Synthetic Quartz Market Size 2024-2028

The synthetic quartz market size is forecast to increase by USD 294.7 million at a CAGR of 5.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand for advanced electronic devices in various industries, particularly in healthcare and automotive sectors. The healthcare industry's reliance on sophisticated medical equipment is fueling the market's expansion, as synthetic quartz's unique properties make it an ideal material for manufacturing high-precision sensors and transducers. Similarly, the automotive industry's shift towards advanced electronics, including engine control systems and safety features, is leading to increased usage of synthetic quartz in automotive applications. However, the market's growth is not without challenges. Volatile raw materials prices pose a significant threat to market stability, as quartz is a critical raw material in the production of synthetic quartz.

- Fluctuations in the price of natural quartz, which is the primary raw material, can significantly impact the cost structure of synthetic quartz manufacturers. As such, companies must closely monitor raw material prices and adopt cost management strategies to mitigate risks and maintain profitability. Despite these challenges, the market's long-term growth prospects remain promising, with opportunities for innovation and differentiation through the development of advanced synthetic quartz products and applications. Companies seeking to capitalize on these opportunities must focus on research and development, supply chain optimization, and strategic partnerships to stay competitive in this dynamic market.

What will be the Size of the Synthetic Quartz Market during the forecast period?

- The market encompasses the production and application of quartz crystals through artificial means, primarily for use in various industries. This market is driven by the demand for high-quality quartz crystals, which exhibit unique properties such as piezoelectricity and resonance. The production process involves high temperatures and pressure, resulting in large-scale industrial production of quartz crystals through methods like temperature-difference growth and autoclave processing. Quartz crystals find extensive use in civil applications, including as resonators in clocks and oscillators in telecommunication equipment.

- Their piezoelectric properties make them valuable in ultrasonic-wave generators, underwater communication systems, and electric resonators. Thickness-shear and longitudinal vibrations are essential characteristics of quartz crystals, leading to their application as optical materials and resonator plates. The synthetic quartz industry continues to grow, with advancements in technology leading to improved production methods and expanded applications.

How is this Synthetic Quartz Industry segmented?

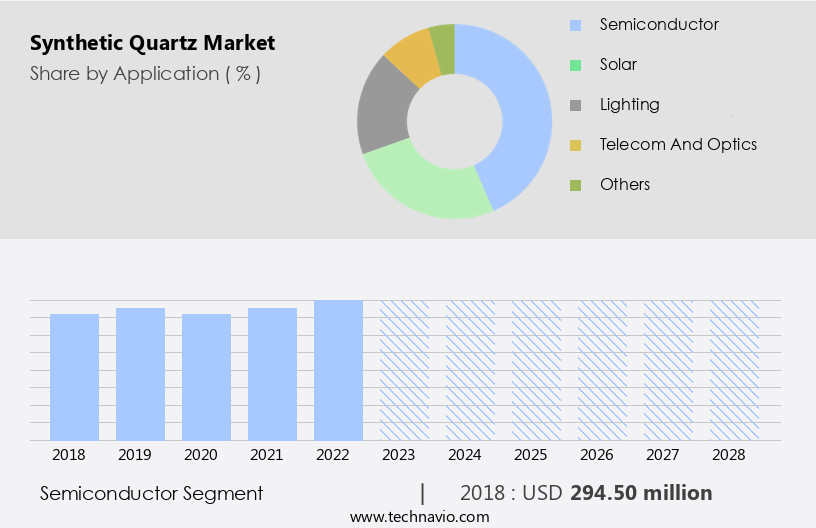

The synthetic quartz industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Semiconductor

- Solar

- Lighting

- Telecom and optics

- Others

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

The semiconductor segment is estimated to witness significant growth during the forecast period.

The market experiences notable expansion in the semiconductor sector, fueled by technological advancements and escalating demand for superior electronic components. Synthetic quartz plays a pivotal role in this industry due to its unparalleled purity and optical properties, which are indispensable for applications like photomasks and UV lithography processes. These features significantly enhance the accuracy and dependability of semiconductor manufacturing, a critical aspect in producing innovative devices such as smartphones, computers, and advanced medical equipment. The semiconductor industry's growth is a significant factor, as the increasing intricacy of semiconductor devices necessitates top-tier materials like synthetic quartz to guarantee optimal functionality.

Electric wave applications, such as quartz resonators and electric resonators, utilize the piezoelectric oscillation property of quartz crystals. The production of synthetic quartz involves various methods, including photolithography processing, temperature-difference growth method, and high-pressure techniques. The resulting quartz crystal units exhibit consistent dimensions, thickness longitudinal vibration, and thickness-shear vibration, making them suitable for various industries, including civil use, underwater communication, and large-scale industrial production. The quartz industry's growth is further driven by the demand for safety control devices, optical materials, and communication waves. Quality control measures ensure the elimination of internal defects, ensuring high-grade C standard crystals with minimal deviation from the frequency temperature coefficient.

Artificial synthesis methods, such as autoclave and seed crystals, enable mass production of quartz resonator plates for telecommunication applications, AT-cut wafer sizes, and etch channel densities.

Get a glance at the market report of share of various segments Request Free Sample

The Semiconductor segment was valued at USD 294.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

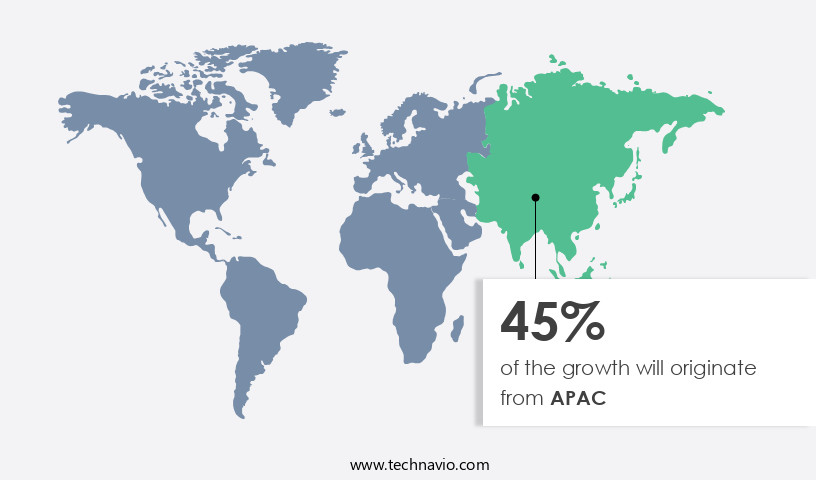

APAC is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant growth, particularly in the Asia Pacific (APAC) region. This expansion is driven by the increasing production of automobiles and the rising demand for advanced electronics, particularly in countries like China and India. The region's dominance in the electronics and automotive industries, with major Original Equipment Manufacturers (OEMs) present, contributes to this trend. Quartz resonators, which undergo piezoelectric oscillation due to crystal orientation, are integral to various applications, including quartz clocks and communication waves. These resonators are produced through synthetic methods such as photolithography processing, temperature-difference growth method, or artificial synthesis. The thickness longitudinal and thickness-shear vibrations of quartz crystals are crucial for their functionality.

The production of synthetic quartz crystals involves high temperatures and pressures. Wafer processing costs are a significant factor in the overall production process, which includes wafer cutting, etch channel density adjustments, and machined dimensions. Quality control is essential to ensure high-quality quartz crystal units with minimal internal defects and consistent piezoelectricity. Quartz crystals are used extensively in various industries, including civil use, underwater communication, telecommunication, and safety control devices. The market's growth is expected to continue due to the increasing demand for large-scale industrial production and the versatility of quartz crystals as optical materials.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Synthetic Quartz Industry?

- Increasing demand for advanced electronic devices in healthcare industry is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for advanced electronic devices in various industries, with a notable impact in the healthcare sector. As technology advances, devices such as wearable gadgets, smart implants, and remote monitoring systems are becoming indispensable for enhancing patient care and outcomes. These technologies heavily rely on high-quality electronic components, including synthetic quartz, which is essential for their functionality due to its stability and precision in frequency control. The integration of the Internet of Things (IoT) and artificial intelligence (AI) into healthcare devices further amplifies their capabilities by enabling real-time data collection and analysis, leading to proactive health management.

- For instance, wearable devices can continuously monitor vital signs and transmit data to healthcare providers, enabling timely interventions. This market trend is expected to continue as technology continues to revolutionize industries and improve our daily lives.

What are the market trends shaping the Synthetic Quartz Industry?

- Increasing adoption of advanced automotive electronics is the upcoming market trend.

- The market is experiencing significant growth due to the increasing adoption of advanced automotive electronics, particularly in healthcare applications. As vehicles become more integrated with sophisticated electronic systems, such as advanced driver-assistance systems (ADAS) and connected technologies, the demand for high-quality materials like synthetic quartz is rising. Synthetic quartz's exceptional stability and reliability make it an ideal choice for these systems, which require precise timing and frequency control. Furthermore, the convergence of automotive and healthcare technologies is facilitating the development of advanced medical devices that can be integrated into vehicles.

- This trend is driven by innovations in IoT and AI, and is expected to continue fueling market growth. Synthetically produced quartz's unique properties make it a valuable component in various industries, including electronics, telecommunications, and automotive, due to its ability to provide accurate and consistent performance under extreme conditions.

What challenges does the Synthetic Quartz Industry face during its growth?

- Volatile raw materials prices is a key challenge affecting the industry growth.

- The market experiences volatility due to the unpredictable pricing of raw materials, specifically high-purity quartz, which is crucial for semiconductor and electronic applications in the healthcare sector. The costs of this essential material can fluctuate significantly due to supply chain disruptions and geopolitical tensions, leading to increased production costs for manufacturers. This volatility poses a challenge as the healthcare industry increasingly relies on advanced electronic devices, putting pressure on manufacturers to secure stable raw material supplies at reasonable prices to maintain competitiveness and meet quality standards.

Exclusive Customer Landscape

The synthetic quartz market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the synthetic quartz market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, synthetic quartz market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AGC Inc. - The company showcases its synthetic quartz crystal product, CQ, renowned for its resistance to laser irradiation. This advanced material boasts superior durability, making it an ideal choice for various industries requiring high-performance quartz crystals. CQ's resilience under laser exposure sets it apart from competitors, ensuring long-lasting functionality and reliability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGC Inc.

- CoorsTek Inc.

- Daishinku Corp

- Heraeus Holding GmbH

- Impex HighTech GmbH

- Murata Manufacturing Co. Ltd.

- Nihon Dempa Kogyo Co. Ltd.

- SCR Sibelco NV

- Seiko Epson Corp.

- SGX Minerals Pvt. Ltd.

- Shin Etsu Chemical Co. Ltd.

- SIWARD Crystal Technology Co. Ltd.

- Sun Lakes Dental

- SUNTSU ELECTRONICS INC.

- The Dentists at 650 Heights

- Tosoh Quartz Corp.

- TXC Corp.

- Tydex LCC

- Universal Quartz Inc.

- Yuzhnouralsk plant

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Synthetic quartz, a type of artificially produced quartz crystals, has gained significant traction in various industries due to its unique properties and versatility. This inorganic material, primarily composed of silicon dioxide, is prized for its piezoelectric and quartz resonator properties. The production process of synthetic quartz involves several techniques, including photolithography processing and temperature-difference growth method. The former utilizes light to create patterns on a silicon wafer, which are then used as masks for crystal growth. The latter method, on the other hand, relies on the difference in temperature between two zones to induce crystal growth. Quartz resonators are essential components in various applications, such as clocks, communication systems, and safety control devices.

The crystals' dimensions, including thickness, are critical factors in determining their resonant frequency and quality. High-quality synthetic quartz crystals exhibit minimal internal defects and consistent crystal orientation, ensuring optimal performance. The quartz industry has seen a shift towards large-scale industrial production, with mass production techniques like wafer cutting and machined dimensions becoming increasingly common. These methods help reduce production costs and ensure consistent product dimensions. Quartz crystals are valued for their piezoelectricity, which allows them to convert electrical energy into mechanical energy and vice versa. This property is essential in various applications, including underwater communication and telecommunication systems.

The crystals' orientation and crystal growth conditions significantly impact their piezoelectric properties. Synthetic quartz's popularity can be attributed to its high temperature resistance and stability, making it an ideal material for various applications. Its use extends beyond communication and industrial applications to civil use, such as in safety control devices and optical materials. The market is driven by the growing demand for high-performance components in various industries. The need for precise frequency control and stability, coupled with the increasing miniaturization of electronic devices, fuels the market's growth. The production process of synthetic quartz involves several stages, including seed crystal preparation, crystal growth, and wafer processing.

Each stage requires stringent quality control measures to ensure the production of high-quality crystals. The thickness-shear vibration and longitudinal vibration modes of synthetic quartz crystals are crucial factors in determining their application areas. Thickness-shear vibration is essential in underwater communication systems, while longitudinal vibration is used in quartz clocks and oscillators. The use of synthetic quartz crystals in various applications, from communication systems to safety control devices, highlights their importance in modern technology. The ongoing research and development in crystal growth techniques and production methods aim to improve the quality and reduce the production costs of synthetic quartz crystals.

In , synthetic quartz is a versatile and essential material in modern technology, with applications ranging from communication systems to safety control devices. The production process involves several stages, including crystal growth and wafer processing, and requires stringent quality control measures to ensure the production of high-quality crystals. The market for synthetic quartz is driven by the growing demand for high-performance components in various industries, and ongoing research and development aim to improve the material's properties and reduce production costs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2024-2028 |

USD 294.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.1 |

|

Key countries |

China, US, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Synthetic Quartz Market Research and Growth Report?

- CAGR of the Synthetic Quartz industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the synthetic quartz market growth of industry companies

We can help! Our analysts can customize this synthetic quartz market research report to meet your requirements.