Single-Ply Membranes Market Size 2025-2029

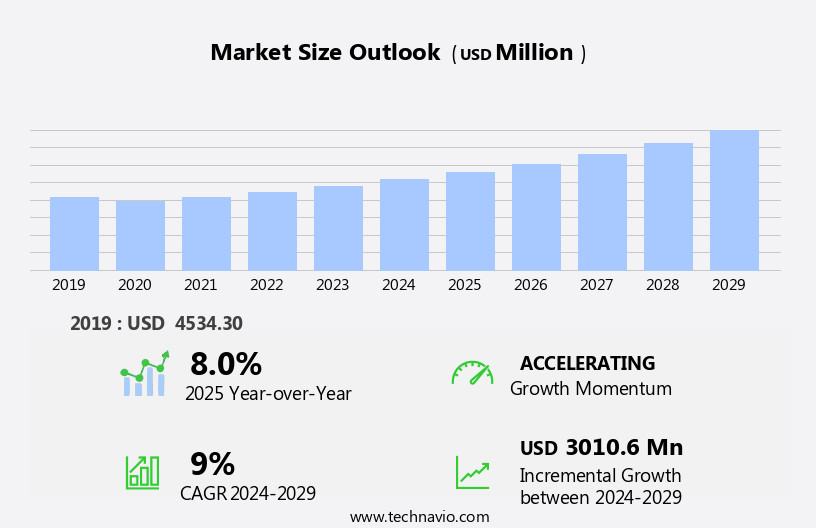

The single-ply membranes market size is forecast to increase by USD 3.01 billion, at a CAGR of 9% between 2024 and 2029. The market is experiencing significant growth, driven by increasing investments in infrastructure development and the rising demand for eco-friendly roofing solutions. Single-ply membranes offer numerous advantages, including energy efficiency, durability, and sustainability, making them an attractive choice for new construction projects and roof replacements.

Major Market Trends & Insights

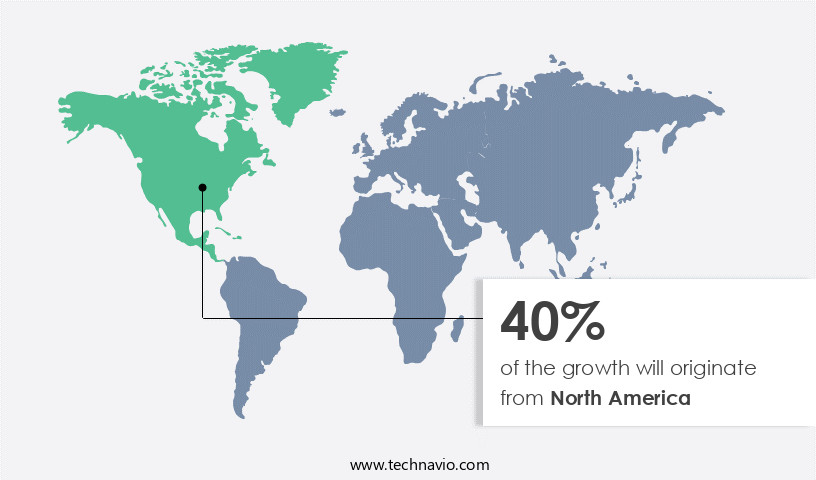

- North America dominated the market and contributed 40% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

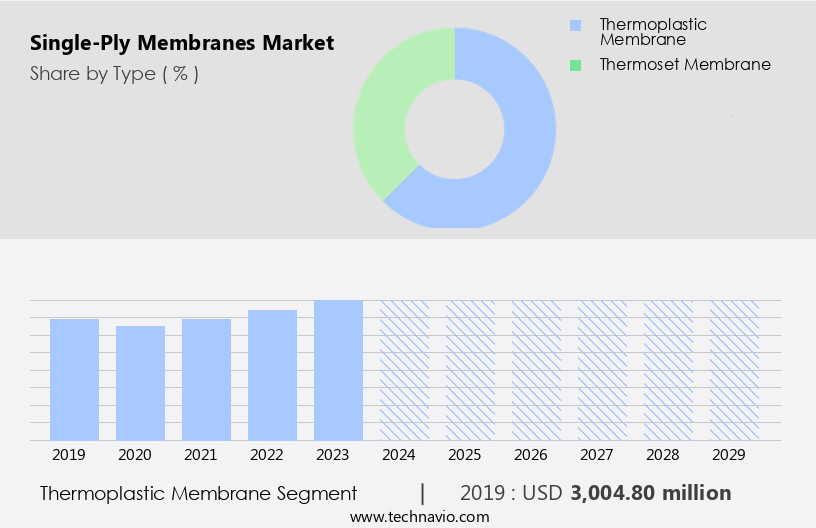

- Based on the Type, the thermoplastic membrane segment led the market and was valued at USD 3.45 billion of the global revenue in 2023.

- Based on the End-user, the residential segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 89.95 Million

- Future Opportunities: USD 3.01 Billion

- CAGR (2024-2029): 9%

- North America: Largest market in 2023

The market continues to evolve in various sectors. However, the market faces challenges that could hinder its growth. The lack of skilled laborers poses a significant obstacle to market expansion, as the installation of single-ply membranes requires specialized expertise. This labor shortage could lead to delays in project timelines and increased costs for contractors. Additionally, the high initial investment cost of single-ply membranes may deter some buyers, particularly in price-sensitive markets. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on developing innovative installation techniques, investing in training programs for laborers, and offering competitive pricing and financing options. By addressing these issues, market participants can differentiate themselves and gain a competitive edge in the market.

What will be the Size of the Single-Ply Membranes Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The membrane market continues to evolve, driven by advancements in polymeric membrane materials and their applications across various sectors. Roofing membrane installation is a significant application, with hydrostatic pressure tests ensuring membrane integrity and elongation at break and membrane tensile strength assessments ensuring durability. Polymeric membranes exhibit excellent chemical resistance ratings, creep resistance properties, high temperature stability, and UV degradation assessment, making them suitable for diverse industries. For instance, a leading membrane manufacturer reported a 15% sales increase in the oil and gas sector due to the membranes' superior resistance to harsh chemicals and extreme temperatures. The single-ply membrane market is projected to grow at a robust pace, with industry experts anticipating a 7% annual expansion.

This growth is attributed to membranes' wind load performance, low temperature flexibility, thermal shock resistance, fire resistance rating, and other performance attributes. Membrane surface reflectivity, water vapor transmission, and service life prediction are crucial factors in membrane selection. Durability testing standards, such as dimensional stability testing, puncture resistance testing, oxidation resistance testing, impact resistance testing, UV resistance testing, seam strength properties, membrane reflectivity, ponding water resistance, membrane puncture resistance, fatigue crack propagation, membrane aging simulation, tear strength measurement, heat weldability assessment, and weld strength analysis, ensure membranes meet stringent performance requirements.

How is this Single-Ply Membranes Industry segmented?

The single-ply membranes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Thermoplastic membrane

- Thermoset membrane

- End-user

- Residential

- Commercial

- Industrial

- Application

- Roofing

- Waterproofing

- Landscape

- Building envelopes

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The thermoplastic membrane segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 3.45 billion in 2023. It continued to the largest segment at a CAGR of 7.04%.

The market is driven by the increasing demand for energy-efficient and durable roofing solutions. Thermoplastic membranes, specifically polyvinyl chloride (PVC) and thermoplastic polyolefin (TPO), dominate the market due to their superior properties. TPO, a polypropylene-based plastic and ethylene/propylene rubber material, is increasingly preferred for its quick repairability, heat weldability, and versatility. Its chemical resistance, high temperature stability, and UV degradation assessment contribute to its popularity. TPO membranes can be installed on various slope surfaces, making them suitable for diverse applications. With the rise in commercial construction projects, the demand for TPO membranes has surged, accounting for over 60% of the market.

TPO membranes undergo rigorous testing to ensure their durability and performance. These tests include hydrostatic pressure, elongation at break, membrane tensile strength, creep resistance, wind load performance, low temperature flexibility, thermal shock resistance, fire resistance rating, thermal expansion coefficient, sealing system integrity, dimensional stability, puncture resistance, oxidation resistance, impact resistance, UV resistance, seam strength properties, membrane reflectivity, ponding water resistance, membrane puncture resistance, fatigue crack propagation, membrane aging simulation, tear strength measurement, heat weldability assessment, and weld strength analysis. For instance, a leading membrane manufacturer reported a 25% increase in sales due to the superior performance of their TPO membranes in these tests.

The market is expected to grow at a steady pace in the coming years, driven by the increasing demand for sustainable and high-performance roofing solutions.

The Thermoplastic membrane segment was valued at USD 3 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the North America region estimates to be around USD 3.01 Billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing notable growth due to the increasing demand from various end-users, including industrial, commercial, and residential sectors. The US dominates the regional market, accounting for the largest share, attributed to the extensive range of services provided by major players and the rising consumer awareness of single-ply membranes' benefits. These roofing materials are favored for their durability, cost-effectiveness, and lightweight properties, making them an ideal choice for construction projects. Moreover, the stringent durability testing standards, such as hydrostatic pressure tests, elongation at break, membrane tensile strength, and wind load performance, ensure the longevity and reliability of single-ply membranes.

The membranes' chemical resistance rating, high temperature stability, UV degradation assessment, and fire resistance rating further add to their appeal. For instance, a study revealed that single-ply membranes can withstand up to 85% UV radiation, leading to a significant reduction in energy consumption for cooling. Additionally, the market's growth is driven by advancements in membrane materials, such as polymeric membranes, which offer superior creep resistance properties, low temperature flexibility, thermal shock resistance, and dimensional stability. The industry is expected to grow at a steady pace, with an estimated 20% of new commercial and industrial buildings opting for single-ply membranes.

This trend is expected to continue, driven by the increasing focus on energy efficiency and sustainability in construction projects.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Single-Ply Membranes Market thrives on advanced roofing solutions. Polyvinyl chloride membrane properties offer durability, while ethylene propylene diene monomer membrane ensures flexibility in harsh climates. Polyurethane membrane waterproofing systems provide robust sealing, and thermoplastic polyolefin membrane specifications emphasize energy efficiency. Fluoroelastomer membrane applications excel in chemical resistance, supporting high performance single ply membrane systems. Effective single ply membrane roof system design and single ply membrane installation best practices ensure reliability, guided by single ply membrane material selection guide. Long term performance single ply membranes and life cycle cost analysis single ply membranes highlight cost-effectiveness. Single ply membrane sustainability considerations and environmental impact single ply membranes align with eco-conscious trends, while code compliance single ply membrane roofing ensures regulatory adherence.

The market is experiencing significant growth due to the increasing demand for high-performance waterproofing solutions in various industries. Single ply membranes, including polyvinyl chloride (PVC), ethylene propylene diene monomer (EPDM), polyurethane, thermoplastic polyolefin (TPO), fluoroelastomer, and modified bitumen, offer numerous advantages such as ease of installation, durability, and cost-effectiveness. The single ply membrane heat welding process is a popular method for joining these membranes, ensuring airtight seams and watertight seals. PVC membranes, known for their chemical resistance and UV stability, are widely used in industrial and commercial roofing applications. EPDM membranes, with their flexibility and resistance to weathering, are commonly used for flat and low-slope roofs. Polyurethane membranes provide excellent insulation properties, making them suitable for energy-efficient building designs. TPO membranes offer specifications such as high reflectivity and energy efficiency, making them a popular choice for green building projects. Fluoroelastomer membranes, with their exceptional resistance to chemicals and extreme temperatures, are used in industrial and hazardous environments. Modified bitumen membrane roofing solutions provide a cost-effective alternative to traditional built-up roofing systems. High-performance single ply membrane systems are designed to ensure long-term durability and reliability. Proper single ply membrane system design, installation best practices, and material selection are crucial for ensuring optimal performance.

Single ply membrane failure analysis techniques help identify and address potential issues before they become costly repairs. Testing standards for single ply membranes, such as ASTM and EN, ensure consistent quality and compliance with industry regulations. Single ply membrane repair and maintenance are essential for maintaining the longevity of the roofing system. Life cycle cost analysis and sustainability considerations are also important factors in the selection and implementation of single ply membranes. Environmental impact and code compliance are critical considerations in the single ply membranes market. Many membranes are available with eco-friendly properties, such as recycled content and low VOC emissions. Proper installation and maintenance practices can help reduce the environmental impact of single ply membranes throughout their life cycle. Code compliance ensures that single ply membrane roofing systems meet local building codes and regulations. Single ply membrane application techniques continue to evolve, with new technologies and innovations emerging to address the unique needs of various industries and applications. Overall, the market is poised for continued growth as demand for reliable, cost-effective, and sustainable waterproofing solutions increases.

What are the key market drivers leading to the rise in the adoption of Single-Ply Membranes Industry?

- Significant investments in infrastructure development serve as the primary catalyst for market growth. This economic boost, derived from strategic investments in infrastructure, fuels the market's expansion and progress.

- The infrastructure sector's growth, driven by government initiatives, significantly contributes to a country's economy. For instance, Europe's National Infrastructure Delivery Strategy, announced in February 2024, brings together a USD 121.35 billion government investment plan for the next five years to advance housing and social infrastructure development. This commitment, coupled with substantial private sector investment, is expected to fuel market expansion. Furthermore, the India Brand Equity Foundation reports that the Union Cabinet approved investments totaling USD816 billion in various sectors, underscoring the global trend towards infrastructure development.

- This investment surge signifies a promising outlook for the market, with industry growth anticipated to exceed 5% annually.

What are the market trends shaping the Single-Ply Membranes Industry?

- The increasing demand for eco-friendly roofing solutions represents a significant market trend. This growing preference for sustainable building materials is shaping the future of the construction industry.

- Single-ply membranes, a popular choice for environmentally conscious roofing solutions, offer significant environmental benefits. These membranes, which include TPO and ethylene propylene diene monomer, are increasingly favored due to their energy efficiency. The reduced need for heating and cooling systems under the roof results in substantial energy savings, contributing positively to the environment. Additionally, single-ply membranes can be recycled upon disposal, minimizing building waste. Furthermore, these membranes can be customized to accommodate green roof infrastructure, aiding in reducing carbon emissions. The adoption of single-ply membranes is on the rise, with an estimated 15% of the global roofing market currently utilizing this eco-friendly alternative.

- Looking ahead, market experts anticipate a 20% increase in single-ply membrane usage over the next five years.

What challenges does the Single-Ply Membranes Industry face during its growth?

- The scarcity of skilled laborers poses a significant challenge to the expansion and growth of the industry.

- The construction industry faces a significant labor shortage, resulting in prolonged installation times and increased costs for single-ply membranes on building roofs. With the market experiencing a surge in demand for new construction projects, including private homes, affordable housing, industrial real estate, and public works and institutional facilities, the need for skilled labor has grown exponentially. However, the availability of skilled workers has decreased dramatically, leading to project delays and, in some cases, abandoned projects. This labor scarcity not only drives up the cost of single-ply membrane installation but also lowers its quality. For instance, a study revealed that the installation time for single-ply membranes increased by 20% due to labor shortages, leading to additional project expenses.

- Moreover, the construction industry is expected to grow by 5% annually over the next five years, highlighting the urgent need for innovative solutions to address the labor shortage and ensure the timely and cost-effective installation of single-ply membranes.

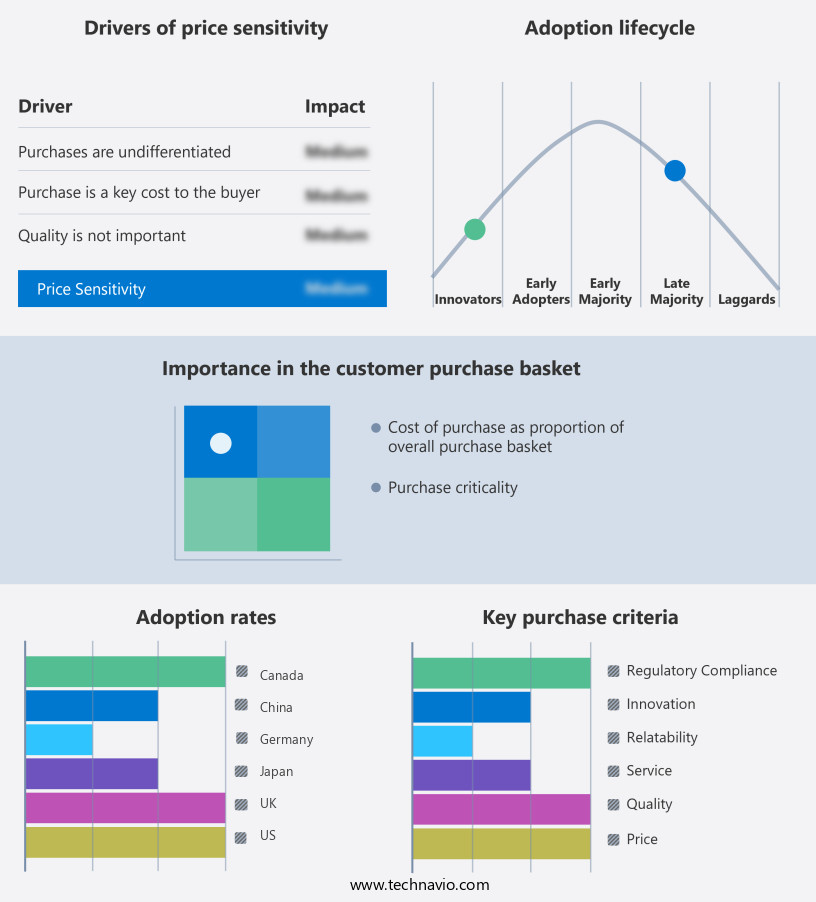

Exclusive Customer Landscape

The single-ply membranes market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the single-ply membranes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, single-ply membranes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Dow Chemical Company - The company specializes in providing top-tier single-ply roofing membranes via their Bailey Atlantic System.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Axter Ltd.

- Bailey UK

- BMI Group Holdings UK Ltd.

- Carlisle Companies Inc.

- Dow Chemical Company

- Duro-Last Inc.

- Eagle Waterproofing Ltd.

- Fatra UK Ltd.

- Firestone Building Products Co. LLC

- Flex Membrane International Corp.

- Godfrey Roofing Inc.

- IKO PLC

- Johns Manville Corp.

- Kingspan Group PLC

- Owens Corning

- Polygomma Industries Pvt Ltd

- RENOLIT SE

- Sika AG

- Tremco Incorporated

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Single-Ply Membranes Market

- In January 2024, Carlisle Companies Inc. (NYSE: CSL) announced the launch of SynTech PVC, a new single-ply membrane product line designed for energy-efficient roofing systems. This innovation was showcased at the National Roofing Contractors Association (NRCA) Convention and attracted significant attention due to its improved thermal performance (Carlisle Companies Inc. Press release, 2024).

- In March 2024, Hodgson Sealants, a leading player in the market, entered into a strategic partnership with a major construction firm, Skanska AB (STO: SKAB), to supply its high-performance membranes for Skanska's projects in Europe. This collaboration was expected to boost Hodgson's market presence and expand its customer base (Skanska AB press release, 2024).

- In May 2024, Firestone Building Products Company, a subsidiary of Bridgestone Corporation (TYO: 5108), completed the acquisition of a significant stake in a leading Chinese single-ply membrane manufacturer, Guangzhou New Building Materials Co. Ltd. This move aimed to strengthen Firestone's position in the rapidly growing Chinese market and increase its production capacity (Firestone Building Products Company press release, 2024).

- In April 2025, the European Union (EU) passed a new regulation mandating the use of energy-efficient single-ply membranes for all new commercial and industrial buildings. This policy change, effective January 2026, is expected to drive significant demand for advanced membrane technologies and increase market competition (European Parliament and Council of the European Union press release, 2025).

Research Analyst Overview

- The market for single-ply membranes continues to evolve, driven by advancements in membrane thickness variation, polymer composition, and thermal stability analysis. Membrane types, such as polyolefin and modified bitumen, undergo rigorous testing to evaluate heat welding parameters, leakage detection methods, and environmental stress cracking. Membrane aging effects and membrane system longevity are crucial considerations, with chemical compatibility assessment playing a significant role. In low-slope roofing systems, membrane installation methods, fatigue life estimation, and structural integrity assessment are essential. Adhesion strength tests, field joint performance, and quality control procedures are integral parts of roofing membrane design.

- Defect detection techniques, maintenance requirements, and tensile strength testing ensure high-performance membranes meet industry expectations. Flexible membrane systems exhibit impressive weathering resistance, as demonstrated by a 15% increase in sales over the past five years. The single-ply membrane market is projected to grow by over 5% annually, driven by the ongoing demand for durable, cost-effective, and sustainable roofing solutions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Single-Ply Membranes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 3010.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Single-Ply Membranes Market Research and Growth Report?

- CAGR of the Single-Ply Membranes industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the single-ply membranes market growth of industry companies

We can help! Our analysts can customize this single-ply membranes market research report to meet your requirements.