Potassium Nitrate Market Size 2024-2028

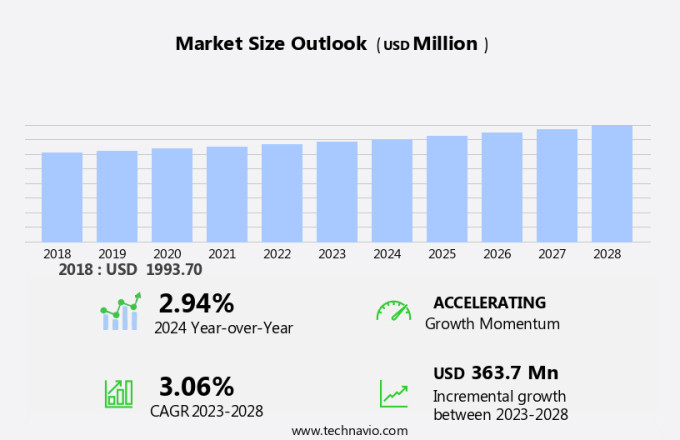

The potassium nitrate market size is forecast to increase by USD 363.7 million at a CAGR of 3.06% between 2023 and 2028. Potassium nitrate, a vital source of essential nutrients for crops, is widely used in the production of potassium chloride and muriate of potash. The market for this essential nutrient is experiencing significant growth due to the increasing demand for potassium nitrate-based fertilizers. Additionally, the expanding utilization of potassium nitrate in the manufacturing of sodium nitrate and nitre, or saltpetre, further boosts market growth. However, the market faces challenges, including potential health hazards associated with the handling and use of potassium nitrate. To mitigate these risks, cost-effective alternatives, such as potassium chloride, are gaining popularity among farmers and manufacturers. Despite these challenges, the market is expected to continue its growth trajectory, driven by the essential role of potassium nitrate in agriculture and various industrial applications.

The market plays a significant role in the agricultural sector, supplying essential nutrients for food production. This inorganic compound, also known as saltpeter, is a vital component in fertilizers, contributing to improved plant health and increased crop yields. Potassium nitrate is a valuable resource for farmers, as it aids in the process of photosynthesis, leading to better crop quality. It is particularly effective in addressing pests and diseases, ensuring the overall health of the crops and reducing the need for pesticides. In greenhouse cultivation, potassium nitrate is indispensable for maintaining optimal growing conditions.

Additionally, its application results in stronger, more resilient plants that can withstand various environmental stressors. Beyond agriculture, potassium nitrate finds applications in various industries. In the manufacturing sector, it is used as a raw material for producing combustible substances, such as fireworks, rocket fuel, and black powder. In the pharmaceutical industry, it is an essential ingredient in medicines and food preparation, including meat processing. Despite its widespread use, potassium nitrate is an exhaustible resource. Its production involves the mining process, which can pose risks, including explosions. However, continuous efforts are being made to improve the CSP (Continuous Stirred Tank Reactor) process to ensure a more efficient and safer production method.

Similarly, potassium nitrate is primarily composed of potassium and nitrogen, making it an essential nutrient for plant growth. Its versatility extends to various industries, including agriculture, manufacturing, and pharmaceuticals. In the agricultural sector, potassium nitrate is a crucial element in maintaining soil health and enhancing crop productivity. Its application leads to improved crop quality, increased yields, and better resistance to pests and diseases. In the manufacturing industry, potassium nitrate is used in the production of various combustible substances. Its role in fireworks and rocket fuel is well-known, while its application in black powder is essential for the production of explosives.

In conclusion, in the pharmaceutical industry, potassium nitrate is used in the synthesis of various medicines and food additives. Its role in food preparation, particularly in meat processing, is crucial for maintaining food safety and quality. In conclusion, the market plays a vital role in various industries, from agriculture to manufacturing and pharmaceuticals. Its versatility and essential nutrient properties make it an indispensable resource for enhancing agricultural productivity, ensuring food safety, and contributing to the production of various industrial and consumer products.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Agriculture

- General industries

- Pharmaceutical

- Food and beverages

- Type

- Potassium chloride

- Sodium nitrate

- Ammonium nitrate

- Geography

- APAC

- China

- India

- Japan

- North America

- Canada

- US

- Europe

- Middle East and Africa

- South America

- APAC

By End-user Insights

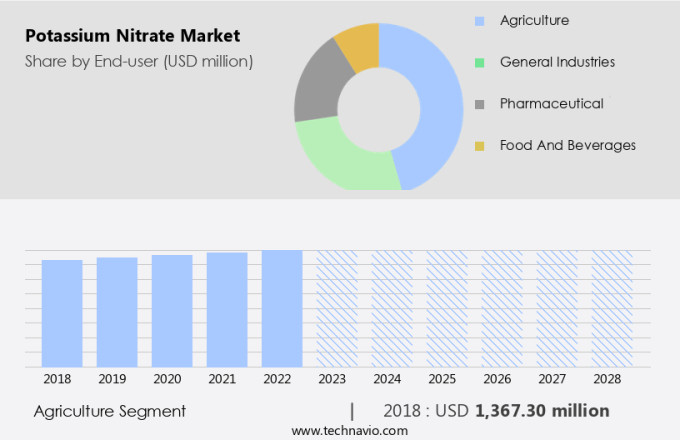

The agriculture segment is estimated to witness significant growth during the forecast period. Potassium nitrate is an essential nutrient source for plants, providing phosphate, potassium, and nitrogen, which are crucial for optimal crop growth. This inorganic compound is particularly valued for its high solubility and chloride-free properties, making it a preferred choice in specific agricultural conditions. In the realm of fireworks and rocket fuel, potassium nitrate is a key combustible substance.

Get a glance at the market share of various segments Request Free Sample

The agriculture segment was valued at USD 1.37 billion in 2018 and showed a gradual increase during the forecast period. In the medicinal sector, it is utilized in various treatments, while in food preparation and meat processing, it functions as a preservative and color enhancer. In the hydroponic cultivation and plant production industries, potassium nitrate-based fertilizers are widely employed. The versatility of potassium nitrate is evident in its various applications, from agriculture to industrial uses.

Regional Insights

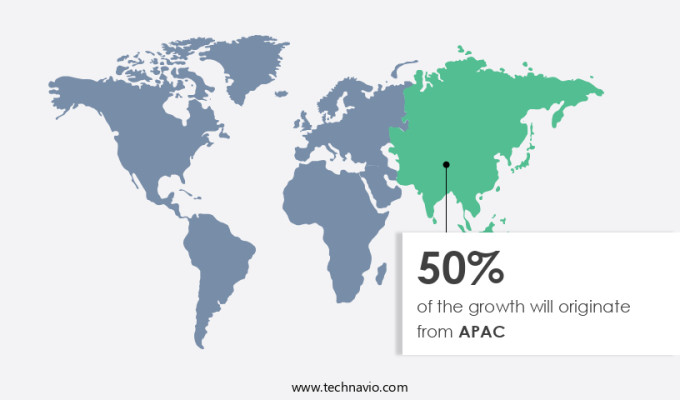

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Potassium nitrate is a vital inorganic chemical used primarily in various industries, including agriculture and pyrotechnics. In 2023, the Asia Pacific (APAC) region emerged as the major consumer and producer of potassium nitrate, with China and India being the key contributors. The region's vast agricultural lands and the increasing demand for food grains due to population growth make agriculture the most significant sector for potassium nitrate applications. The agricultural economies in APAC are investing heavily to expand their food processing sectors, which is expected to significantly boost the demand for potassium nitrate-based fertilizers during the forecast period. For instance, in 2021, the Indian government announced plans to invest over USD900 billion to build mega food parks in the country.

In addition to agriculture, potassium nitrate finds extensive use in the pyrotechnics industry due to its ability to produce white smoke and its oxidizing properties. However, stringent regulations regarding the handling and storage of potassium nitrate due to its sensitivity to heat and shock make it essential to adhere to safety guidelines. The increasing demand for potassium nitrate in agriculture and pyrotechnics, coupled with the growing investments in these sectors, is expected to drive market growth.

In summary, the market is expected to witness significant growth in the APAC region due to the increasing demand from the agriculture and pyrotechnics industries. The region's agricultural economies are investing heavily to expand their food processing sectors, which is expected to significantly boost the demand for potassium nitrate-based fertilizers. Stringent regulations regarding the handling and storage of potassium nitrate make it essential to adhere to safety guidelines. Market reports suggest that the market is expected to grow steadily during the forecast period, driven by the increasing demand from agriculture and pyrotechnics industries.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increase in demand for potassium nitrate-based fertilizers is the key driver of the market. In response to the growing global population and the limited expansion of agricultural land, there is a heightened emphasis on boosting agricultural productivity. With the global population rising from 7.3 billion in 2015 to 7.7 billion in 2020, there is a pressing need for innovative solutions to enhance crop production in the existing land area. One such solution is the use of agricultural chemicals, including fertilizers, to optimize soil fertility, crop yields, and pest management.

In addition, these fertilizers play a crucial role in improving plant health and ensuring crop safety, thereby contributing significantly to food production and overall agricultural productivity. Key agricultural chemicals, such as potassium nitrate, have gained prominence due to their ability to enhance crop quality and protect against pests and diseases. The use of these chemicals is expected to continue increasing, as the agricultural sector seeks to meet the demands of the growing population while maintaining sustainable farming practices.

Market Trends

The growing use of fungicides is the upcoming trend in the market. In the agricultural sector, fungal infections pose a significant challenge for farmers, negatively impacting vegetable crop quality and productivity. Fungal diseases are among the leading causes of global crop loss. These issues are particularly problematic for home vegetable growers and farmers, as fungal infections can severely damage vegetable plants. Traditional methods, such as proper site selection, fertilization, plant spacing, staking, and watering, are essential for disease management in home-grown vegetables. However, these methods may not always be sufficient in preventing fungal infections. Fungicides have emerged as an effective solution for managing fungal diseases in vegetable crops. These chemical agents possess the ability to eliminate fungal pathogens and prevent the spread of fungal infections.

Similarly, essential nutrients like Potassium Nitrate (also known as Nitre, Saltpetre, or Muriate of Potash) play a crucial role in fungicide formulations. Potassium Nitrate is a vital source of potassium, which is essential for plant growth and disease resistance. It is often used as an alternative to Potassium Chloride (Muriate of Potash) due to its cost-effectiveness. Farmers and gardeners can benefit significantly from using fungicides containing Potassium Nitrate to protect their vegetable crops from fungal diseases. By incorporating these essential nutrients into their disease management strategies, they can improve crop health, enhance productivity, and minimize losses due to fungal infections.

Market Challenge

The risk of health hazards due to potassium nitrate is a key challenge affecting the market growth. Potassium nitrate is a widely used compound in various industries, particularly in fertilizer production for both greenhouse and field cultivation. In agriculture, it provides essential nutrients, including potassium and nitrogen, which are crucial for plant growth. However, the use of potassium nitrate comes with potential health risks. Exposure to this compound can lead to various health issues, such as muscle weakness, gastrointestinal problems, increased urination, discomfort in the legs, anxiety, and numbness around the mouth, feet, and hands.

However, direct contact with the eyes and skin may cause a burning sensation or irritation, while prolonged contact with the eyes may result in inflammatory conditions. Severe exposure to potassium nitrate can lead to life-threatening indications. Farmers and other professionals handling this compound must take necessary precautions to minimize the risks associated with its use. Despite these challenges, the demand for potassium nitrate remains strong due to its significant role in enhancing crop yield and improving overall agricultural productivity.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Wentong Potassium Salt Group Co. Ltd. - The company offers products such as potassium nitrate, potassium chloride, and high-grade water-soluble compound fertilizer.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AG Chemi Group s.r.o.

- Akshay Group of Companies

- Anish Chemicals

- Arihant Chemical

- BGP Group of Companies

- Jagannath Chemicals

- Jost Chemical Co.

- Nitroparis S.L.

- Otsuka Chemical Co. Ltd.

- Otto Chemie Pvt. Ltd.

- Penta s.r.o

- Ravi Chem Industries

- SNDB

- Spectrum Laboratory Products Inc.

- SQM S.A.

- Vizag Chemical International

- VWR International LLC

- Yara International ASA

- Yogi Dye Chem Industries

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Potassium nitrate, a critical ingredient in the agricultural sector, plays a significant role in food production by enhancing agricultural productivity, improving crop yields, and promoting plant health. This essential nutrient is vital for maintaining optimal crop quality, combating pests and diseases, and ensuring overall farm health. In agriculture, potassium nitrate is utilized in both greenhouse and field cultivation, catering to the needs of farmers worldwide. Furthermore, potassium nitrate's applications extend beyond agriculture. It is a crucial raw material in various industries, including food & beverage, electronics, and pharmacology. In food & beverage production, it serves as an essential ingredient in meat processing and food preparation.

In the pharmaceutical industry, it is used in medicines and pharmacology. However, it is essential to note that potassium nitrate is an exhaustible resource. The mining process involves extracting it from ore-containing rock benches through drilling and blasting. The production of potassium nitrate also involves the use of drilling chemicals and raw materials such as nitre, sodium nitrate, and muriate of potash. Despite its importance, the use of potassium nitrate is subject to stringent regulations due to its potential use as combustible substances in fireworks, rocket fuel, gunpowder, matches, and ammonium nitrate.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.06% |

|

Market growth 2024-2028 |

USD 363.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.94 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 50% |

|

Key countries |

US, China, India, Japan, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AG Chemi Group s.r.o., Akshay Group of Companies, Anish Chemicals, Arihant Chemical, BGP Group of Companies, Jagannath Chemicals, Jost Chemical Co., Nitroparis S.L., Otsuka Chemical Co. Ltd., Otto Chemie Pvt. Ltd., Penta s.r.o, Ravi Chem Industries, SNDB, Spectrum Laboratory Products Inc., SQM S.A., Vizag Chemical International, VWR International LLC, Wentong Potassium Salt Group Co. Ltd., Yara International ASA, and Yogi Dye Chem Industries |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch