Total Wrist Replacement Market Size 2024-2028

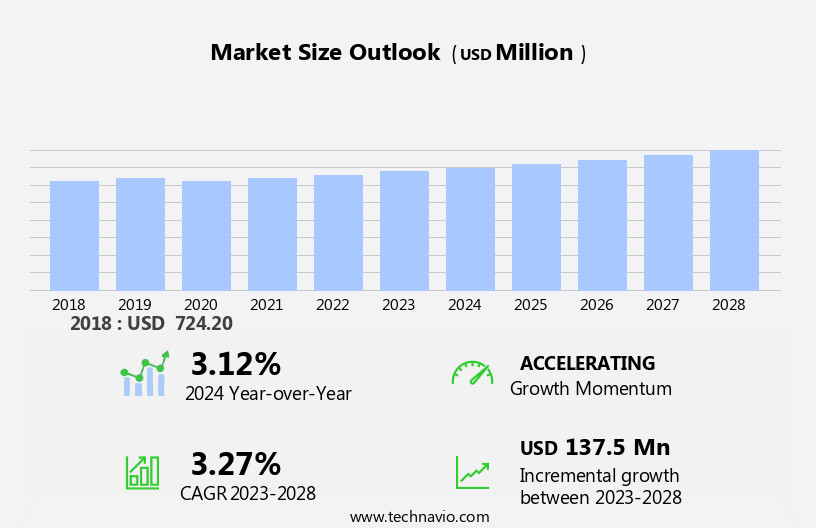

The total wrist replacement market size is forecast to increase by USD 137.5 million at a CAGR of 3.27% between 2023 and 2028.

- The market is witnessing significant growth due to the rising number of road accidents and sports injuries, leading to a higher demand for orthopedic implants. The trend towards advanced technology in healthcare is driving the research and development (R&D) of digital total wrist replacement solutions, including 3D printed ceramic implants and surgical instruments. However, the lack of skilled surgeons capable of performing complex wrist replacement procedures remains a challenge for market growth. Orthopedic implant manufacturers are investing in franchise models and collaborations to expand their reach and address this issue. The use of advanced ceramics in total wrist replacement is gaining popularity due to their biocompatibility and durability, offering long-term benefits to patients. The surgical instruments market is also witnessing growth due to the increasing adoption of digital technology and automation, streamlining the surgical process and improving patient outcomes.

What will be the Size of the Market During the Forecast Period?

- The market encompasses surgical solutions designed to address various orthopedic disorders, including osteoporosis, osteoarthritis, rheumatoid arthritis, and wrist fractures. This market is witnessing significant growth due to the aging population and the increasing prevalence of hand-related disorders. According to recent studies published in esteemed journals such as the Annals of Surgery and the Journal of Bone and Joint Surgery, the number of total wrist replacement surgeries, including arthroplasty and arthrodesis, has been on the rise. Minimally invasive surgical procedures and advancements in bone grafting techniques have contributed to the market's expansion. Additionally, the development of innovative implants and drug administration systems has further fueled the market's growth.

- Total wrist reconstruction surgeries, such as total wrist arthrodesis and total wrist fusion, are becoming increasingly popular treatment options for patients suffering from debilitating wrist conditions. Overall, the market is expected to continue expanding due to the increasing burden of orthopedic disorders and the ongoing advancements in surgical technologies.

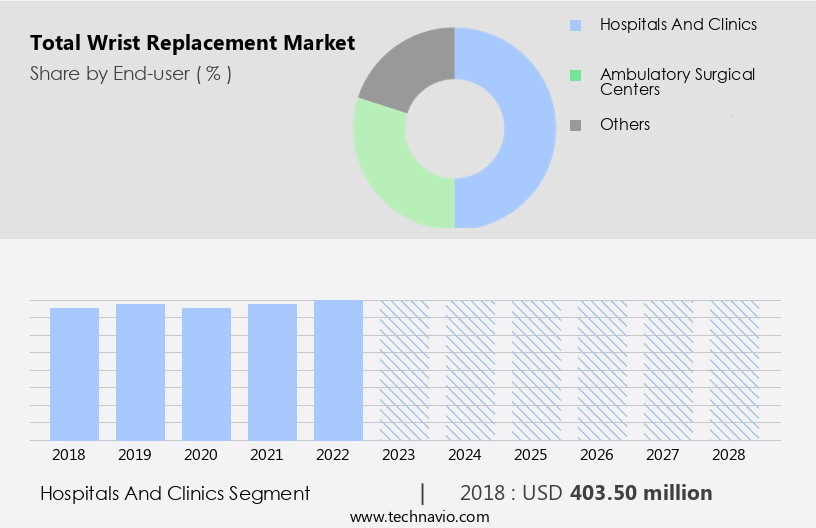

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals and clinics

- Ambulatory surgical centers

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By End-user Insights

- The hospitals and clinics segment is estimated to witness significant growth during the forecast period.

The market encompasses surgical procedures used to treat various hand disorders, including osteoporosis, osteoarthritis, rheumatoid arthritis, fractures, and injuries. Hospitals and clinics are the primary end-users, with smaller hospitals and government-funded facilities leading the way due to their advanced digital devices and highly skilled medical personnel. Wrist reconstruction surgeries, such as total wrist arthrodesis and total wrist fusion, are common procedures within this market. Anatomical plating systems and orthopedic implants are essential components of these surgeries. The aging population and the increasing prevalence of comorbidities, disability, and sports injuries contribute to the market's growth. Healthcare reimbursement and healthcare systems play a significant role In the market's dynamics.

Get a glance at the Total Wrist Replacement Industry report of share of various segments Request Free Sample

The hospitals and clinics segment was valued at USD 403.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is primarily driven by the increasing prevalence of osteoarthritis and related disorders, such as rheumatoid arthritis and osteoporosis, In the aging population. According to The World Bank Group, the geriatric population in North America is projected to increase from 56.28 million in 2017 to 58.9 million in 2023. This demographic shift, coupled with the rising healthcare expenditure and the increasing number of total wrist replacement procedures, is fueling market growth. Additionally, comorbidities, injuries, deformities, and sports injuries are also contributing factors. Key players In the market include Stryker, Zimmer Biomet, Conformis, and Extremity Medical. Wrist reconstruction surgeries, such as total wrist arthrodesis and total wrist fusion, as well as anatomical plating systems, are common surgical procedures In the outpatient setting.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Total Wrist Replacement Industry?

Growing number of road accidents and fatal sports injuries is the key driver of the market.

- Extremity injuries, particularly those affecting the hand and wrist, are commonly caused by road accidents and sports participation. According to the Centers for Disease Control and Prevention (CDC), road accidents result in over 1.25 million deaths worldwide each year, with many of these incidents leading to dislocations, fractures, and other injuries requiring surgical intervention. In the US, orthopedic disorders such as osteoporosis, osteoarthritis, rheumatoid arthritis, and fractures due to accidents or injuries are prevalent, driving the demand for wrist reconstruction surgeries. Total wrist arthrodesis and total wrist fusion are common procedures used to treat wrist disorders, while anatomical plating systems are utilized for the regeneration of bones.

- The aging population, comorbidities, and disability resulting from these conditions further increase the need for joint replacement procedures In the outpatient setting. Pediatric cases, including those involving the PediFrag franchise, also contribute to the market growth. Healthcare reimbursement and healthcare systems play a significant role In the affordability and accessibility of these surgical procedures.

What are the market trends shaping the Total Wrist Replacement Industry?

Increasing R and D of 3D printed wrist implants and surgical instruments is the upcoming market trend.

- Three-dimensional (3D) printing technology has revolutionized the orthopedic industry by enabling customized implants for complex wrist cases. Orthopedic disorders, including osteoporosis, osteoarthritis, rheumatoid arthritis, fracture, and injuries, can lead to wrist pain and deformities. Stryker, Zimmer Biomet, Conformis, Extremity Medical, and other orthopedic companies are leveraging 3D printing to manufacture patient-specific implants for wrist reconstruction surgeries, total wrist arthrodesis, and total wrist fusion. These implants offer several advantages, such as shorter recovery times, reduced pain, and less blood loss. With an aging population and an increasing number of comorbidities, the demand for wrist replacement market is on the rise. Customized implants, fabricated with high-quality and biocompatible materials, can help in accelerating post-operative healing, facilitating osteointegration, and reducing implant stiffness.

- In the outpatient setting, pediatric patients with pediatric fracture or deformities can benefit from the PediFrag franchise. Healthcare reimbursement and healthcare systems play a crucial role In the adoption of joint replacement procedures using customized implants.

What challenges does the Total Wrist Replacement Industry face during its growth?

Lack of skilled surgeons is a key challenge affecting the industry growth.

- The market encompasses surgical procedures aimed at alleviating orthopedic disorders, such as osteoporosis, osteoarthritis, rheumatoid arthritis, fracture, and injuries, leading to wrist deformities. Stryker, Zimmer Biomet, Conformis, and Extremity Medical are among the notable orthopedic implant providers. The aging population and comorbidities associated with these conditions contribute to the increasing demand for wrist reconstruction surgeries, including total wrist arthrodesis and fusion. Anatomical plating systems are often employed In these procedures. In the outpatient setting, wrist replacement procedures are performed for various conditions, including arthritis, injuries, and deformities. Pediatric cases are addressed through the PediFrag franchise. Healthcare reimbursement and healthcare systems play a crucial role In the market's growth.

- Despite the growing need, the number of qualified orthopedic surgeons with expertise in total wrist replacement remains limited, necessitating a steep learning curve for those undertaking the procedure. Clinical success hinges on the surgeon's experience and implantation technique. The market is expected to expand as more surgeons acquire the necessary skills and as demand for effective wrist replacement solutions continues to rise.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acumed LLC

- Anika Therapeutics Inc.

- Conmed Corp.

- Extremity Medical LLC

- Integra Lifesciences Corp.

- Johnson and Johnson Services Inc.

- Medartis Holding AG

- Skeletal Dynamics LLC

- Smith and Nephew plc

- Stryker Corp.

- Swemac

- Wright Medical Group NV

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of orthopedic solutions designed to address various disorders and conditions affecting the wrist. These conditions include, but are not limited to, osteoporosis, osteoarthritis, rheumatoid arthritis, fractures, and injuries. The market caters to both adult and pediatric patient populations, with applications in outpatient settings and trauma services. The aging population is a significant driver of demand In the market. As the population ages, the prevalence of orthopedic disorders and conditions increases, leading to an increased need for surgical interventions. Furthermore, advancements in technology and surgical techniques have made total wrist replacement procedures more accessible and effective, contributing to the market's growth.

In addition, anatomical plating systems and implants play a crucial role in total wrist replacement surgeries. These systems provide the necessary support and stability during the healing process, enabling a successful recovery. Extremity medical devices and implant manufacturers have been investing heavily in research and development to create more effective and efficient solutions. Comorbidities, such as disability and sports injuries, also contribute to the demand for total wrist replacement procedures. Drug administration and joint replacement procedures have become increasingly common in healthcare systems as a means of managing pain and restoring functionality to the affected limb. Total wrist arthrodesis and fusion are alternative surgical procedures used in certain cases where replacement is not feasible or desirable.

Furthermore, these procedures involve fusing the bones of the wrist together, providing stability and reducing pain. The market is highly competitive, with numerous players vying for market share. Companies offer a range of solutions, from traditional implants to advanced, customized options. Competition is driven by factors such as product innovation, pricing, and distribution networks. The market for total wrist replacement is expected to grow steadily In the coming years, driven by the increasing prevalence of orthopedic disorders and the aging population. Healthcare reimbursement policies and regulatory requirements will continue to shape the market dynamics, with a focus on improving patient outcomes and reducing healthcare costs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 137.5 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

3.12 |

|

Key countries |

US, Germany, UK, China, and Canada |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Total Wrist Replacement industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.