Scaffolding Market Size 2025-2029

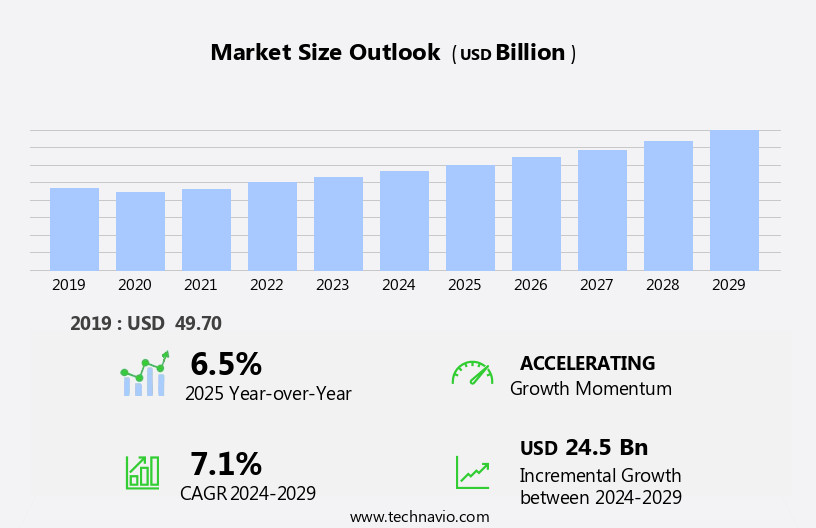

The scaffolding market size is forecast to increase by USD 24.5 billion at a CAGR of 7.1% between 2024 and 2029.

- The market in the construction industry is experiencing significant growth due to several key factors. In developing countries, the increase in construction activities is driving market demand. Additionally, the adoption of modular scaffolding systems made from materials such as aluminum and wooden planks has improved productivity and safety. However, the shortage of skilled labor remains a challenge for market growth. Grid systems are gaining popularity due to their ease of installation and dismantling. Furthermore, sustainable options like bamboo scaffolding are also emerging as viable alternatives in the market. Overall, the market is expected to continue its upward trajectory, driven by these trends and the ongoing demand for safe and efficient construction solutions.

What will be the Size of the Scaffolding Market During the Forecast Period?

- The market encompasses a range of support structures and temporary staging solutions used in various industries, including infrastructure, residential construction, and the mechanical and electrical sectors. Key drivers of market growth include government programs and infrastructure development in developing economies, as well as privatization and the increasing focus on worker safety. Traditional scaffolding, made of wooden planks and metal poles, continues to dominate the market, but low-cost and mechanized alternatives, such as rolling scaffolding and aluminum scaffolding, are gaining popularity.

- High rail constructions, grid systems, and portable stages are also in demand for applications like cleaning, maintenance, renovation operations, and temporary staging. The market is diverse, with both organized and unorganized firms competing in the space. Segments include support structures for home remodeling, scaffold systems for high-rise buildings, and seating and barrier solutions for events. Overall, the market is expected to grow steadily, driven by the increasing need for efficient and safe construction and maintenance solutions.

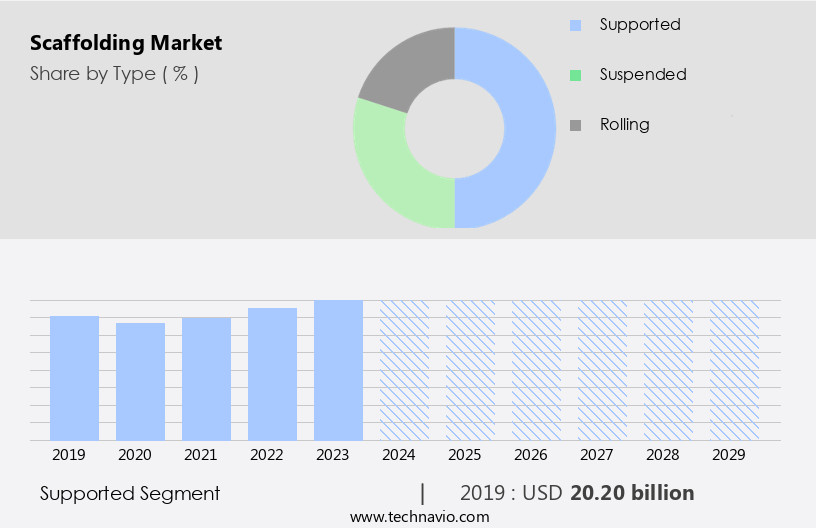

How is this Scaffolding Industry segmented and which is the largest segment?

The scaffolding industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Supported

- Suspended

- Rolling

- End-user

- Construction

- Ship building

- Electrical maintenance

- Residential

- Material

- Steel

- Aluminum

- Wood

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- APAC

By Type Insights

- The supported segment is estimated to witness significant growth during the forecast period. The market encompasses supported scaffolding systems, which utilize ground-based or other structural supports for stability. These systems, comprised of vertical poles, horizontal ledgers, and diagonal braces, are essential for various applications in construction, maintenance, and repair projects across residential, commercial, and industrial sectors. Infrastructure development, including bridge, tunnel, and highway construction, also relies on supported scaffolding.

- Classifications of supported scaffolding include traditional systems using wooden planks and metal poles, as well as advanced options like aluminum and steel structures, grid systems, rolling scaffolding, and mechanical sector applications. In urban areas, residential end-users and construction spending fuel market growth due to urbanization and population expansion. Key industries include the infrastructure, manufacturing, mechanical, electrical, and residential construction sectors. Worker safety remains a critical concern, with regulations mandating baseline scaffold requirements and ongoing efforts to minimize accidents and fatalities.

Get a glance at the market report of share of various segments Request Free Sample

The supported segment was valued at USD 20.20 billion in 2019 and showed a gradual increase during the forecast period.

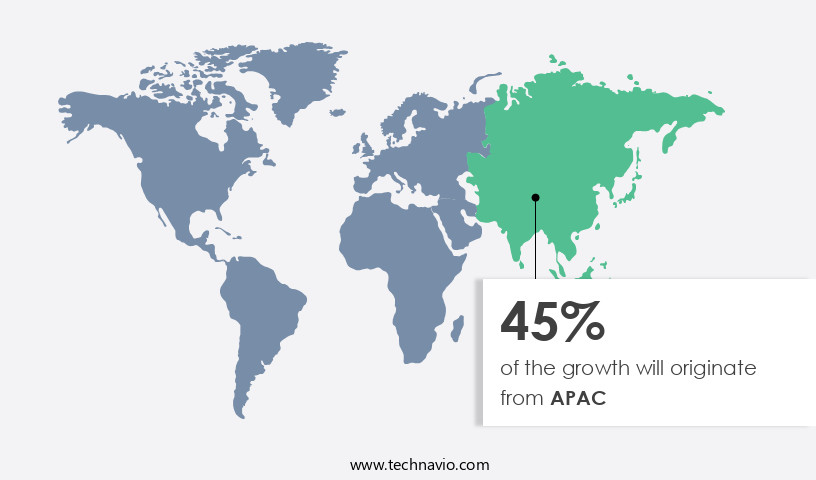

Regional Analysis

- APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Asia Pacific region leads the market due to rapid urbanization and increased government spending on infrastructure projects. In countries like China, India, and Japan, the residential construction sector drives demand for scaffolding in new housing developments. However, worker safety regulations are not consistently enforced, leading to concerns regarding accidents and fatalities.

For more insights on the market size of various regions, Request Free Sample

Traditional scaffolding, such as bamboo structures, remains prevalent in some areas, hindering the adoption of advanced scaffolding solutions. Japan's focus on infrastructure improvements has contributed to the growth of the market, with applications in high rail constructions, mechanical and electrical sectors, and temporary staging. Despite these opportunities, the market faces challenges from unorganized firms and the use of low-cost scaffolding in developing economies. Key sectors for scaffolding include home remodeling, renovation operations, and construction projects in commercial spaces, educational buildings, airports, offices, and malls. The market encompasses various types, including supported and suspended scaffolding, rolling scaffolding, portable stages, seating, barriers, cleaning, and maintenance structures.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Scaffolding Industry?

- Rise in construction activities in developing countries is the key driver of the market. The market is witnessing significant growth due to the increasing infrastructure development in various sectors, particularly in developing economies. Government programs, such as tax incentives and subsidies, are driving the construction of residential properties, with India's Pradhan Mantri Awas Yojana being a notable example. This initiative aims to provide affordable housing to the middle and lower-income population. Infrastructure spending is also on the rise, with India planning to invest USD 1.4 trillion in infrastructure by 2025, focusing on energy, transportation, and urban development. The PM Gati Shakti initiative, which received over USD 130 billion in funding for 2024-25, is supporting key projects like railways and highways.

- Scaffolding is an essential support structure used in various construction activities, including high rail constructions, home remodeling, and repair and renovation works. Traditional scaffolding, such as wooden planks and metal poles, and low-cost scaffolding, like aluminum and steel, are widely used in the residential construction sector. The market also caters to the needs of the mechanical, electrical, and temporary stage segments. Worker safety remains a priority, with regulations in place to ensure the use of advanced access structures, such as rolling scaffolding, mechanical scaffolding, and suspended scaffolding. The market serves various industries, including manufacturing facility, marble and granite tiles, commercial spaces, educational buildings, airports, offices, malls, and the household furnishing industry.

What are the market trends shaping the Scaffolding Industry?

- Improved productivity and safety is the upcoming market trend. Scaffolding plays a crucial role in infrastructure development and construction projects, particularly in the residential sector and high rail constructions. In developing economies, both government programs and privatization have led to an increase in construction spending and urbanization due to population growth. This, in turn, has driven the demand for scaffolding solutions. Traditional scaffolding methods using wooden planks and metal poles have given way to advanced access structures like aluminum and steel scaffolding, grid systems, rolling scaffolding, and portable stages. These modern scaffolding types offer better support, mobility, and safety, making them popular choices for the mechanical, electrical, and construction industries.

- Worker safety is a significant concern in the unorganized firms that dominate the market. To address this issue, scaffolding providers focus on improving productivity and safety by implementing techniques that reduce erection time. These methods include the use of mechanical sector equipment, such as cranes and hoists, and the adoption of suspended scaffolding and supported scaffolding systems. The temporary staging segment of the market caters to various applications, including cleaning, maintenance, renovation operations, and home remodeling. Scaffolding is essential for repair and renovation works on commercial spaces, educational buildings, airports, offices, malls, and household furnishing industries.

What challenges does the Scaffolding Industry face during its growth?

- Shortage of skilled labor is a key challenge affecting the industry growth. Scaffolding is essential infrastructure in the construction industry, serving as support systems for workers operating at varying heights. They facilitate the transportation of workers and construction materials to desired locations while ensuring safety from falls. Government programs worldwide prioritize proper scaffolding erection for a safe working environment. However, the unorganized sector, particularly in developing economies, may not adhere to these regulations, posing risks to worker safety. The types of scaffolding include traditional scaffolding with wooden planks and metal poles, low-cost scaffolding, and advanced access structures like rolling scaffolding, mechanical sector scaffolding, suspended scaffolding, and supported scaffolding. These structures are utilized in various sectors, including high rail constructions, residential construction, home remodeling, and the manufacturing facility.

- The residential construction sector, home remodeling, and the mechanical, electrical, and infrastructure sectors are significant contributors to the market's growth. Urbanization, population growth, and construction spending are driving factors in the market's expansion. However, the industry faces challenges such as accidents, falls, and injuries, necessitating stringent safety regulations. Scaffold manufacturers provide a range of products, including aluminum and steel scaffoldings, grid systems, portable stages, seating, barriers, and cleaning and maintenance equipment for renovation operations and temporary staging. These products cater to various industries, including marble, granite tiles, commercial spaces, educational buildings, airports, offices, malls, and household furnishing industry.

Exclusive Customer Landscape

The scaffolding market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the scaffolding market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, scaffolding market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ADTO Industrial Group Co. Ltd. - The company offers scaffoldings such as ringlock, frame, and kwikstage for construction projects.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altrad Group

- Anish Scaffolding India Pvt. Ltd.

- Brand Industrial Services Inc.

- BSL Scaffolding Ltd.

- Cangzhou Weisitai Scaffolding Co. Ltd.

- Changli XMWY Formwork Scaffolding Co. Ltd.

- GRUPO ULMA S. COOP

- KHK Scaffolding and Formwork LLC

- MJ Gerust GmbH

- PERI SE

- Rizhao Fenghua Scaffoldings Co. Ltd.

- SB Scaffolding India Pvt Ltd.

- Stepup Scaffold LLC

- Uni Span

- Universal Building Supply Inc.

- Waco Kwikform Ltd.

- Wellmade Scaffold Co. Ltd.

- Wilhelm Layher GmbH and Co. KG

- Wuxi Rapid Scaffolding Engineering Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of products and services essential for infrastructure development and construction projects. These structures provide advanced access solutions for various industries, including the mechanical and electrical sectors, residential construction, and high rail constructions. In the context of infrastructure development, government programs play a significant role in driving market growth. Privatization of construction projects in developing economies has led to an increase in demand for scaffolding solutions. In urban areas, residential end users and construction spending fuel the market's expansion. The scaffolding industry comprises various types, such as supported and suspended scaffolding. Traditional scaffolding, made of wooden planks and metal poles, is being gradually replaced by more advanced and safer alternatives like aluminum and steel scaffolding.

Further, the residential construction sector represents a substantial market for scaffolding, particularly in home remodeling projects. Rolling scaffolding and portable stages are popular choices for these applications due to their flexibility and ease of use. The mechanical and electrical sectors also contribute significantly to the market's growth. Scaffolding is essential for maintenance, repair, and renovation operations in these industries. Grid systems, seating, barriers, cleaning, and maintenance are some of the applications where scaffolding finds extensive use. The temporary stage segment, including temporary staging, is a growing area within the market. These structures are used in various applications, such as events, concerts, and film productions.

In addition, the market's growth is influenced by several factors, including urbanization, population growth, and the increasing focus on worker safety. Accidents, falls, injuries, and fatalities are significant concerns in the industry, leading to the establishment of baseline scaffold requirements and regulations. Manufacturing facilities producing scaffolding equipment are crucial players in the market. These entities supply a wide range of products, including support structures, shoring, and scaffold components, to construction sites worldwide. The market caters to various industries and applications, from marble and granite tile installation in commercial spaces to renovation works in offices, malls, airports, and educational buildings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 24.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, Japan, India, South Korea, Australia, UK, Canada, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Scaffolding Market Research and Growth Report?

- CAGR of the Scaffolding industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the scaffolding market growth of industry companies

We can help! Our analysts can customize this scaffolding market research report to meet your requirements.