Specialty Biocides Market Size 2024-2028

The specialty biocides market size is forecast to increase by USD 3.65 billion at a CAGR of 8.09% between 2023 and 2028. The market is witnessing significant growth due to the importance of wastewater recycling and water reuse in various industries. Specialty biocides play a crucial role in ensuring the effectiveness of commercial water treatment processes, making them indispensable in industries such as pharmaceuticals, food and beverage, and pulp and paper. Another trend driving market growth is the increasing use of silver-based biocides, which offer superior antimicrobial properties and long-lasting effectiveness. However, the side effects associated with specialty biocides, such as toxicity and resistance development in microorganisms, pose challenges to market growth. Producers are focusing on developing eco-friendly and biodegradable biocides to mitigate these challenges and meet the growing demand for sustainable and environmentally-friendly solutions.

The market is experiencing significant growth due to the increasing demand for eco-friendly and effective biocides in various industries. The economy's strong expansion in several regions, especially in Asia-Pacific and Europe, is driving the market's growth. However, supply chain concerns and geopolitical tensions pose challenges to market players. Consumer preferences for sustainable and eco-friendly products are leading to innovation in the market. Market players are focusing on developing biodegradable and low-toxicity biocides to cater to this trend. Raw material availability and cost are crucial factors influencing the market's dynamics. The market is segmented into product segments, including preservatives, fungicides, and others.

Applications include water treatment, agriculture, industrial applications, and consumer goods. Strategies such as mergers and acquisitions, partnerships, and collaborations are being adopted by market players to expand their reach and strengthen their position. Recent developments in the market include the launch of new products with enhanced efficacy and eco-friendliness. For instance, a leading player introduced a new biocide that provides broad-spectrum protection against bacteria, fungi, and algae while being biodegradable and non-toxic. This product differentiation is expected to drive market growth in the coming years.

Market Segmentation

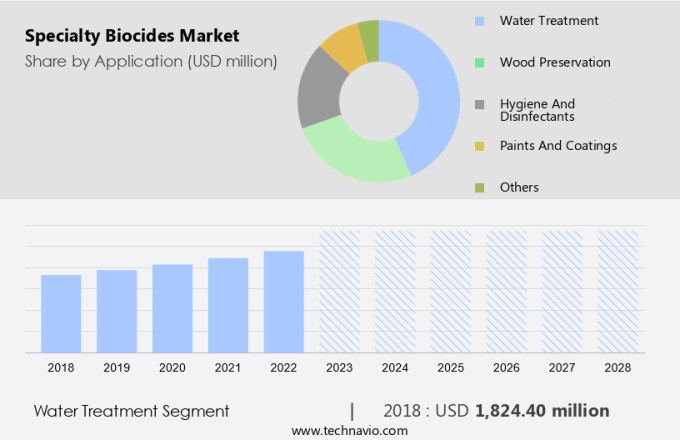

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Water treatment

- Wood preservation

- Hygiene and disinfectants

- Paints and coatings

- Others

- Product

- Halogen compounds

- Nitrogen-based

- Inorganics

- Organosulfur

- Others

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- France

- South America

- Middle East and Africa

- North America

By Application Insights

The water treatment segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth, particularly in the water treatment segment, due to economy-wide concerns over water and wastewater treatment. This application sector does not encompass the treatment of water in the oil and gas industry. Specialty biocides play a crucial role in water treatment, including cooling water systems, process industries, and recreational applications such as swimming pools and spas. Developed and developing countries, including the US, Germany, Japan, and China, are major markets for these biocides due to their extensive use in water treatment. Halogen compounds, like chlorine, are popular biocide choices for water treatment applications. However, geopolitical tensions and supply chain concerns may impact the availability and pricing of raw materials, leading to potential shifts in demand.

Sustainability and innovation are key trends shaping the market, with an increasing focus on bio-chemicals, materials, and energy transition. Procurement, inventory management, and product portfolio capabilities are essential considerations for market participants. Price trends and technologies are also critical factors, with recent deals and developments shaping the competitive landscape. The degree of competition in the market is high, with a significant number of suppliers and diverse distribution channels. The market outlook is positive, with an estimated growth in the derived market during the historical years and the estimated year.

Get a glance at the market share of various segments Request Free Sample

The water treatment segment accounted for USD 1.82 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is an international industry that caters to the demand for effective and eco-friendly biocides used in various applications. Entry barriers for new exporters and importers are high due to stringent regulations and the cost of substitute products. Price analysis is crucial in this market as customers seek cost-effective solutions without compromising on product quality. Product analysis reveals that top-performing specialty biocides offer beneficial alternatives to traditional chemicals, providing superior efficacy and reduced environmental impact. Investment and funding updates, awards, expansion, and offerings from key players shape the competitive landscape. Hamas, supply-chain analytics, and regional supply chain trends are essential elements of market research in this sector. Competition analysis is vital to understand market dynamics and identify opportunities for growth.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Specialty Biocides Market Driver

The importance of wastewater recycling and water reuse is the key driver of the market. The market is experiencing significant growth due to the increasing demand for wastewater treatment and recycling, driven by population growth and urbanization. With the global water crisis looming, there is a pressing need for treated water to meet the demands of various end-use sectors, including agriculture, industrial processes, and municipal water supply. The supply chain dynamics of the market are influenced by various factors such as raw material availability, geopolitical tensions, and consumer preferences. The market is witnessing a shift towards sustainability and innovation, with an increasing focus on bio-chemicals and materials derived from renewable sources. Price trends and technologies are also playing a crucial role in shaping the market's procurement, inventory management, and product portfolios.

The market's geographies, including potential countries, are experiencing shifts in demand, with Asia Pacific leading the way. The market's outlook is positive, with estimated growth in the historical years and a promising future. Recent deals and developments in the market indicate a high degree of competition, with a number of suppliers and distribution channels. Capital needed to enter the market is substantial, requiring significant investment in research and development and manufacturing capabilities. The energy transition and sustainability are key trends influencing the market's future trajectory.

Specialty Biocides Market Trends

The increasing use of silver-based biocides is the upcoming trend in the market. The market has experienced significant growth in recent years, with silver-based biocides being the preferred choice due to their low toxicity towards humans and animals. Silver's effectiveness in inhibiting microbial growth is attributed to the controlled release of silver ions in an antimicrobial system, which attaches to the negatively charged cell walls of microorganisms, resulting in cell wall lysis and growth inhibition. However, the market is subject to various challenges, including supply chain concerns due to geopolitical tensions and economic instability, consumer preferences for sustainable and eco-friendly alternatives, and price trends influenced by raw material costs and innovation in technologies.

Procurement, inventory management, and product portfolios are crucial capabilities for market players as they navigate shifts in demand for various types of specialty biocides, including those based on bio-chemicals and materials. The market outlook is positive, with potential growth in end markets such as energy transition and geographies like Asia-Pacific. The market study identifies prospective segments, potential countries, and types of biocides, including product types and end users. Historical years and the estimated year are essential for understanding price trends and competition dynamics, which include the number of suppliers and distribution channels. Capital needed for entry into this market is significant, and recent deals and developments highlight the importance of innovation and sustainability in the industry.

Specialty Biocides Market Challenge

Side effects associated with specialty biocides is a key challenge affecting the market growth. The market faces challenges from economic concerns, supply chain dynamics, and consumer preferences for eco-friendly alternatives. Geopolitical tensions and raw material availability also pose risks to the market's growth. However, the market is expected to witness innovation and sustainability as key trends, with a focus on applications in bio-chemicals, materials, and end markets. Price trends and technologies are also crucial factors influencing procurement, inventory management, and product portfolios. The energy transition and shifts in demand towards renewable energy sources are creating new opportunities in the market. The market study identifies potential countries for penetration and prospective segments, with an outlook for the estimated year and beyond.

Recent deals and developments highlight the degree of competition, number of suppliers, and distribution channels. Capital needed for entry into the market is significant, requiring full capabilities and strategic partnerships.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Syntec Corp. - The company offers specialty biocides that prevent from causing severe diseases or material deterioration.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albemarle Corp.

- Baker Hughes Co.

- BASF SE

- Buckman Laboratories lnternational Inc.

- Clariant International Ltd.

- DuPont de Nemours Inc.

- Ecolab Inc.

- HIKAL Ltd.

- Kemira Oyj

- Kimberlite Chemicals India Pvt. Ltd.

- Lanxess AG

- Lonza Group Ltd.

- Merck KGaA

- Nouryon

- Solvay SA

- The Lubrizol Corp.

- Thor Group Ltd.

- Valtris Specialty Chemicals

- Vink Chemicals GmbH and Co. KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant shifts in demand due to various economic, geopolitical, and sustainability factors. With the global economic slowdown, supply chain concerns have emerged as a major challenge for market players. Consumer preferences for eco-friendly and sustainable products have led to innovation in specialty biocides, with a focus on bio-chemicals and materials. Price trends in the market are influenced by raw material costs and procurement strategies. Technological advancements in inventory management and distribution channels have improved product portfolios and capabilities, enabling suppliers to meet the evolving needs of end users in various industries. Geopolitical tensions and energy transition are also impacting the market, with potential countries for growth including China, India, and the European Union.

Further, the market study identifies prospective segments and types, including product types such as preservatives, fungicides, and biocides for water treatment. The degree of competition in the market is high, with a large number of suppliers vying for market share. Recent deals and developments in the market include mergers and acquisitions, partnerships, and collaborations. The outlook for the derived market is positive, with continued growth expected in the estimated year and beyond.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 3.65 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 37% |

|

Key countries |

US, China, Germany, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Albemarle Corp., Baker Hughes Co., BASF SE, Buckman Laboratories lnternational Inc., Clariant International Ltd., DuPont de Nemours Inc., Ecolab Inc., HIKAL Ltd., Kemira Oyj, Kimberlite Chemicals India Pvt. Ltd., Lanxess AG, Lonza Group Ltd., Merck KGaA, Nouryon, Solvay SA, Syntec Corp., The Lubrizol Corp., Thor Group Ltd., Valtris Specialty Chemicals, and Vink Chemicals GmbH and Co. KG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch