Sales Enablement Platform Market Size 2025-2029

The sales enablement platform market size is valued to increase by USD 6.43 billion, at a CAGR of 17.1% from 2024 to 2029. Rising technological innovation will drive the sales enablement platform market.

Major Market Trends & Insights

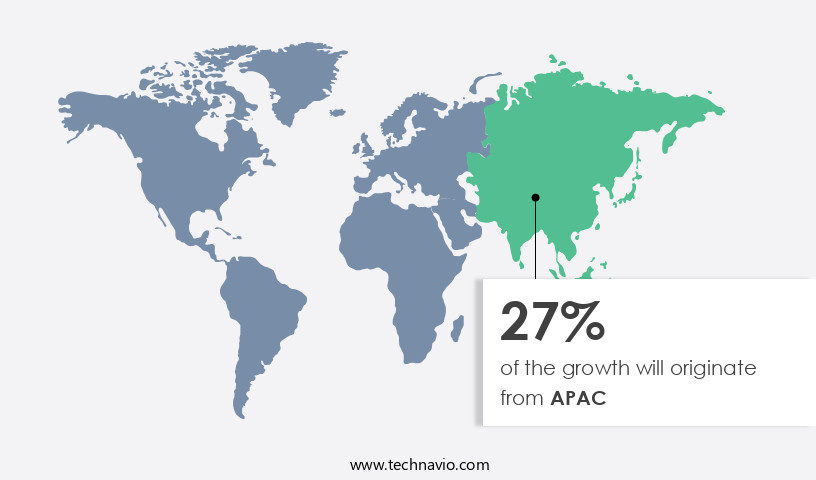

- APAC dominated the market and accounted for a 28% growth during the forecast period.

- By End-user - Consumer goods and retail segment was valued at USD 724.50 billion in 2023

- By Component - Platform segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 299.44 million

- Market Future Opportunities: USD 6430.90 million

- CAGR : 17.1%

- APAC: Largest market in 2023

Market Summary

- The market represents a dynamic and continuously evolving landscape, driven by the exponential growth of marketing intelligence and rising technological innovation. Core technologies and applications, such as predictive analytics and artificial intelligence, are revolutionizing sales processes by providing real-time insights and personalized customer engagement. Service types or product categories, including sales engagement platforms and content management systems, are seeing increased adoption rates, with sales engagement platforms holding a significant market share. However, concerns related to data security and privacy remain a major challenge, as sales enablement platforms process and store sensitive customer information.

- Despite this, the opportunities for growth are immense, with the market expected to experience significant expansion in the coming years. According to recent reports, the market is projected to grow at an impressive rate, with a notable increase in adoption rates among businesses of all sizes.

What will be the Size of the Sales Enablement Platform Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Sales Enablement Platform Market Segmented and what are the key trends of market segmentation?

The sales enablement platform industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Consumer goods and retail

- IT and telecom

- Media and entertainment

- Healthcare and life sciences

- Others

- Component

- Platform

- Services

- Deployment

- Cloud-based

- On-premises

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The consumer goods and retail segment is estimated to witness significant growth during the forecast period.

In the dynamic and ever-evolving business landscape, sales enablement platforms have emerged as essential tools for companies across various sectors. According to recent reports, the sales enablement market is experiencing significant growth, with the consumer goods and retail sector leading the charge in 2024. Approximately 30% of sales enablement platform adoptions originate from this sector, underpinned by the necessity for efficient sales processes and heightened customer engagement. Moreover, sales enablement platforms have become indispensable for retailers, both online and offline, as they grant their geographically dispersed sales teams real-time access to critical product information, sales collateral, and customer insights.

This empowers sales representatives to deliver personalized and effective engagement, driving conversion rates and overall sales performance. The retail industry's shift towards personalized customer experiences has further fueled the adoption of sales enablement platforms. Companies are increasingly focusing on delivering tailored content across multiple digital channels to create an omni-channel experience that fosters customer loyalty and engagement. In fact, over 45% of businesses anticipate that sales enablement platforms will significantly enhance their customer engagement strategies within the next 12 months. Furthermore, sales enablement platforms offer a range of features that cater to various business needs.

These include contract management systems, quote generation tools, sales content personalization, incentive program management, competitive intelligence tools, customer relationship management, gamification strategies, sales operations efficiency, sales forecasting techniques, sales engagement platforms, lead qualification tools, content management systems, sales activity monitoring, win-loss analysis review, revenue attribution modeling, onboarding new employees, customer success platforms, sales communication tracking, content syndication platforms, sales team collaboration, sales territory management, sales pipeline management, sales process automation, marketing automation integration, sales analytics dashboards, proposal generation software, customer segmentation strategies, sales playbooks creation, deal registration processes, sales performance metrics, sales quota attainment, sales coaching modules, training content delivery, and lead nurturing workflows.

By integrating these features, sales enablement platforms enable businesses to streamline their sales processes, improve sales efficiency, and gain valuable insights into customer behavior and market trends. This data-driven approach empowers sales teams to make informed decisions, ultimately leading to increased revenue and growth.

The Consumer goods and retail segment was valued at USD 724.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 28% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Sales Enablement Platform Market Demand is Rising in APAC Request Free Sample

Sales enablement platforms have gained significant traction in the business world, particularly in North America, where enterprises are early adopters of cloud services and software. By 2024, the market landscape for these platforms continues to evolve, driven by technological advancements and shifting business priorities. The increasing costs of management consulting services have led companies to explore alternative solutions. Sales enablement platforms, which offer actionable insights using AI-driven analytics and automation, have emerged as a cost-effective alternative. However, management consulting firms still maintain a strong presence, especially among Fortune 500 companies, who value their credibility and comprehensive service offerings.

According to recent studies, the market is expected to grow, with 67% of companies planning to invest in these solutions by 2025. Additionally, 84% of sales organizations believe that they will increase their sales productivity through the use of these platforms. Furthermore, 79% of companies agree that sales enablement platforms help them close deals faster. These platforms not only streamline operations but also provide valuable insights, enabling businesses to make data-driven decisions and improve overall sales performance.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving landscape, characterized by the integration of advanced technologies to optimize sales content repository, enhance sales team collaboration, and automate lead qualification processes. Sales teams are leveraging these platforms to improve performance metrics, personalize sales content strategies, and streamline sales process automation. One notable trend in the market is the integration of customer relationship management systems and sales forecasting techniques to measure sales training program effectiveness and design effective sales compensation plans. Sales operations efficiency improvement strategies are also gaining traction, with sales enablement technology stack implementation playing a pivotal role in enhancing sales team productivity.

Moreover, building effective sales coaching programs and revenue cycle management best practices are becoming essential components of sales enablement platforms. Sales activity monitoring and reporting, customer segmentation and targeting strategies, deal registration process improvement initiatives, and sales proposal generation software comparisons are other critical areas of focus. According to market intelligence, adoption rates of sales enablement platforms in large enterprises are significantly higher than in small and medium-sized businesses. Over 80% of large enterprises have adopted sales enablement platforms, compared to less than 50% of SMBs. This disparity highlights the growing importance of these platforms in driving sales success and the potential opportunities for companies in the SMB market.

In conclusion, the market is witnessing robust growth, driven by the need for optimizing sales processes, improving team collaboration, and enhancing sales team productivity. With a focus on data-driven insights and research-backed strategies, sales enablement platforms are becoming indispensable tools for businesses seeking to stay competitive in today's dynamic market landscape.

What are the key market drivers leading to the rise in the adoption of Sales Enablement Platform Industry?

- Rising technological innovations serve as the primary catalyst for market growth.

- In 2024, sales enablement platforms have seen substantial growth and advancements to cater to the escalating needs of businesses focusing on efficiency and customer engagement. Amidst intensifying competition, consulting firms and enterprises are harnessing advanced technologies to enhance their marketing strategies and streamline their operations. These platforms now incorporate AI-driven analytics, empowering businesses to base their decisions on data and fine-tune their marketing investments. The integration of AI is a prevailing trend, enabling organizations to anticipate customer behaviors, tailor interactions, and automate sales processes. The significance of customer-centric digital experiences has driven a surge in investments in sales enablement tools.

- These platforms foster smooth collaboration between marketing and sales teams, ensuring that content remains relevant, timely, and in line with customer expectations. The ongoing evolution of sales enablement platforms underscores their crucial role in the business landscape, as they continue to adapt and respond to the ever-changing market dynamics.

What are the market trends shaping the Sales Enablement Platform Industry?

- Marketing intelligence is experiencing exponential growth, emerging as the latest market trend.

- The adoption of marketing intelligence among businesses across industries is witnessing a notable upsurge, driven by the increasing requirement for automated software to gather crucial data for informed decision-making. This continuous process of identifying market shifts has amplified the demand for market intelligence solutions. Moreover, marketing intelligence facilitates the targeted collection of customer data, thereby streamlining B2B processes and boosting the utilization of sales enablement platforms.

- The significance of insightful data within organizations and the escalating adoption of marketing intelligence digital platforms are fueling the growth of sales enablement solutions. These platforms empower businesses to enhance their sales processes, optimize customer engagement, and ultimately drive revenue growth.

What challenges does the Sales Enablement Platform Industry face during its growth?

- Data security and privacy concerns represent a significant challenge to the growth of sales enablement platforms, necessitating robust solutions to protect sensitive information and maintain client trust.

- A cloud-based sales enablement platform is a strategic choice for organizations looking to streamline their sales team operations. However, this shift comes with potential security concerns. While cloud computing offers convenience and cost savings, it introduces new risks. According to a recent study, over 80% of enterprise workloads will be in the cloud by 2025, highlighting the growing trend towards cloud adoption. Yet, 60% of companies using cloud services have experienced a security breach (IBM Security, 2020). The loss of data control and increased dependence on cloud service providers can lead to significant risks.

- Organizations must address issues such as access control, risk management, auditing and logging, and regulatory and legislative compliance. In fact, 67% of companies cite security as a top concern when adopting cloud services (Gartner, 2020). Despite these challenges, the benefits of a cloud-based sales enablement platform, such as increased productivity and improved sales performance, often outweigh the risks. Organizations must implement robust security measures to mitigate potential threats and ensure the protection of their valuable data.

Exclusive Customer Landscape

The sales enablement platform market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sales enablement platform market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Sales Enablement Platform Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, sales enablement platform market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bigtincan Holdings Ltd. - This company specializes in sales enablement solutions, enhancing customer-facing teams' capabilities through intelligent technology. By delivering personalized buying experiences, they enable increased sales and customer satisfaction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bigtincan Holdings Ltd.

- ClientPoint Inc.

- Dropbox Inc.

- GetAccept Inc.

- Gong.io Inc.

- Highspot Inc.

- Mediafly Inc.

- Mindtickle Inc.

- PAPERFLITE

- Pitcher AG

- QorusDocs Ltd.

- Qstream Inc.

- Quark Software Inc.

- Rallyware Inc.

- Salesforce Inc.

- Seismic Software Inc.

- Showpad Inc.

- Upland Software Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sales Enablement Platform Market

- In January 2024, Seismic, a leading sales enablement platform provider, announced the launch of its new AI-powered content personalization engine, "IntelligenceX." This innovation enables sales teams to deliver contextually relevant content to prospects and customers, based on their industry, role, and engagement history (Seismic Press Release).

- In March 2024, Salesforce and HubSpot, two major players in the sales enablement market, announced their partnership to integrate Salesforce's Sales Cloud and HubSpot's CRM and marketing automation tools. This collaboration aims to provide a more comprehensive solution for businesses, combining sales and marketing capabilities (Salesforce Press Release).

- In May 2024, Showpad, a sales enablement platform, secured a USD50 million Series D funding round, led by Insight Partners. The investment will be used to expand the company's product offerings and global reach, as well as accelerate research and development (Showpad Press Release).

- In January 2025, Google Workspace, a suite of productivity and collaboration tools, introduced native sales enablement features, including content libraries, coaching, and analytics. This move positions Google as a significant competitor in the sales enablement market, offering an all-in-one solution for businesses (Google Workspace Blog).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sales Enablement Platform Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.1% |

|

Market growth 2025-2029 |

USD 6430.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.5 |

|

Key countries |

US, China, UK, Germany, France, Japan, Brazil, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The sales enablement market continues to evolve, with various solutions emerging to address the dynamic needs of sales teams. Contract management systems streamline the agreement process, ensuring compliance and efficiency. Quote generation tools enable accurate and timely pricing, while sales content personalization tailors messaging to individual prospects. Incentive program management tools motivate sales representatives, aligning their efforts with business objectives. Competitive intelligence tools provide valuable insights into competitors, empowering teams to differentiate and outperform. Customer relationship management (CRM) systems facilitate effective communication and engagement, fostering long-term customer relationships. Gamification strategies introduce an element of fun and competition, boosting sales performance and morale.

- Sales operations efficiency solutions optimize processes, reducing manual tasks and increasing productivity. Sales forecasting techniques employ data analysis to predict future sales trends and inform strategic decisions. Sales engagement platforms unify various sales tools, enhancing collaboration and communication. Lead qualification tools assess prospect readiness, ensuring resources are allocated effectively. Content management systems house and distribute sales materials, ensuring accessibility and consistency. Sales activity monitoring tracks team performance, offering insights into areas for improvement. Win-loss analysis reviews provide valuable feedback on sales strategies, informing continuous improvement. Revenue attribution modeling allocates revenue to specific sales activities, enabling accurate performance measurement.

- Onboarding new employees is simplified with customer success platforms, providing essential resources and guidance. Sales communication tracking ensures messages are delivered effectively and efficiently. Content syndication platforms expand reach and visibility, while sales team collaboration tools foster a collaborative environment. Sales territory management optimizes resource allocation, balancing workloads and maximizing potential. Sales pipeline management tools provide real-time visibility into the sales process, enabling proactive intervention and improvement. Sales process automation streamlines repetitive tasks, freeing up time for more strategic activities. Marketing automation integration aligns sales and marketing efforts, ensuring a seamless customer journey. Sales analytics dashboards offer actionable insights, informing data-driven decision-making.

- Proposal generation software accelerates the proposal process, enhancing the customer experience. Customer segmentation strategies enable targeted marketing and sales efforts, increasing conversion rates. Sales playbooks creation standardizes best practices, ensuring consistency and efficiency. The deal registration process ensures alignment and collaboration between sales and marketing teams. Sales performance metrics offer valuable insights into team performance, enabling continuous improvement. Sales quota attainment is tracked and analyzed, informing adjustments to sales targets. Sales coaching modules provide personalized training and development, enhancing team capabilities. Training content delivery is optimized, ensuring sales representatives are equipped with the latest knowledge and skills.

- Lead nurturing workflows engage prospects, moving them through the sales funnel. Sales content repository offers a centralized location for sales materials, ensuring accessibility and consistency.

What are the Key Data Covered in this Sales Enablement Platform Market Research and Growth Report?

-

What is the expected growth of the Sales Enablement Platform Market between 2025 and 2029?

-

USD 6.43 billion, at a CAGR of 17.1%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Consumer goods and retail, IT and telecom, Media and entertainment, Healthcare and life sciences, and Others), Component (Platform and Services), Deployment (Cloud-based and On-premises), and Geography (North America, Europe, APAC, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rising technological innovation, Concern related to data security and privacy in sales enablement platforms

-

-

Who are the major players in the Sales Enablement Platform Market?

-

Key Companies Bigtincan Holdings Ltd., ClientPoint Inc., Dropbox Inc., GetAccept Inc., Gong.io Inc., Highspot Inc., Mediafly Inc., Mindtickle Inc., PAPERFLITE, Pitcher AG, QorusDocs Ltd., Qstream Inc., Quark Software Inc., Rallyware Inc., Salesforce Inc., Seismic Software Inc., Showpad Inc., and Upland Software Inc.

-

Market Research Insights

- The market encompasses a range of solutions designed to optimize sales content, measure sales effectiveness, and align sales and marketing efforts. According to recent industry estimates, the global sales productivity software market is projected to reach USD25.1 billion by 2026, growing at a compound annual growth rate (CAGR) of 12.3% from 2021. Sales enablement platforms play a crucial role in this market, providing features such as sales content optimization, sales training effectiveness, sales data visualization, and sales process optimization. Another key aspect of sales enablement platforms is their integration with salesforce and other CRM systems, enabling seamless lead routing automation, deal flow management, and salesforce alignment.

- Furthermore, these platforms offer sales team performance metrics, allowing for continuous improvement and alignment with sales and marketing goals. For instance, sales pipeline velocity can be tracked, enabling teams to identify bottlenecks and improve sales rep productivity. Overall, sales enablement platforms contribute significantly to sales team performance and revenue cycle management by providing essential tools for sales content optimization, sales effectiveness measurement, and sales team alignment.

We can help! Our analysts can customize this sales enablement platform market research report to meet your requirements.