Smartwatch Market Size 2025-2029

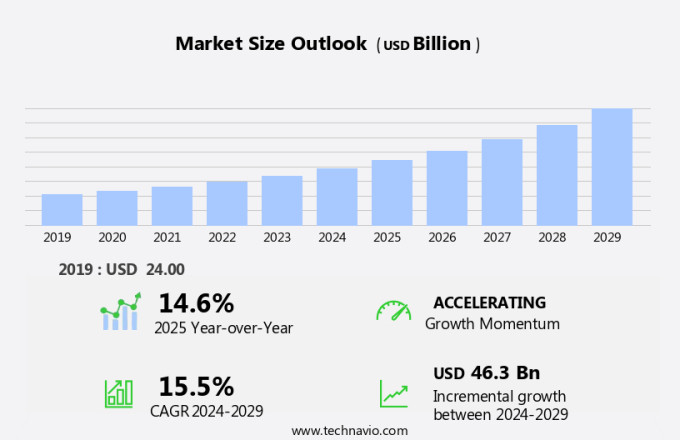

The smartwatch market size is forecast to increase by USD 46.3 billion, at a CAGR of 15.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by technological advancements in the semiconductor industry. These innovations enable the development of more powerful and feature-rich wearable devices. Moreover, the increasing number of patent filings by smartwatch manufacturers underscores the competitive intensity and innovation focus in this sector. However, this market is not without challenges. Data security and privacy concerns are becoming increasingly salient, as consumers become more aware of the potential risks associated with wearable technology. Companies must address these concerns through robust security measures and transparent data handling practices to build trust and maintain customer loyalty.

- Effective navigation of these challenges and continued investment in technological innovation will be key for market players seeking to capitalize on the burgeoning opportunities in the market.

What will be the Size of the Smartwatch Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Lightweight materials and dust resistance are key considerations for this wearable technology, ensuring durability and convenience for users. Heart rate monitoring and personalization features cater to health-conscious consumers, while certification standards and battery optimization address performance and efficiency. Customizable watch faces and smartphone connectivity enhance user experience, with innovation pipeline and software updates ensuring continuous improvement. Machine learning algorithms and voice assistant integration offer personalized assistance and convenience. Target demographics span from sports and fitness enthusiasts to professionals and fashion-conscious individuals. Certification standards, such as water resistance and biometric authentication, ensure quality and security.

Customizable watch bands and NFC payments offer versatility and convenience. Wearable sensors and activity tracking enable daily health management and outdoor activities. Manufacturing processes and supply chain management optimize production and delivery. Display technology and touchscreen interface provide clear and intuitive interaction. Emergency response and medical alert systems offer peace of mind. Power management and Wi-Fi connectivity extend functionality. Scratch-resistant glass and ergonomic design ensure durability and comfort. The market's ongoing evolution encompasses a diverse range of applications, from fitness and health to lifestyle and productivity. With a growing app ecosystem, data processing capabilities, and price point competitiveness, this market continues to disrupt and innovate.

How is this Smartwatch Industry segmented?

The smartwatch industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Integrated

- Standalone

- OS

- Android wear

- Apple watch OS

- Fitbit OS

- Tizen OS

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

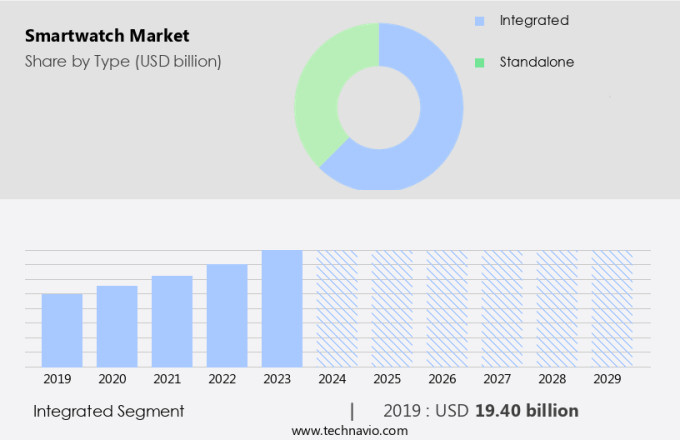

The integrated segment is estimated to witness significant growth during the forecast period.

Smartwatches have evolved from traditional timepieces to integrated wearable computing devices, offering features such as third-party app support, cellular connectivity, and wireless communication. These advanced devices enable users to access the internet, receive messages, and stay updated on social media and weather through Bluetooth or Wi-Fi technology. The integration of augmented reality (AR) and virtual reality (VR) technologies further enhances the user experience. Quality control, water resistance, and biometric authentication are essential features for smartwatches. Customization options, including customizable watch faces, smartwatch bands, and personalization features, cater to diverse user preferences. Wearable sensors and health data analysis facilitate daily health management, sports and fitness tracking, and outdoor activities.

Manufacturers prioritize certification standards, battery optimization, and charging technology to ensure product durability and user convenience. Machine learning algorithms and artificial intelligence (AI) enable advanced features such as activity tracking, heart rate monitoring, and sleep monitoring. The market targets various demographics, from tech-savvy consumers to fitness enthusiasts and professionals. The innovation pipeline includes wearable computing, smart home integration, medical alert systems, and mobile payments. Software updates and voice assistant integration keep the devices up-to-date and competitive. The market's growth is driven by the increasing popularity of wearable technology, the entry of traditional watch manufacturers, and the affordability of low-cost smartwatches.

Ergonomic design, power management, and emergency response features cater to diverse user needs. The app ecosystem, data processing, and price point are critical factors influencing consumer choice. In conclusion, the market is dynamic and innovative, with continuous advancements in technology, design, and functionality. The integration of various features, such as smartphone connectivity, wearable sensors, and machine learning algorithms, offers users a seamless and personalized experience.

The Integrated segment was valued at USD 19.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

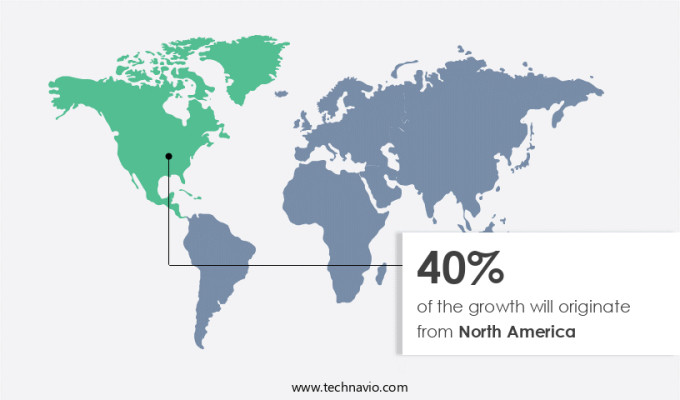

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic technology landscape, North America emerges as a significant market for smartwatch manufacturers. This region's early adoption of advanced technologies, coupled with the presence of leading brands like Apple, Fitbit, and Garmin, fuels the demand for smartwatches. Factors such as the availability of built-in LTE smartwatches, the growing emphasis on health and fitness features, and advancements in wireless network infrastructure are driving market growth. The US dominates the North American market due to its high disposable income and consumer preference for tech-driven devices. Smartwatches in this region offer features such as third-party app support, cellular connectivity, wireless communication, cloud storage, augmented reality, wearable computing, GPS tracking, security features, lifestyle applications, heart rate monitoring, personalization options, and more.

These devices cater to various demographics, integrating seamlessly with voice assistants, sports and fitness apps, and mobile payments. The innovation pipeline includes machine learning algorithms, customizable watch faces, and software updates. Manufacturing processes ensure quality control, water resistance, biometric authentication, and ergonomic design. Smartwatches are designed with lightweight materials, dust resistance, customization options, and long battery life. Certification standards, battery optimization, charging technology, and data processing are essential considerations. The market encompasses a wide range of price points and display technologies, catering to diverse consumer needs. The smartwatch ecosystem includes sensors, wearable sensors, medical alert systems, activity tracking, daily health management, outdoor activities, and more.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Smartwatch Industry?

- The semiconductor industry's technological advancements serve as the primary catalyst for market growth.

- Smartwatches have gained significant traction in the market due to their integration with smart home systems, third-party app support, and cellular connectivity. Wearable computing technology, including augmented reality (AR) and virtual reality (VR), has further enhanced their appeal. Advances in wireless communication, cloud storage, and GPS tracking have made these devices more functional and convenient. Security features, such as biometric authentication, are essential considerations for consumers. Lifestyle applications, including fitness tracking and health monitoring, are also driving demand. Technological innovations, such as chip system-on-a-chip (SoC) technology and microelectromechanical systems (MEMS), have enabled the development of smaller, less power-consuming smartwatches.

- Samsung Electronics Co. Ltd., for instance, uses System-in-Package-embedded Package on Package (SiP-PHP) technology in its Exynos7 Dual chipset for smartwatches. These advancements have allowed companies to incorporate numerous sensors and components into limited board space. Smartwatch bands have become an essential accessory, offering both style and functionality. Water resistance and quality control are crucial factors in ensuring customer satisfaction. In conclusion, the market is witnessing continuous growth, fueled by technological advancements and evolving consumer preferences.

What are the market trends shaping the Smartwatch Industry?

- Smartwatch manufacturers are filing an increasing number of patent applications, reflecting a notable market trend in this industry. This trend underscores the growing importance and innovation in the development of advanced smartwatch technologies.

- The market is witnessing significant patent activity as companies seek to differentiate themselves in this competitive landscape. Patents, which grant exclusive rights to inventions for a set period, enable companies to protect their intellectual property and prevent competitors from replicating their technologies. This trend is particularly prevalent in the areas of displays, cameras, sensors, and other related technologies. By securing patents, companies can integrate advanced features into next-generation smartwatches while keeping the device's footprint compact. In a market characterized by intense competition, patent rights offer a strategic advantage. Lightweight materials, dust resistance, customization options, heart rate monitoring, personalization features, certification standards, battery optimization, charging technology, machine learning algorithms, and smartphone connectivity are key market dynamics shaping the smartwatch industry.

- Customizable watch faces, voice assistant integration, software updates, and innovation pipeline are other essential elements driving growth in this sector. companies are investing heavily in research and development to bring new and improved smartwatch models to market, ensuring the industry remains at the forefront of technology innovation.

What challenges does the Smartwatch Industry face during its growth?

- The escalating importance of data security and privacy is a significant challenge that necessitates robust solutions, threatening to impede industry growth if not adequately addressed.

- Smartwatches have gained significant traction in the market due to their integration of advanced features such as sports and fitness tracking, NFC payments, health data analysis, and sensor fusion. These devices offer users an immersive experience with long battery life, touchscreen interfaces, and Bluetooth connectivity. The app ecosystem enables daily health management, activity tracking, and outdoor activities. However, concerns regarding data security and privacy persist, as smartwatches collect and process sensitive information. With the increasing use of wearable sensors and medical alert systems, it is crucial to ensure data protection.

- Regulations like Europe's General Data Protection Regulation mandate secure processing of personal data through appropriate technical and organizational measures. Artificial intelligence (AI) integration in smartwatches enhances their functionality, offering customized health insights and personalized recommendations. Manufacturing processes continue to improve, making these devices more affordable and accessible to a broader audience.

Exclusive Customer Landscape

The smartwatch market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smartwatch market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smartwatch market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazfit - The company showcases an array of advanced smartwatch models, including the Amazfit GTR 4 and GTS 4. These innovative devices deliver superior functionality, integrating health monitoring features, customizable watch faces, and seamless connectivity to mobile devices. With long battery life and sleek designs, these smartwatches cater to modern consumers seeking to optimize their daily routines and enhance their overall wellness experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazfit

- Apple Inc.

- CASIO Computer Co. Ltd.

- Citizen Watch Co. Ltd.

- Fossil Group Inc.

- Garmin Ltd.

- Google LLC

- HK SMARTMV Ltd.

- Huawei Technologies Co. Ltd.

- Imagine Marketing Pvt. Ltd.

- Kate Spade

- LG Corp.

- LVMH Moet Hennessy Louis Vuitton SE

- Polar Electro Oy

- Samsung Electronics Co. Ltd.

- Suunto Oy

- Tata Sons Pvt. Ltd.

- Timex Group

- Withings

- Xiaomi Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Smartwatch Market

- In March 2024, Apple unveiled the Apple Watch Series 8, featuring advanced health monitoring capabilities, including temperature sensing and improved fall detection (Apple Inc., 2024). This development underscores Apple's commitment to enhancing the health and wellness aspects of its smartwatches.

- In July 2024, Samsung and Google announced a strategic partnership to optimize Wear OS for Samsung smartwatches, aiming to strengthen their market position against Apple (Samsung Electronics, 2024). This collaboration represents a significant move to improve the competitiveness of Android-based smartwatches.

- In October 2024, Fitbit, a leading wearable technology company, was acquired by Google for approximately USD2.1 billion (Google, 2024). This acquisition bolsters Google's wearable offerings and expands its reach in the market.

- In January 2025, Garmin launched the Venu 2 Plus, its first smartwatch with a touch bezel, offering a more intuitive user experience (Garmin, 2025). This technological advancement sets Garmin apart from competitors by providing a unique interface that combines the benefits of a touchscreen and a rotating bezel.

Research Analyst Overview

- In the dynamic the market, advanced features such as ambient light sensors, blood oxygen monitoring, and haptic feedback continue to drive consumer interest. Premium materials like stainless steel and sapphire glass, as well as IP ratings and water resistance ratings, underscore the devices' durability and appeal. E-commerce platforms and retail channels cater to diverse customer preferences, offering a range of smartwatches with OLED displays, compass sensors, voice control, and AMOLed displays. Brands invest in marketing strategies, including UX design, gesture control, fall detection, ECG monitoring, and stress monitoring, to enhance user experience and foster customer loyalty.

- Military-grade standards and sleep apnea detection are emerging trends, appealing to niche markets. Smartwatch straps and ultrasonic sensors add to the customization options, catering to individual preferences.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Smartwatch Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.5% |

|

Market growth 2025-2029 |

USD 46.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.6 |

|

Key countries |

US, China, Canada, Japan, Brazil, UK, Germany, France, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smartwatch Market Research and Growth Report?

- CAGR of the Smartwatch industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smartwatch market growth of industry companies

We can help! Our analysts can customize this smartwatch market research report to meet your requirements.