Oral Care Market Size 2025-2029

The oral care market size is forecast to increase by USD 12.31 billion at a CAGR of 4.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of technology in oral care products. Advanced technologies such as artificial intelligence, nanotechnology, and biotechnology are revolutionizing the industry, leading to innovative solutions for oral hygiene and disease prevention. A key trend in the market is the high demand for mouthwash and teeth-whitening products, as consumers prioritize maintaining good oral health and aesthetics. However, the market faces challenges from stringent regulations on oral care products.

- To capitalize on market opportunities and navigate challenges effectively, companies must stay informed of emerging technologies and regulatory requirements, and adapt their strategies accordingly. By focusing on innovation, quality, and regulatory compliance, oral care companies can differentiate themselves and meet the evolving needs of consumers. Compliance with these regulations requires significant investment in research and development, production, and marketing, which can increase costs for manufacturers. Biodegradable oral care products , bamboo brushes and dental floss made from natural materials align with consumers' eco-conscious preferences.

What will be the Size of the Oral Care Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market encompasses a diverse range of products and services, from dental X-rays and metallic braces to modern innovations like digital radiography and remote dental care. Dental materials science and polymer science underpin the development of advanced dental solutions, such as ceramic braces and 3D printing. Patient compliance is a key market driver, leading to the creation of dental apps, therapeutic mouthwashes, and saliva substitutes. Oral health education is crucial, with pediatric dentistry, oral surgery, and orthodontic treatments playing essential roles.

- Treatment adherence is facilitated through the use of mouth guards, night guards, and tongue scrapers. Herbal mouthwashes and teeth bleaching cater to cosmetic concerns, while sports guards and sleep apnea treatments address specific health needs. Overall, the market is characterized by continuous innovation and a focus on improving patient care and experience. Preventive care is prioritized through the use of interdental cleaning devices, water flossers, and antiseptic mouthwashes. Oral pathology and forensic dentistry offer diagnostic and investigative services, while oral surgery and restorative dentistry address more complex dental issues.

How is this Oral Care Industry segmented?

The oral care industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Application

- Home

- Dentistry

- Product

- Toothpaste

- Toothbrush

- Mouthwash

- Denture products

- Dental accessories

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

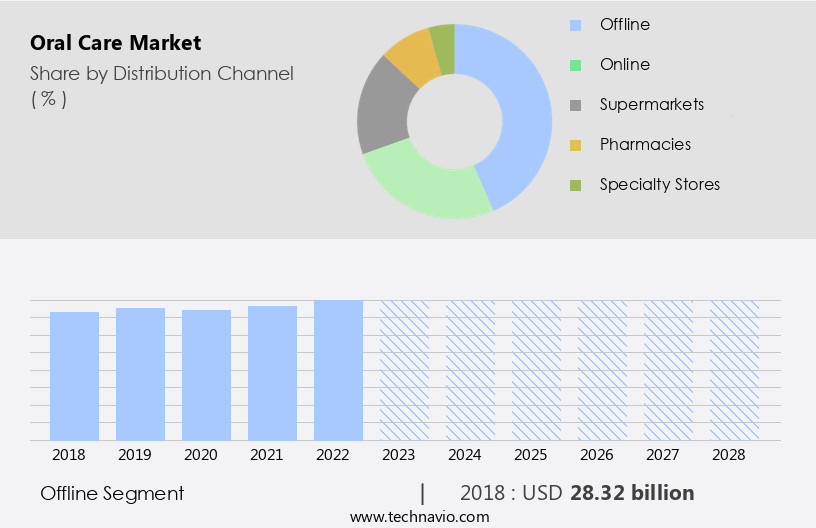

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The market encompasses a range of products and services, from preventative measures like toothbrushes, dental floss, and mouthwash, to more specialized treatments such as root planing, dental sealants, and cosmetic dentistry. Periodontal disease and gum disease are significant concerns, leading to innovations in interdental brushes and sensitive toothpastes. Children's toothbrushes and dental insurance cater to specific demographics. Wisdom teeth and impacted teeth necessitate procedures like extraction and orthodontics. Enamel erosion and mouth ulcers are common oral health issues addressed through calcium phosphate supplements and essential oils. Dental fillings, dental implants, and complete and partial dentures are essential restorative solutions.

Product innovation continues to drive the market, with advancements in whitening toothpastes, electric toothbrushes, and clinical trials for new treatments. Distribution channels include both offline (hypermarkets, supermarkets, etc.) and online (subscription services, e-commerce platforms). Dental hygiene remains a priority, with the ADA seal of acceptance ensuring product effectiveness. Oral cancer screenings are crucial, and professional cleanings are essential for maintaining optimal oral health. Dry mouth, caused by various factors, can lead to cavities and gum disease, necessitating saliva substitutes and other treatments. Sodium lauryl sulfate and BPA-free options are popular in oral care products due to consumer preferences.

Home cleaning solutions and oral hygiene practices go hand in hand, with the importance of maintaining a healthy balance between the two for overall health and well-being. The market's evolving trends reflect a focus on natural ingredients and catering to diverse consumer needs.

The Offline segment was valued at USD 29.16 billion in 2019 and showed a gradual increase during the forecast period.

The Oral Care Market is expanding rapidly, driven by increased awareness of dental hygiene and innovations in treatment technologies. Products like dental floss picks and oral irrigators are gaining popularity for their effectiveness in daily interdental cleaning. Orthodontic advancements such as lingual braces offer discreet alignment solutions, appealing to adults and teens alike. For patients with dry mouth conditions, artificial saliva provides critical relief and protection. Preventive solutions, including fluoride varnishes and fluoride treatments, continue to play a vital role in strengthening enamel and preventing decay. Digital solutions like CAD/CAM (computer-aided design/computer-aided manufacturing) are revolutionizing restorative dentistry. Meanwhile, community outreach programs are vital in promoting oral health awareness and access to underserved populations, reinforcing preventive care at the grassroots level.

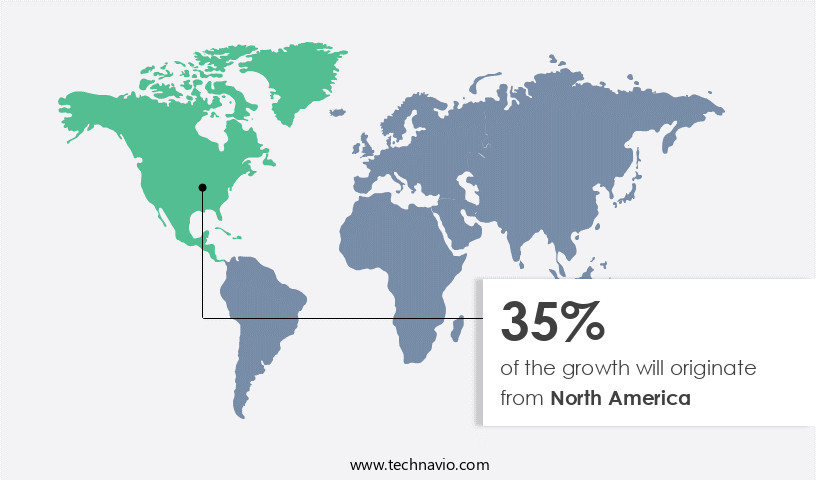

Regional Analysis

Europe is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The US market is experiencing significant growth due to the increasing adoption of advanced oral care products and the rising number of oral care procedures. The prevalence of dental issues, including periodontal disease, enamel erosion, gum disease, partial dentures, and complete dentures, is fueling market expansion. The aging population, a key demographic for dental concerns, is also contributing to market growth. Innovations in oral care, such as whitening toothpastes, dental floss, and sensitive toothpastes, are gaining popularity. Root planing, dental fillings, and dental sealants are commonly used preventive and restorative dental procedures. Cosmetic dentistry, including dental implants and veneers, is also on the rise.

The market is further driven by the increasing number of oral care professionals and dental facilities, which improves access to quality dental care services. Dental insurance coverage for dental services in countries like Austria, Poland, and Spain is also boosting market growth. Oral health concerns, such as canker sores, mouth ulcers, and dry mouth, are also leading to the demand for oral care products. Essential oils and natural ingredients are increasingly being used in oral care products due to their health benefits. The distribution channels for oral care products are expanding, with subscription services and online sales becoming more popular. Advanced technologies such as artificial intelligence, sensors, and nanotechnology are revolutionizing oral hygiene solutions, offering personalized and effective options to consumers.

Clinical trials and research are ongoing to develop new oral care products and improve existing ones. Oral cancer and impacted teeth are significant health concerns that are being addressed through advancements in oral care technology. Electric toothbrushes and manual toothbrushes continue to be popular choices for maintaining oral hygiene. The supply chain for oral care products is well-established, with manufacturers, distributors, and retailers playing key roles. Sodium lauryl sulfate and BPA-free options are becoming increasingly preferred by consumers due to health concerns. Professional cleaning and oral hygiene education are essential components of maintaining optimal oral health.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Oral Care market drivers leading to the rise in the adoption of Industry?

- The significant rise in the adoption of technology in oral care products serves as the primary market driver. This trend is characterized by the integration of advanced technologies such as artificial intelligence, nanotechnology, and smart sensors into toothbrushes, mouthwashes, and other oral hygiene products, enhancing their effectiveness and convenience for consumers. The market is driven by the expansion of product lines and technological innovations in response to consumer demand for advanced, hygienic oral solutions. Furthermore, the availability of dental insurance coverage in countries like Austria, Poland, and Spain is enhancing access to quality dental care services and increasing demand for dental diagnostic, dental equipment and surgical equipment.

- Dental care products, including calcium phosphate-based dental fillings, whitening toothpastes, dental floss, and dental sealants, undergo rigorous testing to ensure their safety and effectiveness. By focusing on product innovation and dental hygiene, companies can differentiate themselves in the competitive market. For instance, the toothbrush industry has seen the introduction of smart connected electric toothbrushes, such as Procter & Gamble's Oral-B Genius Pro 8000 Rechargeable Electric Toothbrush. This innovative device, available under the Oral-B brand, features Bluetooth connectivity, enabling pairing with a mobile app that provides users with real-time feedback on their tooth-brushing practices. Clinical trials and supply chain optimization are also crucial aspects of market growth.

What are the Oral Care market trends shaping the Industry?

- The market trend indicates a significant increase in demand for mouthwash and teeth-whitening products. These items are highly sought after in the present consumer market. The market in the US has witnessed significant growth due to increasing awareness regarding the importance of oral hygiene. This trend has led to the introduction of various products and treatments, including cosmetic dentistry solutions like dental implants and teeth whitening. One of the most popular teeth whitening methods is the use of whitening toothpaste. Manufacturers such as GlaxoSmithKline, Procter & Gamble, and Colgate Palmolive offer toothpaste with teeth-whitening capabilities.

- Additionally, oral health concerns such as canker sores and the need for essential oils have led to the development of various products catering to these issues. Dental insurance coverage for oral care treatments and the availability of subscription services have also contributed to the market's growth. Electric toothbrushes have gained popularity due to their effectiveness in removing plaque and improving oral health. Overall, the market for oral care products in the US continues to expand, driven by consumer demand for innovative and effective solutions. For instance, Sensodyne, a GlaxoSmithKline brand, provides ProNamel Gentle Whitening toothpaste and Sensodyne True White toothpaste. Similar offerings from other suppliers include toothpaste, strips, gels, polish, and other formats.

How does Oral Care market face challenges during its growth?

- The stringent regulations governing the production and marketing of oral care products pose a significant challenge to the industry's growth. Adhering to these regulations, which cover various aspects such as safety, efficacy, and labeling, adds to the production costs and complexities, potentially hindering the industry's expansion. Oral care products in the US market are subject to stringent regulations to ensure consumer safety and product quality. The US Food and Drug Administration (FDA) classifies these products as medical devices, necessitating adherence to rigorous safety and efficacy standards. Regulations cover various aspects, including product composition, labeling, marketing claims, and production procedures.

- Natural ingredients are gaining popularity in oral care, necessitating separate regulations for their sourcing and labeling. Mouth ulcers, oral cancer, impacted teeth, and sensitive teeth are common oral health concerns addressed by various oral care products. Home cleaning and professional cleaning methods also influence product development. Distribution channels, including retail stores and e-commerce platforms, impact marketing strategies and product availability. Overall, these regulations aim to maintain a high standard of oral care products in the US market. For instance, toothpaste claiming to prevent cavities must contain fluoride and meet specific pH requirements. The FDA also has distinct rules for dental products such as teeth-whitening kits and orthodontic appliances. Sodium lauryl sulfate, a common toothpaste ingredient, is subject to specific purity and labeling requirements.

Exclusive Customer Landscape

The oral care market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oral care market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, oral care market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in manufacturing oral care solutions catering to the needs of dental and orthodontic professionals worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Amway Corp.

- Anchor Health and Beauty Care Pvt. Ltd.

- Church and Dwight Co. Inc.

- Colgate Palmolive Co.

- Dabur India Ltd.

- GC Corp.

- GlaxoSmithKline Plc

- Henkel AG and Co. KGaA

- Himalaya Global Holdings Ltd.

- Johnson and Johnson Services Inc.

- Kao Corp.

- Koninklijke Philips NV

- Lion Corp.

- Perrigo Co. Plc

- Prestige Consumer Healthcare Inc.

- Septodont Holding

- Sunstar Suisse SA

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Oral Care Market

- In January 2024, Colgate-Palmolive introduced a new electric toothbrush model, the E1, featuring Bluetooth connectivity and personalized brushing programs (Colgate-Palmolive press release).

- In March 2024, 3M and GlaxoSmithKline's oral care businesses announced a strategic collaboration to co-develop and market oral health products combining 3M's innovative technologies with GSK's oral health expertise (3M and GlaxoSmithKline press releases).

- In April 2024, Procter & Gamble's oral care division, Oral-B, completed the acquisition of Quip, a direct-to-consumer electric toothbrush company, for approximately USD500 million, expanding its digital oral care offerings (Reuters).

- In May 2025, the European Commission approved the merger of Dabur India's oral care business with Orkla's consumer goods division, creating a leading oral care player in Europe with a combined market share of over 15% (European Commission press release).

Research Analyst Overview

The market continues to evolve, with dynamic market activities shaping its various sectors. Cosmetic dentistry, with its focus on enhancing smiles, coexists with the restorative realm of dental implants. Electric toothbrushes, with their advanced technology, complement the traditional use of manual toothbrushes. Oral health concerns, such as canker sores and dry mouth, are addressed through essential oils and dental products free of harmful substances like BPA. Ongoing product innovation, from whitening toothpastes to dental floss, caters to diverse consumer needs. Clinical trials and regulatory approvals shape the supply chain, ensuring the delivery of safe and effective oral hygiene solutions.

Dental insurance and subscription services provide financial accessibility to professional dental care, including root planing and gum disease treatment. Enamel erosion, periodontal disease, and wisdom teeth are common oral health issues addressed through various treatments, such as dental sealants and calcium phosphate-based restorative materials. Oral cancer screenings and home cleaning methods, including sodium lauryl sulfate-free toothpastes, contribute to overall oral health. Market patterns unfold as new applications emerge, such as the integration of natural ingredients in oral care products and the expansion of distribution channels. Sensitive toothpastes and professional cleaning services cater to specific consumer needs, while oral hygiene education remains a crucial aspect of market growth.

Mouth ulcers and teeth whitening are among the numerous applications of oral care solutions, with essential oils and over-the-counter treatments offering relief and aesthetic benefits. The ongoing evolution of the market reflects the continuous pursuit of optimal oral health and well-being.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Oral Care Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2025-2029 |

USD 12.31 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.5 |

|

Key countries |

US, Germany, China, UK, India, Brazil, France, Japan, Italy, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Oral Care Market Research and Growth Report?

- CAGR of the Oral Care industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the oral care market growth of industry companies

We can help! Our analysts can customize this oral care market research report to meet your requirements.