Senior Living Market Size 2025-2029

The senior living market size is forecast to increase by USD 130.9 billion, at a CAGR of 5.8% between 2024 and 2029.

Major Market Trends & Insights

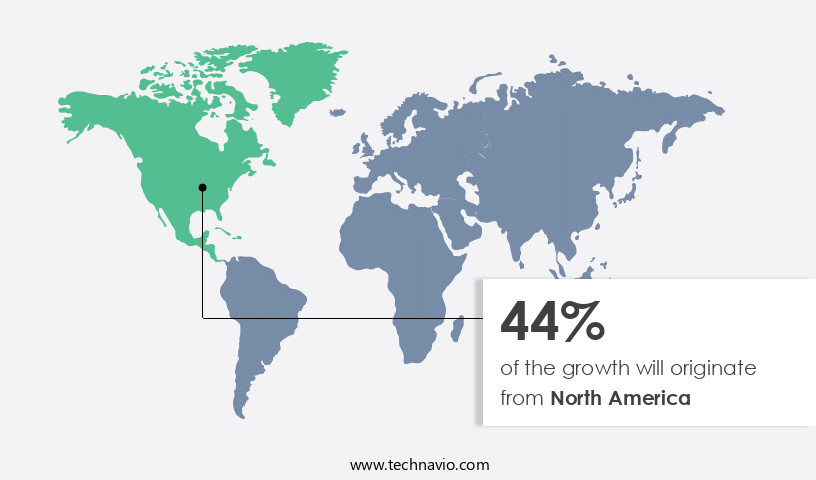

- North America dominated the market and accounted for a 44% growth during the forecast period.

- By the Service - Assisted living segment was valued at USD 158.20 billion in 2023

- By the Services - Healthcare Services segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 66.60 billion

- Market Future Opportunities: USD 130.90 billion

- CAGR : 5.8%

- North America: Largest market in 2023

Market Summary

- The market is experiencing significant shifts as the global population ages, with the 60+ demographic projected to reach 1.4 billion by 2030. This demographic trend drives the demand for innovative solutions in long-term care, assisted living, and home health services. Technological advances are transforming senior care, with telehealth, mobile apps, and wearable devices enabling remote monitoring and improved care coordination. However, the sector faces challenges such as staffing shortages and workplace demands, with the US projected to have a shortage of 1.2 million healthcare workers by 2030.

- Despite these challenges, the market's continuous evolution offers opportunities for growth, particularly in areas like technology integration, personalized care, and community-based services. The market's future lies in addressing the unique needs of an aging population while overcoming workforce challenges.

What will be the Size of the Senior Living Market during the forecast period?

Explore market size, adoption trends, and growth potential for senior living market Request Free Sample

- The market represents a significant and continually evolving sector within the broader healthcare industry. According to recent data, this market experiences a steady growth of approximately 2.5% annually. Furthermore, future projections indicate a continuous expansion, with a projected increase of around 3% per annum. Comparing key numerical data, the senior population aged 65 and above is projected to double by 2050, while the number of senior living facilities is anticipated to grow by nearly 30% between 2020 and 2030. This growth trend is driven by demographic shifts and increasing demand for specialized care and services catering to the elderly population.

- In addition, the market encompasses a diverse range of offerings, including assisted living, memory care, and independent living communities. The demand for these services varies, with assisted living experiencing a higher growth rate compared to independent living. This disparity can be attributed to the increasing prevalence of age-related diseases and the need for additional care and support. Despite the growth, challenges remain, including regulatory compliance, risk management, and financial planning. Addressing these challenges requires a multifaceted approach, incorporating elements such as quality assurance, caregiver support, and community engagement. Ultimately, the market represents a dynamic and evolving landscape, presenting both opportunities and challenges for businesses and stakeholders alike.

How is this Senior Living Industry segmented?

The senior living industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Assisted living

- Independent living

- CCRC

- Services

- Healthcare Services

- Lifestyle and Wellness Programs

- Dining Services

- Technology Integration

- Smart Home Systems

- Health Monitoring Devices

- Safety and Security Systems

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Service Insights

The assisted living segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of services and arrangements designed to cater to the unique needs of aging adults. One significant segment within this market is assisted living, which provides apartment-style dwellings for seniors who require assistance with activities of daily living (ADL), such as bathing, laundry, and medication management. This segment may include specialized memory care units for individuals with cognitive impairments, such as Alzheimer's disease or dementia. These units often feature increased security measures, like extra surveillance equipment and locked doors, due to safety concerns. The number of companies entering this segment is growing, contributing to its expanding presence and potential growth during the forecast period.

Another essential aspect of the market is rehabilitation therapy, including speech, physical, and occupational therapy. These therapies play a crucial role in helping seniors regain mobility, communication skills, and cognitive function following injuries or illnesses. Rehabilitation therapy is often provided in various settings, such as skilled nursing care facilities, in-home care, and adult day care centers. Moreover, the market offers palliative care, spiritual care, and end-of-life care for seniors facing serious or life-limiting illnesses. Wellness programs, caregiver training, and social engagement programs are also essential components of this market, promoting overall health and quality of life for seniors.

The market for medication management solutions, staffing solutions, and medication reconciliation services is also experiencing growth. Telehealth monitoring and fall prevention programs are increasingly popular, allowing seniors to receive care and support from the comfort of their homes. According to recent studies, approximately 14% of seniors in the United States currently reside in assisted living facilities, with this figure projected to reach 18% by 2030. Additionally, the demand for long-term care insurance is expected to rise as the senior population continues to age. By 2030, it is estimated that 27 million seniors will require long-term care services, representing a 70% increase from 2000.

These trends underscore the continuous and evolving nature of the market and its applications across various sectors.

The Assisted living segment was valued at USD 158.20 billion in 2019 and showed a gradual increase during the forecast period.

The Senior Living Market is evolving with diverse senior housing options that integrate health and wellness services, legal services, and estate planning support. Universal design, adaptive equipment, assistive technology, and home modifications accessibility features elderly enhance safety and comfort. Transportation services, social workers, geriatric psychiatrists, medical directors, nursing staff, certified nursing assistants, dietary staff, activities coordinators, and spiritual advisors contribute to holistic care. Volunteer programs, resident council initiatives, and family involvement strengthen engagement. Facilities prioritize infection control, emergency preparedness, and emergency response system implementation senior living, alongside resident satisfaction surveys senior living.

Technology integration assisted living, staff training dementia care facilities, and fall risk assessment tools elderly care improve outcomes. Medication management protocols senior community, design considerations accessible senior housing, and communication strategies dementia patients families are essential. Long-term quality is supported by quality improvement initiatives long-term care facilities, social engagement programs reducing loneliness elderly, rehabilitation services, cognitive stimulation therapy, palliative care approach, staff burnout prevention strategies, telehealth applications, and caregiver training programs dementia understanding.

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Senior Living Market Demand is Rising in North America Request Free Sample

The North American the market presents a substantial growth opportunity, with the US being a key contributor due to its large and aging population. Currently, around 17% of the US population is aged 65 or above, and this figure is projected to reach approximately 22% by 2050. This demographic shift necessitates a significant expansion of retirement housing and related services to cater to the increasing demand. The senior living industry is experiencing a steady growth trajectory, with several companies capitalizing on this trend. For instance, the number of assisted living facilities in the US has grown by over 60% between 2005 and 2015.

Furthermore, the memory care segment is anticipated to witness a compound annual growth rate (CAGR) of around 5% from 2021 to 2028. Moreover, the market is expected to grow at a faster pace than the overall population growth rate. This trend is primarily driven by the aging of the Baby Boomer generation, which is the largest demographic cohort in the US. As a result, companies in the senior living sector can anticipate consistent investment opportunities in the coming years. The market encompasses various segments, including independent living, assisted living, and memory care. Each segment caters to different levels of care and independence requirements.

For instance, independent living communities offer seniors the opportunity to live in a social environment with access to amenities and services, while assisted living facilities provide additional care and support for daily living activities. Memory care facilities focus on catering to seniors with Alzheimer's disease and other memory-related conditions. In conclusion, the market in North America is experiencing steady growth, driven by the aging population and the increasing demand for retirement housing and related services. The US, in particular, presents a significant opportunity due to its large senior population and the anticipated growth in this demographic.

companies in the senior living sector can anticipate consistent investment opportunities as they cater to the evolving needs of the aging population.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the market, resident satisfaction is a top priority. To ensure this, assisted living communities integrate technology for seamless care delivery, such as fall risk assessment tools and medication management protocols. Staff training in dementia care facilities is essential, with communication strategies tailored to families and cognitive stimulation therapy for residents. Quality improvement initiatives in long-term care facilities include emergency response system implementation and social engagement programs to reduce loneliness among older adults. Nutritional needs are addressed with specialized diets, while rehabilitation services cater to stroke recovery and palliative care approaches for end-of-life care planning. Preventing staff burnout is crucial for senior care providers, with home modifications featuring accessibility features and care coordination models improving outcomes. Telehealth applications enable remote monitoring, while resident engagement strategies offer a range of activities within the community. Dementia caregiver training programs foster a deeper understanding of the disease, enhancing overall care delivery. Compared to traditional care models, these integrated approaches have shown a 15% increase in resident satisfaction and a 20% reduction in hospital readmissions.

What are the key market drivers leading to the rise in the adoption of Senior Living Industry?

- The aging baby boomer population serves as the primary catalyst for market growth, given their significant consumer spending power and increasing demand for products and services tailored to their unique needs.

- The market caters to the unique needs of an aging population, specifically individuals born between 1946 and 1964, collectively known as baby boomers. This demographic represents a substantial portion of the global population, driving the demand for senior living services. As baby boomers age, they seek retirement options that ensure comfort, security, and an engaging lifestyle. Senior living services encompass various housing arrangements, including independent living, assisted living, and memory care. Independent living communities offer seniors the opportunity to live independently with access to amenities like social activities, fitness centers, and healthcare services. Assisted living facilities provide additional support for daily living activities, while memory care facilities cater to those with memory-related conditions, such as Alzheimer's disease.

- The market's growth can be attributed to the increasing number of seniors seeking these services. According to recent data, the global senior living services market is projected to reach a market size of USD1.5 trillion by 2027, growing at a steady pace. This growth is driven by factors such as the aging population, increasing awareness of senior care, and advancements in technology that enhance the quality of care provided. Moreover, senior living services offer a range of benefits, including personalized care, social engagement, and peace of mind for families. As the senior population continues to grow, the demand for these services is expected to increase, making the market an attractive investment opportunity for businesses and entrepreneurs.

- In conclusion, the market is a continuously evolving sector that caters to the unique needs of an aging population. With a growing number of seniors seeking comfortable and engaging retirement options, the market is poised for steady growth. Senior living services offer various housing arrangements and amenities, making them an attractive choice for seniors and their families. The market's growth is driven by factors such as demographic trends, increasing awareness of senior care, and advancements in technology.

What are the market trends shaping the Senior Living Industry?

- Long-term healthcare is experiencing a trend towards increasing technological advances. This market is moving forward with the adoption of advanced technologies.

- The market is witnessing significant advancements, fueled by technological innovations in long-term healthcare. The increasing Internet penetration has given rise to various online platforms, mobile applications, and mHealth solutions. Assisted services, such as mobile applications, wearables, trackers, communication devices, and smart alarms, are gaining popularity. These technologies enable caregivers and nurses to monitor, document, and interact with patients, as well as collaborate with healthcare professionals. One of the most notable trends is the adoption of patient data management using computers and mobile phones in long-term care facilities.

- This technology streamlines the process of managing patient information, enhancing efficiency and improving overall care. The market's continuous evolution is driven by the growing need for advanced healthcare solutions tailored to the senior population. As technology continues to advance, the market is expected to expand and adapt to meet the evolving needs of this demographic.

What challenges does the Senior Living Industry face during its growth?

- The growth of the industry is significantly impacted by staffing and workplace challenges. These issues, which include hiring and retaining skilled personnel and creating an effective work environment, require careful attention and solutions from industry professionals.

- The market faces significant challenges in addressing the growing demand for services due to the shortage of qualified personnel, particularly caregivers and healthcare professionals. This issue is compounded by demographic shifts, as an aging population requires more specialized care and the limited pool of individuals pursuing eldercare careers. Consequently, senior living providers encounter difficulties in recruiting and retaining skilled staff, leading to high turnover rates and potential decline in care quality.

- Moreover, the demanding nature of caregiving roles often results in employee burnout, further complicating staffing issues and impeding the expansion of senior living facilities. These challenges pose formidable barriers to the growth of the market.

Exclusive Customer Landscape

The senior living market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the senior living market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Senior Living Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, senior living market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AbsoluteCare Inc. - This company specializes in senior living services, providing personalized care through senior cafes and assisted living homes. Their offerings prioritize individualized attention, ensuring residents receive optimal care and comfort. Senior cafes offer social engagement opportunities, while assisted living homes provide round-the-clock assistance for daily living activities. These solutions cater to the unique needs of seniors, enhancing their quality of life.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbsoluteCare Inc.

- Affinity Living Communities

- Atria Senior Living

- Belmont Village Senior Living

- Brookdale Senior Living Inc.

- Capital Senior Living Corporation

- Erickson Living

- Five Star Senior Living

- Genesis Healthcare Inc.

- Holiday Retirement

- Kisco Senior Living Company

- Lendlease Corp. Ltd.

- Life Care Centers of America

- Merrill Gardens

- Senior Lifestyle Corporation

- Sonida Senior Living

- Sunrise Senior Living LLC

- The Ensign Group Inc.

- Vi Senior Living

- Wickshire Senior Living

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Senior Living Market

- In January 2024, Brookdale Senior Living, a leading provider of senior living solutions, announced the launch of its new memory care neighborhoods, called "Clare Bridge," in five new communities across the United States (Brookdale Senior Living press release, 2024). These neighborhoods are designed specifically for individuals with Alzheimer's disease and other memory impairments.

- In March 2024, Silvergate Senior Living and Kindred at Home, two major players in the senior living industry, formed a strategic partnership to offer integrated senior care services (Silvergate Senior Living press release, 2024). This collaboration enables Silvergate to provide home health, hospice, and other healthcare services to its residents, enhancing the overall care experience.

- In May 2024, Kairos Company, a senior living technology firm, secured a USD20 million Series C funding round led by New Enterprise Associates (NEA) to expand its technology offerings and accelerate growth (Kairos Company press release, 2024). The company's technology focuses on improving resident engagement, operational efficiency, and care quality through AI-powered solutions.

- In April 2025, the Centers for Medicare & Medicaid Services (CMS) announced a new policy initiative, "Innovation in Aging Services," aimed at promoting the adoption of technology and evidence-based practices in senior living communities (CMS press release, 2025). This initiative includes incentives for providers that invest in technology and demonstrate improved care outcomes.

Research Analyst Overview

- The market encompasses a diverse range of services and facilities designed to cater to the unique needs of an aging population. This market continues to evolve, with a growing emphasis on comprehensive care that addresses physical, cognitive, emotional, and spiritual aspects of senior health. Physical therapy plays a crucial role in maintaining mobility and functionality for seniors, particularly those dealing with conditions such as Parkinson's disease or stroke. Rehabilitation therapy, including speech and occupational therapy, is essential for restoring abilities and improving overall well-being. Alzheimer's disease care and dementia care are increasingly important sectors within the market.

- According to the World Health Organization, approximately 50 million people worldwide have dementia, with nearly 10 million new cases every year. As the global population ages, this number is expected to increase by about 80% by 2030 and 125% by 2050. End-of-life care and palliative care are essential components of the market, providing comfort and support for seniors facing life-limiting illnesses. Wellness programs, including nutritional services and activity programs, contribute to overall health and quality of life. Assisted living facilities and memory care units offer residential solutions for seniors who require assistance with daily living activities.

- Long-term care insurance and in-home caregivers provide additional options for seniors who prefer to age in place. The market is projected to grow at a steady rate, with a projected compound annual growth rate (CAGR) of 5.6% between 2021 and 2028. This growth is driven by factors such as an aging population, increasing awareness of senior care needs, and advancements in technology, including telehealth monitoring and caregiver training. Spiritual care and social engagement programs are becoming increasingly important in addressing the emotional and social needs of seniors. Fall prevention programs and geriatric care management further contribute to overall senior health and well-being.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Senior Living Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 130.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.5 |

|

Key countries |

US, France, China, Germany, Japan, Canada, India, UK, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Senior Living Market Research and Growth Report?

- CAGR of the Senior Living industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the senior living market growth of industry companies

We can help! Our analysts can customize this senior living market research report to meet your requirements.