Teeth Whitening Market Size 2025-2029

The teeth whitening market size is forecast to increase by USD 1.27 billion at a CAGR of 5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing awareness among consumers regarding the importance of dental aesthetics and oral hygiene. This trend is further fueled by the influence of social media, where individuals seek to enhance their appearance and project confidence. However, the high cost of teeth whitening procedures poses a challenge for market expansion, particularly in underserved segments. To capitalize on this opportunity, companies can explore innovative pricing models and partnerships with dental clinics and insurance providers. Additionally, the development of over-the-counter and at-home teeth whitening solutions can cater to budget-conscious consumers. Strategic collaborations and product differentiation through advanced technology and customized solutions can further distinguish market players and secure their competitive edge.

- Overall, the market presents a promising landscape for growth, with opportunities in both established and emerging markets. Companies must navigate the cost challenge effectively and leverage consumer trends to capture market share and meet the evolving demands of their customer base.

What will be the Size of the Teeth Whitening Market during the forecast period?

- Oral aesthetics have gained significant importance in self-care routines, particularly among elderly people. Cosmetic dental procedures, including teeth whitening, have seen a notable increase in demand due to the desire for self-improvement and increased health consciousness. Dental clinics report a rise in requests for teeth whitening solutions, driven by media exposure and medical tourism. Nurses, healthcare staff, and paramedics also prioritize dental care, recognizing its connection to overall health. Preventive dental care, such as routine check-ups and cleanings, remain essential, but teeth whitening technologies have become increasingly popular. Motivational factors for teeth whitening extend beyond aesthetics, as tooth ailments and tooth discoloration can impact confidence and self-esteem.

- Dental aesthetics are becoming more accessible, with various teeth whitening technologies available, including in-office treatments and at-home kits. Healthcare professionals recommend teeth whitening as part of a comprehensive oral care regimen. Self-improvement and social distancing measures have further fueled the demand for teeth whitening solutions. As people continue to prioritize their health and appearance, the market for teeth whitening technologies is expected to grow. Technological advancements in teeth whitening, such as RACounter, offer more efficient and effective solutions, catering to the evolving needs of consumers. The trend towards personalized dental care and increased accessibility will continue to shape the market dynamics in the coming years.

How is this Teeth Whitening Industry segmented?

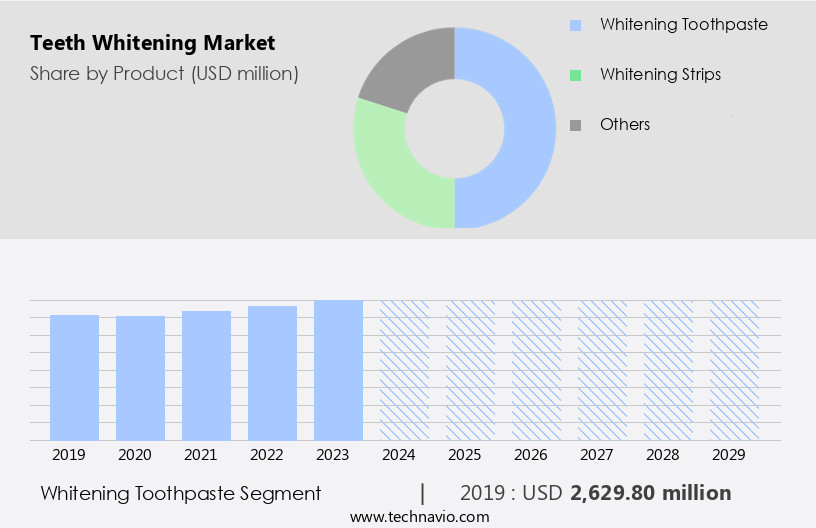

The teeth whitening industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Whitening toothpaste

- Whitening strips

- Others

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Spain

- UK

- Middle East and Africa

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The whitening toothpaste segment is estimated to witness significant growth during the forecast period.

Whitening toothpaste has gained significant attention in the market as an accessible solution for individuals seeking a brighter, whiter smile. Procter and Gamble Co.'s Oral B subsidiary is one of the many companies catering to this demand, offering toothpaste with active ingredients designed to remove surface stains and enhance tooth whitening. The product is intended for daily use as part of a regular oral care routine, providing a convenient option for consumers. Extensive research and development efforts have been dedicated to ensuring the product's efficacy. Young people and elderly individuals, as well as those in middle-aged groups, are increasingly interested in cosmetic dental procedures, including teeth whitening.

Dentists and cosmetic dentists offer professional whitening techniques, but home-based dental aesthetics, such as whitening gels and strips, have become popular due to their cost-effectiveness and ease of use. Digital content and celebrity endorsements have played a role in increasing awareness and demand for these products. Whitening toothpaste is just one aspect of the broader the market, which includes dental tourism destinations, dental films, and teeth whitening solutions. Healthcare staff, online platforms, and LED whitening devices offer quality care and therapeutic benefits. Racounter, a dental care brand, provides aesthetic dental treatments that incorporate whitening effect into their product line.

The market for teeth whitening products is driven by motivational factors, such as self-improvement and social media exposure. Patients often seek quick results, leading to an increased interest in over-the-counter whitening gels, pens, and other solutions. The market caters to various consumer preferences, including natural ingredients, such as coconut oil, and advanced dental facilities offering tooth color correction through semantics like activated charcoal. Dental insurance and eCommerce sales contribute to the lower treatment costs, making teeth whitening more accessible to a global audience. Preventive dental care and self-care routines, such as regular brushing and flossing, are essential components of maintaining oral health and achieving a brighter smile.

Sustainability and chemical reactions are also factors influencing the development of teeth whitening technologies. In summary, the market is a dynamic and evolving industry that caters to the growing desire for a brighter, whiter smile. From whitening toothpaste and gels to professional dental services and advanced technologies, various options are available to meet the diverse needs and preferences of consumers.

Get a glance at the market report of share of various segments Request Free Sample

The Whitening toothpaste segment was valued at USD 2.63 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific (APAC) is experiencing rapid expansion, with India and China leading the charge. The increasing urban population, rising disposable income, evolving tastes and preferences, and growing awareness of oral care products are significant factors fueling market growth. Innovative oral beauty solutions, such as whitening toothpaste, gels, and trays, are gaining popularity, contributing to substantial revenue generation. Additionally, the vast population in APAC provides a significant market opportunity for retailers. Regulatory barriers, which can restrict or control product manufacturing and sale, are less stringent in APAC compared to other regions, further boosting market growth.

The adoption of advanced dental facilities, tooth color correction technologies, and self-care routines are also driving market trends. The market's future looks promising, with increasing interest in affordable tightening solutions, natural ingredients, and easy availability of teeth whitening products on online platforms. The integration of telemedicine and social media in dental care is also expected to impact market dynamics. Despite the side effects associated with some teeth whitening methods, the desire for brighter teeth and improved aesthetics continues to motivate consumers. Dentists, cosmetic dentists, and paramedics offer professional whitening services, while over-the-counter products and home-based dental aesthetics cater to those seeking cost-effective solutions.

The market's growth is further influenced by celebrity endorsements, media exposure, and the rising awareness of oral aesthetics. The market's future looks bright, with a global audience seeking quality care, therapeutic benefits, and sustainable teeth whitening solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Teeth Whitening Industry?

- Growing awareness among consumers about importance of dental aesthetics and oral hygiene is the key driver of the market.

- The market has experienced notable expansion due to the increasing consumer focus on dental aesthetics and oral hygiene. This growing consciousness towards oral health and its impact on overall appearance has led to a heightened demand for teeth whitening solutions. Social media and celebrity culture have significantly influenced this trend, as people are frequently exposed to images of influencers and celebrities displaying bright, white smiles.

- Market growth is further fueled by advancements in technology, providing consumers with a variety of options, including over-the-counter products and professional treatments. The market's continuous expansion is expected to persist as consumers prioritize maintaining a radiant, confident smile.

What are the market trends shaping the Teeth Whitening Industry?

- Increasing influence of social media is the upcoming market trend.

- The market has experienced notable growth due to the increasing influence of social media. With approximately 4.48 billion active social media users globally, platforms such as Instagram, Facebook, and YouTube have emerged as effective marketing tools for promoting teeth whitening products and services. Social media has significantly increased consumer awareness about various teeth whitening options, surpassing the reach of traditional advertising methods like television commercials and print advertisements.

- Consumers now have instant access to a wealth of information and genuine testimonials from peers, enabling informed decisions regarding teeth whitening solutions.

What challenges does the Teeth Whitening Industry face during its growth?

- High cost of teeth whitening procedure is a key challenge affecting the industry growth.

- The market features significant investment in advanced technology and equipment for professional procedures, contributing to high costs. Dental clinics utilize state-of-the-art whitening machines and materials, such as laser devices and professional-grade bleaching agents, which are expensive to acquire and maintain. In-office teeth whitening treatments often incorporate laser technology to accelerate the bleaching process, resulting in faster and more effective results, further increasing the cost.

- These factors underscore the importance of a well-informed decision-making process for individuals considering teeth whitening treatments. Understanding the market dynamics and associated costs can help potential clients make an informed choice between professional and at-home options.

Exclusive Customer Landscape

The teeth whitening market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the teeth whitening market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, teeth whitening market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aspiro Natural - The company introduces a range of portable teeth whitening solutions, including the innovative Beaming White Teeth Whitening Pen. This pen offers users a convenient and effective way to enhance their smile's brightness on-the-go. With a sleek design and easy-to-use application process, this product caters to those seeking a quick and discreet teeth whitening experience. The pen's advanced formula ensures noticeable results, making it an ideal choice for individuals with busy schedules or those who value the convenience of a compact whitening solution.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aspiro Natural

- AuraGlow

- Beaming White LLC

- BMS Dental srl

- CCA Industries Inc.

- Church and Dwight Co. Inc.

- Colgate Palmolive Co.

- Creightons PLC

- DaVinci LLC

- GLO Science

- GoSmile LLC

- GSK Plc

- Johnson and Johnson Inc.

- NuYu Teeth Whitening LLC

- Oralgen

- Pearly Whites

- ProWhiteSmile

- Supersmile

- The Procter and Gamble Co.

- Ultradent Products Inc.

- Unilever PLC

- WSD Labs USA Inc

- Zhengzhou Huaer Electro Optics Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to experience significant growth as a result of various factors driving demand among diverse demographics. Premium brands have capitalized on the desire for brighter teeth, particularly among young people, by offering toothpaste and other whitening products that cater to this desire. Tooth ailments, such as discoloration of teeth, also contribute to the increased demand for teeth whitening solutions. Dentists and cosmetic dental professionals have embraced dentofacial aesthetics, incorporating professional whitening techniques into their practices. Whitening strips and gels have become popular home-based dental aesthetics, providing cost-effective alternatives to professional services. The third quarter of the year often sees a surge in demand for these products as people prepare for social events and seek self-improvement.

Media exposure and celebrity endorsements have played a significant role in raising awareness of teeth whitening solutions. Digital content, including articles and social media, have made it easier for a global audience to access information and purchase products online. However, side effects and potential risks associated with some whitening technologies have led to increased scrutiny and calls for greater regulation. Older-aged groups have also shown an interest in cosmetic dental procedures, including teeth whitening, as part of their overall healthcare and wellness routines. Paramedics and nurses have recognized the therapeutic benefits of these treatments and have begun offering them as part of their services.

The rise of telemedicine and ecommerce sales has made teeth whitening solutions more easily accessible, even in rural areas. LED whitening devices and hydrogen peroxide-based gels have become popular choices due to their quick results and ease of use. However, the market is becoming increasingly competitive, with consolidated companies and over-the-counter products offering affordable alternatives. Natural ingredients, such as activated charcoal and baking soda, have gained popularity among consumers seeking sustainable and cost-effective solutions. Preventive dental care and self-care routines have become essential components of modern society's health consciousness, further fueling the demand for teeth whitening products. The market for teeth whitening solutions continues to evolve, with new technologies and treatments emerging to meet the diverse needs of consumers.

Dental clinics, pharmacies, and retail stores offer a range of options, from routine dental procedures to advanced dental facilities. The future of teeth whitening lies in continued innovation, ensuring quality care, and addressing the unique needs of various demographics.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5% |

|

Market growth 2025-2029 |

USD 1266.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

US, India, China, Germany, Japan, Canada, UK, France, Brazil, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Teeth Whitening Market Research and Growth Report?

- CAGR of the Teeth Whitening industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the teeth whitening market growth of industry companies

We can help! Our analysts can customize this teeth whitening market research report to meet your requirements.