Surgical Lights Market Size 2024-2028

The surgical lights market size is forecast to increase by USD 434.1 million at a CAGR of 4.36% between 2023 and 2028.

What will be the Size of the Surgical Lights Market During the Forecast Period?

How is this Surgical Lights Industry segmented and which is the largest segment?

The surgical lights industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals

- Ambulatory surgical centers

- Others

- Type

- LED lights

- Halogen lights

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

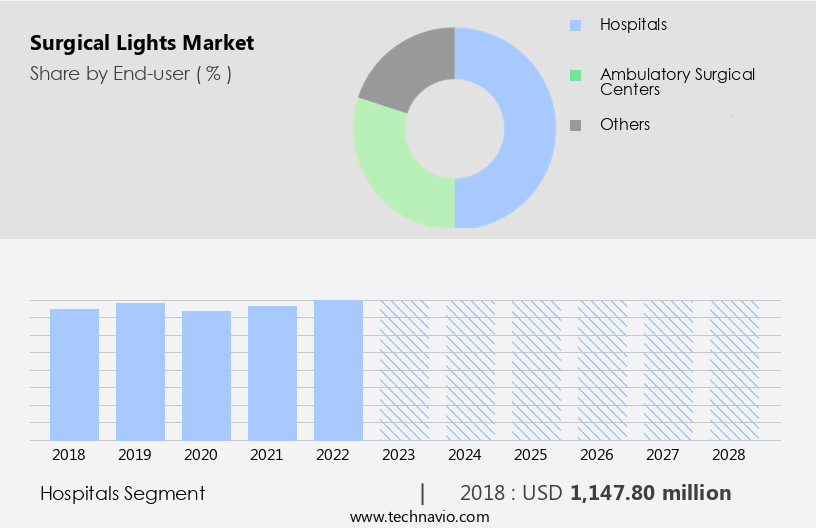

- The hospitals segment is estimated to witness significant growth during the forecast period.

Surgical lights are essential equipment in healthcare facilities, particularly in hospitals, where they are extensively used during various surgical procedures. Hospitals cater to a diverse range of medical specialties, including cardiac surgery, gynecological surgery, neurosurgery, ENT surgery, and more. These facilities house a large number of skilled medical professionals who perform surgeries and manage wounds resulting from accidents, trauma, or elective procedures. Surgical lights enable surgeons to maintain optimal depth perception and focus on the surgical field, minimizing shadows and glare. They are available in different light sources, such as halogen and LED, offering various color temperature and intensity adjustments.

Modern surgical lighting solutions come with smart features like IoT connectivity, remote control, and touchless control systems. Energy-efficient LED technology is increasingly replacing traditional lighting sources, such as incandescent bulbs and halogen bulbs, to reduce electricity bills. Surgical lighting solutions also integrate with surgical instruments, imaging technologies, and laminar flow systems to enhance the overall surgical experience.

Get a glance at the Surgical Lights Industry report of share of various segments Request Free Sample

The Hospitals segment was valued at USD 1147.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Asia is estimated to contribute 29% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market is experiencing consistent expansion due to the increasing older population and rising prevalence of chronic diseases, leading to a surge in surgical procedures. In 2021, approximately 695,000 Americans died from heart disease, highlighting the significance of cardiac surgery in driving market growth. Additionally, the high incidence of colorectal cancer, ulcerative colitis, and the substantial number of orthopedic and gynecological surgeries are expected to fuel market expansion. The US dominates the North American market, with Canada following closely. Surgical lighting solutions are integral to various healthcare facilities, including hospitals and ambulatory surgical centers, enabling optimal visibility during minimally invasive procedures, robotic surgeries, and open surgeries.

LED lighting, with its energy efficiency and advanced features such as shadow dilution, correlated color temperature, and homogeneity, is increasingly adopted for surgical applications. Smart features, IoT connectivity, remote control, and touchless control systems enhance the functionality of surgical light fixtures. Surgical field illumination is crucial for depth perception, tissue identification, and shadow reduction, minimizing glare and maintaining natural daylight. Color temperature control and sterilizable handles ensure hygiene and patient safety. The market encompasses a wide range of applications, from general surgery and orthopedic procedures to cardiovascular and emergency room settings.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Surgical Lights Industry?

Increase in prevalence of chronic diseases is the key driver of the market.

What are the market trends shaping the Surgical Lights Industry?

Increase in adoption of LED surgical lights is the upcoming market trend.

What challenges does the Surgical Lights Industry face during its growth?

Negative impact of surgical lights on surgeons is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The surgical lights market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the surgical lights market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, surgical lights market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ams OSRAM AG - The company specializes in providing advanced surgical lighting solutions, including Xenon Short Arc Discharge Lamps (XBO) for medical procedures. These lamps deliver optimal illumination for surgeons, ensuring precision and clarity during operations. The XBO lamps' brightness and color rendering index enable accurate identification of tissues and instruments, enhancing surgical efficiency and patient safety. The company's commitment to innovation and quality ensures that its surgical lighting systems meet the evolving needs of healthcare professionals and institutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ams OSRAM AG

- Aspen Surgical Products Inc.

- Baxter International Inc.

- BET MEDICAL (P) LTD.

- Bihler of America Inc.

- Dragerwerk AG and Co. KGaA

- EPMD Group Pvt. Ltd.

- Getinge AB

- Hail Mediproducts Pvt. Ltd.

- Herbert Waldmann GmbH and Co. KG

- HOSPEDIA MEDICARE Pvt. Ltd.

- IG Medical GmbH

- Integra Lifesciences Corp.

- medifa GmbH

- Midmark India Pvt. Ltd.Â

- S.I.M.E.O.N. Medical GmbH and Co. KG

- SKYTRON LLC

- STERIS plc

- Stryker Corp.

- Sunoptic Surgical

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of lighting solutions designed to optimize the surgical environment for various medical procedures. These lighting systems are essential in healthcare facilities, including hospitals and ambulatory surgical centers, to ensure optimal visibility and depth perception for surgeons during operations. Surgical lights come in different technologies, with halogen and LED being the most common. Halogen lights have long been the standard for surgical lighting due to their high intensity and brightness. However, the shift towards energy efficiency and advanced features has led to the increasing adoption of LED lighting in surgical applications. LED lighting offers several advantages over traditional halogen sources.

For instance, it is more energy-efficient, producing the same amount of light using less electricity. LED lights also have a longer lifespan, reducing the frequency of replacement and maintenance. Moreover, LED lighting can be engineered to offer smart features such as IoT connectivity, remote control, and touchless control systems. The surgical lighting market is driven by the growing demand for minimally invasive procedures and robotic surgeries. Minimally invasive procedures require precise illumination to enable surgeons to work in confined spaces. LED lighting, with its adjustable light intensity and color temperature, is well-suited for these procedures. Similarly, robotic surgeries require high-quality lighting to enable clear visualization of the surgical field, which is crucial for accurate and efficient surgery.

The importance of surgical lighting in healthcare facilities cannot be overstated. Proper lighting is essential for various surgical procedures, including cardiac, gynecological, neuro, ENT, and general surgery. The surgical field is a critical aspect of healthcare facilities, and surgical lighting plays a crucial role in ensuring the success of surgical procedures. The surgical lighting market is also influenced by factors such as the increasing adoption of imaging technologies and the growing demand for energy-efficient lighting. Imaging technologies, such as laminar flow systems, help to minimize shadows and glare, improving the overall surgical experience. Energy efficiency is another significant consideration, with healthcare facilities seeking to reduce their electricity bills while maintaining optimal lighting conditions.

In conclusion, the market is a dynamic and evolving industry that plays a vital role in healthcare facilities. The market is driven by factors such as the growing demand for minimally invasive procedures, the adoption of advanced lighting technologies, and the need for energy efficiency. Surgical lighting solutions continue to advance, offering features such as IoT connectivity, remote control, and touchless control systems, to enhance the surgical experience and improve patient outcomes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 434.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, Germany, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Surgical Lights Market Research and Growth Report?

- CAGR of the Surgical Lights industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the surgical lights market growth of industry companies

We can help! Our analysts can customize this surgical lights market research report to meet your requirements.