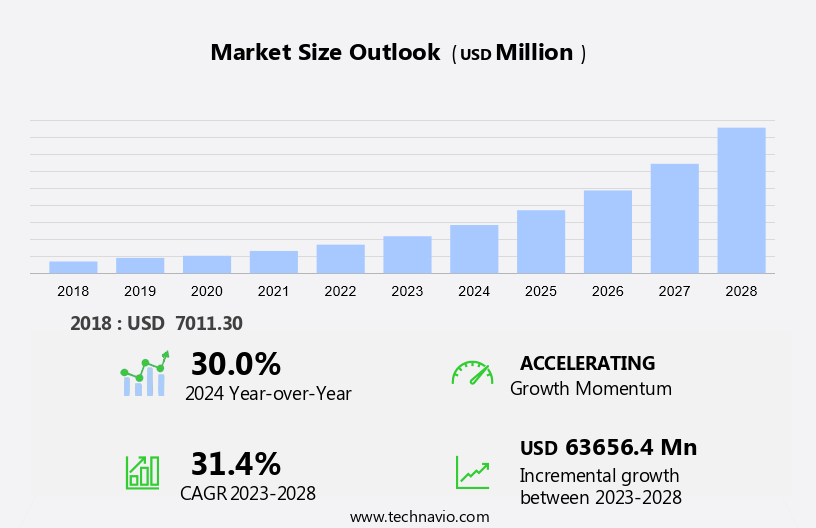

Server AI Chip Market Size 2024-2028

The server AI chip market size is forecast to increase by USD 63.66 billion at a CAGR of 31.4% between 2023 and 2028.

- The market is experiencing significant growth due to digital adoption by businesses of all sizes. The increasing demand for engaging websites and user-friendly interfaces has fueled this trend. Versatility is a key factor driving the market, as AI chips offer advanced features that website builders require for creating digital evolutions. However, the high initial costs of implementing these chips remain a challenge for some small businesses. Programming skills are essential for utilizing the full potential of these chips, but user-friendly interfaces are being developed to mitigate this issue. As digital evolution continues, the need for strong data security measures to protect sensitive data will remain a priority.

What will be the Size of the Market During the Forecast Period?

- Artificial Intelligence (AI) chip technology has been gaining significant attention in various industries due to its potential to enhance efficiency, productivity, and accuracy. The global market is witnessing notable advancements in areas such as AI model compression, thermal design power management, and edge computing optimization. One of the primary focuses in the AI chip market is on reducing high-power consumption, which is a critical challenge in the implementation of AI systems. Low-power AI technology is becoming increasingly important to enable the deployment of AI solutions in resource-constrained environments.

- In addition, another significant trend in the market is the development of AI privacy solutions. With growing concerns over data security and data privacy, there is a rising demand for AI chips that can ensure data confidentiality and protect against unauthorized access. The finance sector is one of the major adopters of AI technology, and the integration of AI chips is expected to further accelerate its growth. AI in finance applications includes fraud detection and prevention, risk management, and customer service, among others. Transportation is another industry that stands to benefit significantly from AI chip technology. AI-enabled systems can optimize traffic flow, improve safety, and enhance the overall transportation experience for passengers.

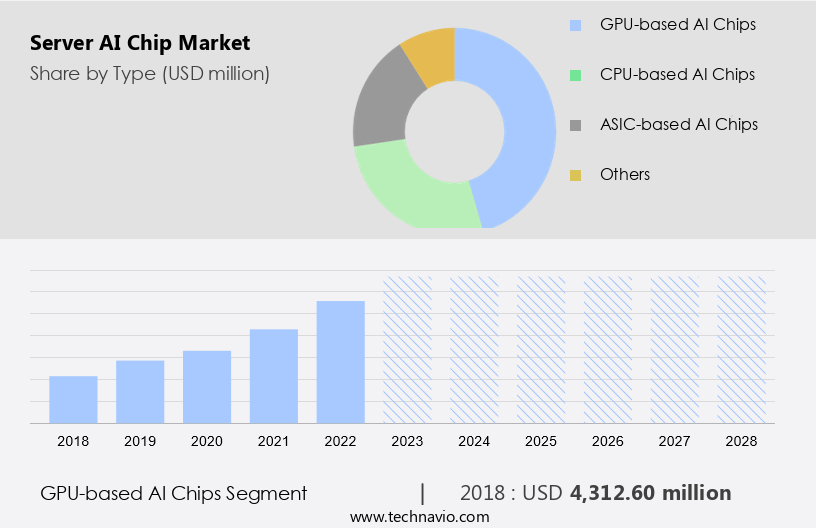

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- GPU-based AI chips

- CPU-based AI chips

- ASIC-based AI chips

- Others

- End-user

- Data centers

- Healthcare

- Automotive

- Retail

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- Brazil

- North America

By Type Insights

- The GPU-based AI chips segment is estimated to witness significant growth during the forecast period.

GPU-based AI chips represent an innovative solution for enhancing the capabilities of artificial intelligence (AI) and machine learning (ML) tasks. These advanced processors utilize the power of graphics processing units (GPUs) to execute intricate mathematical computations at remarkable speeds. The parallel processing power of GPUs makes them indispensable for demanding applications such as deep learning, natural language processing, and computer vision. One significant advantage of GPU-based AI chips is their capacity to deliver substantial performance enhancements compared to conventional central processing units (CPUs). Leveraging the parallel architecture of GPUs, these chips can process multiple operations concurrently, which is essential for the heavy computational requirements of AI and ML workloads.

Get a glance at the market report of share of various segments Request Free Sample

The GPU-based AI chips segment was valued at USD 4.31 billion in 2018 and showed a gradual increase during the forecast period.

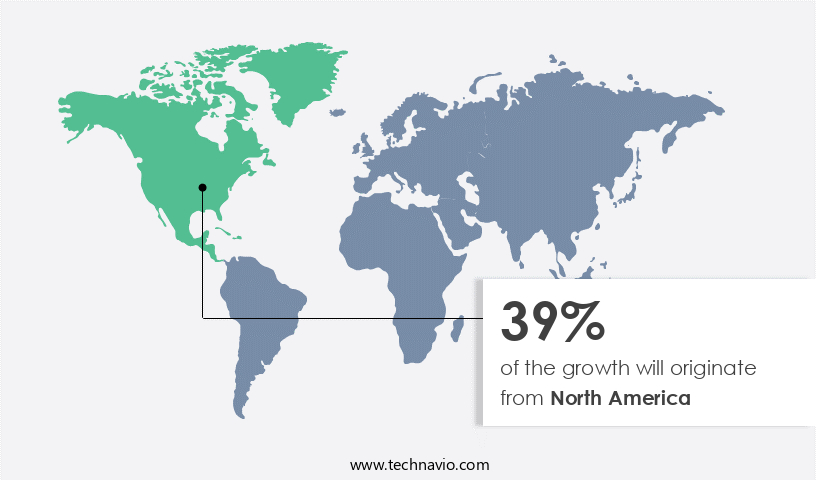

Regional Analysis

- North America is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market holds substantial significance in the server AI chip industry due to the burgeoning data center sector and the increasing implementation of AI technologies in various industries. The region's advanced technological infrastructure and innovation-driven approach position it as a key player in the global AI landscape. In a notable development, EDC VENTURE LLC unveiled its first North American data center in Atlanta, Georgia, in September 2024. This state-of-the-art facility boasts a highly efficient design, incorporating waterless cooling technology, marking a major advancement in the US data center industry. The Atlanta data center is part of a larger 168 MW campus named Edged Atlanta, underscoring the region's dedication to expanding its data center capabilities to accommodate growing AI workloads.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Server AI Chip Market?

Growing number of data centers is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for advanced artificial intelligence (AI) solutions in various sectors, including media and entertainment, retail, and big data analytics. This growth is driven by the need for efficient and secure processing of large amounts of data, which is crucial for applications such as natural language processing (NLP) and matrix multiplications. Cisco Systems' expansion into Indonesia with the launch of edge data centers in May 2024 underscores the importance of localized data processing infrastructure. These data centers enable organizations to comply with local regulations and provide customized solutions for specific industries.

- Moreover, the adoption of parallel processing, cloud computing, and generative AI technologies is expected to further fuel the market's growth. Energy costs are a significant concern for organizations operating large-scale data centers. Therefore, there is a growing focus on optimizing energy usage through AI infrastructure. For instance, AI algorithms can be used to optimize cooling systems, manage power loads, and improve overall energy efficiency. In conclusion, the market in the US is poised for substantial growth due to the increasing demand for advanced AI solutions, the importance of localized data processing infrastructure, and the need to optimize energy usage.

What are the market trends shaping the Server AI Chip Market?

Rapid development of AI-specific hardware is the upcoming trend in the market.

- The digital adoption trend continues to escalate, with small businesses and website creators increasingly seeking advanced solutions for engaging websites. Digital evolution has led to an increased demand for versatile hardware to support artificial intelligence workloads. In response, the market is witnessing significant growth, driven by the development of specialized hardware designed to optimize AI inference tasks. In recent news, d-Matrix unveiled its Corsair AI chip, which boasts impressive capabilities. This innovative technology delivers a throughput of 60,000 tokens per second at a latency of 1 millisecond per token for Llama3 8B within a single server. This level of performance is crucial for enhancing website functionality and improving overall efficiency in data centers and cloud computing environments.

- In addition, the user-friendly interface and strong security measures of these AI chips make them an attractive option for businesses looking to implement AI technology without requiring extensive programming skills.

What challenges does Server AI Chip Market face during the growth?

High initial costs is a key challenge affecting the market growth.

- The market experiences significant investment due to the increasing demand for AI capabilities in various sectors, particularly in data-intensive computing applications such as e-commerce and AIoT. The implementation of AI technologies, including video recognition and brand identity maintenance, enhances online presence and customer experience on e-commerce platforms. However, the adoption of these advanced technologies comes with a substantial price tag. The cost of server AI chips can significantly vary depending on their specifications, with prices ranging from around USD 1,000 to over USD 10,000 per unit. High-end servers, equipped with multiple GPUs and specialized AI acceleration hardware, can cost upwards of USD 100,000.

- Furthermore, factors contributing to these high costs include the number and type of processors, memory capacity, and storage requirements. Leading manufacturers like NVIDIA and Intel produce top-tier AI server chips, which are often utilized in large-scale AI applications, such as deep learning and natural language processing.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Micro Devices Inc.

- Alibaba Cloud

- Alphabet Inc.

- Amazon.com Inc.

- Cerebras Systems Inc.

- Graphcore Ltd.

- Hailo Technologies Ltd

- Intel Corp.

- International Business Machines Corp.

- MediaTek Inc.

- Mythic Inc

- NVIDIA Corp.

- Qualcomm Inc.

- SambaNova Systems Inc.

- Super Micro Computer Inc.

- Syntiant Corp.

- Tenstorrent Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for real-time data processing in various industries. Deep learning models, such as generative AI and NLP, are driving the need for high-performance chips that can handle matrix multiplications and complex AI applications. Edge AI and inference SoCs are gaining popularity due to their energy efficiency and ability to perform AI inference at the edge. However, the high power consumption of these chips is a major challenge that needs to be addressed for sustainable AI adoption. Deep learning models are finding applications in the media and entertainment, retail, and e-commerce industries, where big data analytics is essential for business growth.

The Server AI Chip Market is witnessing significant growth due to the increasing adoption of Artificial Intelligence (AI) in various industries, including manufacturing, transportation, healthcare, and more. AI Hardware Acceleration is a key trend in this market, as organizations seek to reduce high-power consumption and improve AI performance. In manufacturing, AI is being used to optimize production processes and improve quality control. In transportation, AI is being used for route optimization, predictive maintenance, and autonomous vehicles. However, AI privacy concerns are a major challenge, as well as the need for AI bias reduction and ethical guidelines. The market for AI chips is also driven by regulatory policies and sustainability concerns. AI for sustainability is a growing area, with applications in energy management, waste reduction, and environmental impact assessment. Image recognition technology is a major application area for AI chips, with explainability tools being used to increase transparency and trust.

The AI market trends also include the growth of AI startups, investment strategies, and workforce development programs. AI education and training are essential to address the adoption challenges and ensure a skilled workforce. Website audits, redesign strategies, ecommerce website development, web hosting services, and online branding techniques are also important considerations for organizations implementing AI solutions. In conclusion, the Server AI Chip Market is poised for continued growth, with opportunities in various industries and applications. However, challenges such as privacy concerns, bias reduction, and ethical guidelines must be addressed to ensure the responsible and effective use of AI. AI security solutions are also crucial to protect against potential threats and vulnerabilities. The future prospects of AI are vast, with applications in healthcare, education, and many other areas.

The Server AI Chip Market is revolutionizing the way businesses and individuals create and manage websites. This market encompasses a range of digital transformation tools, including mobile-responsive designs, website analytics tools, user experience design, and professional website services. These solutions enable businesses, particularly Small and Medium Enterprises (SMEs), to implement digital marketing strategies, improve coding skills, and optimize website performance. Key trends in the Server AI Chip Market include responsive web design, online sales growth, data privacy practices, and website design trends. Businesses are increasingly focusing on creating accessible, user-friendly websites to attract and retain customers. Ecommerce website platforms and easy website builders are popular options for businesses looking to establish an online presence. Moreover, website migration strategies and website builder for ecommerce are crucial for businesses seeking to upgrade their existing websites. Website performance optimization and best website builder options are essential for ensuring fast-loading, efficient websites. In summary, the Server AI Chip Market is a dynamic and evolving space, offering businesses and individuals a wealth of opportunities to enhance their online presence and drive business growth.

Moreover, the use of AI in these industries is leading to increased energy costs, making it crucial to develop energy-efficient AI chips. Parallel processing and cloud computing are key technologies being used to address the data-intensive computing requirements of AI applications. The versatility of AI chips is another important factor driving their adoption, as they can be used for various applications, including video recognition, brand identity, and online presence management. Small businesses and online retailers are increasingly adopting AI infrastructure to create engaging websites and improve user experience. The digital evolution is leading to the development of user-friendly interface designs, strong security measures, and customizable themes for website builders and web-based portals. The competition among e-commerce platforms is driving the need for dynamic websites and mobile optimization, further fueling the demand for AI chips.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 31.4% |

|

Market growth 2024-2028 |

USD 63.66 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

30.0 |

|

Key countries |

US, China, Germany, Japan, South Korea, UK, Canada, Brazil, France, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch