Toothpaste Market Size 2025-2029

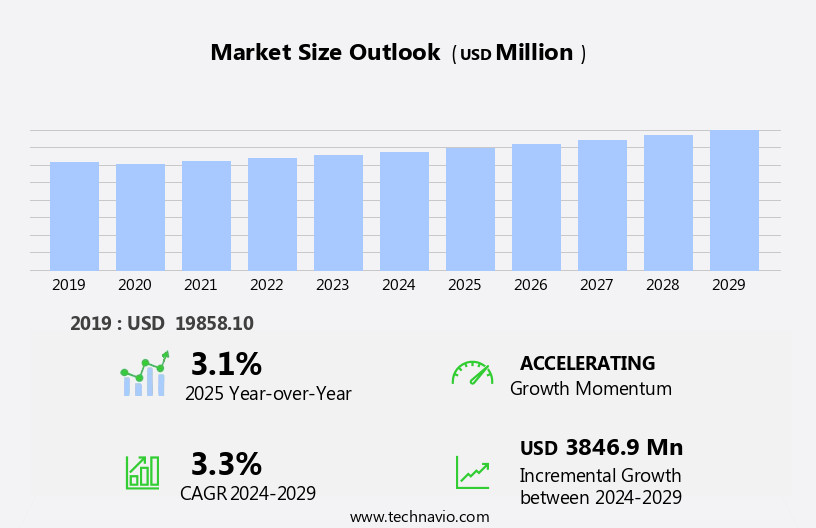

The global toothpaste market is forecast to expand by USD 3.85 billion between 2024 and 2029, registering a steady CAGR of 3.3%.

- Growing awareness of oral hygiene and its link to overall health is fueling consumer demand for advanced toothpaste products. Shifts in lifestyle and rising disposable incomes have pushed companies to launch innovative solutions such as whitening formulas, herbal toothpaste, fluoride-free variants, and sensitivity-specific products. At the same time, the popularity of eco-friendly packaging and sustainable formulations is reshaping the industry landscape.

- However, challenges remain. Homemade remedies, ayurvedic alternatives, and natural DIY solutions are increasingly preferred in cost-sensitive markets, threatening mainstream toothpaste adoption. Brands must counter this trend by offering affordable yet effective products, along with value-driven packaging and strong digital marketing campaigns.

- The rise of e-commerce platforms and direct-to-consumer (D2C) subscription models is also transforming how toothpaste reaches consumers. Leading companies such as Colgate-Palmolive, Procter & Gamble, Unilever, Dabur, and GSK are investing heavily in online strategies to capture this growing sales channel. Moving forward, market success will depend on the ability to align with consumer preferences, leverage digital channels, and differentiate through innovation.

What will be the Size of the Toothpaste Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The toothpaste industry continues to evolve, driven by consumer health priorities, new product development, and advanced oral care routines. Demand is rising for whitening toothpaste, natural/herbal formulations, fluoride-free variants, and sensitivity solutions. Breath-freshening, antibacterial, and tartar-control agents are now mainstream, while nano-hydroxyapatite and stannous fluoride are being adopted in premium products. Validation through clinical trials and American Dental Association (ADA) approvals boosts consumer confidence. Adoption of sonic and ultrasonic toothbrushes is reshaping oral care habits, indirectly boosting premium toothpaste demand. Distribution channels are shifting rapidly. While offline retail (supermarkets, drugstores, pharmacies) continues to dominate, online platforms and subscription services are growing at double-digit rates.

Oral Hygiene:

A Core Consumer Priority Oral health remains a top global priority, with dentists and professional bodies emphasizing fluoride use, antimicrobial agents, and proper brushing techniques. Sensitive teeth products (desensitizing agents, stain removal solutions) are seeing strong growth, particularly among aging populations. Whitening and enamel-protection agents appeal to younger consumers focused on cosmetic benefits. Fluoride concentration and shelf-life stability are critical to both efficacy and safety. Periodontal disease prevention through tartar-control agents and pH-balanced formulations is a fast-growing segment. Research & development investments are accelerating. Brands are exploring probiotic toothpaste, herbal actives (aloe vera, neem, tea tree oil), and sustainable alternatives like toothpaste tablets. These innovations are helping companies capture new consumer groups while ensuring compliance with global safety and quality standards.

How is this Toothpaste Industry segmented?

The toothpaste industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Conventional

- Herbal

- Whitening and sensitive

- End-user

- Adults

- Children

- Active Ingredient

- Fluoride-based

- Fluoride-free

- Formulation

- Gel

- Paste

- Powder

- Tablets

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

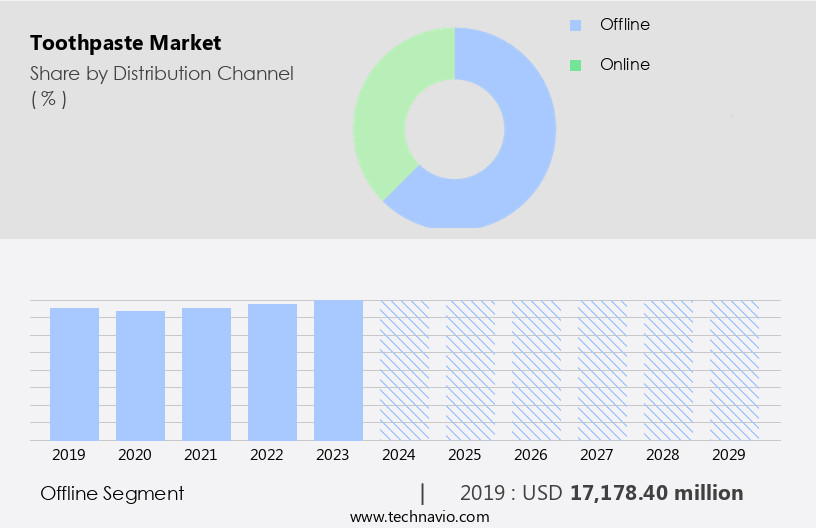

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, essential oils and herbal ingredients have gained popularity among consumers prioritizing natural oral care solutions. Safety standards ensure product quality and consumer safety, guiding marketing campaigns that emphasize these attributes. Retail sales continue to thrive, with offline channels dominated by hypermarkets, supermarkets, department stores, drug stores, and pharmacies. Walmart, Costco Wholesale Corporation, Target Brands, Inc., and Tesco.Com lead the distribution landscape, providing extensive customer reach. Colgate-Palmolive Company and other manufacturers leverage these retailers to sell their oral care products, including toothpaste, manual toothbrushes, and dental floss. Consumer behavior influences pricing strategies, with affordability and brand loyalty key factors.

Sonic and electric toothbrushes, along with whitening agents and desensitizing agents, cater to diverse oral health needs. Oral hygiene remains a priority, driving demand for anti-cavity agents, tartar control agents, and clinical trial-backed products. Online sales and e-commerce platforms are increasingly significant distribution channels, while abrasivity index, flossing techniques, and brushing techniques remain essential considerations for manufacturers. Oral health concerns, such as gum disease, tooth enamel, and periodontal disease, continue to fuel market growth. Whitening effectiveness and breath freshening agents further enhance product appeal, while quality control and distribution channels ensure consumer satisfaction. Ultrasonic toothbrushes and organic ingredients cater to niche markets, with a focus on sustainability and eco-friendly practices.

The Offline segment was valued at USD 17.18 billion in 2019 and showed a gradual increase during the forecast period.

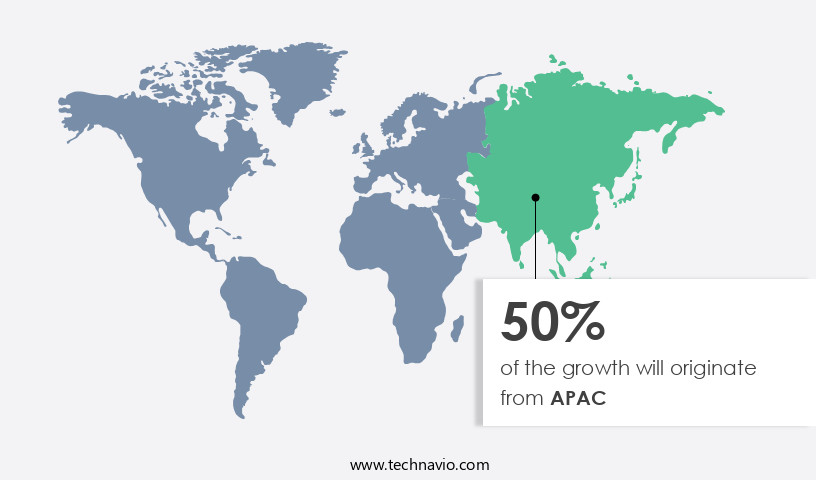

Regional Analysis

APAC is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific region is experiencing significant growth, fueled by increasing consumer awareness and disposable income. In China, there is a growing preference for high-quality toothpaste as more people prioritize oral health. The National Oral Health Epidemiological Investigation revealed a high prevalence of dental issues, particularly among children, leading consumers to seek premium toothpaste options. These products offer enhanced benefits, such as anti-cavity and enamel protection, as people move away from budget-friendly choices. In Japan, the market is expanding due to heightened concerns about oral health among both the aging population and younger consumers.

With one of the highest levels of dental awareness globally, demand is strong for specialized toothpaste addressing issues like hypersensitivity and caries prevention. Herbal ingredients and essential oils are gaining popularity in toothpaste formulations, catering to consumers seeking natural alternatives. Safety standards and quality control are crucial in the industry, ensuring toothpaste is safe for use and effective in maintaining oral hygiene. Marketing campaigns emphasize the importance of oral health and the benefits of using specific toothpaste brands. Retail sales dominate the distribution channels, but online sales are increasing due to convenience and accessibility. Pricing strategies vary, with some brands focusing on affordability and others on premium pricing for added benefits.

Consumers use manual and electric toothbrushes, dental floss, and interdental brushes as part of their oral care routine. Whitening agents, desensitizing agents, and breath freshening agents are common additives in toothpaste. Clinical trials and ph level testing are essential in developing toothpaste formulations that effectively combat gum disease, tooth decay, and other dental issues. The market is dynamic, with ongoing research and development focusing on improving oral health through innovative ingredients and technologies.

Market Dynamics

The global toothpaste market is witnessing dynamic shifts, driven by evolving toothpaste market trends and significant toothpaste market growth drivers. The expanding toothpaste market size reflects increased consumer focus on oral hygiene. While fluoride toothpaste remains a staple for cavity prevention, demand for specialized products like whitening toothpaste, sensitive teeth toothpaste, and gum health toothpaste is rising. Consumers are increasingly seeking herbal toothpaste and natural toothpaste, including options like charcoal toothpaste. Children's toothpaste also represents a crucial segment. Beyond aesthetics, the market emphasizes solutions for plaque removal and bad breath solutions. Key ingredients like fluoride and advancements such as nano-hydroxyapatite are vital. Innovations in sustainable practices, exemplified by recyclable toothpaste tubes and optimized toothpaste manufacturing processes, are shaping the industry's future.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Toothpaste Industry?

- The significance of maintaining optimal oral and dental health has fueled the market's growth.

- Toothpaste is an essential component of oral hygiene, addressing various dental concerns such as gum disease, tooth decay, and tooth sensitivity. The market encompasses antimicrobial agents, whitening agents, and anti-cavity agents to cater to diverse consumer needs. Pricing strategies vary to accommodate different market segments and consumer preferences. In developing countries, the demand for toothpaste remains relatively low due to limited awareness and the use of natural remedies for oral health issues. However, the importance of dental and oral health is gaining recognition worldwide, as poor oral hygiene can lead to severe health complications, including periodontal diseases, oral cancer, and throat cancer.

- According to the Centers for Disease Control and Prevention (CDC), periodontal diseases are primarily caused by bacterial infections and inflammation of the gums and bones surrounding the teeth. Ensuring a long shelf life and ADA acceptance are crucial factors in the market. Consumers seek effective oral care solutions, driving market growth and innovation.

What are the market trends shaping the Toothpaste Industry?

- The trend in the business world is shifting towards an increased focus on new product launches. Companies are prioritizing innovation to stay competitive in the market.

- The market is witnessing significant innovation as companies respond to evolving consumer preferences and competitive pressures. New product launches are a key trend, with firms incorporating advanced ingredients for added health benefits. These include natural extracts and chemical compounds that address specific oral health concerns, such as sensitivity, gum protection, and whitening. Additionally, unique flavors and eco-friendly packaging are gaining popularity, broadening market appeal and enhancing brand differentiation. For instance, Colgate enhanced its Strong Teeth Toothpaste in 2024 with its new Arginine + Calcium Boost Technology. Quality control remains a priority, with companies implementing rigorous testing procedures to ensure toothpaste meets high standards for safety and efficacy.

- Distribution channels continue to expand, with online sales growing in popularity. Stain removal agents and desensitizing agents are also common features in toothpaste, contributing to improved dental health. Brushing and flossing techniques continue to evolve, with consumers seeking effective methods to maintain optimal oral hygiene. Overall, the market is dynamic, with companies investing in research and development to meet consumer needs and stay competitive.

What challenges does the Toothpaste Industry face during its growth?

- The rise in popularity of homemade remedies and alternative products poses a significant challenge to the industry's growth trajectory.

- The market faces challenges from the increasing popularity of alternative oral care products, such as electric toothbrushes, organic and natural toothpastes, and interdental brushes. These alternatives cater to consumers seeking effective whitening, freshening breath, and tartar control, while prioritizing organic ingredients and minimizing the use of synthetic additives. The rural population in developing countries, with limited access to commercial oral hygiene products, presents an opportunity for toothpaste manufacturers. To expand their customer base and revenue, companies are focusing on creating awareness about modern oral care habits and the benefits of toothpaste. Moreover, the adoption of advanced oral care technologies like ultrasonic toothbrushes and the integration of breath freshening agents and tartar control agents in toothpaste formulations have become essential to cater to evolving consumer preferences.

- Clinical trials and research studies play a crucial role in validating the effectiveness and safety of toothpaste ingredients and formulations. Maintaining a pH level within the optimal range is another essential aspect of toothpaste development, as it influences the overall oral health and the efficacy of the toothpaste. By staying informed about market trends and consumer preferences, toothpaste manufacturers can effectively address the challenges and capitalize on the opportunities in this dynamic market.

Exclusive Customer Landscape

The toothpaste market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the toothpaste market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, toothpaste market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This research highlights 3M's Clinpro tooth cream as a notable toothpaste innovation. With advanced fluoride technology, it effectively strengthens teeth and fights cavities. The micro-dentifrice formula delivers optimal plaque removal for improved oral health.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Amway Corp.

- Archer Daniels Midland Co.

- Church and Dwight Co. Inc.

- Colgate Palmolive Co.

- Dabur India Ltd.

- Dr. Fresh LLC

- GC Corp.

- GlaxoSmithKline Plc

- Henkel AG and Co. KGaA

- Himalaya Global Holdings Ltd.

- Johnson and Johnson Services Inc.

- Lion Corp.

- Natura and Co Holding SA

- Orkla ASA

- Patanjali Ayurved Ltd.

- Perrigo Co. Plc

- Sunstar Suisse SA

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Toothpaste Market

- In January 2024, Colgate-Palmolive introduced a new line of toothpastes, "Colgate Eco-Smart," in the European market. This eco-friendly product line uses recycled packaging and is free of microbeads (Reuters, 2024).

- In March 2024, GlaxoSmithKline and PepsiCo's oral health division, Oral Care, announced a strategic partnership to co-develop and commercialize oral health products in emerging markets (Wall Street Journal, 2024).

- In May 2024, Unilever completed the acquisition of the dental business of GSK Consumer Healthcare for €3.3 billion, expanding its reach in the oral care segment (SEC Filing, Unilever, 2024).

- In April 2025, the U.S. Food and Drug Administration (FDA) approved Colgate-Palmolive's new toothpaste, "Colgate Total with Stannaplast," containing the active ingredient stannous fluoride and stannous chloride, for the prevention and treatment of cavities and gum disease (FDA, 2025).

Research Analyst Overview

- In the dynamic the market, hydrogen peroxide and titanium dioxide continue to be popular ingredients, driving sales forecasts. Influencer marketing and social media platforms have emerged as effective channels for brand building, reaching the target audience. Customer satisfaction is paramount, with zinc citrate, baking soda, aloe vera, and tea tree oil catering to diverse consumer preferences. Dental professionals' recommendations and online reviews significantly impact purchasing decisions. Supply chain management and ingredient sourcing are critical aspects of the industry, with potassium nitrate and sodium bicarbonate among the essential components. Product innovation, such as the inclusion of sodium fluoride and stannous fluoride, enhances advertising effectiveness and product positioning.

- E-commerce platforms and online retailers have disrupted traditional sales channels, necessitating marketing research and public relations strategies. Calcium carbonate, an essential component in toothpaste production, undergoes continuous innovation to improve packaging design and sustainability. Consumer preferences for natural ingredients and eco-friendly practices have influenced the market, leading to the rise of brands focusing on these aspects. Overall, the market remains competitive, with companies leveraging various strategies to meet evolving customer demands.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Toothpaste Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 3846.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Toothpaste Market Research and Growth Report?

- CAGR of the Toothpaste industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the toothpaste market growth of industry companies

We can help! Our analysts can customize this toothpaste market research report to meet your requirements.