Thermoplastic Polyolefin Membranes Market Size 2024-2028

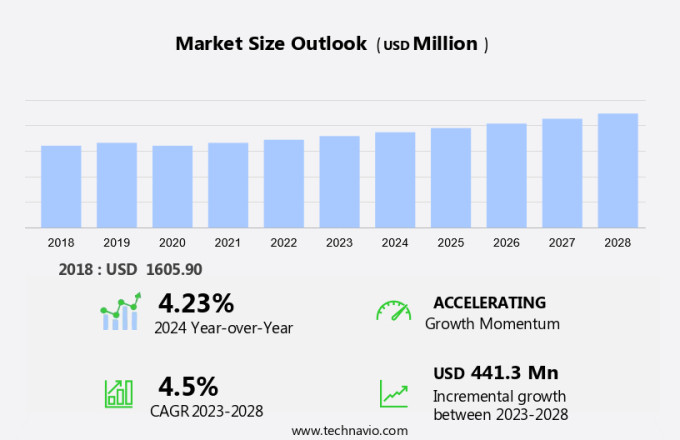

The thermoplastic polyolefin membranes market size is forecast to increase by USD 441.3 billion at a CAGR of 4.5% between 2023 and 2028. Thermoplastic Polyolefin (TPO) membranes have gained significant traction in various industries due to their self-adhering property and excellent waterproofing capabilities. TPO Membranes are self-adhering, Thermoplastic Composites ensuring fast installation with minimal disruption. However, the market faces challenges such as the inadequate resistance of TPO membranes to high heat, which limits their usage in certain applications. Another trend in the market is the refurbishment of existing buildings, where TPO membranes are used to replace aging roofing systems. In the automotive industry, TPO membranes are increasingly being used for exterior applications in cars due to their durability and resistance to UV radiation.

What will the size of the market be during the forecast period?

Thermoplastic Polyolefin (TPO) Membranes are a type of flat roofing solution, known for their waterproofing properties. These membranes are made from polyolefin, a thermoplastic material, which offers excellent durability, flexibility, and UV resistance. TPO Membranes are chlorine-free and environmentally safe, making them a popular choice for commercial roofing applications. The manufacturing process involves techniques such as extrusion molding and injection molding. They offer structural adaptability, heat resistance, and are suitable for various applications, including tunneling and irrigation canals. Key players in the TPO Membranes market include Firestone Building Products, among others. The market for TPO Membranes is driven by high public construction spending, rapid urbanization, and the demand for energy-efficient, green roofing systems. TPO Membranes are increasingly being used in smart cities due to their fast installation, low cost, and ability to provide waterproofing solutions for various structures. The market is expected to grow significantly due to the increasing focus on sustainable and environmentally friendly construction practices.

Market Segmentation

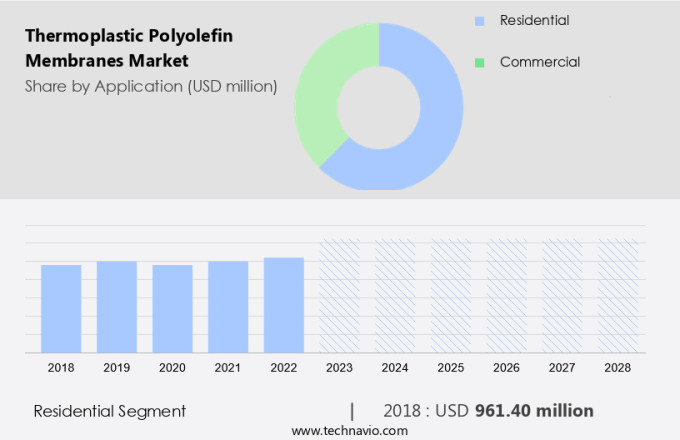

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Residential

- Commercial

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Application Insights

The residential segment is estimated to witness significant growth during the forecast period. In the context of urbanization and industrial expansion, thermoplastic polyolefin (TPO) membranes have emerged as a popular choice for roofing applications. These membranes combine the UV and heat resistance properties of ethylene propylene diene terpolymer (EPDM) with the heat-weldable feature of polyvinyl chloride (PVC). Originating in Italy, TPO membranes have been in use for an extended period. They are available in various colors, including gray, white, and black. The construction sector has witnessed significant growth due to the increasing number of manufacturing hubs and the improvement in living standards. Asia Pacific (APAC) is the leading region driving the global construction market, with China and India being the major contributors.

The demand for TPO membranes is anticipated to escalate due to their suitability for various applications, such as urban infrastructure, affordable housing, commercial buildings, and co-operative housing. Building permits in megacities are expected to fuel the demand for these membranes, as they offer durability and energy efficiency. The automotive manufacturing industry also utilizes TPO membranes for insulation and noise reduction. Overall, the construction industry's ongoing expansion and the need for sustainable and cost-effective roofing solutions are expected to boost the TPO membranes market.

Get a glance at the market share of various segments Request Free Sample

The residential segment accounted for USD 961.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

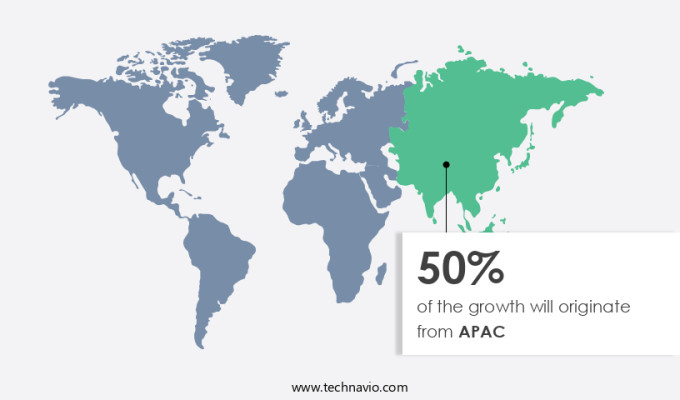

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia-Pacific (APAC) region is a significant market for thermoplastic polyolefin (TPO) membranes due to various factors. Urbanization and housing development are major drivers, as countries such as China, India, and Southeast Asian nations experience a wave in construction activities across residential, commercial, and industrial sectors. This growth creates a demand for waterproofing solutions like TPO membranes. Moreover, regulatory initiatives promoting energy efficiency and environmentally friendly building materials are increasing the adoption of TPO membranes in roofing and waterproofing applications. Infrastructure development, including transportation, healthcare, and education, also contributes to the increasing demand for TPO membranes in APAC.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Strong demand from automotive industry is the key driver of the market. Thermoplastic Polyolefin (TPO) Membranes, derived from polyolefin, have gained significant traction in various industries due to their exceptional properties. In the realm of waterproofing, TPO Membranes have emerged as a preferred choice for applications such as roofing. The manufacturing process of TPO Membranes is chlorine-free, ensuring environmental safety. This eco-friendly attribute adds to their growing popularity. TPO Membranes offer superior UV resistance, making them an optimal solution for prolonged sun exposure. In the US, the automotive industry is a significant contributor to the market's expansion. TPO Membranes are increasingly replacing traditional materials like metal and engineering thermoplastics due to their advantageous characteristics.

These include optimum balance of stiffness, cold temperature impact resistance, and low thermal expansion. The increasing disposable income trend, particularly in emerging economies, is fueling the growth of the automotive sector. The expanding middle class in countries like China, India, Brazil, and South Korea, with rising Household earnings, is expected to create new demands in the automotive industry. This growth will subsequently propel the demand for TPO Membranes in automotive applications. In summary, TPO Membranes, with their unique combination of benefits, are experiencing a swell in demand across various industries, particularly in the US automotive sector. Their eco-friendly manufacturing process, UV resistance, and advantageous properties make them an attractive alternative to traditional materials.

Market Trends

Recycling of TPO membranes is the upcoming trend in the market. TPO membranes, specifically self-adhering types, have gained significant traction in the US construction industry for their waterproofing capabilities. These membranes are commonly used in tunneling projects and irrigations canals due to their durability and flexibility. One of the leading manufacturers, Firestone Building Products, is at the forefront of promoting the use of TPO membranes for refurbishing existing buildings. The high demand for sustainable and cost-effective solutions has fueled the growth of this market. TPO membranes offer an eco-friendly alternative to traditional roofing materials. They are 100% recyclable, making them an attractive choice for contractors and building owners. Manufacturers conduct educational workshops to encourage the recycling of TPO membranes for roofing projects.

This practice not only reduces the carbon footprint but also prevents the accumulation of waste in landfills. Additionally, it helps building owners save on waste removal costs. The recycling process involves melting, purifying, and re-extruding TPO membranes to produce new roof membranes. This cost-effective solution has gained popularity among manufacturers, leading to an increasing number of TPO membrane recycling initiatives. The US construction industry stands to benefit significantly from the adoption of TPO membranes due to their environmental advantages and cost savings.

Market Challenge

TPO roofs offer inadequate resistance to high heat is a key challenge affecting market growth. TPO membranes have gained popularity in the market due to their durability, flexibility, and low installation costs. However, their use in high-heat conditions can pose challenges. Prolonged exposure to intense heat can lead to thermal degradation, which may result in surface cracking, material shrinkage, and loss of flexibility. This can compromise the roof's structural integrity and reduce its lifespan, leading to increased maintenance costs. High-heat conditions can accelerate the breakdown of polymer chains within the TPO membrane, resulting in a reduction of its physical properties. This degradation can make TPO membranes less desirable for commercial roofing projects in regions with extreme temperatures or prolonged direct sunlight exposure.

Despite these challenges, TPO membranes remain a cost-effective and energy-efficient option for many commercial roofing applications. Manufacturing processes such as extrusion molding and injection molding contribute to their flexibility and adaptability. TPO membranes continue to be a viable solution for roofing projects in moderate climates, offering durability and cost savings. In summary, TPO membranes offer several benefits, but their use in high-heat conditions requires careful consideration. Their susceptibility to thermal degradation can impact their structural integrity and lifespan, leading to increased maintenance costs. However, their cost-effectiveness, energy efficiency, and manufacturing flexibility make them a popular choice for commercial roofing projects in moderate climates.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ARDEX GmbH: The company offers thermoplastic polyolefin membranes such as WPM 612 FL TPO and WPM 615 FL TPO roofing membranes.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aditya Profiles Pvt. Ltd.

- Arkema Group

- BASF SE

- Berkshire Hathaway Inc.

- Carlisle Companies Inc.

- Dow Chemical Co.

- Exxon Mobil Corp.

- Filtration Group Corp.

- GAF Materials LLC

- GreenShield

- Holcim Ltd.

- Koster Bauchemie AG

- Lanxess AG

- RPM International Inc.

- Saudi Basic Industries Corp.

- Sika AG

- SOPREMA SAS

- Suzhou GWELL machinery co. LTD.

- T and G Roofing and Solar Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Thermoplastic Polyolefin (TPO) membranes have gained significant traction in the global construction industry due to their exceptional properties and benefits. These membranes are widely used for waterproofing in various applications, including roofing, due to their chlorine-free composition and environmental safety. TPO membranes offer excellent UV resistance, ensuring durability and flexibility even under extreme weather conditions. The manufacturing process of TPO membranes involves techniques such as extrusion molding and injection molding, ensuring low installation costs and fast installation times. Key industries driving the growth of the market include construction, Travel, automotive manufacturing, and industrial expansion. Commercial roofing projects particularly benefit from the structural adaptability, heat resistance, and self-adhering properties of TPO membranes. TPO membranes are increasingly popular in various sectors, including construction, infrastructure, and industrial applications.

Further, the high demand for waterproofing membranes in urbanization and industrial expansion projects, such as tunneling and irrigation canals, is driving the growth of the TPO membranes market. The increasing focus on energy efficiency and green roofing systems in public construction spending, smart cities, and megacities is also contributing to the market's growth. TPO membranes are an environmentally friendly alternative to traditional roofing materials, offering long-term cost savings and weathering resistance. The construction sector demand for TPO membranes is driven by the need for affordable housing, commercial buildings, co-operative housing, and building permits. Additionally, the automotive manufacturing, electric vehicles, packaging applications, solar panel, and solar energy growth sectors are also utilizing TPO membranes due to their cost-effectiveness and durability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 441.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 50% |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ARDEX GmbH, Aditya Profiles Pvt. Ltd., Arkema Group, BASF SE, Berkshire Hathaway Inc., Carlisle Companies Inc., Dow Chemical Co., Exxon Mobil Corp., Filtration Group Corp., GAF Materials LLC, GreenShield, Holcim Ltd., Koster Bauchemie AG, Lanxess AG, RPM International Inc., Saudi Basic Industries Corp., Sika AG, SOPREMA SAS, Suzhou GWELL machinery co. LTD., and T and G Roofing and Solar Co. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch