Power Transmission Motion Control Market Size and Trends

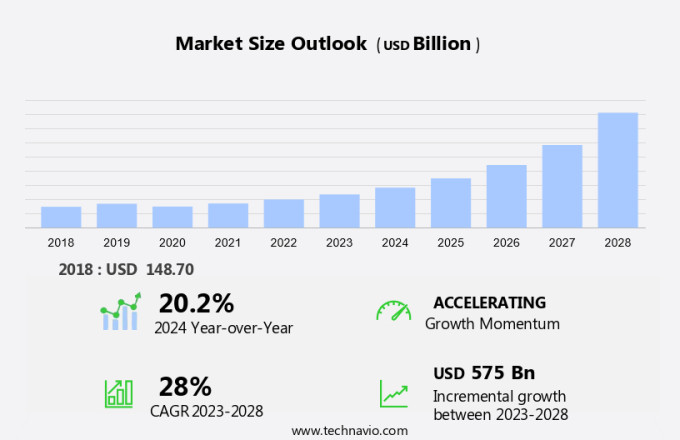

The power transmission motion control market size is forecast to increase by USD 575 billion, at a CAGR of 28% between 2024 and 2028. The market is experiencing significant growth due to the increasing adoption of industrial automation in various sectors, including construction machinery and material handling systems. Advanced gear and bearing & drive systems are essential components in these applications, ensuring reliability and efficiency in the transmission method. The global distribution market for industrial equipment is expanding, leading to increased demand for power transmission motion control solutions. As industries shift towards energy configuration for sustainable operations, there is a growing focus on improving the efficiency of industrial machinery. However, the high costs associated with repair and upgradation of these machines pose a challenge to market growth. To stay competitive, manufacturers must continuously innovate and offer cost-effective, reliable, and efficient solutions to meet the evolving needs of their customers.

The market encompasses a range of components used to transfer mechanical energy from one point to another in industrial applications. These components include bearings, axles, brackets, shafts, belts, chains, gears, and various connection types. Bearings are essential components in power transmission systems, facilitating smooth rotation and reducing friction. Axles serve as the central shaft for transmitting rotational power, while brackets provide support and connection points for other components. Shafts transfer power between connected machinery, and belts and chains serve as power transmission media. Gears alter the movement speed and motion form, enabling efficient energy configuration. Power transmission products play a crucial role in industrial automation, construction machinery, material handling systems, and bearing & drive systems. The global distribution market for these components is vast, catering to the needs of various industrial equipment sectors. Reliability and efficiency are paramount considerations in power transmission motion control. The transmission method and energy configuration must be carefully selected to ensure optimal performance.

Movement speed and motion form are essential factors in determining the appropriate power transmission solution for a given application. Mechanical power transmission is the transfer of energy from one place to another using mechanical means. This process involves the use of mechanical linkages, which connect various machines and components in a system. Power transmission components are essential for ensuring the reliable operation of these systems, as they facilitate the transfer of energy and enable smooth mechanical motion. In summary, the market consists of various components, including bearings, axles, brackets, shafts, belts, chains, and gears, that facilitate the transfer of mechanical energy in industrial applications. These components are essential for the efficient operation of machinery in industries such as automation, construction, and material handling, among others. The selection of appropriate power transmission components depends on factors such as reliability, efficiency, transmission method, energy configuration, movement speed, and motion form.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Component

- Solutions

- Services

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- Middle East and Africa

- South America

- North America

By Component Insights

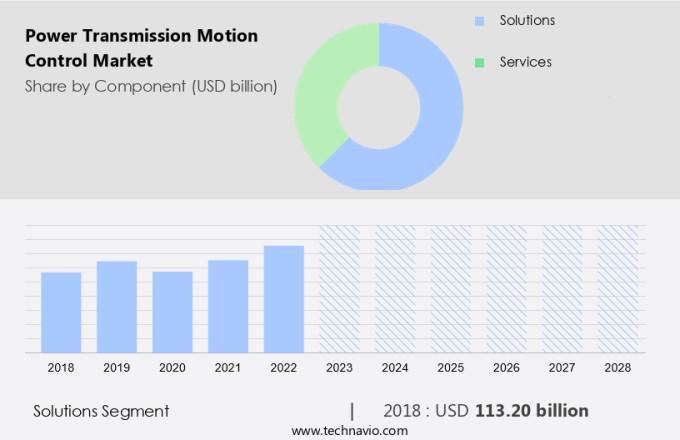

The solutions segment is estimated to witness significant growth during the forecast period. Power transmission refers to the process of transferring mechanical power from its origin to a point where it can be utilized to perform work. Motion control, a subset of automation, involves the use of systems and subsystems that regulate the movement of machine components in a precise manner. Various components, including clutches, chains, gears, couplings, and conveyor belts, are integral to power transmission motion control. In today's manufacturing production environments, the need for energy-efficient solutions has led to an increase in demand for high-precision automated processes. Automation enables organizations to enhance productivity and reduce product lifecycle costs.

Get a glance at the market share of various segments Download the PDF Sample

The solutions segment was valued at USD 113.20 billion in 2018. As automation continues to expand, the utilization of power transmission motion control systems is anticipated to rise, enabling manufacturers to minimize energy consumption and boost production. Power transmission motion control components include clutches, chains, mechanical power transmission systems, electric motors, gears, and couplings. These elements play a crucial role in facilitating the smooth transfer of power and precise control of motion in manufacturing processes. By employing power transmission motion control solutions, manufacturers can optimize their production lines and improve overall operational efficiency.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

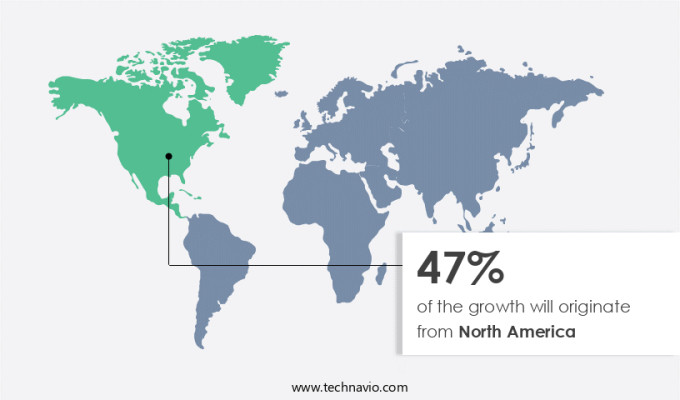

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in North America is experiencing significant growth, with the United States and Canada being the major contributors to this expansion. Established manufacturers in this region hold a strong market presence due to the high adoption of automation in various industries. In North America, there is a preference for personal vehicles, and the well-developed road infrastructure allows for extended commuting hours. However, government agencies, such as the Environmental Protection Agency (EPA) in the US, are implementing regulations on nitrogen oxide and carbon dioxide emissions, leading to an increase in the adoption of electric vehicles (EVs). End-users in North America include sectors like automotive, aerospace and defense, packaging machinery, printing machinery, cranes, hoists, and lifts. The power supply, speed range, and frequency requirements vary across these industries, making it essential for motion control systems to be versatile and efficient. Key players in the market include leading manufacturers who cater to the diverse needs of these industries, ensuring compliance with regulations and delivering optimal performance.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Power Transmission Motion Control Market Driver

High adoption of advanced and automated processes in the manufacturing sector is notably driving market growth. The market is experiencing significant growth due to the increasing demand for energy-efficient solutions in various industries. Automation of manufacturing processes is a key trend, as businesses seek to enhance productivity and decrease product lifecycle costs. Sectors such as electronics and semiconductors, food and beverage, automotive, and chemicals are leading the way in this regard.

Further, the growing emphasis on producing high-quality goods is expected to further boost the need for industrial automation. Consequently, the adoption of power transmission motion control systems is anticipated to increase, providing energy savings while boosting output. These systems are integral to maintaining precise control over machinery and processes, ensuring smooth operation and optimal performance. Thus, such factors are driving the growth of the market during the forecast period.

Power Transmission Motion Control Market Trends

The rise of Industry 4.0 is the key trend in the market. The market is experiencing significant growth due to the ongoing industrial revolution, also known as Industry 4.0. This revolution signifies the integration of traditional automation and information technology, leading to the computerization of industrial processes. The global distribution market for power transmission motion control systems is being driven by the increasing need for greater flexibility and improved overall equipment performance in various industries, including construction machinery, material handling systems, and industrial automation. The Industrial Equipment sector in the US is adopting these solutions to operate continuously, 24/7, thereby increasing efficiency and reliability.

Further, the transmission method and energy configuration of these systems play a crucial role in ensuring optimal performance and reducing downtime. The adoption of Industry 4.0 has led to the widespread use of advanced power transmission motion control solutions, automated equipment, and technology, enabling industrial facilities to operate more efficiently and effectively. Thus, such trends will shape the growth of the market during the forecast period.

Power Transmission Motion Control Market Challenge

High repair and upgradation costs for machines is the major challenge that affects the growth of the market. Power transmission motion control systems are essential components in various industries for transmitting power and controlling motion. These systems consist of several parts such as bearings, axles, brackets, shafts, connections, belts, and chains. The complexity and number of these components contribute to the high cost of procuring and maintaining these systems. As machinery ages, the cost of maintenance and replacement becomes increasingly expensive and, in some cases, unfeasible. End-users seek cost-effective technology for power transmission motion control to offset the high costs. However, the expensive components required for these systems can hinder growth in the market. The inventory cost of these components is a significant concern, making it essential to find cost-efficient solutions.

Effective maintenance and timely replacement of worn-out components are crucial to ensure the longevity and productivity of power transmission motion control systems. The cost of power transmission motion control systems is a significant challenge for end-users due to the high cost of components and inventory. The market growth may be impeded as a result. However, the importance of these systems in various industries necessitates the need for cost-effective solutions and innovative technologies to address the challenges. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Altra Industrial Motion Corp. - The company offers power transmission motion control products such as gear drives, gear motors, and electric clutches and brakes, overrunning clutches and belted system.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADVANCED Motion Controls

- Air Hydro Power Inc.

- Allied Automation Inc.

- Applied Machine and Motion Control Inc.

- C-Flex Bearing Co. Inc.

- Cangro Industries Inc.

- Clayton Controls Inc.

- Cross Co.

- Custom Machine and Tool Co. Inc.

- E and E Special Products LLC

- Electromate Inc.

- Forbes Engineering Sales Inc.

- Galil Motion Control

- Genuine Parts Co.

- MinebeaMitsumi Inc.

- Olympus Controls Corp.

- Poklar Power Motion Inc.

- Servo2Go.com Ltd.

- Shanghai MOONS Electric Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The market encompasses a wide range of components used for transmitting mechanical power and controlling motion in various industries. Key components include bearings, axles, brackets, shafts, and various types of connections such as belts, chains, gears, and mechanical linkages. These power transmission products play a crucial role in industrial automation, construction machinery, material handling systems, and bearing & drive systems. Reliability and efficiency are paramount in the power transmission motion control market. Transmission methods and energy configuration are critical factors in determining movement speed and motion form. Mechanical power transmission is the transfer of energy from one place to another in machines, enabling the conversion of rotational motion into linear reciprocating motion or vice versa.

Motion control components are used in various manufacturing and production environments, including electric motors, mechanical systems, and gearboxes. Applications include conveyor systems, material handling, industrial robots, assembly, welding, machine tools, spindles, lathes, milling machines, grinders, packaging machinery, printing machinery, cranes, hoists, and lifts. Power transmission components are available in a wide range of speed ranges, frequencies, and power supply configurations to suit various industrial applications. AC induction motors, drives, and gearboxes are commonly used in power transmission motion control systems. Clutches, brakes, pulleys, belts, and chains are essential components for transmitting power and controlling motion in these applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

130 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 28% |

|

Market growth 2024-2028 |

USD 575 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

20.2 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 47% |

|

Key countries |

US, China, Germany, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ADVANCED Motion Controls, Air Hydro Power Inc., Allied Automation Inc., Altra Industrial Motion Corp., Applied Machine and Motion Control Inc., C-Flex Bearing Co. Inc., Cangro Industries Inc., Clayton Controls Inc., Cross Co., Custom Machine and Tool Co. Inc., E and E Special Products LLC, Electromate Inc., Forbes Engineering Sales Inc., Galil Motion Control, Genuine Parts Co., MinebeaMitsumi Inc., Olympus Controls Corp., Poklar Power Motion Inc., Servo2Go.com Ltd., and Shanghai MOONS Electric Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch