Sawmill Machinery Market Size 2025-2029

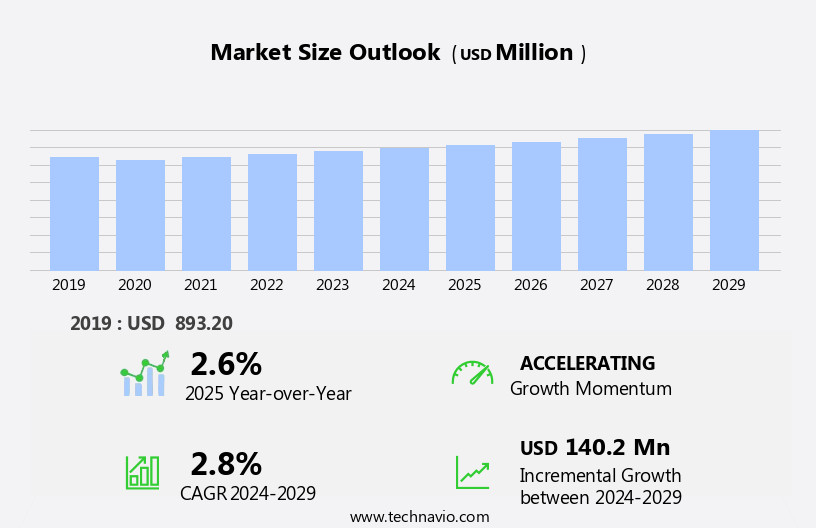

The sawmill machinery market size is forecast to increase by USD 140.2 million, at a CAGR of 2.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing construction activities worldwide. This surge in demand for sawmill machinery is attributed to the expanding construction sector, which necessitates the production of large quantities of lumber and wood products. Another key driver is the continuous advancements in sawmilling technology, enabling increased efficiency and productivity in the manufacturing process. However, the market also faces challenges, including the availability of pre-used sawmills in the market. This trend poses a threat to new machinery manufacturers as potential buyers may opt for cost-effective second-hand options.

- To capitalize on the market's potential, companies must focus on innovation, offering advanced machinery with improved efficiency and cost-effectiveness. Additionally, strategic partnerships and collaborations can help new entrants establish a strong market presence and navigate the competitive landscape effectively.

What will be the Size of the Sawmill Machinery Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by continuous evolution and dynamic market activities. Entities such as log deck, environmental compliance, circular sawmill, lumber stacker, cut optimization, saw blade, gang sawmill, log trailer, kiln drying, automation system, and dry kiln are integral components of this industry. Log deck systems facilitate the sorting and loading of logs for optimal processing. Environmental compliance regulations drive the adoption of advanced technologies for reducing waste and minimizing emissions. Circular sawmills offer increased efficiency and flexibility in processing various wood species. Lumber stackers ensure precise stacking for efficient drying and transportation. Cut optimization technologies enhance yield and reduce waste.

Saw blades, a critical component of sawmill machinery, undergo constant development to improve cutting efficiency and reduce downtime. Gang sawmills cater to large-scale operations, while log trailers facilitate the transportation of logs to sawmills. Kiln drying and automation systems ensure uniform drying and reduce labor requirements. Dry kilns maintain optimal moisture content for high-quality lumber production. Market trends include the integration of PLC control, wood waste management, and safety regulations. Precision forestry, remote sensing, and hydraulic systems optimize forestry management and log handling. Wood density measurement and forestry management systems enable yield optimization and maintenance schedules.

The market's ongoing unfolding is marked by the development of advanced technologies, evolving applications, and regulatory requirements. The interconnected nature of these entities underscores the industry's continuous dynamism.

How is this Sawmill Machinery Industry segmented?

The sawmill machinery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Fixed sawmills

- Portable sawmills

- Type

- Band saw headrig

- Circular saw headrig

- Frames saw headrig

- Method

- Horizontal

- Vertical

- Application

- Forestry

- Woodworking

- Paper industry

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

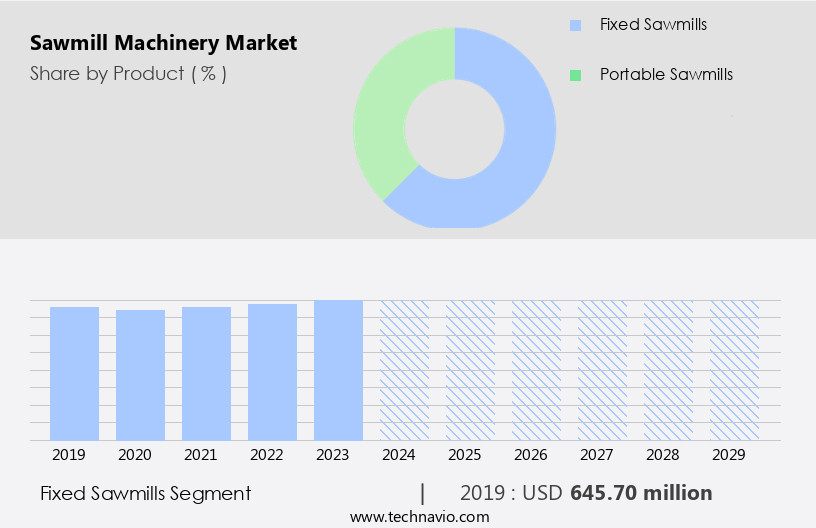

By Product Insights

The fixed sawmills segment is estimated to witness significant growth during the forecast period.

Fixed sawmills, also known as industrial or head rigs, are essential components of the market. In contrast to portable sawmills, these sawmills have a fixed frame for log sawing, necessitating their transportation to the mill site. Due to their large size and enclosed structure, they can operate efficiently during unfavorable weather conditions. Fitted with heavier saw teeth, these sawmills ensure straighter and faster cuts, contributing to a higher production rate. Key components of fixed sawmills include resaws and edgers. Sustainable forestry practices are increasingly integrated into forestry management, ensuring a steady supply of logs for these sawmills.

Log scaling and sorting are crucial processes to ensure lumber grading and quality. Moisture content plays a significant role in determining the wood species' suitability for sawing. Safety regulations mandate the use of advanced systems like PLC control, automation, and scada for optimizing cut yield, maintenance schedules, and lubrication. Wood waste management and chip production are integral parts of the sawmill process, with bark handling and sawdust removal essential for efficient operations. Timber cruising, feller bunching, and timber harvesting are critical upstream processes, while lumber transportation, lumber stacking, and kiln drying are downstream activities. Environmental compliance is a priority, with circular sawmills and gang sawmills adhering to stringent regulations.

The hydraulic system and log truck are essential for log handling, while log decking and board foot measurement facilitate efficient lumber stacking. Wood density plays a crucial role in determining the lumber's strength and value. Remote sensing technology and precision forestry techniques are increasingly used to optimize forest resources and improve yield.

The fixed sawmills segment was valued at USD 645.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In Europe, the market is experiencing growth due to the rising production and consumption of wood products. Wood, as a sustainable and eco-friendly construction material, is increasingly being used in industrial cities like Milan, Italy, for residential complexes, and in multi-story buildings, such as the Panorama Giustinelli in Trieste. This trend is supported by the abundance of natural forest resources in Europe. The major forestry contributors in Europe include countries like the Russian Federation, Germany, and Finland, where forestry output is on the rise. Sustainable forestry practices are essential in this industry, ensuring the preservation of forests while meeting the demand for wood.

Sawmill machinery plays a crucial role in this process, with band sawmills and circular sawmills leading the way in lumber production. Lumber grading, log scaling, and log sorting are integral parts of the sawmill process, ensuring the highest quality of wood products. The use of technology in sawmill machinery is also on the rise, with precision forestry, plc control, scada systems, and automation systems improving yield optimization, maintenance schedules, and safety regulations. Log trucks, lumber stackers, and sawdust removal systems facilitate efficient lumber transportation and wood waste management. Wood species, wood density, and moisture content are essential factors in the production process, and accurate measurement is crucial for optimal cut optimization and saw blade efficiency.

The hydraulic system and lubrication system are vital components of sawmill machinery, ensuring smooth operation and reducing downtime. Remote sensing technology is being adopted to monitor forest health and optimize timber cruising, ensuring environmental compliance and sustainable forest management. Wood chip production and kiln drying are also essential processes in the sawmill industry, contributing to the overall efficiency and productivity of the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and innovative market, manufacturers continue to develop advanced technologies to enhance productivity and efficiency. Sawmill machinery, including circular saws, band saws, and chipping machinery, play a pivotal role in the conversion of logs into value-added lumber products. Automation and digitalization are key trends, with features like CNC control systems, sensor technology, and remote monitoring gaining popularity. Energy efficiency, safety, and maintenance are crucial considerations. Additionally, the market is witnessing a shift towards sustainable and eco-friendly solutions, with biomass energy and waste reduction becoming essential aspects. The market is expected to grow significantly due to increasing demand for wood and wood-based products in the construction, furniture, and packaging industries.

What are the key market drivers leading to the rise in the adoption of Sawmill Machinery Industry?

- The surge in construction activities serves as the primary catalyst for market growth.

- The market is experiencing growth due to the increasing construction activities, particularly in the Asia Pacific and Middle Eastern regions. Population expansion, leading to a surge in demand for residential and non-residential buildings, is driving this growth. In these regions, countries like China, India, the Philippines, Indonesia, and Thailand are expected to significantly contribute to the expansion of the construction industry. The Indian construction market is projected to rank third globally by 2030, with China planning to invest over USD 1 trillion in urban infrastructure projects during the same period. Sawmill machinery is essential for converting logs into lumber, which is a crucial component in construction.

- The machinery involved includes log trucks for transport, lumber stacking systems for organization, sawdust removal systems, and SCADA systems for efficient operation. Additionally, factors like wood density measurement, forestry management, bark handling, and log handling are integral to the market. These elements ensure the production of high-quality lumber, which is vital for the construction industry's growth.

What are the market trends shaping the Sawmill Machinery Industry?

- Advances in sawmilling technology are currently shaping market trends. The use of modern machinery and automation in sawmilling processes is increasingly becoming the industry standard.

- The market encompasses advanced technologies that facilitate the efficient production of lumber from logs. Automation systems, a significant component of this market, utilize sensors and scanners to optimize cutting patterns and log rotation. Linck Holzverarbeitungstechnik is a notable provider of turnkey sawmill machinery solutions, integrating these scanning technologies for optimal cutting. The data generated from these scanners is processed by the cut optimization systems, enabling precise log positioning for efficient cutting. Beyond automation, environmental compliance plays a crucial role in the sawmill machinery industry. Kiln drying, a critical process in lumber manufacturing, ensures the lumber meets required moisture levels before being shipped.

- Dry kilns, a key component of this process, are essential for producing high-quality lumber. Moreover, technology suppliers and automation service providers collaborate to offer comprehensive solutions for sawmill machinery manufacturers. Workshops and conferences serve as platforms for disseminating technological advancements and best practices in the industry. By integrating automation and other technologies, sawmill machinery manufacturers can enhance their production capabilities while maintaining environmental compliance.

What challenges does the Sawmill Machinery Industry face during its growth?

- The scarcity of pre-owned sawmills poses a significant challenge to the industry's growth trajectory.

- Sawmill machinery plays a crucial role in the lumber industry, requiring consistent maintenance and upkeep for optimal performance. Newer sawmill machinery, such as band sawmills, comes with advanced features and higher price tags. For instance, a new Wood-Mizers LT70 sawmill can cost around USD70,000. In contrast, pre-owned sawmill machinery, certified and sold by resellers like Ben Jones Machinery, Surplex, Canadian Mill Equipment, and Ozark Machinery Company, offers a more affordable alternative, with prices starting at USD 49,700 for the same model. The availability of used machinery can hinder the purchase of new units, especially for less frequently used equipment like portable sawmills.

- Log scaling, lumber grading, log sorting, timber cruising, lubrication systems, and log transportation are essential processes in the market. Sustainable forestry practices, such as feller buncher and timber harvesting, also influence the demand for sawmill machinery. Proper maintenance and efficient operations are vital to ensure the longevity and productivity of sawmill machinery.

Exclusive Customer Landscape

The sawmill machinery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sawmill machinery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sawmill machinery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BioCone Oy - The company specializes in providing sophisticated sawmill machinery solutions, encompassing high-speed saw lines and log processing equipment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BioCone Oy

- Brewco Inc.

- Corley MFG

- Hardwood Mills Australia

- Hud Son Forest Equipment

- Hurdle Machine Works Inc.

- Kalyan Industries

- Linck Holzverarbeitungstechnik GmbH

- LOGOSOL AB

- McDonough Manufacturing Co.

- MEBOR d.o.o.

- Norwood Industries Inc.

- PRIMULTINI s.r.l.

- Salem Equipment Inc.

- Shandong Shuanghuan Machinery Ltd.

- Timber Automation LLC

- TimberKing Portable Sawmills

- WINTERSTEIGER AG

- Wood Mizer

- Woodland Mills Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sawmill Machinery Market

- In January 2024, Weyerhaeuser Company, a leading forest products company, announced the launch of its new advanced sawmill machinery, named "Revolution-X," in collaboration with technology partner, Schneider Electric. This machinery is designed to increase production efficiency by 20% and reduce energy consumption by 15% (Weyerhaeuser Company Press Release).

- In March 2024, Timberland Investment Resources (TIR), a global forestland investment management firm, and forest machinery manufacturer, John Deere, entered into a strategic partnership to develop and implement sustainable forest management practices using John Deere's advanced forest machinery. This collaboration aims to improve forest productivity and reduce operational costs for TIR (Timberland Investment Resources Press Release).

- In April 2025, Swedish sawmill machinery manufacturer, Pulpmachinery AB, announced a significant investment of â¬50 million to expand its production capacity by 50%. This expansion is in response to increasing demand for its machinery in the European market (Pulpmachinery AB Press Release).

- In May 2025, the European Commission approved a â¬100 million funding program to support the modernization of sawmills across Europe. This initiative aims to increase the competitiveness of the European sawmill industry by promoting the adoption of advanced machinery and sustainable forest management practices (European Commission Press Release).

Research Analyst Overview

- The market experiences dynamic trends and evolving demands, with key factors shaping its growth. Kerf width and blade speed significantly influence production efficiency, while energy consumption and environmental impact are critical concerns for operators. Value-added products, such as lumber and particleboard, offer a competitive advantage through increased sales and revenue. AI-powered optimization and precision cutting improve operational costs by reducing waste and enhancing product yield. Pricing strategy and industry standards are essential for maintaining customer relationships and regulatory compliance. Emission control and sawdust collection systems are vital for minimizing the carbon footprint and adhering to environmental regulations. Safety procedures, inventory management, and maintenance costs are essential components of supply chain management.

- Grading standards and quality control ensure consistent product output and customer satisfaction. Drying time, moisture meter, and engine power are crucial factors in production efficiency and product development. Automated control systems, defect detection, and digital twin technologies enable real-time monitoring and optimization of sawmill machinery, reducing downtime and increasing production capacity. Competitive advantage is achieved through continuous product development, waste reduction, and marketing strategy. Regulatory compliance, industry standards, and emission control are essential for long-term sustainability and growth in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sawmill Machinery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.8% |

|

Market growth 2025-2029 |

USD 140.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.6 |

|

Key countries |

US, Germany, China, UK, Japan, France, India, Italy, The Netherlands, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sawmill Machinery Market Research and Growth Report?

- CAGR of the Sawmill Machinery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sawmill machinery market growth of industry companies

We can help! Our analysts can customize this sawmill machinery market research report to meet your requirements.