Food Packaging Market Size 2025-2029

The food packaging market size is forecast to increase by USD 79.6 billion, at a CAGR of 4.1% between 2024 and 2029. Prevention of food counterfeiting will drive the food packaging market.

Major Market Trends & Insights

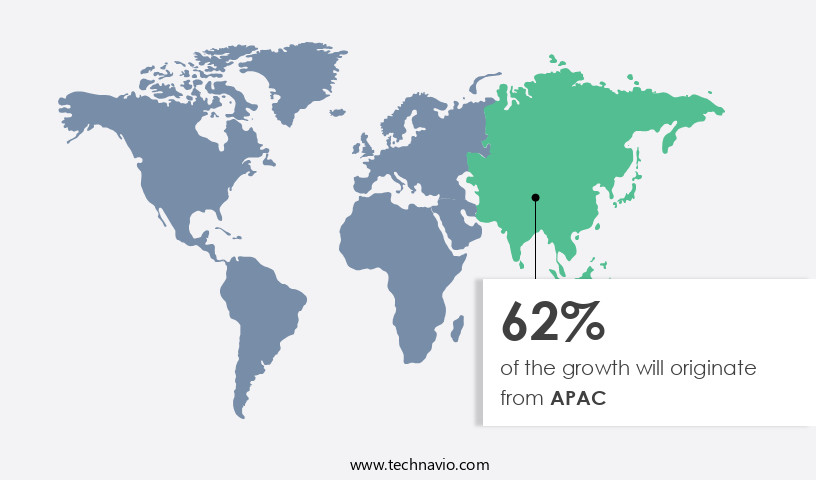

- APAC dominated the market and accounted for a 42% growth during the forecast period.

- By Product - Flexible plastic segment was valued at USD 153.30 billion in 2023

- By Application - Bakery and confectionery segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 43.91 billion

- Market Future Opportunities: USD 79.60 billion

- CAGR : 4.1%

- APAC: Largest market in 2023

Market Summary

- The market is a dynamic and evolving industry, driven by various factors that shape its growth trajectory. Core technologies such as active and intelligent packaging, biodegradable materials, and nanotechnology continue to revolutionize the market, offering enhanced food preservation, safety, and convenience. Applications in food processing, retail, and foodservice sectors are witnessing significant growth, with the e-commerce segment experiencing a surge due to increasing sales of food products online. However, challenges persist, including volatility in raw material prices and the need to prevent food counterfeiting.

- According to recent reports, the active packaging market is projected to account for over 30% of the overall the market share by 2025. As related markets such as the pharmaceutical packaging and beverage packaging industries continue to expand, the market is poised for continued innovation and growth in the forecast period.

What will be the Size of the Food Packaging Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Food Packaging Market Segmented and what are the key trends of market segmentation?

The food packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Flexible plastic

- Rigid plastic

- Glass

- Metal

- Others

- Application

- Bakery and confectionery

- Dairy products

- Poultry meat and sea food

- Fruits and vegetables

- Others

- Packaging

- Bags and pouches

- Bottles and jars

- Films and wraps

- Boxes and cartons

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The flexible plastic segment is estimated to witness significant growth during the forecast period.

The market is a dynamic and evolving industry, with ongoing advancements in technologies and materials shaping its growth. Flexible plastic packaging, which includes bags, pouches, liners, wraps, and sachets, currently holds the largest market share at approximately 37% due to its numerous advantages. These benefits include customizable shapes and sizes, reusability, lightweight nature, and a wide range of printing options. Moreover, the industry anticipates significant growth in the coming years, with the modified atmosphere packaging segment projected to expand by 21% and high-pressure processing expected to increase by 18%. The adoption of biodegradable packaging materials, such as those made from plant-based sources, is also on the rise, with a projected growth of 15%.

Shelf life extension, food preservation techniques, and packaging cost reduction are key drivers in the market. Packaging material selection, sourcing, and optimization play crucial roles in ensuring product freshness and safety. Technologies like intelligent packaging, seal integrity testing, and leak detection systems contribute to improving product quality and consumer perception. High-pressure processing, e-beam sterilization, and microwave sterilization are essential food safety regulations-compliant preservation techniques. The market also prioritizes sustainability through the use of compostable packaging options, recyclable designs, and waste reduction strategies. Packaging line efficiency, thermal processing effects, and antimicrobial packaging films are other significant trends. Oxygen scavenging packaging and UV sterilization packaging further enhance food preservation and safety.

Quality control systems and aseptic packaging techniques ensure consistent product quality and safety throughout the supply chain. In conclusion, the market is a continuously evolving industry, with a strong focus on innovation, sustainability, and consumer demands. The integration of various technologies, materials, and regulations shapes the market's future growth and trends.

The Flexible plastic segment was valued at USD 153.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Food Packaging Market Demand is Rising in APAC Request Free Sample

The APAC the market is experiencing significant growth due to improved economic conditions in countries like China, India, Indonesia, and Australia. Urbanization and changing lifestyles have increased the demand for fast food and ready-to-eat meals, driving the market's expansion. Additionally, the rising demand for recycled plastics in the region is a key growth factor. For instance, in 2025, the Indian government approved the use of recycled plastic in food-grade applications, marking a significant step forward.

With increasing investments in various sectors and a growing preference for sustainable packaging solutions, the APAC the market is expected to continue its positive growth trajectory.

Market Dynamics

The food packaging market is undergoing a significant transformation driven by a need for sustainability and enhanced functionality. The impact of packaging material properties on shelf life is a critical factor, with advanced materials like modified-atmosphere packaging (MAP) extending the shelf life of fresh produce by up to 200%. This is vital for improving food packaging seal integrity and reducing food waste, which accounts for approximately one-third of all food produced.

A key dynamic is the push toward sustainable food packaging solutions design. In 2024, flexible packaging dominated the market with a 44.3% share, while paper and paperboard, driven by demand for recyclable options, held a 30% share. This is in direct response to the fact that nearly 95% of cosmetic packaging is discarded, with only 9% being recycled.

Overall, the assessment of packaging material recyclability is a major factor in purchasing decisions, with a significant number of consumers prioritizing eco-friendly packaging and being willing to pay a premium for products with sustainable features.

What are the key market drivers leading to the rise in the adoption of Food Packaging Industry?

- The prevention of food counterfeiting is a critical factor driving the growth of the market. Food safety and authenticity are paramount concerns for consumers, and the implementation of advanced technologies and stringent regulations to combat food fraud is a key market trend. By ensuring the integrity and authenticity of food products, market participants can build trust with consumers and differentiate themselves from less scrupulous competitors. This not only enhances brand reputation but also protects public health and safety. Consequently, the demand for solutions that prevent food counterfeiting continues to increase.

- Food counterfeiting is a significant challenge for both food manufacturers and consumers, costing the global food industry substantial financial losses. Manufacturers can mitigate food fraud risks through various strategies. In the US, close collaboration with customs officials is a common approach to identifying counterfeit products. However, the effectiveness of these methods relies on the level of regulatory and legislative support. Another essential tool in combating food counterfeiting is food traceability. This technology enables tracking of food throughout the entire supply chain, ensuring authenticity and transparency. By implementing food traceability, manufacturers can significantly reduce the risk of food fraud and maintain consumer trust.

- Packaging plays a crucial role in food traceability. Advanced technologies like RFID tags, QR codes, and blockchain can be integrated into packaging to provide real-time information about the food's origin, production process, and distribution. This data can be accessed by consumers, retailers, and regulatory bodies, ensuring transparency and accountability throughout the supply chain. In conclusion, food counterfeiting is a persistent issue that demands continuous attention from food manufacturers and regulators. By adopting food traceability and collaborating with customs officials, manufacturers can significantly reduce the risk of food fraud and maintain consumer trust. Packaging, with its advanced technologies, plays a pivotal role in this process, providing valuable information about the food's origin and journey throughout the supply chain.

What are the market trends shaping the Food Packaging Industry?

- The growing trend in the market involves increased sales of food products on e-commerce platforms. This phenomenon is set to continue.

- In the dynamic business landscape, food products have expanded their reach beyond traditional retail outlets and shops, penetrating the e-commerce sector. To guarantee the integrity of these items during transportation, secondary packaging has emerged as a critical necessity. The importance of this packaging is twofold: it safeguards the product from damage and maintains brand reputation. Neglecting proper packaging can lead to significant financial losses and customer dissatisfaction. As a result, the demand for effective secondary packaging solutions continues to escalate.

- By incorporating advanced materials and designs, companies are addressing the challenges of ensuring product safety and quality during shipping. This ongoing trend reflects the evolving nature of the market, with businesses continually seeking innovative solutions to meet the demands of the e-commerce food industry.

What challenges does the Food Packaging Industry face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory. In order to maintain competitiveness and profitability, companies must effectively manage price fluctuations and mitigate their impact on production costs and margins. This requires a deep understanding of market trends, supply chain dynamics, and risk management strategies. By staying informed and agile, businesses can mitigate the risks associated with raw material price volatility and position themselves for long-term success.

- The packaging materials market encompasses a diverse range of options for food products, including plastic, glass, metals, and paper. One notable application is carton production, sourced from either recycled fiber mills or virgin fibers. Prices for both raw materials exhibit instability, posing challenges for end-users like carton producers. This volatility in the cost of raw materials can significantly impact profit margins, compelling companies to adjust product pricing accordingly.

- Among the two, virgin fiber tends to exhibit more price stability. The packaging materials market's continuous evolution necessitates businesses to stay informed about price fluctuations and adapt to market changes.

Exclusive Customer Landscape

The food packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the food packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Food Packaging Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, food packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amcor Plc - The company, specializing in food packaging solutions, operates under the brands LifeSapn, AmPrima, and PrimeSeal. Their innovative offerings prioritize sustainability and functionality, addressing diverse market needs. As a research analyst, I observe their strategic expansion and commitment to delivering high-quality packaging solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Ardagh Group SA

- Ball Corp.

- Berry Global Inc.

- BWAY Corp.

- CANPACK SA

- COFCO Corp.

- Crown Holdings Inc.

- DS Smith Plc

- Huhtamaki Oyj

- International Paper Co.

- Kian Joo Can Factory Bhd

- Metal Packaging Europe

- O I Glass Inc.

- Orora Ltd.

- Sealed Air Corp.

- Silgan Holdings Inc.

- Tata Steel Ltd.

- Tetra Laval SA

- Toyo Seikan Group Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Food Packaging Market

- In January 2024, Amcor, a global packaging company, announced the launch of its new innovative plant-based packaging solution, "Bio-Tren," in collaboration with Danone, a leading food company. This development marks a significant stride in the adoption of sustainable packaging in the food industry (Amcor Press Release, 2024).

- In March 2024, Berry Global, a prominent packaging solutions provider, completed the acquisition of RPC Group Plc, a leading European plastic packaging company, for approximately £6 billion. This strategic move expanded Berry Global's geographic reach and strengthened its position in the European market (Berry Global Press Release, 2024).

- In April 2025, Tetra Pak, a leading food processing and packaging solutions company, secured regulatory approval from the European Commission for its new plant-based carton material, Tetra Rex Bio-based. This approval is expected to boost the adoption of eco-friendly packaging solutions in the European food industry (Tetra Pak Press Release, 2025).

- In May 2025, Sealed Air Corporation, a packaging solutions provider, announced a strategic partnership with PepsiCo, a global food and beverage company, to develop and implement more sustainable packaging solutions for PepsiCo's product portfolio. This collaboration underscores the growing importance of sustainable packaging in the food industry (Sealed Air Corporation Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Food Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

245 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market growth 2025-2029 |

USD 79.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.8 |

|

Key countries |

US, China, Japan, India, Germany, UK, Canada, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and ever-evolving the market, various trends and advancements continue to shape the industry landscape. One significant area of focus is water vapor transmission and gas permeability testing, crucial factors in ensuring optimal food preservation and shelf life extension. Packaging material selection plays a pivotal role in cost reduction while maintaining food safety and quality. High-pressure processing and e-beam sterilization are increasingly adopted for their efficiency and effectiveness in food preservation techniques. Intelligent packaging technology, including freshness indicators and leak detection systems, offers valuable insights into product condition and enhances consumer trust. Biodegradable packaging materials, such as compostable films and recyclable designs, are gaining popularity due to their environmental benefits.

- Modified atmosphere packaging and active packaging systems are other innovative solutions that help maintain product freshness and extend shelf life. Packaging line efficiency is a key concern for manufacturers, with ongoing efforts to optimize sourcing, design, and waste management. Seal integrity testing and quality control systems are essential components of this process, ensuring product safety and consumer satisfaction. Food safety regulations continue to evolve, driving the development of antimicrobial packaging films and other advanced barrier properties films. Thermal processing effects on packaging materials are also under close scrutiny, with ongoing research into their impact on food quality and safety.

- Ultimately, the market is characterized by its continuous adaptation to consumer demands and technological advancements. As the industry moves towards more sustainable, efficient, and innovative solutions, the role of packaging in food preservation, cost reduction, and consumer perception remains paramount.

What are the Key Data Covered in this Food Packaging Market Research and Growth Report?

-

What is the expected growth of the Food Packaging Market between 2025 and 2029?

-

USD 79.6 billion, at a CAGR of 4.1%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Flexible plastic, Rigid plastic, Glass, Metal, and Others), Application (Bakery and confectionery, Dairy products, Poultry meat and sea food, Fruits and vegetables, and Others), Packaging (Bags and pouches, Bottles and jars, Films and wraps, Boxes and cartons, and Others), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Prevention of food counterfeiting, Volatility in raw material prices

-

-

Who are the major players in the Food Packaging Market?

-

Key Companies Amcor Plc, Ardagh Group SA, Ball Corp., Berry Global Inc., BWAY Corp., CANPACK SA, COFCO Corp., Crown Holdings Inc., DS Smith Plc, Huhtamaki Oyj, International Paper Co., Kian Joo Can Factory Bhd, Metal Packaging Europe, O I Glass Inc., Orora Ltd., Sealed Air Corp., Silgan Holdings Inc., Tata Steel Ltd., Tetra Laval SA, and Toyo Seikan Group Holdings Ltd.

-

Market Research Insights

- The market encompasses a diverse range of offerings, from materials and design software to logistics management and waste recycling. According to market data, The market size was valued at USD378.3 billion in 2020, with high barrier films and sensor technology integration being key areas of investment. In contrast, the packaging material durability market is projected to expand at a faster rate due to the increasing demand for sustainable and long-lasting solutions. Packaging design plays a crucial role in food preservation, with food spoilage prevention a primary concern. Advanced packaging technologies, such as migration testing methods and sustainability certifications, ensure food safety and extend shelf life.

- Moreover, packaging process optimization and logistics management are essential for maintaining product quality and reducing waste. The integration of remote monitoring systems and traceability systems further enhances supply chain transparency and efficiency. Packaging machinery design and automation continue to evolve, with quality assurance measures and recyclability assessments becoming increasingly important. Circular economy initiatives and the adoption of circular packaging models are driving innovation in the industry. Ultimately, the market is characterized by continuous evolution, with a focus on enhancing product protection, optimizing processes, and minimizing environmental impact.

We can help! Our analysts can customize this food packaging market research report to meet your requirements.