Thermal Barrier Coatings Market Size 2024-2028

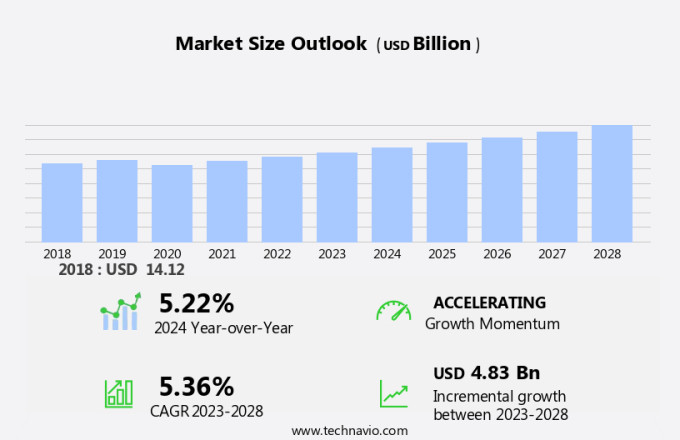

The thermal barrier coatings market size is forecast to increase by USD 4.83 billion at a CAGR of 5.36% between 2023 and 2028. The market is witnessing significant growth due to the increasing demand for fuel-efficient gas turbine engines in various industries, including aviation and power production. These coatings, which incorporate metal particles, are essential for protecting gas turbine blades from high temperatures and thermal shock. In the aviation sector, the use of advanced thermal barrier coating materials is increasing in aviation engines to enhance their durability and improve engine performance. Similarly, in the power production and marine propulsion sectors, thermal barrier coatings are being extensively used to increase the efficiency and longevity of gas turbines. However, the high production and application costs of these coatings remain a challenge for market growth. In summary, the market is experiencing steady expansion due to the increasing demand for fuel-efficient engines and the use of advanced materials, despite the high costs associated with their production and application.

What will be the Size of the Market During the Forecast Period?

Thermal barrier coatings (TBCs) have emerged as a crucial technology in various industries, particularly those that require high-performance components capable of withstanding extreme temperatures. These coatings offer significant benefits in terms of thermal insulation, corrosion protection, and surface durability. In the aerospace sector, TBCs play a pivotal role in enhancing the efficiency and longevity of engines used in aviation. The application of these coatings on gas turbine blades helps prevent thermal degradation, thereby reducing the need for frequent maintenance and increasing the overall operational efficiency of the engines.

Similarly, in the automobile production industry, TBCs are used to improve the performance and fuel efficiency of engines by reducing heat transfer and insulating critical engine components. Coating technologies employed in the production of TBCs include HVOF spraying, flame spraying technique, and plasma transfer arc. Epoxy resins, polymers, aluminates, zirconia, and ceramics are among the commonly used materials in the formulation of these coatings. The choice of material depends on the specific application requirements and the operating conditions. The energy sector is another major consumer of TBCs, particularly in the context of gas turbines. These coatings help improve the efficiency and longevity of gas turbines by reducing thermal stress and preventing corrosion.

The use of TBCs in this sector has become increasingly important due to the growing demand for cleaner and more efficient energy sources. The demand for TBCs is driven by several factors, including the increasing focus on energy efficiency and the need for high-performance components in various industries. The growing use of advanced technologies such as HVOF spraying and plasma transfer arc in the production of TBCs is also expected to drive market growth. The application of TBCs in engines, OEMs, and the energy sector is a significant trend in the market. The use of these coatings in aviation engines is expected to continue to grow due to the increasing demand for fuel-efficient and environmentally friendly aircraft.

Similarly, the use of TBCs in gas turbines is expected to increase due to the growing demand for cleaner and more efficient energy sources. Despite the numerous benefits of TBCs, there are challenges associated with their production and application. These include the high cost of raw materials and the complex production process. Additionally, the use of metal particles in the formulation of some TBCs can lead to issues with surface degradation processes. In conclusion, thermal barrier coatings have become an essential technology in various industries, particularly those that require high-performance components capable of withstanding extreme temperatures. The use of advanced coating technologies and materials is expected to drive market growth, while challenges related to production and application remain key areas of focus for industry stakeholders.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Ceramic

- Metal

- Intermetallic

- End-user

- Aerospace

- Automotive

- Power plants

- Others

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- North America

By Type Insights

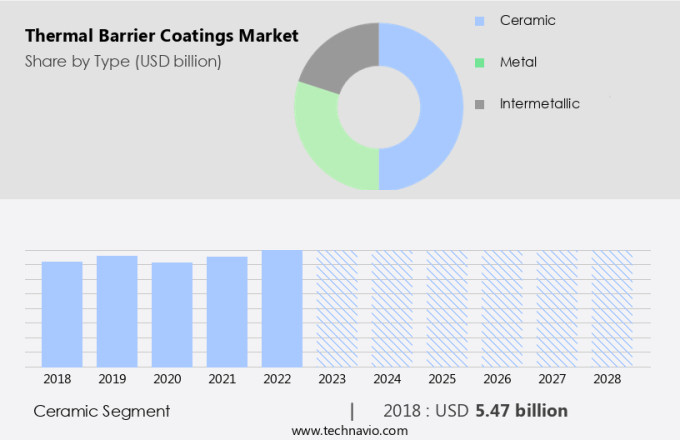

The ceramic segment is estimated to witness significant growth during the forecast period. Thermal barrier coatings, specifically those made of ceramics, have gained significant traction in the global market due to their distinctive properties. The increasing demand for elevated operating temperatures in various industries, such as aerospace and energy, is driving the adoption of ceramic coatings. These coatings offer superior corrosion resistance, durability, and thermal insulation, making them indispensable for gas turbines, turbine engines, and industrial equipment. Two prominent examples of these coatings are yttria-stabilized zirconia and plasma-sprayed alumina. In today's manufacturing landscape, ceramics play a pivotal role in improving fuel efficiency and reducing emissions. The growth of The market is anticipated to be substantial during the forecast period, as regulations and environmental concerns become increasingly stringent.

Get a glance at the market share of various segments Request Free Sample

The Ceramic segment accounted for USD 5.47 billion in 2018 and showed a gradual increase during the forecast period.

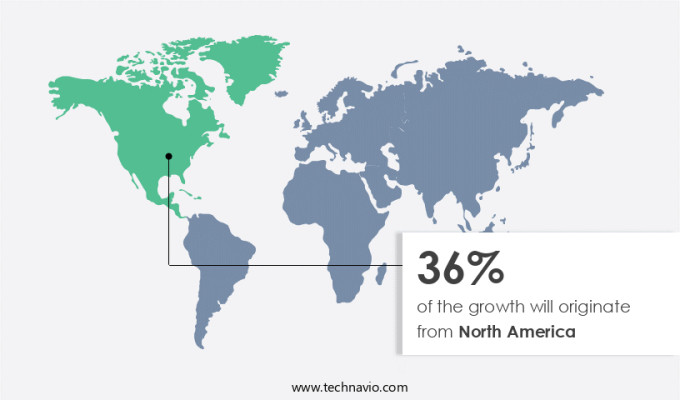

Regional Insights

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market for thermal barrier coatings is poised for significant expansion over the forecast period. This growth is attributed to the increasing demand from various industries, including automotive, power generation, and aerospace sectors. In the aerospace industry, companies like General Electric and Pratt & Whitney have invested in advanced thermal barrier coatings, highlighting their importance in enhancing engine durability and efficiency. Similarly, thermal barrier coatings play a crucial role in enhancing the lifespan and efficiency of gas turbines, which are integral to the energy generation process in the power sector. Notable thermal barrier coatings producers, such as Chromalloy, are expanding their operations to cater to this growing demand.

Mullite-based thermal barrier coatings are gaining popularity due to their excellent thermal insulation properties and resistance to corrosion and surface degradation processes. Two common techniques for applying these coatings are HVOF (High Velocity Oxygen Fuel) spraying and flame spraying technique. Another advanced method is Plasma Transfer Arc (PTA), which offers superior bonding strength and uniformity. Thermal barrier coatings are vital for industries that rely heavily on thermal processes, as they help minimize heat loss and protect surfaces from high temperatures. By enhancing the efficiency and durability of equipment, these coatings contribute to cost savings and reduced maintenance requirements for businesses.

As industries continue to seek innovative solutions for improving operational efficiency and reducing environmental impact, the demand for thermal barrier coatings is expected to remain strong.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing demand for fuel-efficient aircraft and gas turbine engines is the key driver of the market. The market is experiencing significant growth due to the increasing demand for fuel-efficient engines and reduced emissions in various industries, including aerospace and automobile production. Thermal barrier coatings, such as epoxy resins, polymers, aluminates, zirconia, and yttria-stabilized zirconia, play a crucial role in enhancing the longevity and performance of engine components exposed to high temperatures. For instance, in the aerospace sector, thermal barrier coatings are used in Pratt & Whitney PurePower Geared Turbofan engines and Boeing 787 Dreamliner to improve fuel efficiency and lower emissions. Similarly, in the automobile industry, these coatings are applied to exhaust systems and aero engine technologies to increase thermal conductivity and reduce thermal expansion coefficient, thereby improving engine performance and durability.

Moreover, thermal barrier coatings offer excellent erosion resistance and can withstand high operating temperatures, making them suitable for use in stationary power plants, gas turbines, and energy sector applications. Technologies such as physical vapor deposition, air plasma spray, high velocity oxyfuel, flame barrier technology, and vapor deposition technology are used to apply these coatings. The need to meet emission regulations and increasing electricity demand further boosts the market growth. Thermal barrier coatings are also used in marine propulsion and aviation engines, as well as in power generation projects. The market is expected to continue its growth trajectory due to the continuous development of advanced coating technologies and the increasing demand for efficient and durable engine components.

Market Trends

The growing use of advanced thermal barrier coating materials is the upcoming trend in the market. The market is witnessing significant growth due to the increasing demand for advanced materials in various industries. In particular, the use of yttria-stabilized zirconia and rare earth oxides, such as lanthanum and cerium, is gaining popularity in sectors like aerospace and automotive. These materials offer exceptional thermal and chemical stability, making them ideal for safeguarding turbine components used in power production and aviation. Their high resistance to high temperatures enables these coatings to endure harsh conditions, reducing maintenance costs and increasing energy efficiency. Thermal barrier coatings are essential for aerospace applications, including aero engine technologies and exhaust systems, where high operating temperatures and thermal expansion coefficients are common.

In the automotive sector, thermal barrier coatings are used in automobile production to improve engine performance and reduce fuel consumption. Similarly, in the energy sector, thermal barrier coatings are used in stationary power plants to enhance the efficiency of gas turbines and reduce pollution. Coating technologies such as physical vapor deposition, air plasma spray, high velocity oxyfuel, flame barrier technology, and vapor deposition technology are used to apply these coatings. HVOF technology and flame spraying technique are commonly used due to their ability to apply thick coatings with high bond strength. These coatings provide excellent erosion resistance and protection against surface degradation processes.

Mullite, ceramics, polymers, epoxy resins, aluminates, and zirconia are some of the commonly used materials for thermal barrier coatings. The choice of material depends on the specific application and operating temperature requirements. For instance, zirconia is widely used in high-temperature applications due to its excellent thermal conductivity and thermal expansion coefficient. In conclusion, The market is expected to grow significantly due to the increasing demand for advanced materials in various industries. The use of yttria-stabilized zirconia and rare earth oxides is gaining popularity due to their exceptional thermal and chemical stability. These coatings provide excellent protection against high temperatures and harsh conditions, reducing maintenance costs and increasing energy efficiency.

The use of advanced coating technologies such as HVOF and plasma transfer arc ensures the application of thick coatings with high bond strength. The market for thermal barrier coatings is expected to grow in the energy, aerospace, automotive, and marine propulsion industries.

Market Challenge

High production and application costs of thermal barrier coatings is a key challenge affecting the market growth. Thermal barrier coatings play a crucial role in various industries, including aerospace and automobile production, by enhancing the thermal performance of components exposed to high temperatures. These coatings, which utilize advanced technologies such as epoxy resins, polymers, aluminates, zirconia, and yttriastabilized zirconia, offer benefits like reduced thermal conductivity, lower thermal expansion coefficient, and improved erosion resistance. However, the high cost of production and application is a significant challenge in the market, particularly for industries where cost-effectiveness is a priority. For instance, in the aerospace sector, the application of these coatings on engine components is essential due to the extreme heat conditions.

Similarly, gas turbines in the power generation sector benefit from thermal barrier coatings, but their widespread use may be hindered by the high cost of implementation. Technologies like physical vapor deposition, air plasma spray, high velocity oxyfuel, flame barrier technology, and vapor deposition technology are used to apply these coatings, with each technique offering unique advantages. Applications of thermal barrier coatings extend to exhaust systems, aero engine technologies, stationary power plants, pollution control, electricity demand, marine propulsion, and more. Despite the challenges, the demand for thermal barrier coatings continues to grow due to their ability to enhance the efficiency and durability of components operating in high-temperature environments.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

A&A Thermal Spray Coatings: The company offers thermal barrier coatings used in the aircraft industry in the combustion section of turbine engines of aircrafts.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Chromalloy Gas Turbine LLC

- Compagnie de Saint Gobain

- CTS Inc.

- Fisher Barton

- Flame Spray Inc.

- Hannecard Group

- Hayden Corp.

- Honeywell International Inc.

- KECO Engineered Coatings Inc.

- Linde Plc

- Metallic Bonds Ltd.

- Metallisation Ltd.

- Northwest Mettech Corp.

- OC Oerlikon Corp. AG

- Precision Coatings Inc.

- Tech Line Coatings LLC

- Thermion Inc.

- TWI Ltd.

- Zircotec Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Thermal barrier coatings (TBCs) are advanced protective solutions used in various industries, including aerospace and automobile production. These coatings, made from epoxy resins, polymers, aluminates, zirconia, and yttriastabilized zirconia, enhance the performance of components by reducing thermal conductivity and thermal expansion coefficient. TBCs provide erosion resistance and can withstand high operating temperatures in applications such as exhaust systems and aero engine technologies. Coating technologies like physical vapor deposition, air plasma spray, and high velocity oxyfuel (HVOF) are commonly used to apply TBCs. HVOF technology, for instance, utilizes a high-velocity gas stream to spray metal particles onto a substrate, creating a dense, uniform coating.

TBCs play a crucial role in industries dealing with pollution and electricity demand, such as stationary power plants and the energy sector. They protect gas turbine blades and engines from surface degradation processes like corrosion, ensuring optimal performance and longevity. TBCs are not limited to aerospace and power generation; they are also used in automobile production, marine propulsion, and gasoline engines. The versatility of TBCs makes them an essential component in various industries, contributing to efficiency, durability, and reduced emissions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.36% |

|

Market growth 2024-2028 |

USD 4.83 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.22 |

|

Regional analysis |

North America, APAC, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 36% |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

A and A Thermal Spray Coatings, Chromalloy Gas Turbine LLC, Compagnie de Saint Gobain, CTS Inc., Fisher Barton, Flame Spray Inc., Hannecard Group, Hayden Corp., Honeywell International Inc., KECO Engineered Coatings Inc., Linde Plc, Metallic Bonds Ltd., Metallisation Ltd., Northwest Mettech Corp., OC Oerlikon Corp. AG, Precision Coatings Inc., Tech Line Coatings LLC, Thermion Inc., TWI Ltd., and Zircotec Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch