Survival Tools Market Size 2024-2028

The survival tools market size is forecast to increase by USD 442.5 million at a CAGR of 6.36% between 2023 and 2028.

What will be the Size of the Survival Tools Market During the Forecast Period?

How is this Survival Tools Industry segmented and which is the largest segment?

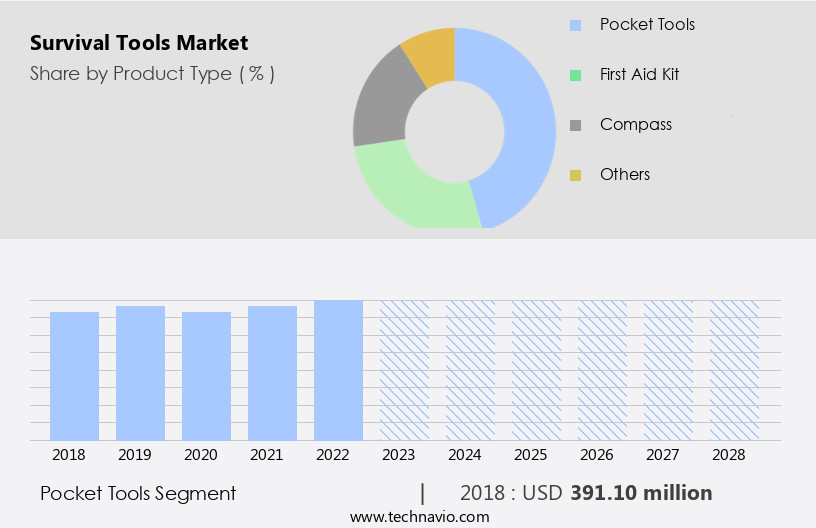

The survival tools industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type

- Pocket tools

- First aid kit

- Compass

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Product Type Insights

- The pocket tools segment is estimated to witness significant growth during the forecast period.

Pocket tools have become essential items for various industries and outdoor activities due to the inherent risks involved. In the military, defense, and law enforcement sectors, pocket tools serve as vital survival equipment during operations. Similarly, in industries such as oil and gas, where hazards like molten metal, chemicals, acids, gases, and vapors pose threats, first aid kits are indispensable. These compact tools contain essential supplies for emergencies, making them convenient and portable. Millennials and Generation Z, avid adventurers and outdoor enthusiasts, also rely on pocket tools for hiking, rock climbing, and camping. Pocket tools include basic tools like compasses, first aid kits, and specialty items like ropes and paracord.

Sales channels include supermarkets, specialty stores, and online stores. Brands like UST offer a range of survival tools. Pocket tools are crucial for addressing unintentional injuries and accidents, such as falls, during recreational activities. They are cost-effective and equipped with automatic technology, making them an essential investment for families planning paid vacation holidays. Natural calamities like earthquakes further emphasize the importance of carrying pocket tools for defense and survival.

Get a glance at the Survival Tools Industry report of share of various segments Request Free Sample

The Pocket tools segment was valued at USD 391.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market is driven by the popularity of recreational activities, such as hiking, rock climbing, and camping, in regions with abundant natural beauty, including national and state parks. The increasing number of millennials and Generation Z seeking adventure tourism experiences further fuels market growth. Online sales channels, including specialty stores and supermarkets, enable easy access to essential supplies like compasses, first aid kits, and pocket tools. Regulatory bodies, such as the Occupational Safety and Health Administration (OSHA), mandate the use of first aid kits and pocket tools for worker safety, thereby increasing demand. Natural disasters, such as earthquakes, and unintentional injuries during outdoor recreational activities contribute to the necessity of survival equipment.

Additionally, sales of specialized tools, such as ropes and paracord, for hunting, fishing, and military operations, further boost market growth. The adoption of automatic technology in survival tools, including compasses, reduces the need for manual navigation and enhances user experience. The market's growth is also influenced by the rising trend of paid vacation holidays and increasing tourist destinations.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Survival Tools Industry?

Increasing outdoor recreational activities is the key driver of the market.

What are the market trends shaping the Survival Tools Industry?

Provision of training to use survival tools is the upcoming market trend.

What challenges does the Survival Tools Industry face during its growth?

Limitations of size and weight of survival tool kits is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The survival tools market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the survival tools market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, survival tools market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Acme United Corp. - The company specializes in providing survival tools, encompassing sleep systems, tents, and shelters, to meet the essential needs of outdoor enthusiasts and survivalists. These offerings ensure optimal comfort and protection in various environments.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acme United Corp.

- Bivouac Outdoor

- Cintas Corp.

- Exxel Outdoors LLC

- Fenix Outdoor International AG

- Fiskars Group

- Full Windsor

- Gerber Gear

- Honeywell International Inc.

- Johnson and Johnson Services Inc.

- L.L. Bean Inc.

- Leatherman Tool Group Inc.

- Lifeline

- Newell Brands Inc.

- Recreational Equipment Inc.

- Sharpal Inc.

- SOG Specialty Knives Inc.

- SureFire LLC

- Unchartered Supply Co.

- VSSL

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products designed to ensure safety and preparedness in various situations. These tools cater to diverse demographics, including those engaged in outdoor recreational activities and individuals seeking defense and preparedness for natural calamities or unintentional injuries. Outdoor recreational activities, such as hiking, camping, rock climbing, and adventure tourism, have witnessed a significant surge in popularity. Millions of individuals participate In these activities each year, leading to a growing demand for survival tools. Pocket tools, compasses, and first aid kits are among the most commonly used items in this category. The sales channels for survival tools have evolved significantly over the past decade.

Traditional brick-and-mortar specialty stores have been joined by supermarkets and online stores as key sales channels. UST brands and other manufacturers have capitalized on this trend by expanding their distribution networks to cater to a broader consumer base. The demand for survival tools is driven by several factors. Unintentional injuries and accidental mortality due to falls and other accidents are a major concern for families, particularly during outdoor activities. Natural calamities, such as earthquakes and other disasters, also underscore the importance of being prepared with the right equipment. Defense and military operations are another significant market for survival tools.

The military relies on specialized equipment, including ropes and paracord, for various missions. Transportation costs and the need for automatic technology have led to advancements In the design and production of these tools. Hunting and fishing enthusiasts also utilize survival tools to enhance their experiences. Living standards have improved, allowing more people to afford vacations and paid holidays, which in turn increases the demand for survival equipment. Tourist destinations have recognized the importance of providing adequate safety measures and equipment for visitors. Survival equipment, such as compasses and first aid kits, are now offered as essentials for many outdoor activities.

The market is expected to continue growing as more people engage in outdoor activities and seek to be prepared for various situations. The market dynamics are influenced by factors such as consumer preferences, technological advancements, and regulatory requirements. In conclusion, the market is a diverse and dynamic industry that caters to a wide range of consumers and applications. From outdoor enthusiasts to military personnel, the demand for these tools remains strong due to the inherent need for safety and preparedness in various situations. The market is characterized by continuous innovation and expansion, driven by factors such as changing consumer preferences, technological advancements, and regulatory requirements.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.36% |

|

Market growth 2024-2028 |

USD 442.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.58 |

|

Key countries |

US, China, Canada, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Survival Tools Market Research and Growth Report?

- CAGR of the Survival Tools industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the survival tools market growth of industry companies

We can help! Our analysts can customize this survival tools market research report to meet your requirements.