Tanker Aircraft Market Size 2024-2028

The tanker aircraft market size is forecast to increase by USD 31.4 billion at a CAGR of 7.09% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increase in combat aircraft procurement programs worldwide is driving the demand for tanker aircraft, as these aircraft play a crucial role in refueling military jets mid-air during combat missions. Additionally, the rising demand for larger military aircraft fleets to enhance operational capabilities is another growth factor. However, the high installation and maintenance costs associated with tanker aircraft pose a challenge to market growth. Despite these challenges, the market is expected to continue expanding due to the essential role tanker aircraft play in military aviation.

What will be the Size of the Tanker Aircraft Market During the Forecast Period?

- The market is a critical segment of the global defense sector, driven by ongoing military expenditure and modernization plans. Old tanker aircraft are being replaced with new multimission tanker transports to enhance aerial refueling capabilities and extend the operational range of combat aircraft, contributing to air superiority and air dominance during allied operations. Defense expenditure on air-to-air refueling systems is expected to increase, with several countries investing in advanced technologies such as unmanned systems. The Eurofighter Typhoon and Israel Aerospace Industries' Heron TP are among the modern tanker aircraft models that offer enhanced avionics, mission capabilities, and fuel efficiency. Delivery timelines for these aircraft are crucial, as they support various missions, including cargo transportation, medical evacuation, and humanitarian efforts.

- The market is poised for growth, with a focus on advanced aerial refueling systems and versatile aircraft designs that cater to diverse mission requirements. Operation Noble Defender and other multinational exercises underscore the importance of reliable tanker aircraft in ensuring air force readiness and effectiveness.

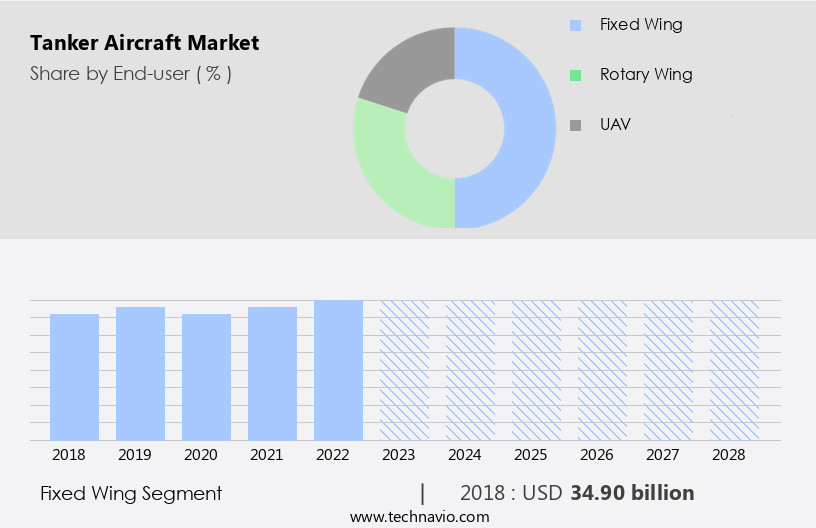

How is this Tanker Aircraft Industry segmented and which is the largest segment?

The tanker aircraft industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Fixed wing

- Rotary wing

- UAV

- Geography

- North America

- US

- Europe

- Germany

- France

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By End-user Insights

- The fixed wing segment is estimated to witness significant growth during the forecast period.

The fixed-wing segment dominates The market, accounting for a significant market share in 2023. Fixed-wing aircraft, which utilize wings for lift generation, offer superior flight efficiency and longer operational ranges compared to rotary-wing counterparts. This segment's popularity stems from its ability to support various applications, including air-to-air refueling, cargo transportation, medical evacuation, and humanitarian missions. Military modernization plans, defense expenditure, and geopolitical dynamics are key drivers for the market's growth. Aircraft platforms, such as the Eurofighter Typhoon and Israel Aerospace Industries' multimission tanker transports, are integral to military capabilities, enabling air dominance, air superiority, and overseas deployments. Incorporating advanced avionics, aerial refueling systems, and communication capabilities, these tanker aircraft support coalition operations and joint strike fighter programs.

Cost analyses, investment climates, and environmental considerations also influence market trends, with factors like energy demand, offshore exploration, and economic downturns shaping the market landscape.

Get a glance at the Tanker Aircraft Industry report of share of various segments Request Free Sample

The Fixed wing segment was valued at USD 34.90 billion in 2018 and showed a gradual increase during the forecast period.

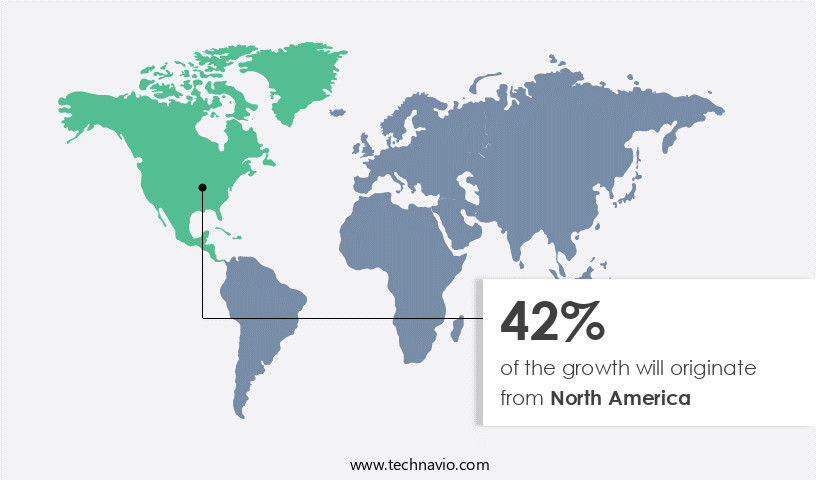

Regional Analysis

- North America is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is set to dominate the tanker aircraft industry due to the US's substantial military expenditure and modernization plans. The US Air Force intends to replace a significant portion of its aging KC-135 and KC-10 aerial refueling tanker fleet. The defense sector's focus on air-to-air refueling capabilities for air superiority, combat aircraft, bombers, and fighter jets is driving the demand for tanker aircraft. Key players In the market include Lockheed Martin Corp., Boeing Co., PJSC United Aircraft Corp., and Bombardier Inc., among others. Military capabilities such as mission capabilities, avionics, aerial refueling systems, communication capabilities, and operational range are crucial factors influencing the market.

Additionally, geopolitical dynamics, cost analyses, and energy demand are other significant factors impacting the market's growth trajectory.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Tanker Aircraft Industry?

Increase in combat aircraft procurement is the key driver of the market.

- Countries worldwide are prioritizing military modernization plans to enhance their defense capabilities, driven by geopolitical tensions, territorial disputes, and the need to replace aging military aircraft fleets with more advanced, multimission tanker transport and combat aircraft. In January 2021, India approved the procurement of 83 LCA-Tejas Mk-1A fighter jets and 10 trainer aircraft, while Greece purchased 18 Dassault Rafale jets from France for USD3.04 billion. In February 2021, Australia inducted F-35A aircraft into its maintenance depot as part of the Joint Strike Fighter Program, with twelve countries having committed to acquiring the fighter jet. Military expenditure and defense sector investment climates remain strong, with a focus on air dominance, aerial refueling, and cargo transportation capabilities.

- Modern tanker aircraft are essential for extended overseas deployments, air-to-air refueling, and mission capabilities such as medical evacuation, humanitarian missions, and fuel efficiency. Advanced avionics, communication capabilities, and aerial refueling systems are crucial for coalition operations and strategic alliances. The market is witnessing significant growth due to increasing military capabilities, fueled by military modernization programs and the demand for refueling capabilities in various military aircraft platforms. Factors influencing market dynamics include economic downturns, security risks, and political instability, as well as the exploration of offshore gas fields, hydrocarbon reserves, and environmental activism. The market's cost analyses are influenced by high installation and maintenance costs, the development of the Multipoint Refueling System, and the increasing demand for air superiority and combat aircraft procurement.

What are the market trends shaping the Tanker Aircraft Industry?

Rising demand for military aircraft fleet is the upcoming market trend.

- In the global military landscape, tanker aircraft continue to play a pivotal role in enhancing the operational capabilities of defense forces. With military expenditure and modernization plans on the rise, there is a growing demand for tanker aircraft to extend the range and endurance of military aircraft, particularly In the context of air-to-air refueling. This method of in-flight refueling is crucial for strategic missions and aerial conflicts, enabling air dominance and facilitating overseas deployments. Several countries are expanding their tanker fleets to bolster their air forces, as evidenced by the Indian Air Force's recent lease of six mid-air refueling aircraft from France.

- The benefits of reduced pilot error and fatigue at receiving aircraft further fuel the market's growth. Modernization programs In the defense sector are driving investment in advanced tanker aircraft, such as multimission transport tankers and unmanned aerial refueling systems. These new platforms offer enhanced avionics, communication capabilities, and mission flexibility, catering to a diverse range of applications, including cargo transportation, medical evacuation, and humanitarian missions. Geopolitical dynamics, energy demand, and economic factors are influencing the market. Cost analyses, investment climates, and strategic alliances are key considerations for countries looking to procure tanker aircraft. Offshore exploration, offshore gas fields, environmental activism, offshore wind energy, and maritime boundary disputes are among the geopolitical factors shaping the market.

- The market is expected to experience significant growth due to the increasing demand for refueling capabilities from fighter jets, bombers, and other military aircraft platforms. Fuel efficiency, operational range, and mission capabilities are essential factors influencing the selection of tanker aircraft. High installation costs and maintenance costs are challenges that market participants must address to remain competitive. In conclusion, the market is poised for growth due to the expanding role of air-to-air refueling in military capabilities and the modernization of defense forces worldwide. The market's dynamics are influenced by various factors, including geopolitical dynamics, energy demand, economic factors, and technological advancements.

What challenges does the Tanker Aircraft Industry face during its growth?

High installation and maintenance cost is a key challenge affecting the industry growth.

- The market is a critical segment of the military aviation sector, driven by defense expenditure and modernization plans. Old tanker aircraft, with their high installation and maintenance costs, pose significant challenges to operational efficiency and cost-effectiveness. For instance, the aging refueling aircraft require increased spending on personnel, fuel, and depot maintenance, leading to higher costs per flight hour. The Air Force alone is projected to spend around USD2.5 billion annually through 2001 on tanker aircraft operations, support, and modernization. This includes approximately USD8.2 billion for KC-135 direct operations and support during fiscal year 2001 due to the increased maintenance requirements of older aircraft.

- Furthermore, the KC-46 aerial refueling tanker modernization program, valued at approximately USD44 billion, underscores the substantial financial investment required for the development and maintenance of modern tanker aircraft. Military capabilities, such as air-to-air refueling, are essential for air superiority, combat aircraft, and bombers, enabling extended operational range and mission capabilities. These capabilities are crucial for overseas deployments, coalition operations, cargo transportation, medical evacuation, and humanitarian missions. Advanced avionics, communication capabilities, and aerial refueling systems are key features of modern tanker aircraft, enhancing operational capabilities and mission flexibility. Geopolitical dynamics, energy demand, investment climates, and environmental activism influence the market.

- Cost analyses, offshore exploration, offshore gas fields, and subsea infrastructure are among the factors shaping the market landscape. Economic downturns, security risks, and political instability also impact military capabilities and combat aircraft procurement. Strategic alliances and hydrocarbon reserves further influence the market, with the market expected to grow steadily In the coming years.

Exclusive Customer Landscape

The tanker aircraft market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tanker aircraft market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, tanker aircraft market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Airbus SE - The company specializes in providing tanker aircraft solutions, including the Airbus A330 Multi-Role Tanker Transport (MRTT) model. This aircraft is renowned for its versatility and capability to refuel various military and civilian aircraft in flight, extending mission range and operational endurance. The A330 MRTT is equipped with advanced systems for air-to-air refueling, as well as the ability to transport cargo and passengers. This aircraft is a valuable asset for military and civil applications, offering enhanced operational flexibility and efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- BAE Systems Plc

- Bandak Aviation Inc.

- Cobham Ltd.

- Eaton Corp. Plc

- Elbit Systems Ltd.

- Israel Aerospace Industries Ltd.

- Lockheed Martin Corp.

- Marshall of Cambridge Holdings Ltd.

- Northrop Grumman Corp.

- Protankgrup

- Rolls Royce Holdings Plc

- RTX Corp.

- Safran SA

- Serco Group Plc

- Thales Group

- The Boeing Co.

- United Aircraft Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a vital segment of the global aerospace industry, supplying air-to-air refueling capabilities to military forces worldwide. These aircraft play a pivotal role in extending the operational range and endurance of combat aircraft, enabling them to perform missions more effectively and efficiently. Tanker aircraft are integral to military operations, particularly in air dominance, air superiority, and coalition engagements. Their capabilities extend beyond refueling, with some platforms offering multimission functions, such as cargo transportation, medical evacuation, and humanitarian missions. The demand for tanker aircraft is driven by several factors. Military modernization programs, geopolitical dynamics, and operational requirements are among the primary influences shaping the market.

Fuel efficiency and operational range are crucial considerations for military forces, necessitating the acquisition of advanced tanker aircraft to maintain a competitive edge. The market is characterized by continuous innovation, with avionics, communication capabilities, and aerial refueling systems undergoing significant advancements. Multipoint refueling systems, for instance, enable simultaneous refueling of multiple aircraft, enhancing operational efficiency. Military capabilities, such as air force operations, offshore exploration, and overseas deployments, necessitate the use of tanker aircraft. In the context of energy demand, offshore gas fields and offshore wind energy projects require the support of tanker aircraft for logistical and operational purposes.

The market faces various challenges, including high installation costs, maintenance costs, and economic downturns. Security risks and political instability can also impact the market, influencing procurement decisions and investment climates. Geopolitical tensions and maritime boundary disputes can create demand for tanker aircraft, as nations seek to secure their hydrocarbon reserves and protect their subsea infrastructure. Strategic alliances and foreign military sales are common strategies employed by countries to acquire tanker aircraft and expand their military capabilities. In conclusion, the market plays a crucial role in supporting military operations and enabling strategic objectives. The ongoing evolution of tanker aircraft technology, coupled with the dynamic geopolitical landscape, presents both opportunities and challenges for market participants.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.09% |

|

Market growth 2024-2028 |

USD 31.4 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

6.5 |

|

Key countries |

US, Germany, China, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Tanker Aircraft Market Research and Growth Report?

- CAGR of the Tanker Aircraft industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the tanker aircraft market growth of industry companies

We can help! Our analysts can customize this tanker aircraft market research report to meet your requirements.