Torque Converter Market Size 2024-2028

The torque converter market size is forecast to increase by USD 3.97 billion at a CAGR of 6.8% between 2023 and 2028.

What will be the Size of the Torque Converter Market During the Forecast Period?

How is this Torque Converter Industry segmented and which is the largest segment?

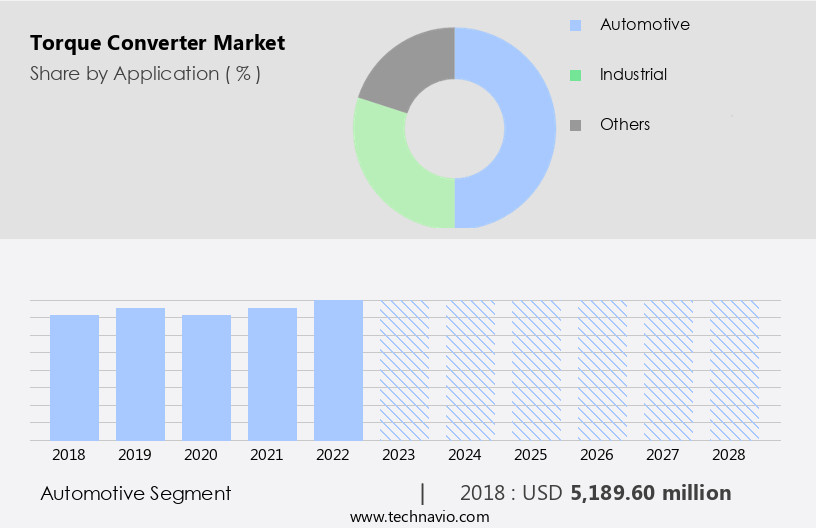

The torque converter industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Automotive

- Industrial

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

- The automotive segment is estimated to witness significant growth during the forecast period.

A torque converter is a vital component in continuous variable transmission (CVT) and hydraulic automatic transmission vehicles. It facilitates power transmission from the engine to the transmission, allowing the engine to rotate independently when the vehicle is idling. At low engine speeds, such as when a vehicle is stationary at a traffic light, the torque transmitted to the transmission is minimal, requiring only light pressure on the brake pedal. However, when the driver accelerates, the engine revs up and pumps more fluid into the torque converter, resulting in increased torque transmission to the wheels. The torque converter comprises an impeller, turbine, stator, clutch, converter housing, lock-up clutch, and fluid.

It functions by circulating transmission fluid, which absorbs torque and transmits it to the transmission shaft. The torque converter enhances vehicle fuel efficiency by controlling torque transmission during the acceleration and coupling phases, minimizing slippage and overheating. Elastomer seals prevent fluid leakage, while the clutch ensures smooth torque multiplication. The torque converter's efficiency is measured by the system's overall efficiency during idle and transmission oil circulation.

Get a glance at the Torque Converter Industry report of share of various segments Request Free Sample

The Automotive segment was valued at USD 5.19 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth In the Asia Pacific region, driven by the increasing demand for passenger vehicles in developing economies, such as China, India, and South Korea. Factors contributing to this growth include rising disposable income, industrialization, and the launch of new car models. In these countries, the perception of owning a car as a symbol of social status is a major driver, despite challenges such as traffic congestion, government regulations, and air pollution. The torque converter, a key component of automatic transmissions, facilitates power transmission from the engine to the transmission input shaft. It consists of an impeller, turbine, stator, clutch, and converter housing.

During the acceleration phase, the impeller rotates at a higher speed than the turbine, causing fluid to be forced through the torque converter. In the coupling phase, the clutch engages, allowing the turbine to rotate at the same speed as the impeller, resulting in torque multiplication. The market is also influenced by factors such as vehicle fuel efficiency, system efficiency, and transmission fluid circulation. However, challenges such as stall, slippage, overheating, elastomer seals, fluid leak, and clutch seizure can impact market growth. The torque converter plays a crucial role in power transmission, enabling vehicles to move smoothly and efficiently.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Torque Converter Industry?

Globalization of auto industry to increase demand for automatic transmission vehicles in APAC is the key driver of the market.

What are the market trends shaping the Torque Converter Industry?

Increasing technological advancements in torque converters is the upcoming market trend.

What challenges does the Torque Converter Industry face during its growth?

High replacement and repair costs is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The torque converter market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the torque converter market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, torque converter market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ACC Performance Products Plus Inc. - The company provides an extensive selection of torque converters, encompassing innovative designs such as the eAxle Offset Design (150kW) and 1-motor hybrid transmission, as well as high torque capacity RWD multi-stage hybrid transmissions and high torque capacity RWD 10-speed automatic transmissions. Additionally, the product range includes a direct shift continuously variable transmission. These advanced torque converter solutions cater to diverse applications and industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACC Performance Products Plus Inc.

- AISIN CORP.

- BorgWarner Inc.

- Continental AG

- Dynamic Manufacturing Inc.

- EXEDY Corp.

- Ford Motor Co.

- Honda Motor Co. Ltd.

- Hyundai Motor Co.

- Isuzu Motors Ltd.

- Porsche Automobil Holding SE

- Precision Industries

- Renault SAS

- Schaeffler AG

- Sonnax Transmission Co. Inc.

- SUBARU Corp.

- Transtar Industries Inc.

- Valeo SA

- Voith GmbH and Co. KGaA

- ZEPPELIN GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Torque converters are essential components In the powertrain system of automatic transmissions in various types of vehicles. These devices transmit power from the engine to the transmission, facilitating smooth acceleration and vehicle movement. The torque converter functions as a fluid coupling, utilizing the principles of fluid mechanics and rotating driven loads to transmit torque. The torque converter comprises several parts, including an impeller, turbine, stator, clutch, and converter housing. The impeller, located at the engine end of the converter, rotates when the engine is running, drawing in transmission fluid. This fluid then passes through the turbine, which is connected to the output shaft of the converter.

The stator, a stationary component, is located between the impeller and turbine and acts as a barrier, directing the fluid flow to the turbine blades. The clutch in a torque converter is a friction clutch that engages and disengages the impeller and turbine during different phases of vehicle operation. In the acceleration phase, the clutch slips, allowing the impeller to rotate faster than the turbine, increasing torque multiplication. During the coupling phase, the clutch locks up, allowing the impeller and turbine to rotate at the same speed, improving system efficiency. Torque converters play a crucial role in vehicle performance and fuel efficiency.

However, they can experience issues such as slippage, overheating, elastomer seal failure, fluid leak, and clutch seizure. Slippage occurs when the clutch fails to engage properly, resulting in power loss and reduced vehicle performance. Overheating can damage the torque converter and other components, leading to costly repairs. Elastomer seal failure can cause fluid leakage, while clutch seizure can prevent the clutch from disengaging, affecting vehicle movement. To maintain optimal torque converter performance, regular maintenance is essential. This includes checking the transmission fluid level, inspecting the elastomer seals, and monitoring the converter housing for signs of damage. Additionally, proper fluid circulation and cooling are crucial to prevent overheating.

Torque converters have undergone significant advancements in engineering and fluid mechanics, leading to improvements in system efficiency, power output, and vehicle fuel efficiency. The use of tilting blades, centrifugal pumps, and advanced materials has enhanced torque converter performance and durability. In conclusion, torque converters are vital components In the powertrain system of automatic transmissions, facilitating smooth power transmission from the engine to the transmission. Their functionality relies on the principles of fluid mechanics and rotating driven loads, with various components working in harmony to ensure efficient power transfer. Regular maintenance and proper usage are essential to maintain optimal torque converter performance and prevent potential issues.

Continuous advancements in engineering and fluid mechanics continue to improve torque converter performance and contribute to vehicle innovation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2024-2028 |

USD 3971 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.9 |

|

Key countries |

China, US, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Torque Converter Market Research and Growth Report?

- CAGR of the Torque Converter industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the torque converter market growth of industry companies

We can help! Our analysts can customize this torque converter market research report to meet your requirements.