Thinners And Paint Strippers Market Size 2024-2028

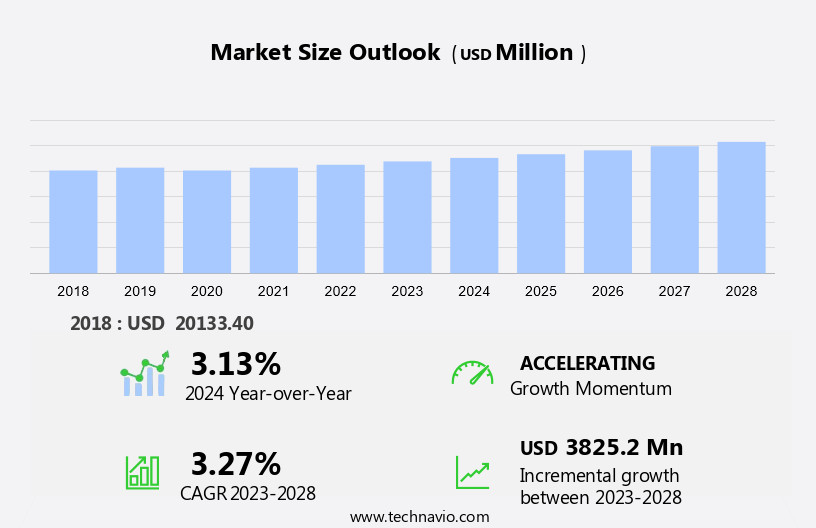

The thinners and paint strippers market size is forecast to increase by USD 3.83 billion at a CAGR of 3.27% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for these products in the paints and coatings industry. Fluctuating crude oil prices have minimal impact on the market, as thinners and paint strippers are derived from various sources, including crude oil, but also natural gas and coal. However, health hazards associated with the use of thinners and paint strippers pose a challenge to market growth. These chemicals can cause respiratory issues, skin irritation, and other health problems. To mitigate these risks, manufacturers are focusing on developing eco-friendly and low-toxicity alternatives. Additionally, stringent regulations regarding the use and disposal of these chemicals are driving innovation in the market. Overall, the market is expected to grow steadily, driven by increasing demand and ongoing efforts to improve product safety and sustainability.

What will be the Size of the Thinners And Paint Strippers Market During the Forecast Period?

- The market exhibits a dynamic business landscape, driven by various factors influencing supply and demand. Pricing in the market is influenced by consumer preferences, which lean towards eco-friendly and water-based alternatives. Data validation and forecasting models indicate a growing demand for thinners and paint strippers in application segments such as furniture refinishing, building renovation, industrial repair, and vehicle maintenance. Subsegments like solvent-based and water-based thinners and paint strippers witness varying growth trends. Crude oil prices and environmental protection regulations also impact market dynamics. Digital marketing and social media are increasingly utilized for product promotion, while methodologies like direct sales and distribution channels continue to dominate. The market scenario remains positive, with a focus on innovation and formulations that cater to diverse consumer needs and preferences.

How is this Thinners And Paint Strippers Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Furniture refinishing

- Building renovation

- Industrial repair

- Vehicle maintenance

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Application Insights

- The furniture refinishing segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of products used to modify the consistency of paints and remove old coatings. In 2023, the furniture refinishing segment emerged as the leading application area, driven by the growing preference for restoring and upgrading existing furniture. Dichloromethane, a common solvent, is extensively utilized for this purpose due to its ability to adjust paint viscosity and prevent hardening. The market landscape is influenced by various factors, including consumer trends, pricing dynamics, and supply-demand gaps. Data validation and forecasting models are employed to analyze market trends and future growth prospects. Subsegments include solvent-based and water-based thinners and paint strippers, with the former holding a significant market share.

Crude oil prices and digital marketing strategies, including social media, impact market scenarios. This professional analysis is based on credible data sources and reputable research studies from various market intelligence firms.

Get a glance at the market report of share of various segments Request Free Sample

The Furniture refinishing segment was valued at USD 5.65 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

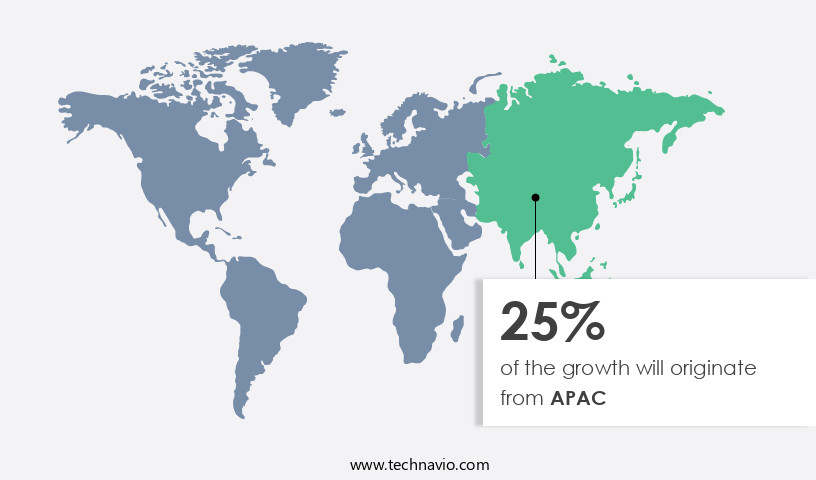

- APAC is estimated to contribute 25% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Another region offering significant growth opportunities to companies is North America. The growing demand for wooden furniture refinishing, coupled with the increasing number of affluent consumers, will facilitate the thinners and paint strippers market growth in North America over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Thinners and Paint Strippers Industry?

Increasing demand for thinners and paint strippers in the paints and coatings industry is the key driver of the market.

- Thinners and paint strippers are essential components in various applications, including furniture refinishing, building renovation, industrial repair, and vehicle maintenance. These products offer functional benefits beyond enhancing substrate aesthetics, such as paint thickness moderation, insulation, and light absorption. As a solvent in the paints and coatings industry, thinners and paint strippers, like acetone and dichloromethane, ensure fire protection, thereby driving market expansion during the forecast period. Consumer preferences and application scenarios influence market dynamics, with volume growth contingent on methodologies and data forecasting models. Crude oil prices and environmental protection regulations impact formulations, while digital marketing and social media influence company selection.

- The market encompasses several subsegments, including solvent-based and water-based products. Understanding these trends and factors is crucial for businesses seeking to capitalize on the market scenario. Data sources, including industry studies from reputable research firms, provide valuable insights into the market landscape and application segments.

What are the market trends shaping the Thinners And Paint Strippers Industry?

Fluctuating crude oil prices is the upcoming market trend.

- The market is influenced by various factors, including consumer preferences, product demand, and pricing dynamics. Methylene chloride and Methyl Ethyl Ketone (MEK) are key products in this market, used as paint thinners and strippers. These substances are derived from natural gas and oil, making their production and pricing dependent on crude oil prices. The EIA reports a 44.42% increase in Brent crude oil prices in 2022 compared to 2021, which may negatively impact the cost of petroleum fraction products, potentially hindering market growth. Data validation and forecasting models are crucial for understanding the market scenario and its subsegments, including Furniture Refinishing, Building Renovation, Industrial Repair, and Vehicle Maintenance.

- Digital marketing and social media are essential for company selection and reaching consumers. The application segment, geographic landscape, and environmental protection regulations also influence market dynamics. Synthesis of data from reliable sources is essential for gaining insight into this market.

What challenges does the Thinners And Paint Strippers Industry face during its growth?

Health Hazards of using thinners and paint strippers is a key challenge affecting the industry growth.

- The market faces challenges due to health and safety concerns. Exposure to paint thinners, which release hazardous fumes, can lead to symptoms such as headache, nausea, and discomfort. Methylene chloride, a solvent commonly used in paint strippers, is a significant health risk, with long-term exposure linked to cancer. Additionally, paint thinners are highly flammable and require careful storage in well-ventilated areas. These factors may impede market growth during the forecast period. Consumer preferences and application segments play a crucial role in market dynamics. Thinners and paint strippers find extensive use in various industries, including furniture refinishing, building renovation, industrial repair, and vehicle maintenance.

- However, environmental concerns and the push for eco-friendly alternatives may impact product demand. Data validation and forecasting models are essential for understanding market scenarios and subsegments. Market research methodologies include primary and secondary research, industry analysis, and data triangulation. Crude oil prices and digital marketing trends, such as social media, influence market dynamics. Thinner and paint strippers formulations continue to evolve, with a focus on environmental protection and increased efficiency. company selection and product evaluation are critical aspects of market analysis. Synthesis of data from various sources, including industry reports and company databases, is essential for a comprehensive understanding of the market landscape.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Akzo Nobel NV

- Asian Paints Ltd.

- BASF SE

- Cosmos Colour

- Ecochem

- EZ Strip Inc.

- Franmar Chemical

- Green Products Co

- GSP Sandblasting and Painting Inc.

- Henkel AG and Co. KGaA

- Innovative Chemical Products

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- Sika AG

- SolvChem Inc.

- Tetraclean

- The Savogran Co.

- The Sherwin Williams Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market exhibits a significant supply-demand gap, driven by varying consumer preferences and application segments. Pricing dynamics play a crucial role in this market, with factors such as production costs, crude oil prices, and environmental regulations influencing the price points. Product preferences among consumers continue to evolve, with a growing emphasis on eco-friendly and water-based alternatives. This trend is particularly noticeable in the furniture refinishing and building renovation sectors, where solvent-based products have traditionally dominated. The market is experiencing growth as demand rises in industries like luxury furniture and construction, where these products are essential for refinishing surfaces and preparing materials for high-end designs and durable structures. However, the increasing awareness of environmental concerns has led to a shift towards more sustainable options. Data validation and forecasting models are essential tools for market participants to understand the market scenario and make informed decisions.

Moreover, these models take into account various market dynamics, including consumer patterns, methodologies, and subsegments. The application segment for industrial repair and vehicle maintenance continues to be a significant contributor to the market's growth. The geographic landscape of the market is diverse, with different regions exhibiting unique market scenarios. For instance, some regions may prioritize cost-effective solutions, while others may focus on eco-friendliness and regulatory compliance. Crude oil prices have a significant impact on the production costs of thinners and paint strippers, particularly those derived from petroleum-based sources. Digital marketing and social media have become essential channels for market participants to reach customers and promote their products.

Furthermore, company selection is a critical aspect of the market, with buyers considering factors such as product quality, environmental impact, and pricing when choosing suppliers. The study of the market involves a synthesis of various data sources, including industry reports, company databases, and government statistics. Paint strippers find extensive applications in various industries, including furniture refinishing, building renovation, industrial repair, and vehicle maintenance. The market for these products is expected to grow, driven by increasing demand for efficient and eco-friendly solutions. Environmental protection regulations continue to shape the market landscape, with formulations becoming increasingly focused on reducing VOC emissions and minimizing environmental impact.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 3.83 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.13 |

|

Key countries |

US, China, India, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Thinners And Paint Strippers Market Research and Growth Report?

- CAGR of the Thinners And Paint Strippers industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the thinners and paint strippers market growth of industry companies

We can help! Our analysts can customize this thinners and paint strippers market research report to meet your requirements.