Contract Life-Cycle Management (CLM) Software Market Size 2025-2029

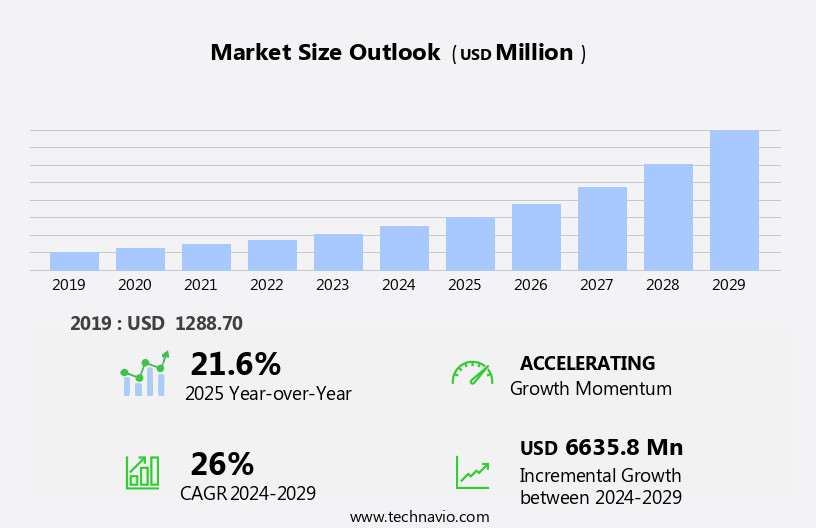

The contract life-cycle management (CLM) software market size is forecast to increase by USD 6.64 billion, at a CAGR of 26% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of technology in business operations and the emergence of analytics in contract management. Companies are recognizing the value of automating and optimizing their contract processes to enhance efficiency, reduce risk, and improve compliance. However, the market also faces challenges. The high implementation and maintenance costs associated with CLM software can be a barrier to entry for smaller organizations. Additionally, ensuring data security and privacy in contract management systems is a critical concern, particularly in industries subject to stringent regulatory requirements. These challenges necessitate careful consideration and strategic planning for companies seeking to capitalize on the opportunities presented by the CLM market.

- To remain competitive, organizations must evaluate pricing strategies, explore cost-effective implementation options, and invest in robust security measures. By addressing these challenges, businesses can effectively leverage CLM software to streamline their contract processes, gain valuable insights, and ultimately, drive business growth.

What will be the Size of the Contract Life-Cycle Management (CLM) Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, responding to the dynamic needs of businesses across various sectors. CLM solutions facilitate efficient and effective management of contractual agreements from authoring to execution, renewal, and termination. These systems integrate vital features such as salesforce integration, performance monitoring, data security, and AI-powered capabilities. AI-driven CLM solutions enhance contract review processes by identifying potential risks and opportunities through contract analytics. ML-powered systems further optimize workflows by automating repetitive tasks, enabling swift and accurate contract approvals. Seamless third-party integrations, including SAP, expand the reach and functionality of CLM systems. Centralized contract management ensures version control, legal hold, and obligation tracking, while customizable dashboards and reporting & analytics offer valuable insights into contract performance.

User roles and permissions, audit trails, and mobile access further enhance the usability and adaptability of CLM solutions. As the market continues to unfold, the importance of contract intelligence, risk management, and compliance management in driving business success becomes increasingly apparent. Integration APIs enable seamless data exchange between systems, ensuring a cohesive and efficient contract management ecosystem. Contract termination and renewal processes are streamlined, ensuring businesses maintain control over their contractual agreements. In this ever-changing landscape, CLM software plays a pivotal role in managing company relationships, ensuring regulatory compliance, and optimizing business operations. The continuous integration of advanced technologies and features underscores the market's commitment to meeting the evolving needs of businesses worldwide.

How is this Contract Life-Cycle Management (CLM) Software Industry segmented?

The contract life-cycle management (CLM) software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Software

- Services

- Deployment

- On-premises

- Cloud-based

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Component Insights

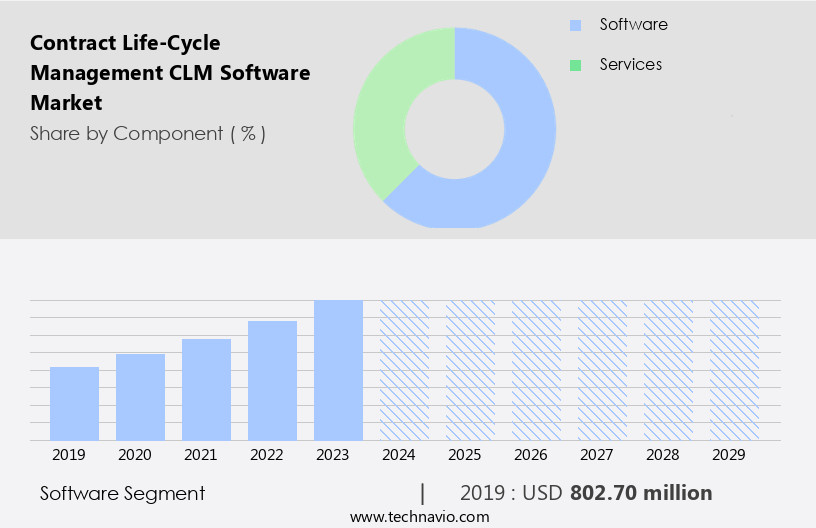

The software segment is estimated to witness significant growth during the forecast period.

Contract life-cycle management (CLM) software is a vital tool for organizations to effectively manage their business contracts. This software streamlines the process of creating, negotiating, renewing, and analyzing contracts, ensuring the intent of each agreement is fully realized. Advanced CLM solutions offer features such as self-service contract creation, auto-building contracts based on business rules, and bulk data upload. These capabilities accelerate time-to-revenue and significantly reduce legal operating expenses. Moreover, CLM software can maximize contract performance, enforce commercial terms, and minimize the risk of non-compliance. Integrations with third-party systems, such as SAP and Salesforce, enhance the functionality of CLM solutions.

Contract analytics and machine learning algorithms provide valuable insights, enabling better decision-making and improved contract intelligence. company management, negotiation management, risk management, compliance management, and spend management are essential components of CLM software. Features like version control, legal hold, contract automation, obligation tracking, mobile access, user roles & permissions, audit trails, customizable dashboards, reporting & analytics, and contract termination are crucial for efficient contract management. The market for CLM software is witnessing significant growth as companies recognize the benefits of centralized contract management. Integration APIs enable seamless data exchange between systems, ensuring a cohesive and efficient contract management process.

In conclusion, CLM software plays a pivotal role in managing the entire contract lifecycle, from authoring to execution, and beyond.

The Software segment was valued at USD 802.70 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

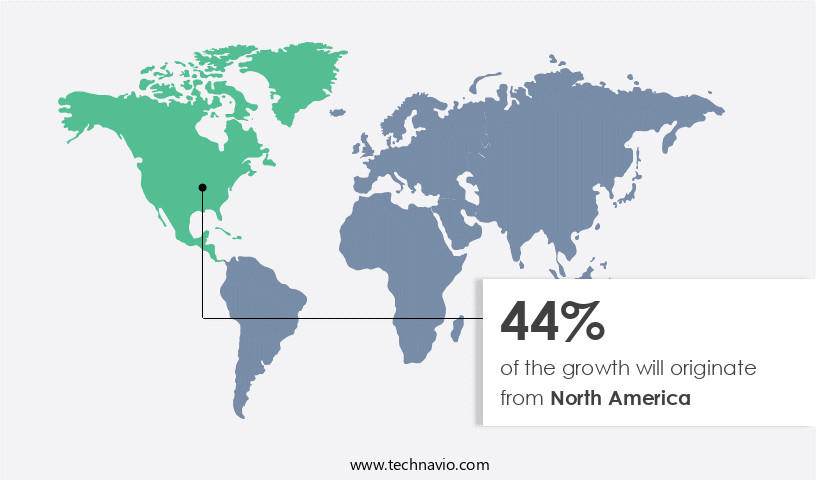

North America is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing regulatory requirements in various industries. The region, particularly the US and Canada, is witnessing a surge in adoption as businesses seek to ensure compliance adherence. The proliferation of digital technology across industries is a key driver of this trend, enabling more efficient and effective contract management. Prominent companies such as Corcentric, IBM, and Coupa, based in the US, are leading the market with their robust offerings. These companies cater to a large customer base in the US, leveraging the region's advanced IT infrastructure and heightened awareness of the benefits of CLM.

CLM software solutions offer various features, including company management, contract approvals, contract analytics, clause management, contract authoring, third-party integrations, negotiation management, contract execution, centralized contract management, spend management, compliance management, risk management, SAP integration, contract lifecycle management, version control, legal hold, contract automation, salesforce integration, performance monitoring, data security, AI-powered CLM, workflow automation, contract lifecycle stages, contract review, ML-powered CLM, integration APIs, contract intelligence, contract termination, obligation tracking, mobile access, user roles & permissions, audit trails, customizable dashboards, reporting & analytics, contract renewal, and contract repository. These solutions streamline the contract process, from authoring and negotiation to execution, renewal, and termination.

They enable organizations to manage contracts more efficiently, reducing the risk of non-compliance and improving operational efficiency. Additionally, they offer features like version control, legal hold, and audit trails, ensuring that organizations maintain a secure and compliant contract environment. The market is also witnessing the integration of advanced technologies like AI and ML, enabling more intelligent contract management and analysis. These technologies help organizations gain valuable insights from their contracts, improving decision-making and risk management. In conclusion, the CLM software market in North America is poised for continued growth, driven by the increasing need for compliance adherence and the proliferation of digital technology.

The market is dominated by US-based companies, offering a range of features and advanced technologies to cater to the evolving needs of businesses.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic business landscape, the market plays a pivotal role in streamlining and optimizing business operations. This market encompasses solutions designed to manage the entire contract lifecycle from creation and negotiation to execution, compliance, renewal, and termination. Key features of CLM software include automated workflows, electronic signatures, contract analytics, risk assessment, and reporting. Integration with other business systems, such as CRM and ERP, further enhances its value. Companies across industries leverage CLM software to mitigate risks, improve efficiency, and ensure regulatory compliance. With the increasing focus on digital transformation and remote work, the CLM software market is poised for significant growth. Solutions cater to various business sizes, offering scalability and flexibility.

What are the key market drivers leading to the rise in the adoption of Contract Life-Cycle Management (CLM) Software Industry?

- The pricing strategies adopted by companies significantly influence market dynamics.

- In the global market for Contract Life-Cycle Management (CLM) software, companies are prioritizing customer value and flexible pricing strategies. Companies are offering customized pricing models based on features and added benefits for customers. Economic and market factors, such as return on investment (ROI), availability of free models, and IT budget constraints, significantly influence customer decisions. Companies must cater to diverse customer pricing preferences and budgets to remain competitive.

- Key aspects of CLM software include company management, contract approvals, contract analytics, clause management, contract authoring, third-party integrations, negotiation management, and contract execution. These features enable organizations to streamline their contract processes, minimize risks, and enhance operational efficiency.

What are the market trends shaping the Contract Life-Cycle Management (CLM) Software Industry?

- Contract life-cycle management is experiencing a significant trend toward the integration of analytics. The emergence of analytics in this field is becoming increasingly mandatory for professional and effective contract management.

- Contract Life-Cycle Management (CLM) software is a vital solution for enterprises seeking to centralize and streamline their contract management processes. CLM software offers advanced capabilities in spend management, compliance, and risk management. By implementing CLM, businesses can gain valuable insights from built-in analytics, enabling them to make informed decisions based on historical data. This data includes contract cycle times, compliance statuses, and active contracts within the organization. Spend management is a crucial aspect of CLM, allowing businesses to monitor and control contract expenses. Compliance management ensures adherence to legal and regulatory requirements, reducing the risk of non-compliance penalties.

- Risk management features help businesses identify and mitigate potential risks associated with contracts, safeguarding the organization from potential liabilities. Moreover, CLM software can be integrated with other systems, such as SAP, for enhanced functionality. Version control and legal hold capabilities ensure that contract information remains secure and accessible for audits and litigation. Contract automation streamlines the contract creation process, reducing manual effort and errors. With these features, CLM software is an essential tool for businesses looking to optimize their contract processes and improve overall performance.

What challenges does the Contract Life-Cycle Management (CLM) Software Industry face during its growth?

- The high implementation and maintenance costs pose a significant challenge to the growth of the industry. This issue, which is mandatory for businesses to address, can significantly impact the profitability and sustainability of organizations operating within this sector.

- Contract Life-Cycle Management (CLM) software is an essential tool for businesses to manage and automate various stages of the contract process. The integration of CLM software with Salesforce is a significant trend, enabling seamless data exchange and improving overall business efficiency. Performance monitoring is another crucial aspect of CLM software, allowing organizations to identify bottlenecks and optimize contract processes. Data security is a major concern for businesses, and CLM software must ensure the confidentiality, integrity, and availability of contract data. AI-powered and ML-powered CLM solutions are gaining popularity due to their ability to automate contract review and analysis, reducing manual effort and errors.

- Workflow automation is another key feature, streamlining the contract process and improving turnaround time. Integration APIs enable seamless integration with other business applications, enhancing the functionality of CLM software. The implementation of CLM software requires careful planning, adequate funding, and cooperation at all managerial levels. Post-implementation, continuous upgradation is necessary to keep up with market trends and ensure the software remains effective. Overall, CLM software is a valuable investment for businesses looking to streamline their contract processes and improve operational efficiency.

Exclusive Customer Landscape

The contract life-cycle management (CLM) software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the contract life-cycle management (CLM) software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, contract life-cycle management (CLM) software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Contract Logix Llc - This company specializes in contract life cycle management software, enabling secure and convenient access and management of contracts from any location, using various devices.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Contract Logix Llc

- Corcentric Inc.

- Coupa Software Inc.

- DocuSign Inc.

- ESM Solutions Corp.

- Great Minds Software Inc.

- Icertis Inc.

- Infor Inc.

- International Business Machines Corp.

- Ivalua Inc.

- JAGGAER LLC

- Newgen Software Technologies Ltd.

- Optimus BT Inc.

- Oracle Corp.

- Robobai Pty Ltd.

- SAP SE

- Scanmarket AS

- Thoma Bravo LP

- Wolters Kluwer NV

- Zycus Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Contract Life-Cycle Management (CLM) Software Market

- In January 2024, DocuSign, a leading e-signature solutions provider, announced the launch of Agreements Cloud with CLM capabilities, expanding its product portfolio to offer a more comprehensive contract management solution (DocuSign Press Release). This integration aimed to streamline the entire contract process from creation to execution, approval, and renewal.

- In March 2024, Icertis, a leading CLM software provider, entered into a strategic partnership with IBM to integrate Icertis Contract Management (ICM) into IBM's Cloud Pak for Enterprise Contracts. This collaboration aimed to offer a more robust and scalable contract management solution for large enterprises (IBM Press Release).

- In April 2025, Coupa Software, a business spend management company, announced the acquisition of ContractWorks, a mid-market CLM software provider. This acquisition aimed to strengthen Coupa's offerings in the mid-market segment and expand its presence in the CLM software market (Coupa Software Press Release).

- In May 2025, Salesforce, a leading CRM provider, announced the acquisition of Kustomer, a customer service and engagement platform. Although not directly related to CLM software, this acquisition is significant as Salesforce plans to integrate Kustomer's capabilities into its Salesforce Contracts product, enhancing its CLM offerings and providing a more holistic solution for businesses (Salesforce Press Release).

Research Analyst Overview

- In the dynamic Contract Lifecycle Management (CLM) software market, hybrid solutions are gaining traction, integrating the benefits of both cloud-based and on-premise deployments. Contract templates are being enhanced with advanced features, such as predictive analytics and machine learning (ML), to streamline the creation process. Alerting & notifications, powered by ML, enable real-time monitoring of contract statuses and deadlines. Blockchain technology and data encryption ensure data security and privacy, while audit logs and access control maintain regulatory compliance. Contract data extraction and spend analysis provide valuable insights for legal operations, leading to increased contract lifecycle efficiency. Collaboration tools and automated routing facilitate seamless communication and workflow management among stakeholders.

- Risk assessment and data governance ensure the accuracy and consistency of contract data. User adoption rates are boosted by intuitive interfaces and easy integration with business process management systems. Cloud-based CLM solutions offer scalability and flexibility, while on-premise deployments provide greater control and customization. Regardless of the deployment model, data privacy remains a top priority, with encryption, access control, and data governance measures in place to protect sensitive information.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Contract Life-Cycle Management (CLM) Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 26% |

|

Market growth 2025-2029 |

USD 6635.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

21.6 |

|

Key countries |

US, Canada, China, Germany, UK, France, Italy, The Netherlands, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Contract Life-Cycle Management (CLM) Software Market Research and Growth Report?

- CAGR of the Contract Life-Cycle Management (CLM) Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the contract life-cycle management (CLM) software market growth of industry companies

We can help! Our analysts can customize this contract life-cycle management (CLM) software market research report to meet your requirements.