Telecom Tower Market Size 2025-2029

The telecom tower market size is forecast to increase by USD 19.72 billion at a CAGR of 7% between 2024 and 2029.

The market is experiencing significant growth, driven by several key trends. One of the primary factors fueling market expansion is the increasing demand for fixed wireless access (FWA), which offers a cost-effective alternative to traditional wired broadband connections. Another trend is the integration of small cells in telecom towers, enabling enhanced network coverage and capacity in densely populated areas. The market In the US is experiencing significant growth, driven by the increasing demand for advanced wireless communication services, including 5G technology and the Internet of Things (IoT). However, there are challenges that could hinder market progress, such as the rise in carbon emissions from tower installations, which necessitates the adoption of eco-friendly solutions. Overall, the market is poised for strong growth, with these trends shaping its future trajectory.

What will be the Size of the Telecom Tower Market During the Forecast Period?

- Telecom towers serve as critical infrastructure components for mobile networks, supporting radio broadcast and wireless communication for a vast array of mobile devices. With the rollout of 5G connectivity, the market is witnessing increased adoption of telecom towers, as they are essential for delivering high-speed data transmission and low latency required by modern telecommunications networks. The market dynamics are influenced by various factors, such as the gross domestic product, technological advancements like Long Term Evolution (LTE-A) and 5G technology, and the proliferation of IoT devices. The market is expected to continue its upward trajectory, with tall structures adorned with antennas becoming increasingly common in urban landscapes.

How is this Telecom Tower Industry segmented and which is the largest segment?

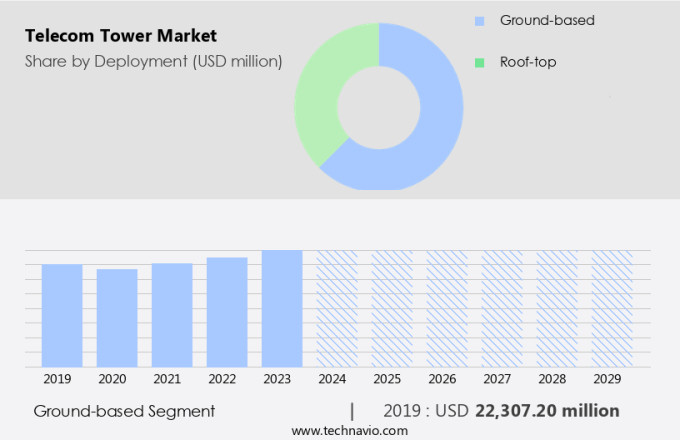

The telecom tower industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- Ground-based

- Roof-top

- Business Segment

- Operator-led tower companies

- MNO captive sites

- Independent tower companies

- Joint venture infrastructure companies

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- APAC

By Deployment Insights

- The ground-based segment is estimated to witness significant growth during the forecast period.

Ground-based telecom towers offer cost-effective solutions for telecommunications infrastructure deployment. Their simpler design and easier installation process result in lower construction costs. The lattice structures and guy wires ensure durability and stability, enabling these towers to withstand various weather conditions. Versatile in nature, they can be installed in urban, suburban, and rural areas. Ground-based towers support various telecommunication services such as mobile networks, 5G connectivity, wireless communication services, phone lines, cellular services, radar systems, radio broadcast, and television antennas. These towers are essential for providing essential telecommunication services, making them a crucial component of telecoms infrastructure.

Get a glance at the Telecom Tower Industry report of share of various segments Request Free Sample

The ground-based segment was valued at USD 22.31 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia-Pacific (APAC) region, with its large and expanding population of over 4.3 billion people, is driving the growth of the market. The increasing mobile subscriber base, fueled by smartphone adoption and the demand for high-speed internet and data services, necessitates enhanced network infrastructure. Telecom towers are essential in meeting this demand for increased data speeds and capacity in urban areas and remote working environments. Wireless communication technologies, such as 5G, IoT applications, virtual communication, and smart cities, further focuses on the importance of network coverage and capacity. The APAC region's market is expected to grow significantly due to these factors.

Market Dynamics

Our telecom tower market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Telecom Tower Industry?

Rising demand for fixed wireless access (FWA) is the key driver of the market.

- Telecom towers are critical infrastructure components in modern telecommunications networks, supporting various wireless communication technologies such as 5G, Long Term Evolution (LTE), and LTE-Advanced (LTE-A). The GSMA Association reports that 5G penetration is expected to reach 25% of mobile subscriptions by 2025, necessitating the expansion and densification of network connections. TowerCos, including Bharti Infratel, SBA Communications, and DISH, play a significant role in deploying and maintaining LTE-A infrastructure, enabling high-speed internet, data services, and IoT applications. Telecom towers accommodate various wireless communication services, including cellular technology, radio broadcast, television antennas, radar systems, and phone lines. They facilitate network extension and capacity improvement in urban areas, supporting remote working, virtual communication, smart cities, and smart infrastructure projects.

- Moreover, the deregulation and privatization of the telecommunications sector have led to the growth of infrastructure companies specializing in cell towers. Fiber-Wireless Access (FWA) is an essential solution for providing high-speed broadband connectivity in areas where traditional wired infrastructure is challenging to deploy. Telecom towers help facilitate the deployment of FWA by offering the necessary infrastructure. FWA is not limited to rural areas; it is increasingly used in urban and suburban environments to offer an alternative or supplementary broadband option. This trend is driven by the growing mobile subscriber base, smartphone adoption, and increasing demand for high-speed internet, data services, and IoT applications.

- However, network coverage and capacity improvement are essential for meeting the demands of urbanization, technology efficiency, sustainability, and improving quality of life. Telecommunications sector deregulation and privatization have led to infrastructure expansion and upgrades, including renewable and non-renewable energy sources, rooftop installations, and ground-based installations. Operator-owned, joint venture, MNO captive, and other tower business models are used to deploy and maintaIn the necessary infrastructure. Thus, telecom towers are a crucial component of modern telecommunications networks, enabling various wireless communication services, including 5G, LTE, and LTE-A. They facilitate network extension and capacity improvement, support FWA deployment, and contribute to the growth of the telecommunications sector. Thus, the trend towards deregulation and privatization has led to infrastructure expansion and upgrades, ensuring network coverage and capacity for the increasing demand for high-speed internet, data services, and IoT applications.

What are the market trends shaping the Telecom Tower Industry?

The rise of small cell integration in telecom towers is the upcoming market trend.

- Telecom towers play a critical role in modern telecommunications networks, providing the infrastructure for various wireless communication services, including 5G technology and Long Term Evolution (LTE-A). The GSMA Association reports that 5G penetration is expected to increase significantly In the coming years, leading to a growth in demand for tower infrastructure. In response, TowerCos, such as Bharti Infratel, SBA Communications, and DISH, are investing in tower densification to improve network connection and reduce latency for 5G subscriptions and mobile subscriptions. Small cell integration is a crucial aspect of network densification strategies. Operators, including Bharti Airtel, Bell Mobility, TCI, RCCI, and Rogers, are deploying small cells in conjunction with macro towers to enhance network capacity and coverage, particularly in urban areas.

- Moreover, these tall structures house antennas for wireless communication, enabling voice calls, text messaging, internet connectivity, and data transfer for an ever-growing user base. The integration of small cells into existing telecom towers requires additional infrastructure investments. Mechanical structures, such as phone lines and radar systems, may need to be upgraded to accommodate the new technology. Furthermore, the proliferation of IoT devices and the increasing adoption of smartphones and other mobile devices necessitate the expansion and upgrade of cellular networks. In the context of the telecommunications sector's deregulation and privatization, infrastructure companies, such as PG&E and MNO captive towers, are increasingly becoming essential players In the tower industry.

- Thus, the wireless revolution has led to an explosion in data services, high-speed internet, IoT applications, and smart devices, all of which require strong network coverage and capacity. Telecom towers serve as the backbone of urban services, including virtual communication, smart cities, and smart infrastructure projects. The integration of renewable and non-renewable energy sources into tower infrastructure is a critical consideration for sustainability and efficiency, enhancing the quality of life in urban areas. Overall, the market is poised for growth as the demand for connectivity continues to soar.

What challenges does the Telecom Tower Industry face during its growth?

An increase in carbon emissions is a key challenge affecting industry growth.

- Telecom towers are critical infrastructure components of modern telecommunications networks, supporting wireless communication for mobile devices and providing network coverage for voice calls, text messaging, internet connectivity, and data transfer. With the increasing adoption of high-speed internet, data services, and IoT applications, the demand for telecom towers is on the rise, particularly in urban areas. The market is witnessing significant growth due to the deployment of 5G technology and the densification of LTE-A infrastructure. The GSMA Association reports that 5G penetration is expected to reach 1.3 billion subscriptions by 2025, necessitating the expansion and upgrade of network infrastructure. Operator-owned towers and TowerCos, such as Bharti Infratel, SBA Communications, DISH, PG&E, Bell Mobility, TCI, RCCI, and Rogers, are investing heavily In the deployment of 5G connectivity and LTE-A infrastructure.

- However, the increasing number of towers and the power consumption required to operate them pose challenges for the telecom industry. It is estimated that telecom towers consume approximately 2 billion liters of diesel per year in India alone, leading to 5 million tons of carbon dioxide emissions annually. This equates to 2% of global greenhouse gas emissions. To address these concerns, infrastructure companies are exploring renewable energy sources for tower power, such as solar and wind, and implementing energy-efficient designs. Deregulation and privatization of the telecommunications sector have also facilitated the entry of new players and innovation In the tower industry.

- Thus, the market is experiencing significant growth due to the deployment of 5G technology and the increasing demand for wireless communication services. However, the challenges posed by power consumption and carbon emissions require innovative solutions to ensure efficiency, sustainability, and quality of life for users.

Exclusive Customer Landscape

The telecom tower market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the telecom tower market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, telecom tower market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

American Tower Corp.: The company offers telecom towers that provide the wireless infrastructure needed to enable a connected world outdoors, indoors, and in urban and rural locations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Tower Corp.

- AT and T Inc.

- Bharat Sanchar Nigam Ltd.

- Cellnex Telecom SA

- China Tower Corporation Limited

- GTL Infrastructure Ltd

- Helios Towers plc

- IHS Holding Ltd

- Indus Towers Ltd.

- Phoenix Tower International

- QMC Telecom International

- SBA Communications Corp.

- T Mobile US Inc.

- TAWAL

- Telefonaktiebolaget LM Ericsson

- Telefonica SA

- Tower One Wireless

- WINITY TELECOM

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Telecom towers have become an indispensable part of modern telecommunications networks, providing the necessary infrastructure for wireless communication services. These structures serve as the backbone of mobile networks, enabling cellular coverage, voice calls, text messaging, and high-speed internet connectivity for users. The telecom tower industry has seen significant growth in recent years due to the increasing demand for wireless communication services and the adoption of advanced technologies such as 5G. This technology, which promises faster data transfer rates and lower latency, requires a dense network of towers to ensure adequate coverage and capacity. Telecom towers support various wireless communication technologies, including 5G, Long Term Evolution (LTE), and LTE-Advanced (LTE-A). These technologies enable the integration of Internet of Things (IoT) devices, smartphones, and other wireless communication devices.

Moreover, the market is driven by several factors, including the growing mobile subscriber base, smartphone adoption, and the need for network extension and capacity improvement in urban areas. Urbanization and the shift towards remote working and virtual communication have further fueled the demand for reliable and efficient telecommunications infrastructure. Telecom towers come in various forms, including tall structures and mechanical structures such as rooftop installations and ground-based installations. Operator-owned towers and towers owned by infrastructure companies (towercos) are common In the market. Joint ventures and captive infrastructure initiatives by Mobile Network Operators (MNOs) have also gained popularity in recent years. The telecom tower industry is subject to deregulation and privatization trends, with governments and regulatory bodies encouraging the entry of private players to expand and upgrade network infrastructure. This has led to increased competition and innovation In the market. Telecom towers support various applications, including radio broadcast, television antennas, radar systems, and phone lines.

Additionally, they are essential components of critical infrastructure, providing connectivity and enabling various urban services such as smart cities and smart infrastructure projects. The market is expected to continue growing, driven by the increasing demand for wireless communication services, the adoption of advanced technologies, and the need for network infrastructure expansion and upgrade. The market is also expected to become more sustainable, with the increasing use of renewable energy sources and the adoption of energy-efficient designs. Thus, telecom towers play a critical role in enabling wireless communication services and supporting various applications. The market for telecom towers is expected to continue growing, driven by the increasing demand for wireless communication services, the adoption of advanced technologies, and the need for network infrastructure expansion and upgrade. The industry is subject to deregulation and privatization trends, with a focus on sustainability and efficiency.

|

Telecom Tower Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market growth 2025-2029 |

USD 19.72 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, China, India, Japan, Canada, South Korea, Germany, UK, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Telecom Tower Market Research and Growth Report?

- CAGR of the Telecom Tower industry during the forecast period

- Detailed information on factors that will drive the Telecom Tower growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the telecom tower market growth of industry companies

We can help! Our analysts can customize this telecom tower market research report to meet your requirements.