Self-Paced E-Learning Market Size 2025-2029

The self-paced e-learning market size is forecast to increase by USD 6.96 billion, at a CAGR of 2.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the availability of subject proficiency assessments and certifications. These assessments enable learners to measure their progress and gain recognition for their achievements, making self-paced e-learning an attractive option for individuals seeking to upskill or reskill. Additionally, the popularity of microlearning, which offers short, focused learning modules, has expanded the market's reach. This flexible learning format caters to learners' busy schedules and diverse learning styles, further fueling market growth. However, the increasing number of free online courses poses a challenge for market players.

- As more free resources become available, competition intensifies, and providers must differentiate themselves through high-quality content, user experience, and additional features to maintain market share. To capitalize on opportunities and navigate challenges effectively, companies should focus on delivering personalized learning experiences, leveraging technology to enhance engagement, and continuously improving content offerings.

What will be the Size of the Self-Paced E-Learning Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the shifting dynamics of talent development and curriculum design in various sectors. Marketing automation and data analytics play a pivotal role in reaching and engaging learners through personalized and interactive approaches. Technical training and corporate learning are embracing subscription models, enabling flexible access to software training and professional development. E-learning platforms seamlessly integrate pricing strategies, SCORM compliance, and blended learning, offering a mix of self-paced and instructor-led sessions. Digital marketing, learning analytics, and user segmentation help target the right audience with tailored content and revenue models. A/B testing and sales funnels optimize the learning experience, ensuring alignment with learning objectives.

Course authoring tools and analytics dashboards facilitate the creation and tracking of progress in self-paced learning, while virtual classrooms and video tutorials provide opportunities for live sessions and interactive learning. User experience (UX) and content strategy are crucial in delivering engaging and effective educational content. Adaptive learning and social media marketing cater to the diverse needs of learners, enhancing their overall experience. Elearning authoring tools and progress tracking enable the creation and management of online courses, while customer personas guide the development of effective educational content. In this ever-changing landscape, the market continues to unfold, offering innovative solutions for talent development, curriculum design, and professional growth.

How is this Self-Paced E-Learning Industry segmented?

The self-paced e-learning industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Packaged content

- Services

- End-user

- Students

- Employees

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

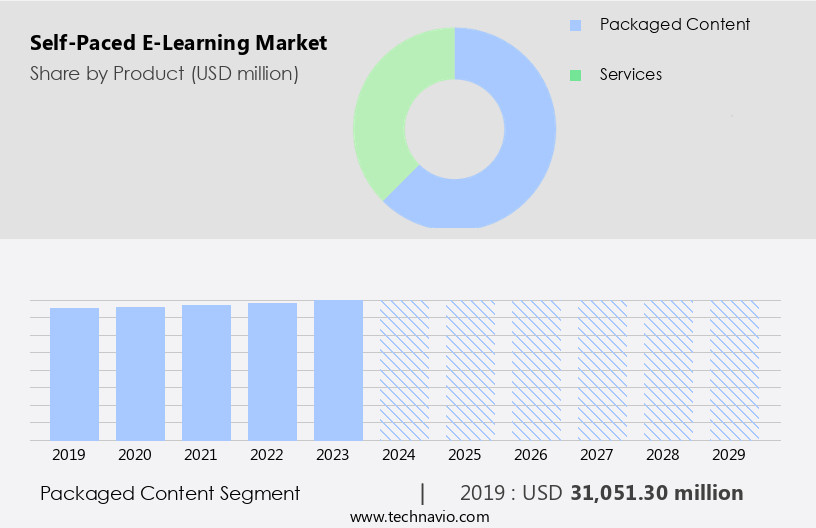

The packaged content segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing adoption of technology in talent development and corporate training. Packaged e-learning content, which includes on-demand, off-the-shelf courses, is gaining popularity for its effectiveness, contextualization, and precision. This segment encompasses various elements, such as videos, gamified content, and microlearning, catering to the increasing demand for personalized learning experiences. The education sector, particularly post-secondary institutions, and corporations are major contributors to this market's growth. The need for off-the-shelf courses that can be easily integrated into existing curriculum design and training programs is driving the demand for packaged e-learning content.

companies, such as City and Guilds Group, are meeting this demand by offering a wide range of courses. Marketing automation and data analytics are essential tools for e-learning platforms to optimize pricing strategies, learning objectives, and sales funnels. These platforms also offer features like A/B testing, compliance training, and progress tracking to cater to the diverse needs of their clients. Live sessions, instructor-led training, and interactive learning are other elements that enhance the learning experience. Subscription models, revenue models, and content strategy are critical components of the e-learning industry. User segmentation and user experience (UX) are essential for creating targeted content that resonates with the audience.

Digital marketing, social media marketing, and email marketing are effective channels for lead generation and customer engagement. Course development, knowledge management, and professional development are key areas where e-learning platforms provide value. Virtual classrooms, video tutorials, and elearning authoring tools facilitate the creation and delivery of high-quality educational content. Adaptive learning and data visualization are advanced features that personalize the learning experience and improve learning outcomes. In conclusion, the market is evolving rapidly, with a focus on personalized, contextualized, and precise learning experiences. The integration of marketing automation, data analytics, and digital marketing tools is transforming the way e-learning platforms engage with their customers and deliver value.

The adoption of these technologies is set to continue, driving the growth of the market.

The Packaged content segment was valued at USD 31.05 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

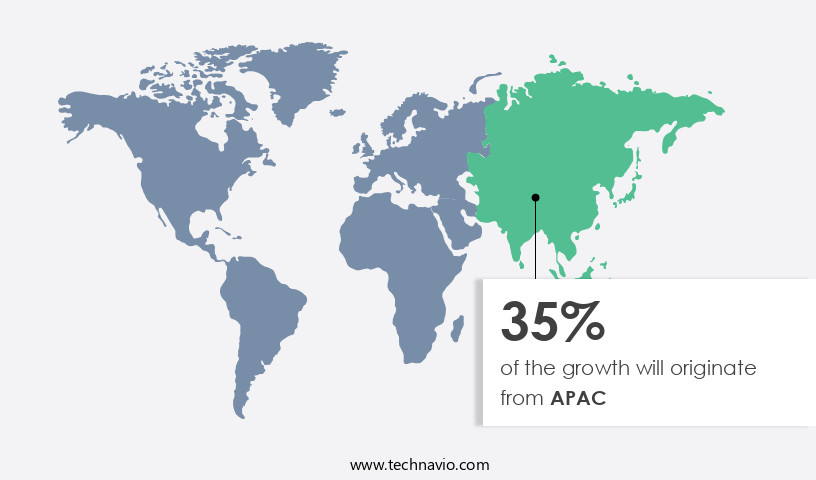

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing consistent growth due to the region's tech-savvy population and early adoption of modern technologies. With a rising number of individuals enrolling in online courses and self-paced distance learning programs, the US and Canada are major contributors to the regional market's expansion. The integration of marketing automation, data analytics, and digital marketing in talent development and corporate training has led to the popularity of subscription models and personalized learning. Course development, including instructional design and SCORM compliance, is a crucial aspect of the market, ensuring compatibility with various e-learning platforms and analytics dashboards.

Self-paced learning caters to diverse learning objectives, such as compliance training, software training, and professional development, through various delivery methods, including video tutorials, live sessions, and virtual classrooms. Pricing strategies, such as revenue models and adaptive learning, are essential to cater to different customer personas and user segments. Social media marketing, user experience (UX), and content strategy further enhance the market's reach and engagement. E-learning authoring tools and progress tracking enable the creation and management of educational content, ensuring a seamless learning experience for the target audience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and evolving the market, learners have the freedom to access educational content at their own speed and convenience. This market caters to diverse learning styles and schedules, enabling individuals to upskill or reskill from anywhere in the world. Self-paced e-learning platforms offer a rich, interactive learning experience, integrating multimedia content, quizzes, and assessments. Adaptive learning technologies personalize instruction, while gamification keeps learners engaged. Mobile compatibility ensures accessibility, making self-paced e-learning an essential tool for professional development and lifelong learning. Progress tracking and certificates add value, while social learning features foster community engagement. With a vast array of subjects available, the market empowers learners to acquire new skills and knowledge at their own pace and convenience.

What are the key market drivers leading to the rise in the adoption of Self-Paced E-Learning Industry?

- The market's growth is primarily fueled by the accessibility of subject proficiency assessments and certifications. These evaluations and credentials serve as essential tools for measuring and validating individuals' expertise, thereby driving demand within the industry.

- Self-paced e-learning courses offer assessments to evaluate learners' proficiency in various subjects and concepts. These assessments are essential for talent development and curriculum design in corporate training. They engage learners in the learning process and provide immediate feedback through online tests. This feature allows learners to revisit and reinforce their understanding of weaker areas. Two primary components of self-paced e-learning assessments are learner-involved assessments and automated assessments. In learner-involved assessments, learners actively engage with the subject matter and are evaluated based on their knowledge. Online assessments in self-paced e-learning enable students to identify and improve their weaker areas by revisiting the relevant content.

- Marketing automation, data analytics, and subscription models are essential elements of self-paced e-learning platforms. Marketing automation streamlines the process of delivering personalized content to learners based on their learning objectives and progress. Data analytics provide insights into learners' performance, enabling instructors to tailor the curriculum to meet the needs of individual learners. Subscription models offer flexibility and affordability for learners to access a wide range of courses and content. Moreover, self-paced e-learning platforms employ A/B testing to optimize the learning experience. Compliance training and technical training are crucial applications of self-paced e-learning, ensuring that employees are up-to-date with industry regulations and technical skills.

- Sales funnels are also utilized to guide learners through the learning process and maximize engagement and retention.

What are the market trends shaping the Self-Paced E-Learning Industry?

- The growing trend in the market is the increasing popularity of microlearning, a learning method that delivers content in short, focused sessions. This approach to education and professional development is both efficient and effective, making it a mandatory choice for many individuals and organizations.

- The market is witnessing significant growth due to the increasing adoption of software training and the shift towards flexible learning solutions. Instructional design plays a crucial role in creating effective e-learning content, while pricing strategies vary from freemium models to subscription-based plans. E-learning platforms are integrating advanced features such as learning analytics, live sessions, and SCORM compliance to enhance the learning experience. Course authoring tools and analytics dashboards enable organizations to create and manage customized training programs. Blended learning, which combines self-paced e-learning with live sessions, offers a more comprehensive training solution.

- Microlearning, a trend gaining prominence, utilizes bite-sized content for quick and focused learning. The growing importance of digital marketing and the availability of mobile devices have made microlearning an attractive choice for organizations.

What challenges does the Self-Paced E-Learning Industry face during its growth?

- The proliferation of free online courses poses a significant challenge to the growth of the industry, as the increasing availability of free education may deter potential students from enrolling in traditional, fee-based programs.

- Self-paced e-learning, a flexible and personalized approach to education, continues to gain popularity in the corporate world and beyond. Course development in this sector caters to various customer personas, enabling professional development and knowledge management. The market's dynamics are influenced by several factors, including the availability of free online courses and content. The rise of Massive Open Online Courses (MOOCs) has led to an increase in their adoption, with platforms like edX and LinkedIn's Lynda.Com offering free and partially free courses to millions of learners.

- In 2022, edX reported serving over 86 million learners worldwide through more than 4,600 courses. However, this trend may pose a challenge to the market's growth. Adaptive learning, virtual classrooms, video tutorials, email marketing, and social media marketing are other essential components shaping the revenue models in this sector.

Exclusive Customer Landscape

The self-paced e-learning market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the self-paced e-learning market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, self-paced e-learning market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

2U Inc. - This company delivers flexible e-learning experiences through short courses, intensive boot camps, and assessment programs, empowering individuals to upskill at their own pace. Our offerings span various disciplines, enhancing professional growth and industry expertise.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 2U Inc.

- Anthology Inc.

- Aptara Inc.

- Berlitz Corp.

- Cerritos College

- City and Guilds Group

- D2L Inc.

- e Careers Ltd.

- Encompass Safety Solutions Ltd.

- GP Strategies Corp.

- Houghton Mifflin Harcourt Co.

- John Wiley and Sons Inc.

- NIIT Ltd.

- Pearson Plc

- Simplilearn

- StraighterLine Inc.

- Think and Learn Pvt. Ltd.

- Totara Learning Solutions Ltd.

- Udemy Inc.

- Vedantu Innovations Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Self-Paced E-Learning Market

- In January 2024, Coursera, a leading self-paced e-learning platform, announced the launch of its new subscription model, Coursera Plus, offering unlimited access to over 3,000 courses for a single fee (Coursera Press Release). This strategic move aimed to attract more learners and provide them with greater flexibility and value.

- In March 2024, edX, another prominent self-paced e-learning provider, entered into a partnership with Microsoft to integrate Microsoft's professional certifications into its courses, expanding its offerings and catering to the growing demand for skill development in the tech industry (edX Press Release).

- In May 2024, Udemy, the world's largest marketplace for self-paced e-learning, raised USD100 million in a Series F funding round, led by Prosus Ventures, to further invest in its platform and expand its presence in emerging markets (Bloomberg).

- In April 2025, the European Union passed the Digital Skills and Jobs Coalition Action Plan, which includes a significant investment in self-paced e-learning platforms to upskill and reskill its workforce, making Europe a major growth market for the self-paced e-learning industry (European Commission Press Release).

Research Analyst Overview

- The market is experiencing significant growth, with community building and multimedia learning emerging as key trends. Progress reports enable learners to track their progress, fostering accountability and engagement. The future of learning lies in cognitive load theory, which optimizes content delivery based on learning pathways and styles. Edtech trends include social constructivism, with collaboration tools and peer learning facilitating interactive experiences. Skill gap analysis, online assessment, and automated grading streamline the learning process, while content moderation ensures a safe and effective learning environment.

- Artificial intelligence (AI), machine learning (ML), virtual reality (VR), and augmented reality (AR) are transforming education, providing personalized recommendations and immersive experiences. Investment in edtech continues to rise, with startups leveraging AI for plagiarism detection, performance monitoring, behavioral analytics, and automated feedback. Competency modeling and automated assessment tools are essential for measuring learning outcomes and identifying areas for improvement.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Self-Paced E-Learning Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.5% |

|

Market growth 2025-2029 |

USD 6.96 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.4 |

|

Key countries |

US, Canada, China, UK, India, Brazil, Germany, Japan, France, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Self-Paced E-Learning Market Research and Growth Report?

- CAGR of the Self-Paced E-Learning industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the self-paced e-learning market growth of industry companies

We can help! Our analysts can customize this self-paced e-learning market research report to meet your requirements.