyethylene terephthalate (PET), polystyrene, and other polymers, while reducing the carbon footprint of the industry.

The circular economy concept is gaining traction in various sectors, including consumer goods, building and construction, and the agricultural industry. Recycled high-density polyethylene (HDPE) and polypropylene (PP) are commonly used in the production of durable goods, while biodegradable and compostable plastics provide eco-friendly alternatives for non-durable goods. Government regulations and consumer pressure continue to drive the development of recycling infrastructure and the implementation of recycled content targets. The recycling industry is constantly evolving, with new technologies such as plastics-to-fuel conversion and recycled plastic films offering innovative solutions for waste reduction and resource efficiency. Injection molding and blow molding are essential processes in the production of recycled plastic products, with performance characteristics such as dimensional accuracy and surface finish playing a significant role in their market acceptance.

The recycled plastic market is expected to continue growing as businesses and consumers embrace the circular economy and seek sustainable alternatives to virgin plastics.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 39.86 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

China, US, Germany, Japan, India, UK, Canada, France, Saudi Arabia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rigid Recycled Plastics Market Research and Growth Report?

- CAGR of the Rigid Recycled Plastics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rigid recycled plastics market growth of industry companies

We can help! Our analysts can customize this rigid recycled plastics market research report to meet your requirements.