Tail Spend Management Solutions Market Size 2025-2029

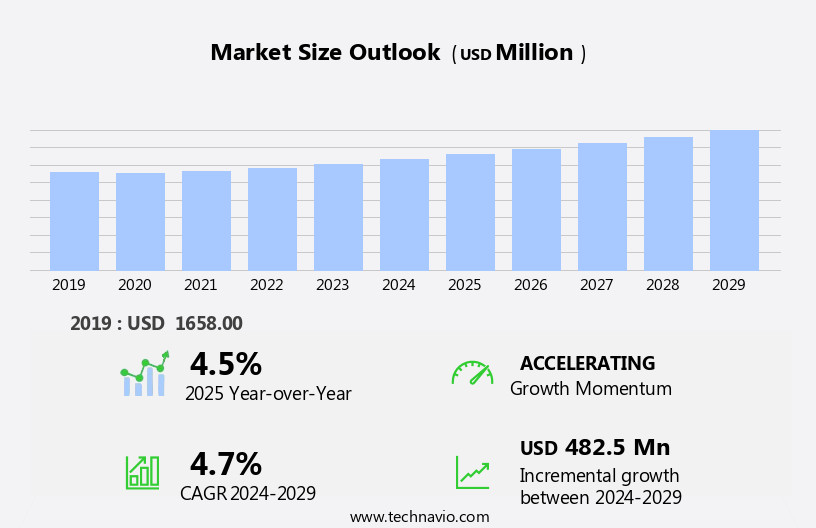

The tail spend management solutions market size is forecast to increase by USD 482.5 million, at a CAGR of 4.7% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing emphasis on cost reduction strategies. Companies are recognizing the potential savings that can be achieved by optimizing their spend on low-value, infrequent purchases, also known as tail spend. This trend is further fueled by the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) technologies, which enable automated identification and management of tail spend. However, the market is not without its challenges. Data quality issues pose a significant obstacle to effective tail spend management. With a large number of suppliers and transactions involved, maintaining accurate and up-to-date data is essential for identifying opportunities for cost savings and managing risk.

- Ensuring data accuracy and completeness requires robust data management processes and technologies, presenting an opportunity for solution providers to differentiate themselves in the market. Companies seeking to capitalize on the opportunities presented by the market must address these challenges head-on, investing in advanced data management capabilities and leveraging AI and ML technologies to gain visibility and control over their tail spend.

What will be the Size of the Tail Spend Management Solutions Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with cloud-based supplier performance management systems gaining traction. These solutions enable businesses to automate payment processes, integrating business intelligence and data visualization for value creation. Supplier relationships are strengthened through effective communication and performance monitoring, leading to cost reduction and process improvement. Risk management is a critical component, with demand forecasting and supply chain optimization ensuring business continuity. Contract management solutions facilitate efficient negotiation and compliance, while tail spend optimization uncovers hidden savings opportunities. Ethical sourcing and supplier diversity initiatives are integrated, enhancing corporate social responsibility. Artificial intelligence and machine learning are transforming the landscape, providing predictive analytics for inventory management and spend data analysis.

Procurement automation streamlines workflows, reducing manual tasks and increasing efficiency gains. Purchase order management and reporting and analytics provide real-time spend visibility, enabling informed decision-making. The ongoing unfolding of market activities reveals a dynamic and interconnected ecosystem, where e-procurement platforms, spend analytics, and category management are seamlessly integrated. Strategic sourcing initiatives leverage spend data to optimize contracts and negotiate favorable terms. Invoice processing is automated, ensuring accurate and timely payments to suppliers. The continuous evolution of tail spend management solutions is shaping the future of procurement, with a focus on data integration and supplier relationship management.

The market's ongoing growth and innovation are driving significant value for businesses across various sectors.

How is this Tail Spend Management Solutions Industry segmented?

The tail spend management solutions industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Solution

- Spend analytics

- Order management

- Contract management

- End-user

- BFSI

- Transportation and logistics

- Healthcare

- Retail

- Others

- Deployment Type

- Cloud

- On-Premises

- Enterprise Size

- SMEs

- Large Enterprises

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By Solution Insights

The spend analytics segment is estimated to witness significant growth during the forecast period.

The market is witnessing notable development, fueled by the growing demand for enhanced supplier performance management, payment automation, and business intelligence. Cloud-based solutions are increasingly adopted due to their scalability, flexibility, and cost-effectiveness, enabling companies to optimize tail spend and improve efficiency gains. Supplier relationship management is another crucial area of focus, with data integration and machine learning technologies playing a significant role in streamlining workflows and predicting future trends. Advanced analytics, such as data visualization, predictive analytics, and spend data analysis, are essential components of tail spend optimization. These technologies offer valuable insights into spending patterns, enabling companies to identify cost reduction opportunities, manage risks, and improve compliance.

Moreover, the integration of artificial intelligence and machine learning algorithms enhances the capabilities of spend analytics, enabling more accurate forecasting and demand management. E-procurement platforms and contract management solutions are also gaining popularity, offering automated procurement processes, contract negotiation, and inventory management. Green procurement and ethical sourcing are becoming increasingly important, with companies prioritizing sustainability and ethical business practices. In addition, real-time reporting and analytics enable companies to monitor performance and identify areas for improvement, while compliance management ensures adherence to regulatory requirements. Overall, the market is evolving rapidly, with a focus on value creation, process improvement, and cost reduction.

Companies are leveraging advanced analytics and cloud-based solutions to gain spend visibility, optimize their supply chain, and build stronger supplier relationships.

The Spend analytics segment was valued at USD 898.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the market for tail spend management solutions is experiencing significant growth due to the region's advanced procurement processes and the increasing emphasis on cost optimization and process efficiency. The adoption of digital technologies and automation is a major catalyst for this growth, as companies seek to streamline their operations and reduce costs through the use of cloud-based solutions. Tail spend management solutions enable organizations to automate procurement processes for low-value items, allowing procurement teams to focus on strategic initiatives. Additionally, the highly competitive business environment in North America is driving demand for these solutions, as companies strive to improve efficiency, manage risk, and reduce costs.

Supplier performance management, payment automation, business intelligence, data visualization, and e-procurement platforms are integral components of tail spend management solutions, offering value creation, process improvement, and spend visibility. Furthermore, these solutions facilitate ethical sourcing, compliance management, contract management, and supplier relationship management, among other benefits. Artificial intelligence, machine learning, and predictive analytics are also increasingly being integrated into tail spend management solutions, providing advanced capabilities for demand forecasting, inventory management, and category management. Overall, the North American market for tail spend management solutions is poised for continued growth, as companies recognize the value of these solutions in driving operational efficiency, reducing costs, and improving supplier relationships.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Tail Spend Management Solutions Industry?

- The market is primarily driven by an increasing focus on cost reduction. This trend, which is mandatory for many organizations to maintain competitiveness, is a key factor shaping market dynamics.

- Tail spend management solutions have become essential for businesses seeking to reduce costs and improve supplier performance. With numerous small transactions involving numerous suppliers, managing tail spend can be a complex and time-consuming process, often resulting in maverick spending and missed cost-saving opportunities. Cloud-based tail spend management solutions offer businesses advanced capabilities, including payment automation, business intelligence, data visualization, and e-procurement platforms. These features enable companies to gain better control and visibility over their tail spend, allowing them to identify cost-saving opportunities, consolidate suppliers, negotiate better pricing, and reduce maverick spend.

- By automating and streamlining the procurement process, businesses can free up resources and improve overall process efficiency. Additionally, some solutions offer green procurement capabilities, helping companies reduce their environmental impact while optimizing costs. Overall, tail spend management solutions provide significant value creation for businesses, making them an indispensable tool for cost reduction and process improvement.

What are the market trends shaping the Tail Spend Management Solutions Industry?

- The use of artificial intelligence (AI) and machine learning (ML) technologies is becoming increasingly prevalent in the market. This emerging trend signifies a significant shift towards automated and intelligent business solutions.

- The market is experiencing significant growth due to the increasing adoption of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML). These technologies enable automation of procurement processes, risk management, demand forecasting, and supply chain optimization. By automating routine tasks like purchase order processing and invoice management, AI and ML algorithms help reduce manual errors, save time, and lower costs. Additionally, predictive analytics using historical spending data allows for identifying trends and forecasting future demands, enabling proactive decision-making.

- Contract management, compliance management, supplier management, and procurement automation are other areas where AI and ML are making a significant impact. Furthermore, ethical sourcing and contract negotiation are being enhanced through these technologies, ensuring compliance and fair business practices. Overall, AI and ML are transforming tail spend management solutions by providing data-driven insights and optimizing processes for improved efficiency and cost savings.

What challenges does the Tail Spend Management Solutions Industry face during its growth?

- Data quality issues represent a significant challenge to the industry's growth, as inadequate data accuracy, completeness, and consistency can hinder business operations, decision-making, and customer trust.

- Tail spend management solutions offer significant efficiency gains for businesses by automating workflows, improving inventory management, and enabling strategic sourcing. These solutions leverage advanced technologies such as artificial intelligence, machine learning, and spend data analysis to identify cost-saving opportunities and optimize supplier relationships. However, the effectiveness of these solutions hinges on data quality. Data inconsistencies, arising from the lack of standardization among a large number of suppliers, can hinder accurate spending analysis. Incomplete or inaccurate data can lead to misinformed decisions and missed cost-saving opportunities.

- To address these challenges, businesses must prioritize data integration and ensure data accuracy through standardization and automation. By addressing data quality issues, companies can maximize the benefits of tail spend management solutions and achieve long-term cost savings.

Exclusive Customer Landscape

The tail spend management solutions market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tail spend management solutions market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, tail spend management solutions market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

SAP SE - This company specializes in optimizing organizational spend through tailored procurement solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- SAP SE

- Coupa Software Incorporated

- Oracle Corporation

- Jaggaer

- GEP Worldwide

- Zycus Inc.

- Proactis Holdings Plc

- Ivalua Inc.

- Corcentric LLC

- Basware Corporation

- Determine Inc. (Corcentric)

- BirchStreet Systems Inc.

- Vroozi Inc.

- Tradeshift Inc.

- Fairmarkit Inc.

- Bellwether Software Corporation

- Xeeva Inc.

- eBid Systems

- Scoutbee GmbH

- Simfoni Analytics Limited

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Tail Spend Management Solutions Market

- In March 2023, Icertis, a leading provider of Contract Intelligence (CI) and Contract Lifecycle Management (CLM) solutions, announced the launch of its Tail Spend Management (TSM) solution, Icertis Procurement 8.0. This new offering aims to automate and optimize the management of low-value, high-volume spend, addressing the unique challenges of tail spend (Reuters, 2023).

- In July 2024, SAP Ariba, a business unit of SAP SE, entered into a strategic partnership with JAGGAER, a leading independent spend management company. The collaboration aims to integrate their respective solutions, creating a comprehensive end-to-end spend management platform (Bloomberg, 2024).

- In November 2024, Basware, a leading provider of networked source-to-pay solutions, completed the acquisition of Zycus, a leading provider of spend management solutions. The acquisition is expected to strengthen Basware's position in the TSM market and expand its customer base (Wall Street Journal, 2024).

- In February 2025, Coupa Software, a business spend management company, announced the deployment of its TSM solution at a leading Fortune 500 company. The implementation is expected to automate and optimize the management of the company's long-tail spend, enabling significant cost savings and improved visibility (Company Press Release, 2025).

Research Analyst Overview

- In the dynamic world of procurement, tail spend management solutions have gained significant traction, enabling businesses to optimize inventory, evaluate suppliers, and leverage e-sourcing platforms for strategic sourcing. Procurement analytics plays a pivotal role in supplier segmentation, contract lifecycle management, and company rationalization, while supplier network onboarding and digital transformation are essential for agile and lean procurement strategies. Supplier evaluation and e-sourcing platforms facilitate effective supplier selection and enable real-time bidding through reverse auctions. Spend categories and classification are crucial for identifying maverick spend and implementing RFP/RFI processes. Supplier performance metrics, demand planning, and risk mitigation strategies are essential components of a robust strategic sourcing strategy.

- Integrated supply chain, cross-functional collaboration, and business process modeling further enhance supply chain resilience and just-in-time inventory management. Data governance and security are paramount in tail spend management, ensuring data accuracy, integrity, and protection. Shadow procurement, a growing concern, can be mitigated through effective change management and supplier network transparency. In the global procurement landscape, procurement teams must navigate spend hierarchy, supplier segmentation, and supplier onboarding while balancing the need for strategic procurement and supply chain disruption mitigation. Leveraging the latest technology and best practices, businesses can optimize their tail spend management strategies and unlock value from their supplier network.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Tail Spend Management Solutions Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 482.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.5 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Tail Spend Management Solutions Market Research and Growth Report?

- CAGR of the Tail Spend Management Solutions industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the tail spend management solutions market growth of industry companies

We can help! Our analysts can customize this tail spend management solutions market research report to meet your requirements.