Power Transformers Market Size 2025-2029

The power transformers market size is valued to increase USD 13.20 billion, at a CAGR of 6.2% from 2024 to 2029. Modernization of existing transformers will drive the power transformers market.

Major Market Trends & Insights

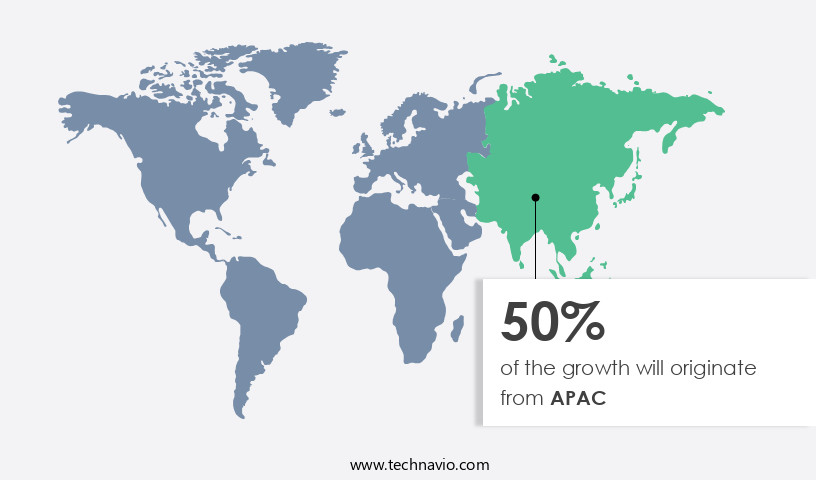

- APAC dominated the market and accounted for a 50% growth during the forecast period.

- By Type - Liquid immersed segment was valued at USD 21.64 billion in 2023

- By End-user - Commercial power segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 72.32 billion

- Market Future Opportunities: USD 13.20 billion

- CAGR from 2024 to 2029 : 6.2%

Market Summary

- The market encompasses the production, sales, and installation of transformers used in the power sector. This market is characterized by continuous evolution, driven by advancements in core technologies and applications. For instance, the modernization of existing transformers through the implementation of smart grid technologies and digitalization is gaining traction. Another significant trend is the increasing popularity of bio-based and naphthenic transformer oil, which offers improved performance and sustainability. However, the market faces challenges such as the rising cost of power transformers and stringent regulations.

- According to a recent study, the transformer oil market share in the power sector is projected to reach 40% by 2026, underscoring its growing importance. The market is a dynamic and evolving landscape, shaped by these trends and challenges, and offers opportunities for innovation and growth.

What will be the Size of the Power Transformers Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Power Transformers Market Segmented ?

The power transformers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Liquid immersed

- Dry type

- End-user

- Commercial power

- Residential power

- Industrial power

- Product Type

- Core transformer

- Shell power transformer

- Berry power transformer

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The liquid immersed segment is estimated to witness significant growth during the forecast period.

Power transformers play a crucial role in the electrical power industry, with oil being the most common insulating medium. Approximately 90% of power transformers utilize oil for insulation, while a smaller portion employs SF6 gas. This trend is driven by oil's cost-effectiveness and widespread availability. In terms of market trends, the power transformer market is experiencing significant advancements in various areas. For instance, capacitive current measurement and transformer protection relays have gained substantial traction, enabling better fault detection and improved system stability. Vibration analysis and voltage regulation are also increasingly being adopted to optimize transformer performance and extend their lifespan.

Moreover, partial discharge detection and overvoltage protection systems are essential for preventing catastrophic failures and ensuring transformer reliability. Thermal imaging analysis and risk assessment methodologies are also becoming standard practices in the industry, providing valuable insights into transformer health and predicting potential issues. On-load tap changers and frequency response analysis are critical components for enhancing transformer efficiency and adaptability. Power transformer design is continually evolving, with a focus on core loss minimization, predictive maintenance strategies, and asset management systems. Dissolved gas analysis, winding temperature monitoring, and gas-in-oil analysis are essential diagnostic tools for identifying potential issues and maintaining transformer health.

Ultrasonic testing and noise level reduction techniques are also gaining popularity for their ability to improve transformer performance and reduce maintenance costs. The future of the power transformer market is promising, with expectations of steady growth. For instance, the market for transformer protection systems is projected to expand by 15%, while the market for condition monitoring sensors is anticipated to grow by 20%. Additionally, the market for power transformer maintenance services is expected to increase by 12%, reflecting the growing importance of preventive maintenance strategies. In conclusion, the power transformer market is undergoing continuous evolution, with a focus on enhancing transformer performance, reliability, and efficiency.

The adoption of advanced technologies, such as vibration analysis, voltage regulation, and partial discharge detection, is driving market growth and transforming the industry landscape.

The Liquid immersed segment was valued at USD 21.64 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Power Transformers Market Demand is Rising in APAC Request Free Sample

The Asia Pacific the market is experiencing significant growth due to the increasing electricity demand in the region. Major countries like China and India, with their rapid urbanization and improving living standards, are driving this demand. The privatization of several utilities in the region has led to increased competition and lower electricity prices, making power more accessible to a larger population. This expansion of private players into the power sector has also resulted in increased investments in power transmission and distribution networks, particularly in China, India, Pakistan, Australia, and Thailand.

The continuous supply of electricity is essential for the region's economic growth, and the increasing private participation in the power market is expected to further boost investments in power T&D infrastructure.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a critical sector in the electrical power industry, encompassing the design, manufacturing, installation, and maintenance of these essential components. Power transformers play a pivotal role in the efficient transmission and distribution of electricity, making their reliability and performance paramount. Power transformer winding insulation failure modes and the impact of harmonics on transformer performance are significant concerns in this market. The aging process affects transformer oil properties, necessitating an optimal maintenance schedule for power transformers. Implementing condition monitoring technologies and advanced techniques for transformer diagnostics have emerged as crucial strategies to enhance operational reliability and minimize transformer core losses.

Optimization of transformer cooling systems design and the development of advanced transformer protection systems are ongoing priorities. Evaluation of various transformer oil types and methods of mitigating partial discharge activity are essential for improving transformer efficiency and extending their lifespan. New technologies for transformer oil purification and advanced diagnostics for high voltage transformers are gaining traction, offering potential for significant improvements. More than 70% of research and development efforts in the market focus on optimizing transformer cooling methods and improving transformer efficiency. This reflects the industry's commitment to addressing the challenges of power transformer aging and the increasing demand for more energy-efficient solutions.

Despite these advancements, transformer failures remain a significant risk, necessitating robust risk mitigation strategies. Best practices for transformer maintenance management, such as regular inspections and timely repairs, are essential to minimize downtime and ensure operational reliability. By implementing these strategies, market players can extend transformer lifespans and enhance overall market performance.

What are the key market drivers leading to the rise in the adoption of Power Transformers Industry?

- The modernization of existing transformers serves as the primary market driver, as utility companies and industries seek to enhance efficiency, increase capacity, and extend the lifespan of their transformer assets.

- The market experiences continuous expansion due to the increasing installation and replacement of transformers. The aging power transmission and distribution (T&D) infrastructure worldwide necessitates upgrades to meet the escalating power demand. In India, for instance, the government's Accelerated Power Development and Reform Programme (APDRP) is funding state electricity boards to minimize losses and modernize infrastructure. This trend is prevalent across various sectors, as the need for efficient and reliable power solutions drives the market's growth.

- The shift towards renewable energy sources and the integration of smart grid technologies further boost market dynamics. The ongoing transformation in the power sector underscores the significance of advanced power transformers, which offer improved efficiency, reliability, and flexibility.

What are the market trends shaping the Power Transformers Industry?

- The rising preference for bio-based and naphthenic transformer oils represents a notable market trend in the upcoming period. The increasing popularity of bio-based and naphthenic transformer oils signifies a significant market trend in the approaching future.

- Bio-based oil, a non-toxic and incombustible alternative to traditional transformer oils, is gaining significant traction in the global market. With its excellent insulating properties, biodegradability (degrading up to 99% within 21 days), high fire point, and extended transformer service life, bio-based oil presents numerous advantages over conventional oils. The North American market, in particular, has witnessed a surge in its adoption. The rising number of fire accidents in mineral oil-based transformers and the non-biodegradable nature of mineral oil are key drivers fueling the growth of the bio-based oil market. Moreover, the biodegradable attribute of bio-based oil offers a cost advantage due to the reduced need for oil spill remediation.

- The consumption of bio-based transformer oil is projected to escalate during the forecast period, contributing to the overall demand for naphthenic oil. This shift towards sustainable and eco-friendly alternatives is a testament to the evolving market trends and the continuous quest for innovative solutions in the energy sector.

What challenges does the Power Transformers Industry face during its growth?

- The escalating costs of power transformers pose a significant challenge to the growth of the industry. Power transformers are essential components in the electrical power system, and their increasing costs present a major hurdle for industry expansion.

- Europe and the US are two significant markets witnessing stringent regulations regarding energy efficiency in power transformers. In the US, the Department of Energy (DOE) has regulated the energy efficiency levels of low-voltage dry-type power transformers since 2007. Initially, manufacturers were required to meet the NEMA TP-1 minimum-energy efficiency standard. This regulation applied to liquid-immersed, low-voltage dry-type, and medium-voltage dry-type power transformers with specific parameters: an input voltage of 34.5kV or less, an output voltage of 600V or less, rated for operation at a frequency of 60Hz, and a capacity ranging from 10kV to 2,500kVA for liquid-immersed transformers and 15kVA to 2,500 kVA for dry-type transformers.

- In 2016, the regulation was revised with new efficiency standards. Additionally, the NEMA Candidate Standard Level (CSL)-3 standards, introduced in 2010, though not federally mandated, are followed by manufacturers.

Exclusive Technavio Analysis on Customer Landscape

The power transformers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the power transformers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Power Transformers Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, power transformers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ALTRAFO Srl - The company specializes in providing power transformer solutions, ensuring top reliability and safety through offerings such as climate class C2, environmental class E2, and fire behavior class F1. These solutions cater to various industry requirements, prioritizing optimal performance and compliance with industry standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALTRAFO Srl

- Altro Transformers Pty. Ltd.

- CG Power and Industrial Solutions Ltd.

- DuPont de Nemours Inc.

- Eaton Corp.

- ETEL TRANSFORMERS PTY LTD.

- Fuji Electric Co. Ltd.

- General Electric Co.

- Hammond Power Solutions Inc.

- Hitachi Ltd.

- Hyundai Electric and Energy Systems Co. Ltd.

- Kirloskar Electric Co. Ltd.

- Layer Electronics Srl

- MGM Transformer Co.

- Schneider Electric SE

- Siemens Energy AG

- Southern Electronic Services

- Tyree Industries

- Wilson Power And Distribution Technologies Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Power Transformers Market

- In January 2024, ABB, a leading power and automation technology company, announced the launch of its new Oncor Smart Transformer, which integrates digital technologies to enhance grid reliability and efficiency. This innovative product was showcased at the World Economic Forum in Davos (ABB Press Release, 2024).

- In March 2024, Siemens Energy and Mitsubishi Power agreed to a strategic collaboration to jointly develop and market gas-insulated high-voltage direct current (HVDC) transformers. This partnership aimed to strengthen their positions in the growing renewable energy sector (Siemens Energy Press Release, 2024).

- In May 2024, General Electric (GE) completed the acquisition of Bharat Heavy Electricals Limited's (BHEL) power transformer business for approximately USD3.2 billion. This deal expanded GE's presence in the Indian power transformer market and increased its global market share (GE Press Release, 2024).

- In February 2025, the European Union (EU) approved new regulations on the energy performance of transformers. These regulations set minimum energy efficiency requirements for transformers, aiming to reduce greenhouse gas emissions and improve energy efficiency in the EU power sector (European Commission Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Power Transformers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market growth 2025-2029 |

USD 13.20 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.1 |

|

Key countries |

China, US, Japan, Germany, India, UK, France, Canada, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving power transformer market, various advancements and innovations continue to shape the industry landscape. One significant trend is the increasing adoption of technologies for enhanced transformer performance and protection. Capacitive current measurement is a growing area of focus, enabling real-time monitoring of transformer health and improving overall system efficiency. Transformer protection relays, another essential component, ensure the reliable operation of power transformers by detecting and responding to faults. Vibration analysis and thermal imaging are essential for condition monitoring, providing valuable insights into transformer performance and potential issues. Risk assessment methodologies and on-load tap changers are also critical for optimizing power transformer design and lifespan extension.

- Advancements in fault detection systems, including partial discharge detection and overvoltage protection, enable early identification and resolution of potential issues. Cooling system optimization and surge protection devices are also crucial for maintaining transformer efficiency and reliability. Transformer commissioning and maintenance are ongoing processes that require continuous attention. Advanced techniques, such as gas-in-oil analysis, ultrasonic testing, and winding temperature monitoring, help ensure optimal performance and extend transformer lifespan. Power transformer design continues to evolve, with a focus on core loss minimization and reactive power compensation. Predictive maintenance strategies and asset management systems are increasingly important for proactively addressing potential issues and maximizing the value of transformer assets.

- Frequency response analysis and impedance measurements are essential for maintaining transformer performance and ensuring grid stability. Lightning arrester coordination and insulation diagnostics are also critical for protecting transformers from damage and ensuring reliable power delivery. In summary, the power transformer market is characterized by ongoing innovation and advancements in transformer design, protection, and maintenance. These technologies enable improved performance, increased efficiency, and extended transformer lifespan, ensuring the reliable delivery of power in a dynamic and evolving energy landscape.

What are the Key Data Covered in this Power Transformers Market Research and Growth Report?

-

What is the expected growth of the Power Transformers Market between 2025 and 2029?

-

USD 13.20 billion, at a CAGR of 6.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Liquid immersed and Dry type), End-user (Commercial power, Residential power, and Industrial power), Product Type (Core transformer, Shell power transformer, and Berry power transformer), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Modernization of existing transformers, Increasing cost of power transformers

-

-

Who are the major players in the Power Transformers Market?

-

ALTRAFO Srl, Altro Transformers Pty. Ltd., CG Power and Industrial Solutions Ltd., DuPont de Nemours Inc., Eaton Corp., ETEL TRANSFORMERS PTY LTD., Fuji Electric Co. Ltd., General Electric Co., Hammond Power Solutions Inc., Hitachi Ltd., Hyundai Electric and Energy Systems Co. Ltd., Kirloskar Electric Co. Ltd., Layer Electronics Srl, MGM Transformer Co., Schneider Electric SE, Siemens Energy AG, Southern Electronic Services, Tyree Industries, and Wilson Power And Distribution Technologies Pvt. Ltd.

-

Market Research Insights

- The power transformer market encompasses the design, manufacturing, and application of transformers used in the electrical power industry. These transformers facilitate voltage level adjustments and ensure power system stability, integrating various energy sources into the grid. Two significant aspects of the power transformer market are reliability and efficiency. Transformers undergo rigorous testing to ensure reliability, including dielectric strength testing, load flow studies, and magnetic flux density assessments. Thermal stress analysis and mechanical stress analysis are crucial for assessing the transformer's ability to withstand extreme temperatures and physical forces. Energy efficiency standards continue to evolve, driving the demand for transformers with improved performance.

- For instance, transformers with lower transformer winding resistance and reduced harmonic distortion mitigation contribute to energy savings. Smart grid integration and renewable energy integration necessitate transformers with advanced capabilities, such as power quality monitoring and fault current calculations. Magnetic flux density and insulation aging mechanisms are essential factors influencing transformer performance. Regular maintenance practices like oil filtration systems, condition-based maintenance, and protective relay settings help mitigate the impact of these factors on transformer lifespan and efficiency. High voltage testing, buchholz relay operation, and transient stability analysis are essential for ensuring transformer reliability and power system stability.

- The market for power transformers is expected to grow, driven by the increasing demand for energy efficiency and the integration of renewable energy sources into the power grid. No-load losses calculation and ferroresonance prevention are additional considerations for power transformer design and operation. Overall, the power transformer market is dynamic, requiring continuous innovation and improvement to meet the evolving needs of the electrical power industry.

We can help! Our analysts can customize this power transformers market research report to meet your requirements.