Secondary Battery Market Size 2025-2029

The secondary battery market size is forecast to increase by USD 34486.5 billion, at a CAGR of 23.2% between 2024 and 2029.

- The market is witnessing significant developments, driven primarily by the declining costs of lithium-ion batteries. This cost reduction is fueling the adoption of these batteries in various industries, including telecommunications, electric vehicles, and renewable energy storage. However, this trend poses challenges for traditional lead-acid battery manufacturers, as their operational and environmental issues become increasingly evident. Advanced lead-based secondary batteries are being developed to address these challenges. For instance, researchers are exploring the use of alternative materials and manufacturing processes to improve the performance and longevity of lead-acid batteries. Additionally, efforts are being made to minimize the environmental impact of lead-acid battery production and disposal.

- Despite these advancements, operational and environmental issues associated with lead-acid batteries remain significant challenges. For example, lead-acid batteries require regular maintenance, which can be costly and time-consuming. Moreover, the environmental impact of lead mining and battery disposal continues to raise concerns. These challenges are driving the shift towards alternative battery technologies, such as lithium-ion batteries, which offer greater efficiency, longer lifespan, and lower maintenance requirements. Companies seeking to capitalize on market opportunities and navigate these challenges effectively should focus on innovation, sustainability, and cost competitiveness.

What will be the Size of the Secondary Battery Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the expanding applications across various sectors. Entities such as flow batteries, modular battery systems, renewable energy integration, solid-state batteries, and energy density are at the forefront of this dynamic landscape. Power electronics, lithium-ion batteries, fast charging, and ISO certification are integral components, ensuring safety and efficiency. Flow batteries offer advantages in terms of scalability and long cycle life, making them suitable for large-scale energy storage. Modular battery systems provide flexibility in design and deployment, enabling integration into diverse applications. Renewable energy integration is a key application area, with batteries playing a crucial role in grid stability and peak demand shaving.

Solid-state batteries promise higher energy density and improved safety, while energy density remains a critical factor in the ongoing pursuit of more efficient energy storage solutions. Power electronics enable optimal battery management, ensuring safe and efficient charging and discharging. Lithium-ion batteries, with their high power density and fast charging capabilities, continue to dominate the market. ISO certification, overdischarge protection, and DC-DC converters are essential features for ensuring battery safety and compatibility with various systems. Battery safety, battery life, and recycling are increasingly important considerations, with advancements in thermal management, cell balancing, and frequency regulation contributing to improved performance and longevity.

Anode and cathode materials, internal resistance, self-discharge rate, and power density are ongoing areas of research and development. Short-circuit protection, cycle life, and capacity fade are critical performance metrics, with advancements in battery pack design and temperature monitoring enabling more reliable and efficient energy storage solutions. Voltage sag and overcharge protection are essential features for maintaining optimal battery performance and ensuring system stability. The market is characterized by continuous innovation and evolving patterns, with entities such as flow batteries, modular battery systems, renewable energy integration, solid-state batteries, energy density, power electronics, lithium-ion batteries, fast charging, ISO certification, overdischarge protection, dc-dc converter, battery safety, battery life, and recycling shaping the future of energy storage.

How is this Secondary Battery Industry segmented?

The secondary battery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Lead-acid

- Lithium-ion

- Others

- Application

- Automotive batteries

- Industrial batteries

- Portable batteries

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

The lead-acid segment is estimated to witness significant growth during the forecast period.

Lead-acid batteries, an established technology in power supply for automotive applications and energy storage, continue to be favored for their cost-effectiveness and ease of availability. Among various lead-acid battery types, flooded lead-acid (FLA) batteries, enhanced flooded batteries (EFBs), absorbent glass mat (AGM) batteries, and lead-carbon batteries hold significant market share. FLA batteries, the most commonly used type, offer the lowest cost per ampere-hour. UL and IEC certifications ensure safety and reliability in battery manufacturing. Fire suppression systems are integrated into battery installations for safety purposes. Grid-scale energy storage, a critical component of electric grid stability, is addressed through advanced battery technologies.

Peak demand shaving and frequency regulation are achieved through battery systems with high power density and fast response times. Cyclic voltammetry (CV) is used for battery testing and certification, providing valuable insights into battery performance. Thermal runaway and overcharging are mitigated through advanced battery management systems. Temperature monitoring, wireless charging, and thermal management are essential features for optimizing battery life and safety. Lithium-ion batteries, with their high energy density and fast charging capabilities, are increasingly used in grid-scale energy storage applications. Modular battery systems and renewable energy integration are driving the market for solid-state batteries.

The Lead-acid segment was valued at USD 6422.70 billion in 2019 and showed a gradual increase during the forecast period.

Cathode and anode materials are under constant research to improve battery performance and safety. ISO certification, overdischarge protection, DC-DC converters, and battery safety regulations ensure the reliability and safety of battery systems. Battery recycling and power distribution are crucial aspects of the battery market, addressing environmental concerns and improving overall efficiency. In conclusion, the battery market is driven by the need for energy storage solutions, grid stability, and renewable energy integration. Advanced battery technologies, such as lithium-ion, solid-state, and flow batteries, offer improved performance and safety features. Battery testing, certification, and management systems are essential for ensuring reliability and safety in various applications.

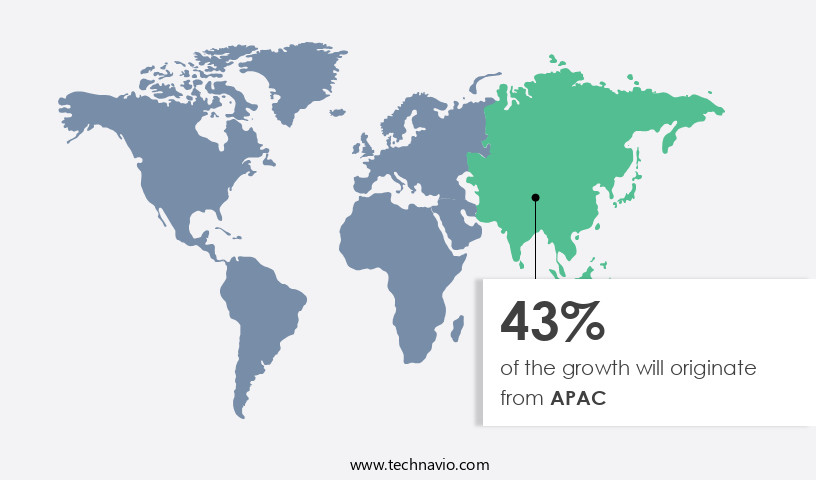

Regional Analysis

APAC is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is poised for significant expansion due to the increasing adoption of both internal combustion engine (ICE) vehicles and electric vehicles (EVs), as well as the growing demand for energy storage systems (ESSs) in utility and motive applications. In APAC, countries such as India, China, Indonesia, Malaysia, the Philippines, and Vietnam are projected to experience substantial annual growth in nominal disposable personal income during the forecast period. This economic development will lead to increased consumer spending, benefiting industries like automobiles and e-commerce, which will subsequently drive the demand for secondary batteries. IEC and UL certification are crucial for battery safety and are increasingly being mandated in various industries.

Fire suppression systems and thermal management solutions are essential components of battery packaging to ensure safety during charging and discharging. Grid-scale energy storage plays a vital role in electric grid stability by providing frequency regulation and peak demand shaving capabilities. Cyclic voltammetry (CV) testing and battery certification are essential for evaluating battery performance and ensuring compliance with industry standards. Thermal runaway and overcharging can lead to safety concerns, necessitating overdischarge protection and temperature monitoring. Fast charging and wireless charging are becoming increasingly popular, requiring advanced power electronics and battery management systems. Lithium-ion batteries, nickel-metal hydride batteries, and flow batteries are among the most common types of secondary batteries.

Modular battery systems and solid-state batteries are emerging technologies with high energy density and improved safety features. Renewable energy integration is a significant trend, with secondary batteries playing a crucial role in storing excess energy generated from renewable sources. Anode and cathode materials, internal resistance, self-discharge rate, power density, and cycle life are essential performance metrics for secondary batteries. Short-circuit protection, overcharge protection, and overdischarge protection are crucial safety features. Battery recycling is essential for minimizing environmental impact and reducing the demand for primary resources. In conclusion, the market in APAC is experiencing robust growth due to the increasing demand for secondary batteries in various industries, including automobiles, e-commerce, and utilities.

The market is driven by factors such as economic development, increasing adoption of renewable energy, and the need for safe and efficient energy storage solutions. Advanced battery technologies and stringent safety regulations are shaping the market landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving sector that focuses on the buying, selling, and recycling of used rechargeable batteries. This market encompasses various types of batteries, including lithium-ion, nickel-cadmium, nickel-metal hydride, and lead-acid batteries. Participants in this market engage in activities such as refurbishing, repurposing, and recycling these batteries for their second life applications. The market caters to diverse industries, including automotive, telecommunications, renewable energy, and consumer electronics. It offers numerous benefits, including cost savings, environmental sustainability, and resource conservation. Players in this market employ advanced technologies, such as battery testing, dismantling, and refurbishing, to ensure the quality and performance of the recycled batteries. The market is a significant contributor to the circular economy, offering a sustainable solution for managing the growing volume of used batteries.

What are the key market drivers leading to the rise in the adoption of Secondary Battery Industry?

- The significant decrease in the cost of lithium-ion batteries serves as the primary catalyst for the market's growth.

- Lithium-ion batteries have gained significant popularity due to their superior performance characteristics, including higher current density, longer power-holding capacity, and longer shelf life compared to other battery technologies. However, their comparatively higher cost is a key consideration for end-users. The manufacturing cost of lithium-ion batteries and battery packs has decreased due to increased production scale and manufacturing efficiency of companies. This cost reduction is driven by the high adoption of battery technology in the automotive industry and the development of cost-effective production methods. To ensure safety and reliability, lithium-ion batteries undergo rigorous testing and certification processes.

- They must comply with international standards such as UL (Underwriters Laboratories) and IEC (International Electrotechnical Commission) certifications. Fire suppression systems are also crucial for preventing thermal runaway, a potential safety hazard. Lithium-ion batteries are increasingly being adopted for grid-scale energy storage applications due to their ability to provide electric grid stability by smoothing out power fluctuations and shaving peak demand. Cyclic voltammetry (CV) testing is a common battery testing method used to evaluate battery performance and longevity. Battery certification plays a vital role in ensuring the safety and reliability of lithium-ion batteries for various applications, including electric vehicles, renewable energy systems, and portable electronics.

What are the market trends shaping the Secondary Battery Industry?

- Advanced lead-based secondary batteries are gaining significant attention in the battery market due to their ongoing development. This trend reflects the growing demand for efficient and cost-effective energy storage solutions.

- Advanced lead-acid batteries offer enhanced performance compared to traditional lead-acid batteries, addressing the issue of sulfation that negatively affects battery life. These batteries utilize advanced technologies, including Enhanced Flooded Batteries (EFBs), absorbent glass mat (AGM) batteries, and lead-carbon batteries. The market for advanced lead-acid batteries is significant due to their application in on-grid and off-grid energy storage systems, ensuring continuous electricity supply. In the automotive sector, these batteries are primarily used for start-stop applications in micro-hybrid vehicles and electric vehicles (EVs). Advanced lead-acid batteries provide several benefits, such as improved temperature monitoring, wireless charging, thermal management, cell balancing, frequency regulation, and reduced internal resistance and self-discharge rate.

- Power density and the use of cathode materials are also essential considerations in the development of these batteries. The demand for advanced lead-acid batteries is driven by the increasing need for energy storage solutions in various industries, including telecommunications, renewable energy, and transportation. The market for advanced lead-acid batteries is dynamic, with ongoing research and development focusing on improving battery efficiency, reducing costs, and increasing power density. Temperature monitoring, wireless charging, thermal management, cell balancing, frequency regulation, and internal resistance are critical factors influencing the market's growth. Additionally, advancements in cathode materials and power density are expected to further expand the market's potential applications.

What challenges does the Secondary Battery Industry face during its growth?

- The lead-acid battery industry faces significant operational and environmental challenges, which pose key impediments to its growth. These issues encompass various complexities and require industry experts' attention to ensure sustainable advancements.

- The market encompasses various battery technologies, with lead-acid batteries being commonly used due to their cost-effectiveness. However, their limitations, such as lower energy density and shorter life expectancy under continuous charge, have led to the exploration of alternative solutions. Flow batteries and modular battery systems, for instance, offer advantages like longer cycle life and scalability. Solid-state batteries are another emerging technology with potential for higher energy density and faster charging capabilities. Power electronics play a crucial role in optimizing the performance of these batteries, enabling efficient energy conversion and management. Lithium-ion batteries, with their high energy density and fast charging capabilities, have gained significant traction in various industries.

- However, ensuring safety features like iso certification, overdischarge protection, and dc-dc converters is essential for their widespread adoption. Comparatively, lead-acid batteries have lower energy density and lose their ability to accept a charge when discharged for extended periods due to sulfation. While they remain a cost-effective solution, advancements in battery technology and the integration of renewable energy sources necessitate a shift towards more efficient and durable alternatives.

Exclusive Customer Landscape

The secondary battery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the secondary battery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, secondary battery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accumulatorenwerke HOPPECKE Carl Zoellner and Sohn GmbH - This company specializes in supplying secondary batteries, including AGM and low voltage options, enhancing search engine visibility through innovative analysis.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accumulatorenwerke HOPPECKE Carl Zoellner and Sohn GmbH

- Brookfield Business Partners LP

- BYD Co. Ltd.

- Contemporary Amperex Technology Co. Ltd.

- East Penn Manufacturing Co. Inc.

- EEMB

- EnerSys

- Exide Technologies

- Furukawa Electric Co. Ltd.

- GS Yuasa International Ltd.

- Hitachi Ltd.

- Leoch International Technology Ltd.

- LG Energy Solution Ltd.

- Lithium Battery Co.

- Murata Manufacturing Co. Ltd.

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Shenzhen GMCELL Technology Co., Ltd.

- Stellantis NV

- Tesla Inc.

- Tata AutoComp GY Batteries Pvt. Ltd

- TianJin Lishen Battery Joint Stock Co. Ltd.

- TotalEnergies SE

- Toyota Motor Corp.

- U.S. Battery Manufacturing Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Secondary Battery Market

- In January 2024, Tesla, a leading player in the market, announced the launch of its new energy storage product, the Megapack 2.0, which can store up to 3 GWh of energy (Tesla Press Release, 2024). This development signified a significant leap in energy storage capacity for the company.

- In March 2024, LG Chem and Panasonic, two major secondary battery manufacturers, formed a strategic partnership to collaborate on research and development of advanced battery technologies (Reuters, 2024). This collaboration aimed to enhance their competitive edge in the market.

- In May 2025, BYD Company Limited, a Chinese battery manufacturer, secured a USD 2 billion investment from Berkshire Hathaway, led by Warren Buffet, to expand its battery production capacity (Bloomberg, 2025). This strategic investment marked a significant milestone for BYD in its quest to become a global leader in the market.

- In the same month, the European Union passed the Battery Regulation, setting strict rules for the production, collection, treatment, and recycling of batteries (European Commission, 2025). This regulatory development is expected to boost the market, as it encourages the circular economy and sustainable production.

Research Analyst Overview

- The market is experiencing significant activity and trends, driven by advancements in next generation batteries and the increasing demand for portable electronics. Manufacturing process optimization plays a crucial role in reducing costs and improving battery performance. However, understanding battery degradation mechanisms, such as cycle aging and calendar aging, is essential for supply chain management and lifecycle assessment in the circular economy. Raw material sourcing and material science are key areas of focus for battery manufacturers, as they strive to minimize environmental impact and ensure quality control. The circular economy also influences the market, with electric bikes, medical devices, drones, and industrial equipment utilizing batteries in their operations.

- Cost reduction strategies are a priority, with advanced battery chemistries and big data analytics playing a significant role. The market also caters to various applications, including electric boats, smart homes, backup power systems, and aerospace applications, further expanding its reach. Military applications require high-performance batteries, necessitating ongoing research into aging mechanisms and cost reduction strategies. The market's environmental impact is under constant scrutiny, with a growing emphasis on sustainable raw material sourcing and circular economy principles. Battery manufacturing continues to evolve, with a focus on improving efficiency and reducing waste. This trend is evident in the production of batteries for consumer electronics, electric scooters, and smart grid applications.

- Overall, the market is dynamic and diverse, with ongoing innovation and a commitment to sustainability shaping its future.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Secondary Battery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.2% |

|

Market growth 2025-2029 |

USD 34486.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

19.6 |

|

Key countries |

Japan, US, China, India, UK, Germany, France, Canada, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Secondary Battery Market Research and Growth Report?

- CAGR of the Secondary Battery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the secondary battery market growth of industry companies

We can help! Our analysts can customize this secondary battery market research report to meet your requirements.