Squalene Market Size 2024-2028

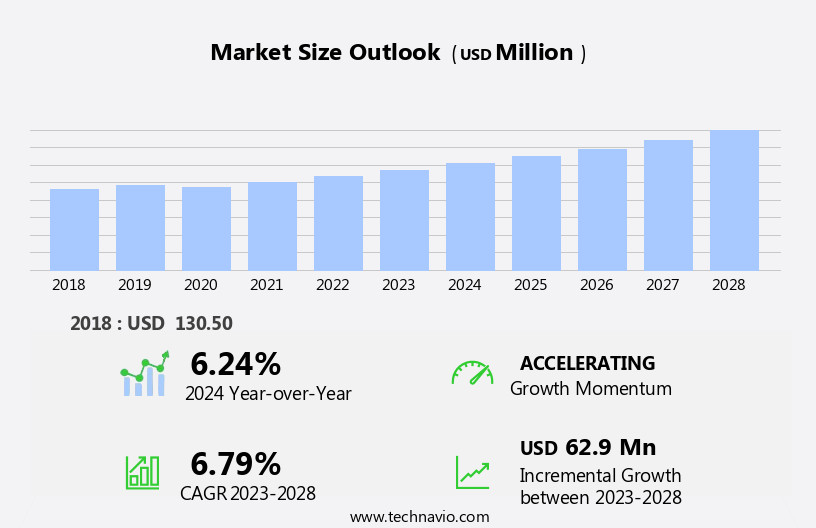

The squalene market size is forecast to increase by USD 62.9 million at a CAGR of 6.79% between 2023 and 2028.

- The market is experiencing significant growth due to increasing trends in the use of UVA/B filters in sunscreens and sun protection cosmetics as well as after sunburn care products. This demand is driven by the rising awareness of skin health and the importance of sun protection. Additionally, the preference for squalene derived from renewable resources aligns with consumer trends toward sustainable and eco-friendly products.

- However, stringent safety regulations on sun care products pose a challenge to market growth. Manufacturers must ensure compliance with these regulations to maintain consumer trust and market presence. Overall, the market is expected to continue its expansion, fueled by these market dynamics.

What will be the Size of the Squalene Market During the Forecast Period?

- The market encompasses the production and supply of squalene, a prized ingredient in personal care and cosmetics applications, including creams, cosmetic serums, oils, and masks. Sourced from both animal-derived and plant-based sources, squalene's popularity stems from its exceptional emollient properties, making it an effective anti-aging ingredient In the skincare sector. Traditionally sourced from shark liver oil, concerns over animal welfare and sustainability have led to the increasing adoption of vegetable-sourced squalene from olives, sugarcane, and other plant-based sources.

- As the demand for natural and sustainable ingredients continues to grow, the cosmetics sector is witnessing a shift towards plant-based squalene. However, the production of vegetable-sourced squalene poses challenges, including the need for large quantities of raw materials and the potential toxicity of certain sources.

- The MMPA (Marine Mammal Protection Act) in the US further complicates matters for animal-sourced squalene. Tobacco crops, terpene oils, amaranth oil, and rice bran oil are among the potential alternative sources being explored for nutraceuticals. The anti-aging market, fueled by the aging population and the increasing awareness of free radicals' role In the aging process, is expected to drive the demand for squalene in the coming years. Despite these opportunities, the sustainability and scalability of vegetable-sourced squalene remain key challenges for market growth.

How is this Squalene Industry segmented and which is the largest segment?

The squalene industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Cosmetic and personal care products

- Food supplements

- Pharmaceutical

- Type

- Vegetable

- Animal

- Biosynthetic

- Geography

- Europe

- Germany

- France

- APAC

- China

- Japan

- North America

- US

- South America

- Middle East and Africa

- Europe

By End-user Insights

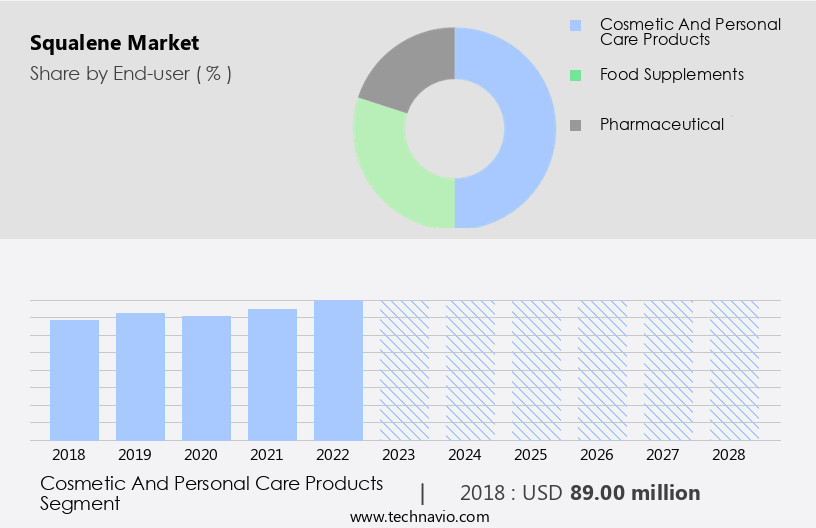

- The cosmetic and personal care products segment is estimated to witness significant growth during the forecast period.

Squalene and squalane, derived from natural sources such as olives, wheat germ oil, and rice bran, are essential components In the cosmetics and personal care sector. Squalene, a precursor to cholesterol, is known for its moisturizing and protective properties for the skin. Squalane is a stable alternative for skincare products. Both ingredients offer benefits beyond moisturization, including anti-aging, anti-inflammatory, and healing properties. The market caters to various industries, with a significant portion serving the personal care sector. Sourced from renewable resources like sugarcane and vegetable oils, squalene provide a sustainable alternative to animal-sourced shark liver oil, reducing the impact on shark populations.

The market's growth is driven by increasing consumer demand for natural and eco-friendly ingredients, with applications extending to emollients in lotions, hair conditioners, bath oils, lipsticks, foundations, and vaccines as adjuvants. In the pharmaceutical industry, squalene plays a role in enhancing immunogenicity, heterologous antibody responses, and antigen dosage sparing in influenza vaccines. Companies are investing In the oncology segment, further expanding the market's potential.

Get a glance at the Squalene Industry report of share of various segments Request Free Sample

The Cosmetic and personal care products segment was valued at USD 89.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

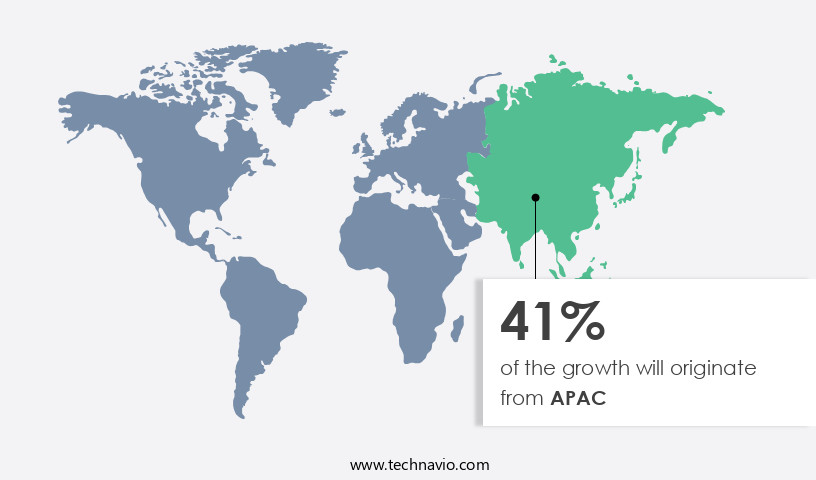

- APAC is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European healthcare industry is experiencing growth due to advanced medical technologies and an aging population in key countries like Germany, France, the Netherlands, and Sweden. Government investments in healthcare infrastructure and EU regulations are driving market expansion. In the facial care sector, anti-aging products hold the largest market share. Germany led the facial care market in 2022, with significant growth anticipated during the forecast period. Squalene, a popular ingredient in skincare, is derived from both animal-sourced shark liver oil and renewable sources like sugarcane and olives. Squalene functions as an emollient, cleansing ingredient, and moisturizer in beauty and personal care products, including creams, serums, oils, masks, lotions, hair conditioners, bath oils, lipsticks, foundations, and vaccines.

Its use in immunogenicity enhancement and antigen dosage sparing in vaccines, particularly flu vaccinations, has gained attention from pharmaceutical companies like GlaxoSmithKline, Sanofi S, and CureVac N. The oncology segment also utilizes squalene as an adjuvant. Plant-based squalene is increasingly popular due to ethical concerns regarding shark populations. Nutraceutical firms and the plant segment are exploring synthetic squalene and alternative sources like terpene oils from tobacco crops and Amaranth oil, Rice bran oil, and Olive oil.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Squalene Industry?

Increasing acceptance of UVA/B filters in sunscreens and sun protection cosmetics is the key driver of the market.

- The personal care and cosmetics sector In the US has seen a significant increase In the demand for squalene-based products, including creams, serums, oils, masks, lotions, hair conditioners, bath oils, lipsticks, foundations, and vaccines. Squalene, a naturally occurring hydrocarbon, is a valuable emollient known for its excellent moisturizing properties and ability to reduce the toxicity of free radicals. Traditionally sourced from shark liver oil, recent advancements have led to the exploration of renewable sources such as sugarcane, olives, and rice bran. Animal-sourced squalene, derived from shark populations, has faced criticism due to ethical concerns and potential supply chain sustainability issues.

- Vegetable-sourced squalene, also known as squalane, is gaining popularity as a viable alternative. Sugarcane, olives, rice bran, amaranth olive, and terpene oils are among the raw materials used to produce plant-based squalene. Squalene has applications beyond personal care. In the pharmaceutical industry, it is used as an adjuvant in vaccines to enhance the immune response, reduce the antigen dosage sparing, and improve immunogenicity. GlaxoSmithKline, Sanofi S, CureVac N, and other nutraceutical firms have been investing in plant-based squalene for use in flu vaccinations. In the oncology segment, squalene is used for its anti-aging properties, targeting the Matrix Metalloproteinase A (MMPA) to slow down the aging process.

- The plant segment is expected to dominate the market due to the increasing demand for plant-based products and the availability of renewable sources. In conclusion, squalene's versatility and benefits have led to its widespread use in various industries, from personal care to pharmaceuticals. The shift towards renewable sources is a positive step towards sustainability and ethical sourcing.

What are the market trends shaping the Squalene Industry?

Squalene derived from renewable resources is the upcoming market trend.

- Squalene, a naturally occurring hydrocarbon, has gained significant attention In the personal care and cosmetics sector due to its exceptional moisturizing properties. Traditionally sourced from shark liver oil, concerns over animal welfare and sustainability have led to the exploration of renewable sources. Vegetable-derived squalene, such as that from amaranth oil, olive oil, wheat germ oil, and rice bran oil, has emerged as a viable alternative. Among these, olive oil is particularly noteworthy for its high squalene content. Countries with abundant olive cultivation, including Greece, Portugal, Italy, France, Spain, the US, Australia, Turkey, and Austria, are increasingly embracing the use of olive oil-derived squalene.

- This renewable resource offers several advantages, including improved purity and higher quality compared to shark liver oil. Sugarcane is another promising source of squalene, which is gaining traction due to its superior quality. Squalene is a versatile ingredient, finding applications in various personal care products such as creams, serums, oils, masks, lotions, hair conditioners, bath oils, lipsticks, foundations, and even vaccines. Its role extends beyond the cosmetics industry, with applications in nutritional supplements and immunogenicity enhancement in flu vaccinations. In the oncology segment, squalene is being explored for its potential anti-aging properties, particularly In the form of Matrix Metalloproteinase A (MMPA) inhibitors.

- The increasing demand for natural and plant-based ingredients in personal care products is expected to drive the growth of the market. Nutraceutical firms are also exploring the use of squalene in tobacco crops and terpene oils for various health benefits. Synthetic squalene is another promising avenue, offering cost-effective and consistent production. The plant segment is expected to dominate the market due to the abundance of raw materials and the growing trend towards plant-based products. In conclusion, squalene, derived from renewable sources such as olive oil and sugarcane, is gaining popularity due to its exceptional moisturizing properties and versatility.

- Its applications extend beyond the cosmetics industry, with potential uses in nutritional supplements, immunogenicity enhancement, and oncology. The increasing demand for natural and plant-based ingredients is expected to fuel the growth of the market.

What challenges does the Squalene Industry face during its growth?

Stringent safety regulations on UV sun care products is a key challenge affecting the industry growth.

- Squalene, a natural hydrocarbon, is a valuable ingredient in various personal care and cosmetics applications, including creams, serums, oils, masks, and lotions. Squalene can be sourced from both animal-sourced shark liver oil and renewable sources, such as sugarcane and olives. The use of animal-sourced squalene, derived from shark liver oil, has raised concerns regarding the impact on shark populations. To address this issue, companies are increasingly focusing on vegetable-sourced squalene, such as squalane derived from sugarcane or olive oil. The personal care and cosmetics sector is a significant consumer of squalene. This ingredient acts as an emollient, providing moisture and improving the skin's texture.

- It also has antioxidant properties, helping to neutralize free radicals and slow down the aging process. Squalene is used in various products, including cleansers, hair conditioners, bath oils, lipsticks, foundations, and vaccines. In the pharmaceutical industry, squalene is used as an adjuvant in vaccines to enhance the immune response. It is used in flu vaccinations, where it increases the immunogenicity of the antigen, allowing for a lower antigen dosage sparing. Companies like GlaxoSmithKline, Sanofi S, and CureVac N are some of the key players In the oncology segment that use squalene In their products. The market dynamics for squalene are influenced by various factors, including regulations on manufacturing, packaging, and distribution processes.

- In the US, the FDCA regulates food components, vitamins, and cosmetics, ensuring their safety and quality. The Natural Cosmetics/Personal Care Goods Safety Act and the FTC further regulate cosmetics and personal care products. companies must adhere to these regulations to maintaIn the quality and safety of their products. In recent years, there has been a shift towards plant-based squalene as a sustainable alternative to animal-sourced squalene. Nutraceutical firms are also exploring the use of squalene in tobacco crops, terpene oils, and other plant-based sources, such as amaranth oil and rice bran oil. Synthetic squalene is also an option, providing a consistent and reliable source of this valuable ingredient.

- The plant segment is expected to grow significantly In the coming years, driven by the increasing demand for sustainable and eco-friendly ingredients.

Exclusive Customer Landscape

The squalene market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the squalene market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, squalene market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Amyris Inc. - Sugarcane-derived squalene is commercially produced by the company, sourced naturally from this renewable resource. This vegetable-origin squalene serves as a sustainable alternative to the traditionally shark-derived counterpart, catering to the growing demand for eco-friendly and ethical ingredients in various industries, including cosmetics and pharmaceuticals.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amyris Inc.

- ARISTA INDUSTRIES

- BOCSCI Inc.

- Cibus

- Croda International Plc

- Evonik Industries AG

- Gracefruit Ltd.

- KISHIMOTO SPECIAL LIVER OIL CO. LTD.

- KURARAY Co. Ltd.

- LBB Specialties LLC

- MacroCare Tech Ltd.

- Majestic Mountain Sage Inc.

- Maruha Nichiro Corp.

- Maypro Group

- Micro Capsule Technologies

- New Zealand Green Health Ltd.

- Parchem Fine and Specialty Chemicals Inc.

- Seadragon

- Sophim

- VESTAN

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the production and supply of squalene, a hydrocarbon lipid, for various applications in industries such as personal care and cosmetics, as well as in pharmaceuticals and vaccines. Squalene is a valuable raw material due to its unique properties, including its high level of unsaturation, which makes it an effective emollient and moisturizing agent. Squalene is traditionally sourced from shark liver oil, but increasing concerns over animal welfare and sustainability have led to the exploration of alternative sources. Renewable sources, such as sugarcane and olives, have gained popularity as potential alternatives to animal-sourced squalene. Sugarcane squalene, also known as squalane, is derived from sugarcane through a hydrogenation process, resulting in a high-purity, odorless, and colorless product.

Olive-sourced squalene is another vegetable-derived alternative, extracted from the olive fruit. The personal care and cosmetics sector is a significant market for squalene, with its use as an emollient and moisturizing ingredient in various products such as creams, serums, oils, masks, lotions, hair conditioners, bath oils, and lipsticks. Squalene's ability to mimic the skin's natural lipids makes it an effective ingredient for improving skin hydration and elasticity, making it a popular choice in anti-aging products. Beyond personal care and cosmetics, squalene also finds applications in pharmaceuticals and vaccines. For instance, it is used as an adjuvant, which is a substance that enhances the body's immune response to antigens, in vaccines.

Squalene's ability to stimulate the production of heterologous antibody responses and antigen dosage sparing makes it an attractive alternative to traditional adjuvants such as aluminum salts. The pharmaceutical industry's use of squalene extends to oncology, where it is used In the production of certain drugs. For example, it is used In the production of some anticancer drugs as a solvent and stabilizer. The shift towards renewable sources of squalene has gained momentum due to concerns over the sustainability of shark populations and the ethical implications of sourcing squalene from shark liver oil. However, the production of vegetable-sourced squalene also poses challenges, such as the need for large quantities of raw materials and the energy-intensive hydrogenation process. The nutraceutical industry also utilizes squalene, primarily In the form of squalane, as a nutritional supplement. Squalane is marketed for its potential health benefits, including its antioxidant properties and its ability to improve skin health.

The market dynamics of the squalene industry are influenced by various factors, including raw material availability and prices, technological advancements, regulatory requirements, and consumer preferences. The increasing demand for sustainable and renewable sources of squalene is driving innovation In the industry, with companies investing in research and development to improve the production efficiency and sustainability of vegetable-sourced squalene. In conclusion, the market is a dynamic and evolving industry, with applications ranging from personal care and cosmetics to pharmaceuticals and vaccines. The shift towards renewable sources of squalene is driving innovation and sustainability In the industry, with companies investing in research and development to improve the production efficiency and sustainability of vegetable-sourced squalene. The market is influenced by various factors, including raw material availability and prices, technological advancements, regulatory requirements, and consumer preferences.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.79% |

|

Market growth 2024-2028 |

USD 62.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.24 |

|

Key countries |

China, US, France, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Squalene Market Research and Growth Report?

- CAGR of the Squalene industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the squalene market growth of industry companies

We can help! Our analysts can customize this squalene market research report to meet your requirements.