Supply Chain Management (SCM) Software Market Size 2025-2029

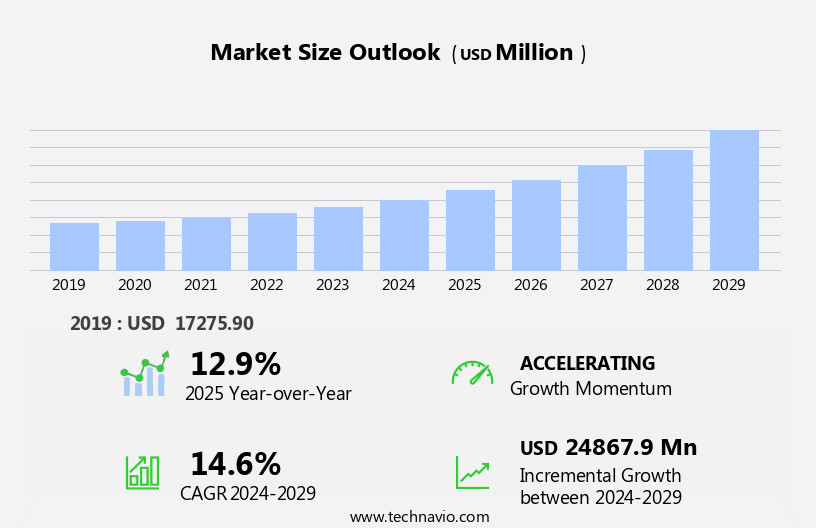

The supply chain management (scm) software market size is forecast to increase by USD 24.87 billion at a CAGR of 14.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for supply chain visibility and event management. The logistics service industry's growing emphasis on fleet management is a key factor fueling this trend. However, high initial costs remain a significant challenge for market adoption, especially for small and medium-sized enterprises. Additionally, the availability of open-source software presents a competitive threat, as some businesses opt for free solutions to manage their supply chains.

- To capitalize on market opportunities, companies must focus on offering cost-effective solutions with robust features that cater to the logistics industry's unique needs. Navigating these challenges requires a strategic approach, including continuous innovation, competitive pricing, and effective marketing to differentiate offerings in the market.

What will be the Size of the Supply Chain Management (SCM) Software Market during the forecast period?

- The market continues to evolve, with dynamic market activities shaping its landscape. Order management, supply chain transformation, efficiency, planning, and financial services are integral components, seamlessly integrated to optimize business operations. Real-time tracking, predictive analytics, and supply chain control further enhance the system's capabilities. Warehouse management, SAAS SCM, on-premise SCM, inventory management, business intelligence, and cloud-based SCM are all part of the evolving SCM ecosystem. Artificial intelligence, supply chain automation, transportation management, and supply chain visibility are transforming the industry, enabling greater control and resilience. Supply chain digitization, machine learning, and supply chain analytics are driving innovation, providing insights into demand planning, risk management, and supply chain monitoring.

- The ecosystem's agility and adaptability are essential, as businesses navigate the complexities of global supply chains and respond to changing market conditions. Big data and data analytics play a crucial role in optimizing supply chain performance, while supply chain optimization and supply chain execution are key priorities for businesses seeking to improve their bottom line. The continuous unfolding of market activities underscores the importance of staying informed and adaptable in this ever-evolving landscape.

How is this Supply Chain Management (SCM) Software Industry segmented?

The supply chain management (scm) software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Logistics

- Inventory Management

- Procurement

- Order Management

- Deployment

- On-premises

- Cloud-based

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

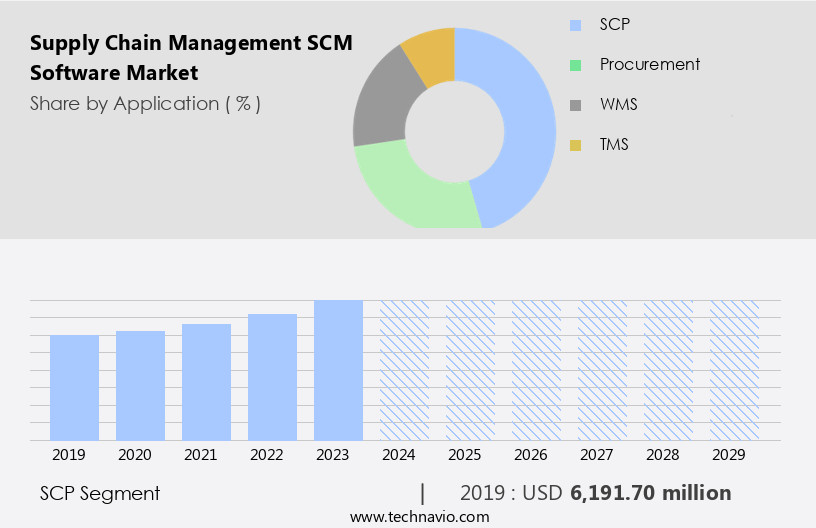

The logistics segment is estimated to witness significant growth during the forecast period.

Supply Chain Planning (SCP) software plays a crucial role in balancing demand and supply by effectively managing inventories using sales data and demand forecasting. SCP is an essential component of business management, integrating functions such as sales and operations planning, demand planning, strategic supply network design, and long-term planning. The software helps executive teams synchronize these functions continuously, providing data on sales plans, production plans, inventory plans, and financial plans. SCP software solutions offer valuable insights by analyzing trends in sales and operations planning. Companies worldwide are embracing these solutions to optimize their supply chains, enhancing efficiency, and ensuring agility in response to market demands.

Real-time tracking, predictive analytics, and supply chain visibility are integral features that enable businesses to make informed decisions and mitigate risks. Cloud-based and on-premise SCP solutions cater to various business needs. Warehouse management, inventory management, financial services, and transportation management are some areas where SCP software solutions make a significant impact. Artificial intelligence, machine learning, and big data analytics are transforming SCP, providing advanced capabilities for demand planning, risk management, and supply chain optimization. Supply chain digitization and automation are key trends driving the market, with mobile SCM and supply chain ecosystems becoming increasingly important. SCP software solutions enable businesses to monitor their supply chain networks in real-time, ensuring resilience and adaptability to disruptions.

By leveraging these advanced capabilities, businesses can improve their overall supply chain performance, ensuring customer satisfaction and competitive advantage.

The Logistics segment was valued at USD 6.19 billion in 2019 and showed a gradual increase during the forecast period.

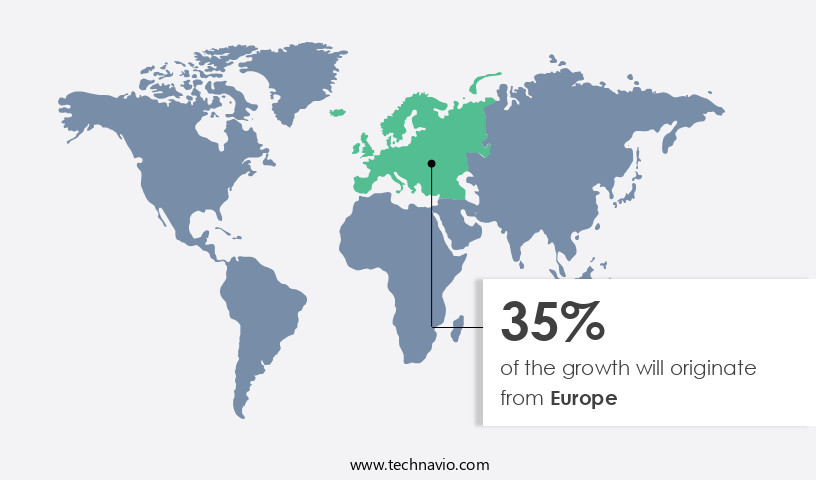

Regional Analysis

Europe is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic world of Supply Chain Management (SCM), North America emerges as a significant growth market for companies. The region's advanced network communication infrastructure and well-established connected device ecosystem facilitate the seamless integration of automation technologies, such as Internet of Things (IoT), machine learning, predictive analytics, and artificial intelligence. These advanced technologies enable effective implementation of smart solutions in industries like retail, oil and gas, and construction, which register considerable fleet movement. Cloud-based SCM solutions, including Software-as-a-Service (SaaS) and on-premise systems, are increasingly popular. Inventory management, supply chain planning, financial services, warehouse management, transportation management, and demand planning are key areas of focus.

Real-time tracking, supply chain visibility, and risk management are essential components of modern SCM systems. Business intelligence, big data, and data analytics play a crucial role in optimizing supply chain agility and efficiency. Supply chain digitization, mobile SCM, and supply chain network management are emerging trends. Supply chain execution, control, monitoring, resilience, and ecosystem management are critical aspects of comprehensive SCM strategies. Artificial intelligence and machine learning are transforming SCM by enabling predictive analytics and automation. Supply chain transformation, optimization, and monitoring are key drivers of growth in the market. The market is expected to continue evolving, with a focus on enhancing supply chain efficiency, reducing costs, and improving customer satisfaction.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Supply Chain Management (SCM) Software Industry?

- The emergence of supply chain visibility and event management solutions is a primary market driver, enabling organizations to gain real-time insights and respond effectively to disruptions in their global supply chains.

- Supply Chain Visibility and Event Management (SCVEM) software plays a vital role in Supply Chain Management (SCM) solutions. This software enables companies to manage events across various departments and crucial aspects of the entire supply chain. By utilizing SCVEM modules within SCM software, businesses can make informed decisions regarding strategic initiatives to enhance cost-effectiveness and boost operational efficiency. The user base for SCVEM software includes warehouse and procurement managers, material suppliers, and product carriers. These modules facilitate control, measurement, simulation, notification, and monitoring of business processes aligned with supply chain activities.

- Many organizations collaborate with their extended network of supply chain partners, who are open to technological upgrades, through Electronic Data Interchange (EDI). In turn, this necessitates the implementation of SCVEM software. By leveraging real-time tracking, predictive analytics, and supply chain planning features, businesses can optimize their supply chain operations and gain a competitive edge in their respective industries.

What are the market trends shaping the Supply Chain Management (SCM) Software Industry?

- The logistics service industry is experiencing a surging demand for fleet management solutions. This trend reflects the increasing importance of efficient and effective transportation operations in meeting customer demands and reducing costs.

- Supply Chain Management (SCM) software plays a crucial role in optimizing logistics services by managing and implementing processes for transportation management, fleet management, order fulfillment, logistics network design, and inventory control. Fleet management is a significant component of SCM systems, enabling businesses to efficiently utilize their work vehicles, minimize fuel costs, reduce fleet operating expenses, enhance productivity, and ensure driver safety. Integration of SCM software is essential for fleet management systems to record and analyze data via middleware. Cloud-based SCM solutions, such as Software-as-a-Service (SaaS), have gained popularity due to their ease of implementation and accessibility. Inventory management and business intelligence capabilities are essential features of SCM software, providing real-time insights for better decision-making.

- Artificial intelligence and machine learning algorithms are increasingly being integrated into SCM software for supply chain automation and predictive analytics. The benefits of implementing SCM software extend beyond logistics services. It offers end-to-end visibility, improved collaboration, and increased efficiency across the entire supply chain network. By automating manual processes, businesses can reduce errors, minimize lead times, and streamline operations. Furthermore, cloud-based SCM solutions offer scalability and flexibility, allowing businesses to adapt to changing market conditions and customer demands. In conclusion, the applications of SCM software in logistics services are vast and essential for businesses seeking to optimize their supply chain operations.

- Fleet management is a critical aspect of SCM systems, offering benefits such as vehicle tracking, cost reduction, productivity enhancement, and driver safety. The integration of SCM software with fleet management systems is a major step towards achieving optimal supply chain performance. Cloud-based SCM solutions, with their inventory management, business intelligence, and automation capabilities, offer businesses the flexibility and scalability required to thrive in today's dynamic marketplace.

What challenges does the Supply Chain Management (SCM) Software Industry face during its growth?

- The expansion of the industry is hindered by the high initial costs and the prevalence of open-source software options.

- Supply Chain Management (SCM) software has become an essential tool for businesses to gain control and visibility over their supply chain network. However, the increasing adoption of SCM solutions comes with significant costs. These expenses include software licensing, installation, maintenance, hardware, customization, and training. One of the primary challenges faced by stakeholders is the need to monitor and manage ongoing transportation and logistics activities. The implementation of Transportation Management Systems (TMS) and Warehouse Management Systems (WMS) requires the installation of data-capturing devices on transportation fleets and the investment in IT infrastructure. These costs, coupled with the requirement for trained IT staff and dedicated personnel for operation, add to the overall expense.

- Moreover, to remain competitive, businesses must periodically upgrade their SCM solutions to incorporate advanced technologies, such as supply chain digitization, machine learning, and supply chain analytics. Demand planning and forecasting also require continuous attention and investment. In conclusion, while SCM software offers numerous benefits, its implementation and maintenance come with substantial costs. Businesses must carefully consider these expenses and weigh them against the potential gains in supply chain efficiency, visibility, and agility.

Exclusive Customer Landscape

The supply chain management (scm) software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the supply chain management (scm) software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, supply chain management (scm) software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Blue Yonder Group Inc. - The company specializes in providing advanced supply chain management solutions through its software offering, Logility. This technology enables businesses to optimize inventory levels, streamline operations, and improve supply chain visibility. By leveraging data analytics and machine learning algorithms, Logility empowers organizations to make informed decisions and respond effectively to market demands. The software's features include demand forecasting, supply and inventory planning, and transportation management. By implementing Logility, businesses can enhance their overall efficiency, reduce costs, and improve customer satisfaction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Blue Yonder Group Inc.

- Coupa Software Incorporated

- Descartes Systems Group Inc.

- E2open LLC

- Epicor Software Corporation

- Fishbowl Inventory

- HighJump (Körber)

- IFS (Industrial and Financial Systems)

- Infor Inc.

- JDA Software Group Inc.

- Kinaxis Inc.

- Logility Inc.

- Manhattan Associates Inc.

- NetSuite Inc. (Oracle)

- Oracle Corporation

- SAP SE

- Syspro

- TradeGecko Pte. Ltd.

- WiseTech Global Limited

- Zoho Corporation

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Supply Chain Management (SCM) Software Market

- In February 2024, SAP SE, a leading enterprise application software provider, announced the launch of its next-generation Supply Chain Control Tower solution, which uses artificial intelligence and machine learning to predict and prevent disruptions in real-time (SAP Press Release, 2024). This new offering aims to revolutionize supply chain management by providing end-to-end visibility and predictive analytics.

- In June 2025, IBM and Maersk, the world's largest container shipping company, expanded their strategic partnership to integrate IBM's blockchain technology into Maersk's supply chain management system. This collaboration is expected to enhance transparency, security, and efficiency in global trade by enabling real-time tracking and sharing of data among multiple stakeholders (IBM Press Release, 2025).

- In August 2024, Oracle Corporation completed the acquisition of NetSuite, a leading provider of cloud business software, including SCM solutions. This acquisition is expected to strengthen Oracle's position in the cloud market and provide a broader range of integrated business applications to its customers (Oracle Press Release, 2024).

- In December 2025, the European Union announced the Digital Operational Resilience Act (DORA), which aims to improve the cybersecurity and operational resilience of critical sectors, including supply chain management. The regulation sets new requirements for risk assessment, incident reporting, and incident response (European Commission, 2025). This initiative is expected to drive investments in advanced SCM software solutions that can address cybersecurity challenges.

Research Analyst Overview

In the dynamic and complex world of supply chain management (SCM), software solutions play a pivotal role in optimizing operations and mitigating risks. The SCM software market is witnessing significant trends, including a heightened focus on reverse logistics and supply chain disruption management. Supply chain services providers are increasingly offering innovative solutions to help businesses navigate supply chain bottlenecks and improve their strategies. Supply chain professionals require advanced tools for simulation, modeling, and design to stay competitive. Technology, such as supply chain software, is transforming the industry, enabling real-time visibility, collaboration, and finance management. Supply chain transparency and traceability are essential for maintaining customer trust and ensuring regulatory compliance.

Third-party logistics (3PL) providers are collaborating with businesses to offer end-to-end solutions, addressing supply chain interruptions and certification requirements. Supply chain innovation continues to drive the market, with a growing emphasis on security, training, and implementation. As the industry evolves, the demand for skilled supply chain professionals is on the rise. Standards and certification programs are essential for maintaining quality and efficiency in the supply chain ecosystem. In conclusion, the SCM software market is a vibrant and ever-changing landscape, with a focus on collaboration, innovation, and risk mitigation. By embracing technology, businesses can optimize their supply chains, enhance their competitive edge, and ensure a seamless flow of goods and services.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Supply Chain Management (SCM) Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.6% |

|

Market growth 2025-2029 |

USD 24867.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.9 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Supply Chain Management (SCM) Software Market Research and Growth Report?

- CAGR of the Supply Chain Management (SCM) Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the supply chain management (scm) software market growth of industry companies

We can help! Our analysts can customize this supply chain management (scm) software market research report to meet your requirements.