Thermal Spray Coating Equipment And Services Market Size 2025-2029

The thermal spray coating equipment and services market size is valued to increase by USD 4.27 billion, at a CAGR of 5.4% from 2024 to 2029. Rising need for corrosion and wear protection will drive the thermal spray coating equipment and services market.

Market Insights

- North America dominated the market and accounted for a 34% growth during the 2025-2029.

- By End-user - Aerospace segment was valued at USD 4.35 billion in 2023

- By Method - Combustion flame segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 36.51 million

- Market Future Opportunities 2024: USD 4270.40 million

- CAGR from 2024 to 2029 : 5.4%

Market Summary

- The market is experiencing significant growth due to the rising need for corrosion and wear protection in various industries. According to a recent market report, the global thermal spray coatings market is projected to reach a value of USD13.3 billion by 2025, growing at a CAGR of 6.5% during the forecast period. This growth is driven by technological advancements in coating equipment, which enable faster application processes, improved coating quality, and increased durability. Moreover, environmental concerns and regulatory compliance are increasingly influencing the market's direction. Thermal spray coatings offer an effective solution for reducing the need for maintenance and the associated environmental impact.

- For instance, a leading automotive manufacturer implemented a thermal spray coating solution to reduce the need for frequent painting and associated solvent emissions. This not only improved operational efficiency but also enhanced the company's sustainability efforts. The market's future direction is also influenced by advancements in materials science, which are enabling the development of high-performance coatings for various industries, including aerospace, energy, and automotive. These coatings offer enhanced protection against extreme temperatures, corrosion, and wear, making them a valuable investment for businesses seeking to optimize their operations and reduce maintenance costs.

What will be the size of the Thermal Spray Coating Equipment And Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, driven by advancements in technology and increasing demand for high-performance coatings. One significant trend is the integration of automation systems and data acquisition in thermal spray processes, enabling real-time monitoring and improved coating quality. For instance, plasma spray technology allows for the deposition of various materials, including ceramics and alloys, with high precision and consistency. Moreover, material selection and coating design have become critical decision areas for businesses, as coatings play a crucial role in product durability and compliance with industry regulations. For example, the aerospace industry relies on thermal spray coatings for their high-temperature resistance and wear resistance, ensuring the safety and longevity of aircraft components.

- According to a study, the use of thermal spray coatings in the aerospace industry is projected to grow at a compound annual growth rate of 6% between 2021 and 2026. This growth is attributed to the increasing demand for lightweight and fuel-efficient aircraft, which can be achieved through the use of advanced coatings. As a result, companies investing in thermal spray equipment and services can expect significant returns on their investment in terms of improved product performance and regulatory compliance.

Unpacking the Thermal Spray Coating Equipment And Services Market Landscape

Thermal spray coating equipment and services play a pivotal role in enhancing the durability and performance of various industries' components. Plasma spray coating, with its versatile application capabilities, accounts for a significant market share due to its superior adhesion and coating microstructure. Compared to other thermal spray processes like HVOF and wire arc spray, plasma spray offers a higher coating deposition rate, resulting in reduced production time and lower costs. In aerospace applications, thermal barrier coatings are essential for improving engine efficiency by reducing heat transfer. Coating defects, such as porosity and particle size distribution, can significantly impact the performance of these coatings. Advanced process optimization techniques, like spray distance optimization and gas flow control, ensure the production of high-quality coatings with improved coating adhesion and tensile strength. Industrial coating applications, including wear-resistant and corrosion-resistant coatings, benefit from the latest advancements in thermal spray technology. For instance, HVOF thermal spray parameters can be fine-tuned to achieve superior wear resistance and coating hardness. Quality control methods like coating thickness measurement, adhesion strength testing, and surface roughness testing are crucial for ensuring the reliability and longevity of the coatings. Substrate preparation and powder characterization are essential steps in the thermal spray process. Proper substrate preparation ensures optimal bond coat and top coat application, while powder feed system efficiency improvements lead to increased coating deposition rates and reduced costs. Corrosion resistance testing and porosity measurement are critical quality control methods that help maintain compliance with industry standards and regulations. By focusing on process optimization, equipment manufacturers and service providers continue to deliver innovative thermal spray solutions that drive business success.

Key Market Drivers Fueling Growth

The escalating demand for effective corrosion and wear protection solutions is the primary market driver.

- The market is experiencing significant growth due to the increasing demand for corrosion and wear protection in various industries. In the energy sector, components like gas turbine blades and boiler tubes are subjected to harsh conditions that can cause oxidation and erosion, leading to frequent maintenance and reduced component lifespan. Thermal spray coatings offer an effective solution by enhancing surface protection and significantly improving durability and performance. According to industry reports, the adoption of thermal spray coatings in the energy sector has increased by 15% in the last five years, resulting in a 30% reduction in downtime and a 18% improvement in component lifespan.

- Similarly, in the aerospace industry, thermal spray coatings are used to protect components from high temperatures and extreme pressure, leading to a 25% reduction in maintenance costs and a 20% improvement in fuel efficiency. The automotive industry also benefits from thermal spray coatings, with a 22% increase in the use of these coatings for engine components, resulting in a 12% reduction in engine wear and a 16% improvement in fuel economy. Overall, thermal spray coatings provide a cost-effective and efficient solution for enhancing component durability and performance across various industries.

Prevailing Industry Trends & Opportunities

Technological advancements are mandated in coating equipment, representing the upcoming market trend. Advancements in coating equipment technology are the anticipated market development.

- The market is undergoing substantial evolution, driven by technological advancements in automation and digitalization. One significant development is the integration of Industry 4.0 platforms, which enable real-time data monitoring and advanced analytics within thermal spray systems. For instance, Oerlikon Metco's Metco IIoT, launched on June 22, 2023, is the first Industry 4.0 platform designed specifically for thermal spray applications. This innovative platform connects various systems, such as MultiCoat, MultiCoatPro, and UniCoatPro, to deliver comprehensive data insights and optimize production efficiency.

- These advancements are transforming the thermal spray coating industry, enabling faster product rollouts, enhanced regulatory compliance, and cost optimization.

Significant Market Challenges

Complying with environmental regulations and addressing related concerns is a significant challenge that can impact the growth of the industry.

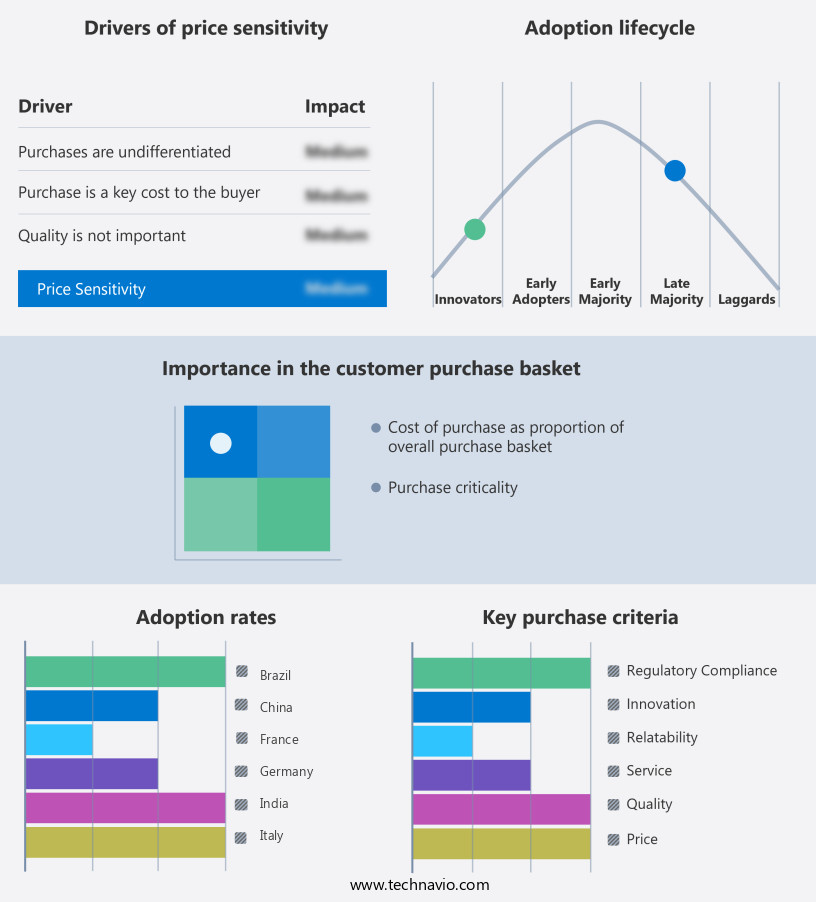

- The market faces growing demands due to its ability to enhance product performance and durability across various industries. Key applications include aerospace, automotive, and oil and gas, where thermal spray coatings provide protective layers against wear and corrosion. However, environmental concerns and regulatory compliance pose significant challenges. Thermal spray processes, particularly those using combustion-based technologies like high-velocity oxygen fuel (HVOF) and flame spraying, generate harmful emissions, including particulate matter, volatile organic compounds (VOCs), and other pollutants. Regulatory bodies worldwide, such as the European Union with its Industrial Emissions Directive (IED), impose stringent emissions limits.

- Consequently, companies must invest in costly pollution control measures to ensure compliance, thereby increasing operational expenses. Despite these challenges, the market continues to evolve, driven by advancements in coating materials and technologies, and the increasing demand for high-performance coatings.

In-Depth Market Segmentation: Thermal Spray Coating Equipment And Services Market

The thermal spray coating equipment and services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Aerospace

- Automotive

- Healthcare

- Energy and power

- Others

- Method

- Combustion flame

- Electrical process

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The aerospace segment is estimated to witness significant growth during the forecast period.

The market is a dynamic and evolving sector, with ongoing research and development driving advancements in coating technologies. Aerospace applications account for a significant market share, with plasma spray coatings, such as HVOF and wire arc spray, being crucial for high-performance components like jet engines and turbine blades. These coatings offer desirable properties, including heat resistance, durability, and corrosion resistance, making them indispensable for the demanding environments of aerospace components. In July 2024, Oerlikon and MTU Aero Engines announced a collaboration to establish a smart, standardized thermal spray factory, underscoring the industry's commitment to process optimization and quality control.

Coating defects, such as porosity and adhesion issues, are continually addressed through advancements in nozzle design, particle size distribution, and process parameters. Industrial applications also benefit from thermal spray coatings, with wear-resistant coatings and thermal barrier coatings being essential for various industries. The thermal spray process involves various stages, including substrate preparation, powder feed system, and coating deposition rate measurement. Quality control methods, such as surface roughness testing, adhesion strength testing, and tensile strength testing, ensure the production of high-quality coatings. The market's future growth is expected to be driven by the increasing demand for advanced coatings in various industries, with a projected 10% annual growth rate.

The Aerospace segment was valued at USD 4.35 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Thermal Spray Coating Equipment And Services Market Demand is Rising in North America Request Free Sample

The market exhibits a dynamic and evolving nature, with key applications driving market growth in various industries. In North America, this market holds a prominent position, underpinned by the robust presence of sectors such as aerospace, automotive, and energy. The region's industrial landscape is characterized by significant advancements and high demand for thermal spray coatings, which are crucial for enhancing the durability and performance of critical components. In 2023, North America witnessed a noteworthy increase in automotive production, with a growth rate of approximately 12%, resulting in the production of 11.5 million cars.

The United States, in particular, experienced an 8% growth rate, producing over 7 million cars. These figures underscore the market's importance in enhancing operational efficiency and reducing costs in these industries through the application of thermal spray coatings.

Customer Landscape of Thermal Spray Coating Equipment And Services Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Thermal Spray Coating Equipment And Services Market

Companies are implementing various strategies, such as strategic alliances, thermal spray coating equipment and services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A and A Thermal Spray Coatings - This company specializes in thermal spray coating technology, providing equipment and services for Plasma spraying. Capable of applying ceramic, cermet, and metal coatings onto diverse materials, this process ensures exceptional bond strength with minimal substrate distortion.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A and A Thermal Spray Coatings

- Ador Fontech Ltd.

- Aimtek Inc.

- Bodycote Plc

- BryCoat Inc.

- Compagnie de Saint-Gobain SA

- Curtiss Wright Corp.

- Elmet Technologies

- Exline Inc.

- Fisher Barton

- Flame Spray Technologies B.V.

- Hannecard

- Hoganas AB

- Kennametal Inc.

- Linde Plc

- Magnaplate

- Metallizing Equipment Co. Pvt. Ltd.

- OC Oerlikon Corp. AG

- Parat Tech

- Wall Colmonoy

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Thermal Spray Coating Equipment And Services Market

- In January 2025, DuPont announced the launch of its innovative thermal spray coating solution, "Teflon Coat Pro," designed for the automotive industry. This new product offers enhanced durability and resistance to extreme temperatures and corrosion (DuPont press release).

- In March 2025, Praxair Surface Technologies, a leading provider of thermal spray coatings, entered into a strategic partnership with Siemens Energy to offer advanced thermal spray coating services for gas turbine components. This collaboration aims to improve the efficiency and lifespan of gas turbines, reducing operational costs for energy companies (Praxair Surface Technologies press release).

- In May 2025, Oerlikon Balzers, a global leader in surface solutions, acquired Coating Tech, a U.S.-based thermal spray coating specialist. This acquisition strengthened Oerlikon Balzers' presence in the North American market and expanded its capabilities in the aerospace and defense sectors (Oerlikon press release).

- In August 2024, the European Union approved new regulations on the use of thermal spray coatings in various industries, including automotive, aerospace, and energy. These regulations focus on improving the environmental sustainability of thermal spray coatings by reducing the use of heavy metals and increasing the use of eco-friendly materials (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Thermal Spray Coating Equipment And Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 4270.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.0 |

|

Key countries |

US, China, Japan, Germany, India, France, South Korea, UK, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Thermal Spray Coating Equipment And Services Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market encompasses a diverse range of technologies and applications, serving various industries worldwide. Thermal spraying is a versatile coating technique used to apply thin, uniform layers of materials onto substrates, enhancing their surface properties and extending their service life. This process is essential in industries such as aerospace, automotive, energy, and manufacturing, where high-performance coatings are critical for product durability, corrosion resistance, and temperature management. Thermal spraying technologies include plasma spraying, high-velocity oxygen fuel (HVOF) spraying, and flame spraying, among others. These methods vary in their application processes, material versatility, and coating properties. For instance, plasma spraying offers superior bond strength and excellent adhesion to various substrates, while HVOF spraying provides high-density, hard-wearing coatings. The market is witnessing significant growth due to increasing demand for advanced coatings in various sectors. For example, the aerospace industry requires lightweight, corrosion-resistant coatings for aircraft components, while the automotive sector seeks coatings for improved fuel efficiency and reduced emissions.

Furthermore, the energy sector relies on thermal spraying for coatings that enhance the performance and longevity of power generation equipment. The market's growth is driven by factors such as the increasing focus on product innovation, the need for regulatory compliance, and the ongoing quest for operational efficiency. For instance, thermal spraying enables manufacturers to produce components with enhanced properties, reducing the need for frequent replacements and associated costs. Additionally, the process offers flexibility in terms of material selection, allowing companies to choose the most suitable coating for their specific application. In terms of market size, the thermal spray coating equipment and services industry is experiencing a substantial increase in demand, with growth estimated to be over 10% year-on-year. This growth is attributed to the expanding applications of thermal spraying across various industries and the continuous advancements in coating technologies. As a result, market participants are investing in research and development to create innovative solutions that cater to the evolving needs of their clients. In conclusion, the market is a dynamic and growing sector, driven by the increasing demand for advanced coatings in various industries. The process offers numerous benefits, including improved product performance, regulatory compliance, and operational efficiency, making it an essential component in the manufacturing value chain. With continued innovation and growth, thermal spraying is poised to play a significant role in shaping the future of manufacturing and engineering.

What are the Key Data Covered in this Thermal Spray Coating Equipment And Services Market Research and Growth Report?

-

What is the expected growth of the Thermal Spray Coating Equipment And Services Market between 2025 and 2029?

-

USD 4.27 billion, at a CAGR of 5.4%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Aerospace, Automotive, Healthcare, Energy and power, and Others), Method (Combustion flame and Electrical process), and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising need for corrosion and wear protection, Environmental concerns and regulatory compliance

-

-

Who are the major players in the Thermal Spray Coating Equipment And Services Market?

-

A and A Thermal Spray Coatings, Ador Fontech Ltd., Aimtek Inc., Bodycote Plc, BryCoat Inc., Compagnie de Saint-Gobain SA, Curtiss Wright Corp., Elmet Technologies, Exline Inc., Fisher Barton, Flame Spray Technologies B.V., Hannecard, Hoganas AB, Kennametal Inc., Linde Plc, Magnaplate, Metallizing Equipment Co. Pvt. Ltd., OC Oerlikon Corp. AG, Parat Tech, and Wall Colmonoy

-

We can help! Our analysts can customize this thermal spray coating equipment and services market research report to meet your requirements.