Home Entertainment Market Size 2025-2029

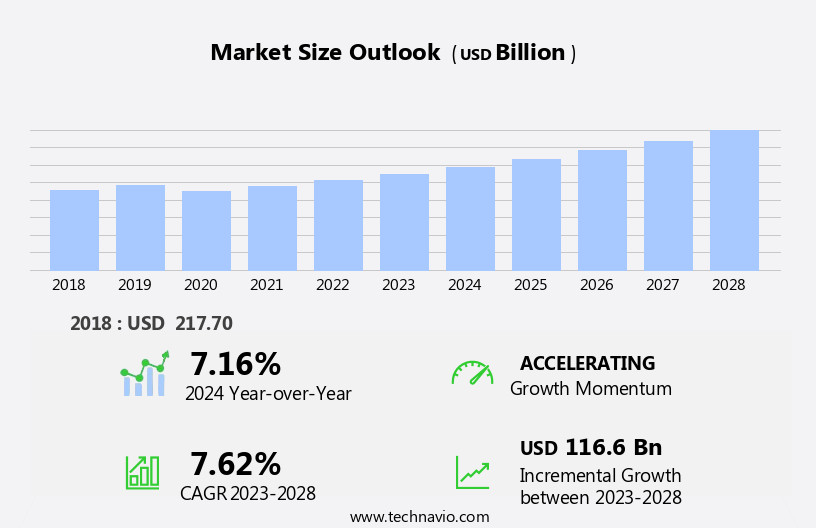

The home entertainment market size is forecast to increase by USD 138 billion at a CAGR of 8.3% between 2024 and 2029.

- The market is experiencing significant shifts, driven by the emergence of smart televisions and the integration of advanced technologies in Over-The-Top (OTT) services. These developments are transforming consumer viewing habits, enabling on-demand access to a vast array of content. However, the market faces challenges as well. The high energy consumption of televisions, a growing concern for environmentally-conscious consumers, is one such challenge. The integration of Bluetooth and Wi-Fi connectivity in home entertainment systems has enabled seamless streaming of audio and video content.

- To capitalize on opportunities and navigate challenges effectively, market participants must stay abreast of technological advancements and consumer preferences, while also focusing on sustainability and energy efficiency. Companies must address this issue through energy-efficient designs and innovative technologies. Another challenge is the intensifying competition in the market, as new players enter the fray and existing ones expand their offerings. These technologies continue to evolve, integrating smart home capabilities, Bluetooth and Wi-Fi connectivity, and cloud services.

What will be the Size of the Home Entertainment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market is characterized by continuous advancements in technology, with picture quality and display technology taking center stage. Software updates and device compatibility ensure seamless integration of new features and technologies, such as OLED and QLED, into existing systems. Digital content licensing and copyright protection are crucial aspects of the market, ensuring access to high-quality digital content while maintaining intellectual property rights. Energy consumption and user experience design are increasingly important factors, with energy-efficient LED backlighting and digital signal processing optimizing power usage and enhancing viewing experiences.

- Platform integration and cable management contribute to a clutter-free setup, while user interface design and cloud storage facilitate easy access to content. Room acoustics and audio calibration ensure optimal sound performance, and installation services cater to users seeking professional assistance. Environmental impact is a growing concern, with companies focusing on reducing waste and improving sustainability. As the market evolves, trends include advancements in OLED and QLED technology, as well as the integration of AI and machine learning for enhanced user experiences. The market encompasses a range of home entertainment-related devices, including high-definition television sets, projectors, soundbars, and home theater in a box (HTIB) systems.

How is this Home Entertainment Industry segmented?

The home entertainment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Video device

- Audio device

- Gaming console

- Distribution Channel

- Offline

- Online

- Application

- Residential

- Commercial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

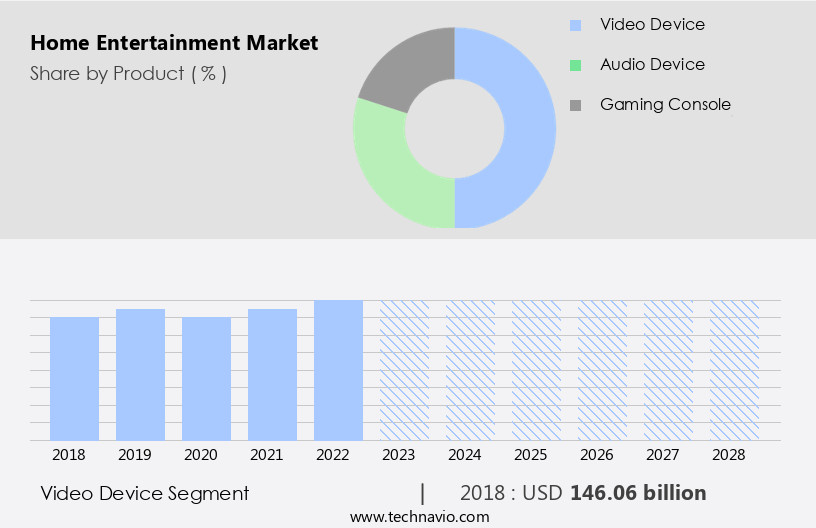

By Product Insights

The video device segment comprises video-enabled consumer electronic devices such as televisions, Blu-ray and DVD players, projectors, and streaming devices. The video device segment is expected to register a significant share in the global home entertainment market during the forecast period. The growth in the video device segment can be attributed to the growing consumer preference for visual entertainment. Factors such as rapid innovations in the existing products, an increase in the digitalization of electronic goods, and a growing tech-savvy urban population in developing countries will increase the demand for video devices. Video devices are undergoing groundbreaking improvements such as the introduction of 8K and 4K resolution, micro-LED and mini-LED displays, high dynamic range (HDR) video in televisions, and the emergence of wireless and portable projectors, which fuel the demand for the video device segment. Moreover, video devices are economically viable for mass production, making them affordable to consumers.

The video device segment, which includes televisions, Blu-ray and DVD players, projectors, and streaming devices, holds a substantial share in this market. This growth can be attributed to the increasing consumer preference for visual entertainment and advancements in technology. Innovations such as 8K and 4K resolution, HDR video in televisions, and wireless and portable projectors fuel the demand for video devices. Additionally, the digitalization of electronic goods and the expanding tech-savvy population in developing countries contribute to the market's growth. The emergence of smart home integration, multi-room audio, and voice control further enhances the entertainment experience, driving the market forward. Therefore, all such factors will foster the growth of the video device segment, which, in turn, will propel the growth of the global home entertainment market during the forecast period.

The Video device segment was valued at USD 154.80 billion in 2019 and showed a gradual increase during the forecast period.

The Home Entertainment Market is evolving rapidly, driven by innovations in sound and display technologies. Superior audio quality is achieved through advanced sound processing and strategic speaker placement, delivering engrossing experiences. The rise of OLED technology enhances visual performance with deeper blacks and vibrant colors. Streaming platforms benefit from optimized streaming bandwidth and improved network performance, ensuring seamless content delivery. Consumers rely on mobile apps for smart control, adjusting settings and accessing entertainment on-the-go. Regular firmware updates enhance device functionality, improving compatibility and security.

The Home Entertainment Market is rapidly evolving with cutting-edge technologies like audio receivers, Blu-ray players, and surround sound systems enhancing user experience. The rise of Dolby Atmos ensures superior sound quality, complementing high frame rate visuals for a lifelike viewing experience. Traditional cable TV competes with advanced media players, while wireless speakers and portable speakers redefine audio convenience. Smart living integration includes the smart thermostat, elevating the modern home setup. The industry's focus on engaging audio and engagiing video extends beyond homes, influencing theme parks and museum exhibits for interactive entertainment.

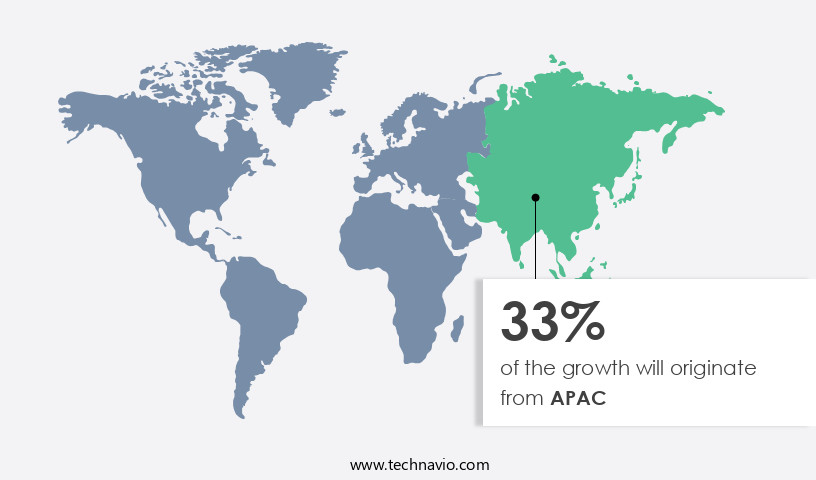

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth in 2024, with APAC holding a dominant share. Factors driving this expansion include rising disposable income, increased Internet penetration in developing economies, and evolving consumer lifestyles leading to increased spending on home entertainment devices. The sports industry's growing interest is a major catalyst, as the region houses a vast and diverse audience for various sports such as football, cricket, and basketball.

Smart TVs, commercial AV, smart thermostats, smart lighting, voice control, streaming services, DTS:X, home theater systems, interactive entertainment, digital signage, user experience, digital media, live events, smart home integration, multi-room audio, gaming consoles, home automation, satellite TV, content consumption, user interface, virtual reality, augmented reality, content delivery networks, ultra HD, remote control, and digital antennas are all shaping the future of home entertainment. The market's evolution is marked by advancements in technology, consumer preferences, and industry trends. These elements are redefining the home entertainment landscape and offering new opportunities for innovation and growth. One of the primary factors driving market expansion is the increase in disposable income, enabling consumers to invest in premium home entertainment systems.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Home Entertainment market drivers leading to the rise in the adoption of Industry?

- The emergence of smart televisions serves as the primary catalyst for market growth, revolutionizing home entertainment with their advanced features and connectivity capabilities. The market is experiencing significant growth, driven by the increasing popularity of advanced television technologies. Smart televisions, in particular, have gained substantial traction due to their integrated Internet connectivity and interactive features. In 2023, smart televisions accounted for over half of all television sales. These televisions offer high-definition viewing experiences, with many models featuring 4K resolution and high dynamic range for enhanced visual quality. The integration of voice control, smart thermostats, and smart lighting further enhances the convenience and functionality of smart televisions.

- The availability of streaming services like Amazon Prime Video and video games adds to their appeal. The market is expected to continue growing during the forecast period, as consumers seek to enhance their at-home entertainment experiences. The introduction of new technologies, such as 8K resolution and advanced audio systems, will further fuel market growth. Overall, the market is poised for continued expansion, as consumers increasingly prioritize comfort and convenience in their leisure activities. Home theaters increasingly offer access to video streaming platforms, such as Netflix and Disney Plus, and audio content in various formats.

What are the Home Entertainment market trends shaping the Industry?

- Advanced technologies are increasingly being integrated into Over-The-Top (OTT) services, marking a significant market trend. This technological evolution enhances user experience and offers innovative features to subscribers. The market is experiencing significant growth due to the integration of advanced technologies, including AI (artificial intelligence) and ML (machine learning), into streaming services. These technologies enable personalized content recommendations and targeted advertising, enhancing the user experience. Digital signage is becoming increasingly popular for advertising and promotional purposes. Moreover, the convergence of home entertainment with live events and gaming consoles is driving market growth. Smart home integration and multi-room audio systems are gaining traction, allowing users to control their entertainment systems with voice commands or mobile apps.

- Home automation is another area of focus, with companies integrating entertainment systems with other smart home devices. The market is witnessing a paradigm shift, with advanced technologies and innovative features becoming the norm. AI and ML are transforming the way we consume digital media, making entertainment more personalized and engaging. The integration of home entertainment with other smart home devices and live events is creating new opportunities for market growth. Devices such as Bluetooth and Wi-Fi connectivity-enabled soundbars, component systems, wireless subwoofers, and projector screens are popular choices.

How does Home Entertainment market face challenges during its growth?

- The high energy consumption of televisions poses a significant challenge to the industry's growth trajectory. This issue, which is of great concern to both manufacturers and consumers, necessitates the development and implementation of energy-efficient technologies to mitigate its impact on the industry. The market is experiencing significant advancements, driven by the adoption of technologies such as satellite TV, virtual reality (VR), and augmented reality (AR). User interface innovations continue to enhance content consumption, with remote controls now offering voice commands and touchscreens. However, energy consumption is a challenge in the market. UHD televisions, with their high-pixel resolution, consume more power than standard HD models. The backlights used in UHD televisions require increased brightness to produce clear, vibrant pictures, leading to higher energy usage.

- Additionally, the processing power required to display videos with high-dynamic-range (HDR) encoding further contributes to energy consumption. Content providers are investing in these technologies to create engaging, interactive experiences for users. The market is expected to continue growing, driven by these advancements and the increasing demand for high-quality entertainment at home. User interfaces are becoming more intuitive, with voice commands and touchscreens simplifying the process of accessing content. Content delivery networks ensure that users have access to high-definition content without interruption. Smart TVs and flat-screen TVs are popular video sources, and Echo and Chromecast enable wireless connectivity for easy use

Exclusive Customer Landscape

The home entertainment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the home entertainment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, home entertainment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apple Inc. - This company specializes in innovative home entertainment solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- Bose Corp.

- Haier Smart Home Co. Ltd.

- Hitachi Ltd.

- Koninklijke Philips NV

- LG Electronics Inc.

- Microsoft Corp.

- Mitsubishi Electric Corp.

- Panasonic Holdings Corp.

- Pioneer Corp.

- Samsung Electronics Co. Ltd.

- Sennheiser Electronic GmbH and Co. KG

- Sharp Corp.

- Sonos Inc.

- Sony Group Corp.

- TCL Industries Holdings Co. Ltd.

- Toshiba Corp.

- VIZIO Holding Corp.

- Xiaomi Inc.

- Yamaha Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Home Entertainment Market

- In February 2024, Disney+ announced the launch of its ad-supported subscription tier, aiming to broaden its customer base and compete more effectively with Netflix and other streaming services (Disney Press Release). This strategic move represented a significant shift in the market, as major streaming platforms began to introduce more affordable, ad-supported options to attract price-sensitive consumers.

- In May 2024, Amazon Prime Video and MGM Studios signed a landmark deal, with Amazon acquiring MGM for approximately USD8.45 billion (Bloomberg). This merger marked a major strategic collaboration, as Amazon aimed to bolster its content library and strengthen its position in the competitive streaming market.

- In August 2024, Apple TV+ unveiled a new feature, "Share Play," which allows users to watch shows and movies together with friends and family in real-time, even if they're not in the same location (Apple Press Release). This technological advancement demonstrated Apple's commitment to enhancing the user experience and differentiating its streaming service from competitors.

Research Analyst Overview

The market continues to evolve, with new technologies and applications shaping the landscape. Streaming services have become a dominant force, offering on-demand access to a vast library of movies and TV shows. Interactive entertainment, such as virtual and augmented reality, adds a new dimension to content consumption. Digital signage and user experience are essential components of modern entertainment, providing dynamic and engaging displays for commercial AV and public spaces.

Home automation, including smart security, thermostats, and lighting, adds a layer of convenience and control. Gaming consoles and multi-room audio systems cater to the growing demand for interactive and shared entertainment experiences. Content management systems and delivery networks ensure seamless access to digital media, while 4K resolution and HDR offer improved visual quality. Voice control and remote control add to the user-friendly interface, making entertainment more accessible than ever before. The market's continuous dynamism ensures that innovation remains at the forefront of the entertainment experience.

Despite these advancements, energy consumption remains a concern. UHD televisions, with their high-pixel resolution, consume more power than standard HD models. The backlights used in UHD televisions require increased brightness to produce clear, vibrant pictures, leading to higher energy usage. Additionally, the processing power required to display videos with high-dynamic-range (HDR) encoding further contributes to energy consumption. The market is witnessing significant advancements, driven by technologies such as satellite TV, virtual reality, augmented reality, and ultra-high-definition content.

User interfaces are becoming more intuitive, and content delivery networks ensure seamless access to high-definition content. However, energy consumption remains a challenge, with UHD televisions requiring more power to produce clear, vibrant pictures. The market is expected to continue growing, driven by these advancements and the increasing demand for high-quality entertainment at home.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Home Entertainment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.3% |

|

Market growth 2025-2029 |

USD 138 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.5 |

|

Key countries |

US, China, Japan, Brazil, Germany, South Korea, UK, India, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Home Entertainment Market Research and Growth Report?

- CAGR of the Home Entertainment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the home entertainment market growth of industry companies

We can help! Our analysts can customize this home entertainment market research report to meet your requirements.