APAC Shunt Reactor Market Size 2024-2028

The APAC shunt reactor market size is forecast to increase by USD 160.5 million at a CAGR of 2.8% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. One major factor is the increasing demand for electricity transmission and distribution, particularly in developing nations undergoing industrialization. Another trend is the integration of shunt reactors with smart grid technologies, which enhances power system stability and flexibility. However, the high initial investment required for shunt reactor implementation remains a challenge. Additionally, electric utilities are increasingly focusing on renewable energy integration and addressing climate change concerns, making shunt reactors an essential component in mitigating power factor issues and ensuring grid reliability. Effective insulation and cooling systems are crucial in ensuring the efficient operation of shunt reactors, further driving market growth.

What will be the size of the Market during the forecast period?

- The market is witnessing significant growth due to the increasing integration of renewable energy sources, such as wind power and solar power, into the power grid. Renewable energy sources are becoming increasingly popular as part of the clean energy transition, but they present unique challenges for grid operators. Renewable energy sources generate reactive power, which is necessary for maintaining grid stability and voltage regulation. However, the intermittent nature of these sources can lead to voltage fluctuations and power quality issues. Shunt reactors provide an effective solution to these challenges by compensating for the reactive power needs of the grid.

- Grid stabilization is a critical aspect of power system efficiency, ensuring the reliability of electricity supply. Voltage fluctuations can cause significant energy loss and damage to equipment. Shunt reactors help mitigate these issues by providing reactive power compensation, ensuring that the voltage levels remain within acceptable limits. High-power applications, such as high-voltage transmission lines, require specialized reactive power solutions. Oil-immersed shunt reactors are commonly used In these applications due to their high power rating and ability to handle large currents. These reactors offer significant benefits, including energy loss minimization and improved power system efficiency. The aging technology of traditional power generation methods contributes to a growing carbon footprint and the need for more sustainable energy solutions.

How is this market segmented and which is the largest segment?

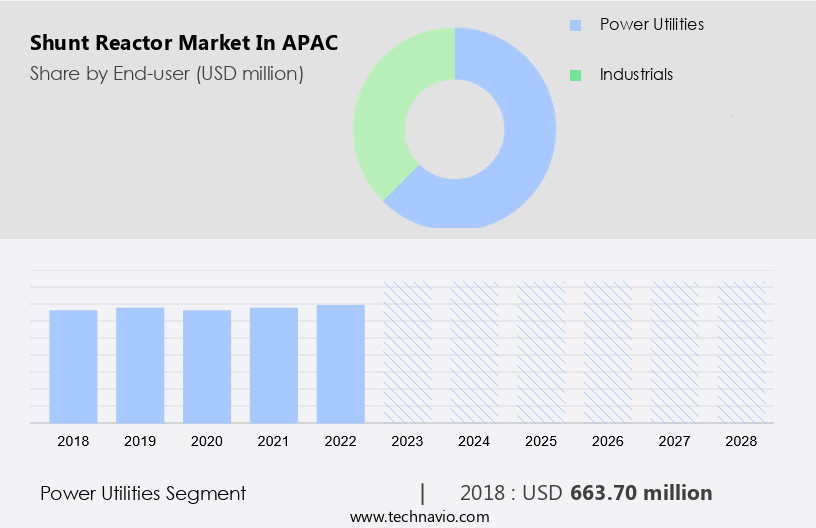

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Power utilities

- Industrials

- Geography

- APAC

- China

- India

- Japan

- APAC

By End-user Insights

- The power utilities segment is estimated to witness significant growth during the forecast period.

Shunt reactors are essential components in electricity transmission systems used by power utilities to ensure voltage control, reactive power compensation, and system stability. These reactors mitigate the Ferranti effect, which arises when the capacitive current of power lines exceeds the current of the connected load, leading to increased line voltage. The Ferranti effect is particularly prevalent in renewable energy integration and during climate change-induced weather events, resulting in increased greenhouse gas emissions and potential power system instability. Shunt reactors provide insulation and cooling to prevent overheating and ensure efficient energy transfer. Their flexibility in handling variable loads makes them indispensable in modern power systems.

Get a glance at the market share of various segments Request Free Sample

The power utilities segment was valued at USD 663.70 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of APAC Shunt Reactor Market?

Increased industrialization in developing nations is the key driver of the market.

- In the Asia Pacific region, the industrialization process in developing countries is driving the demand for shunt reactors. Countries such as India, Vietnam, Indonesia, and the Philippines are undergoing rapid economic growth, leading to an increased need for a dependable and efficient power supply to support expanding industries, infrastructure, and urbanization. Shunt reactors are essential in managing reactive power, enhancing voltage stability, and reducing energy losses in high-demand power grids. As industrialization advances, these nations are investing significantly in upgrading and expanding their power transmission and distribution networks. The integration of renewable energy sources, including wind and solar, into national grids intensifies the requirement for reactive power compensation offered by shunt reactors.

- This ensures grid efficiency and reliability, which is crucial for the integration of renewable energy sources into the power grid. Moreover, the implementation of smart city projects In the region further prioritizes the importance of a stable and efficient power supply. Shunt reactors play a vital role in maintaining grid stability and minimizing power fluctuations, making them an indispensable component of modern power systems.

What are the market trends shaping the APAC Shunt Reactor Market?

Integration of shunt reactors with smart grid technologies is the upcoming trend In the market.

- Shunt reactors are essential components In the integration of renewable energy sources, such as wind and solar power, into the power grid. In Asia Pacific (APAC), the adoption of these renewable energy sources is increasing, leading to the need for advanced grid technologies to maintain stability and reliability. Shunt reactors, specifically those used in smart grids, play a crucial role in managing reactive power and minimizing transmission losses. Smart grids enable real-time monitoring, control, and optimization of power flows, making them ideal for addressing the fluctuating power supply challenges posed by renewable energy sources. Shunt reactors, integrated into these smart grids, can dynamically adjust reactive power levels, ensuring efficient energy distribution and minimizing voltage fluctuations.

- The importance of shunt reactors in APAC is further highlighted by the region's push for modernized and efficient power infrastructure. As the demand for reliable and high-quality power increases, the market for shunt reactors is expected to grow. Oil-immersed shunt reactors, in particular, are suitable for high-power applications and can effectively manage the reactive power requirements of the grid.

What challenges does APAC Shunt Reactor Market face during the growth?

High initial investment is a key challenge affecting the market growth.

- Shunt reactors play a crucial role in energy loss minimization and power quality improvement in electric utilities' TandD infrastructure, particularly in high-voltage transmission networks. Oil-immersed reactors are commonly used for reactive power compensation and grid stability. However, the high initial investment required for their installation and integration poses a challenge for the market. The cost of advanced materials, manufacturing processes, and skilled labor can deter smaller utilities and developing nations from adopting these solutions. Instead, they may prioritize immediate infrastructure needs, such as expanding basic electricity access. Integrating shunt reactors into existing grid systems can also be complex and costly, necessitating specialized equipment, adherence to safety standards, and skilled personnel.

- Smart Grid Technology is a potential solution to mitigate these challenges by improving grid efficiency and reducing the need for reactive power compensation in certain situations. Therefore, the market may experience growth as economies develop and grid modernization efforts continue.

Exclusive Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- ALSTOM SA

- CG Power and Industrial Solutions Ltd.

- Clariant Power System Ltd.

- ENPAY Endustriyel Pazarlama ve Yat?r?m A.S.

- Fuji Electric Co. Ltd.

- Hitachi Ltd.

- Hyosung Heavy Industries Corp.

- Hyundai Motor Group

- Mitsubishi Electric Corp.

- Precise Engineering Models Pvt. Ltd.

- Shrihans Electricals Pvt. Ltd.

- Siemens AG

- Starlit Electricals

- Sumitomo Electric Industries Ltd.

- Tamura Corp

- Toshiba Corp.

- TSEA

- Zaporozhtransformator PrJSC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Shunt reactors are essential components In the power grid, playing a crucial role in renewable energy sources integration, grid stabilization, and voltage regulation. These reactors are designed to provide reactive power, improve power factor, and ensure voltage stability in high-power applications. Both oil-immersed and air-core types are used, with oil-immersed reactors being commonly employed in high-voltage transmission lines. Renewable energy sources, such as wind power and solar power, are increasingly being integrated into the power grid. It helps mitigate voltage fluctuations and ensure power quality, enabling the smooth integration of these clean energy sources. Grid reliability is a significant concern, and contributes to energy loss minimization and grid operators' ability to maintain voltage regulation.

In addition, variable reactors offer flexibility in handling varying power requirements and can be used in smart city projects and HVDC systems. The clean energy transition is a global priority, with renewable energy becoming an essential part of electricity transmission. Shunt reactors are essential in this context, reducing the carbon footprint by minimizing energy losses and ensuring grid reliability. Power system efficiency is a critical factor In the electricity industry, and contributes significantly to it by providing reactive power and maintaining voltage stability. Transformers and other T&D infrastructure benefit from the use of shunt reactors, reducing power outages and improving overall power supply quality. Smart grid technology integration further enhances the capabilities of shunt reactors, ensuring a more efficient and reliable power grid.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.8% |

|

Market growth 2024-2028 |

USD 160.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.7 |

|

Competitive landscape |

Leading Companies, Market Report, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch