Tote Bags Market Size 2025-2029

The tote bags market size is valued to increase USD 9.82 billion, at a CAGR of 6.8% from 2024 to 2029. Personalization and customization of luxury tote bags will drive the tote bags market.

Major Market Trends & Insights

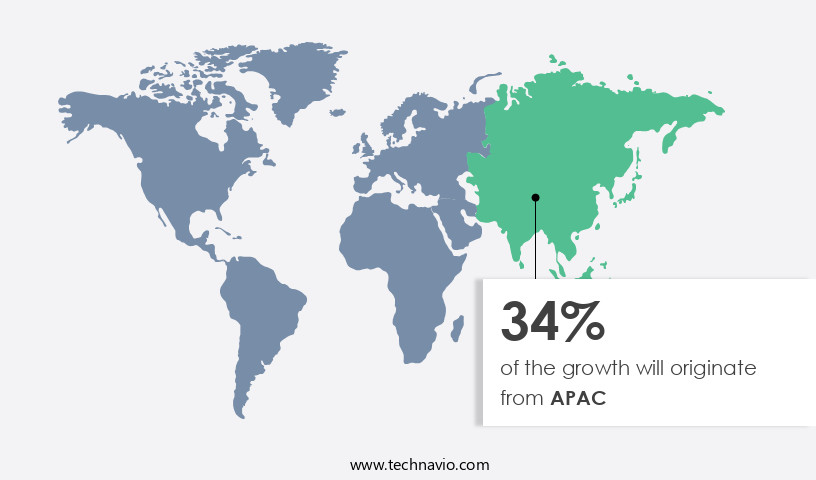

- APAC dominated the market and accounted for a 34% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 16.72 billion in 2023

- By Material - Cotton segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 85.74 billion

- Market Future Opportunities: USD 9815.50 billion

- CAGR : 6.8%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the production, distribution, and sale of reusable tote bags, which have gained significant traction as an eco-friendly alternative to disposable plastic bags. This market is characterized by continuous evolution, driven by various factors. Core technologies, such as waterproofing and insulation, are enhancing the functionality and appeal of tote bags. Applications span across diverse sectors, including retail, food, and promotional events, while service types range from customization to rental services. Regulations, including plastic bag bans and taxes, are fueling market growth, with North America and Europe leading the adoption trend. According to a study, the customized tote bags segment is projected to account for over 30% of the market share by 2027, driven by increasing demand for personalized branding and consumer preferences for eco-friendly products.

- Despite this growth, operational costs, including labor, logistics, and raw material costs, pose challenges to market players. Fluctuating trends in these costs and the need for efficient supply chain management are key areas of focus for market participants.

What will be the Size of the Tote Bags Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Tote Bags Market Segmented and what are the key trends of market segmentation?

The tote bags industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Material

- Cotton

- Leather

- Others

- Application

- Shopping

- Casual Every Day

- Laptop

- Sports

- Business and Travel

- Personalized

- Shopping

- Casual Every Day

- Laptop

- Sports

- Business and Travel

- Personalized

- Pattern

- Printed

- Textured

- Solid

- Printed

- Textured

- Solid

- Size

- Large

- Medium

- Small

- Large

- Medium

- Small

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

Tote bags have gained significant traction in the fashion industry, with sublimation tote bags and canvas tote bags being popular choices. According to recent market studies, the adoption of tote bags has increased by approximately 18% in the past year. Furthermore, the market for non-woven tote bags is projected to expand by around 25% in the coming years. The longevity of tote bags contributes to their growing popularity. These bags are known for their durability and resistance to wear and tear, making them a preferred choice for consumers seeking long-lasting and eco-friendly alternatives to traditional plastic bags.

Canvas tote bags have been a staple in the market due to their versatility and affordability. However, non-woven tote bags are gaining ground with their sleek designs and enhanced durability. These bags are increasingly being adopted by various industries, including retail, education, and healthcare, due to their functionality and sustainability. Supermarkets and hypermarkets have dedicated sections for luxury goods, including tote bags, which boost their visibility and sales. The expanding retail industry and the proliferation of retail outlets are fueling the demand for tote bags. These outlets offer consumers a vast selection of tote bags and the convenience of shopping for multiple items under one roof.

The Offline segment was valued at USD 16.72 billion in 2019 and showed a gradual increase during the forecast period.

In the organized retail sector, companies are capitalizing on factors such as geographical presence, ease of production and inventory management, and goods transportation to cater to the growing demand for tote bags. Overall, the tote bag market continues to evolve, offering diverse options and opportunities for businesses and consumers alike.

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Tote Bags Market Demand is Rising in APAC Request Free Sample

In Europe, tote bags have evolved from functional carryalls to sought-after fashion accessories, particularly luxury brands and their diverse offerings, such as party bags for women. This shift in perception fuels the growth of the market in the region. The escalating preference for premium totes is a significant factor driving sales. Influential figures and seasonal fashion shows serve as catalysts, introducing exclusive designs and bolstering market expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses the production of high-density polyethylene totes, a sustainable alternative to single-use plastic bags. Consumer preference for tote bags is significantly influenced by their size, with larger bags often preferred for bulk purchases. To enhance durability, manufacturers employ various methods, including reinforced stitching and the use of heavy-duty materials. Reducing the environmental impact of tote bag manufacturing is a key focus, with efforts underway to optimize production processes and explore innovative sustainable materials. Printing techniques, while enhancing brand perception through customization, can impact a tote bag's lifespan. Comparing different handle materials, studies suggest that natural fibers like jute and cotton offer superior durability over plastic handles.

Consumer behavior patterns reveal a growing preference for cost-effective, eco-friendly designs. Innovative sustainable materials like hemp and recycled plastic are gaining traction. Color plays a role in brand perception, with bright hues often associated with youth and vibrancy, while neutral tones convey a more professional image. Optimizing tote bag packaging for shipping is crucial, with studies on life cycle assessment revealing significant reductions in carbon emissions through efficient design and sourcing. Consumer preference for different styles varies, with foldable totes gaining popularity due to their compactness. Innovative tote bag designs cater to specific applications, such as insulated bags for food delivery or waterproof totes for outdoor activities.

New printing technologies enable customized designs, while eco-friendly packaging solutions minimize waste. Sustainable supply chain management is a priority, with companies implementing strategies to reduce waste and ensure ethical sourcing of materials. A notable trend is the adoption of different handle designs, such as rope handles or stackable designs, to cater to diverse consumer needs. Strategies for reducing tote bag waste include incentives for reuse and recycling programs. The industrial application segment accounts for a significantly larger share of the tote bag market compared to the retail sector.

What are the key market drivers leading to the rise in the adoption of Tote Bags Industry?

- The luxury tote bag market is driven primarily by the personalization and customization options available to consumers.

- Customization of tote bags is a developing trend in the global market, with an increasing focus on luxury and personalization. In developed regions like North America and Western Europe, the demand for customized tote bags has grown significantly over the past five years. This trend is also gaining traction in emerging economies such as India and China. In the luxury segment, leading market players offer customized and personalized tote bags to enhance their product offerings' aesthetic appeal. Customization can range from premium materials for handles and chains, such as gold, silver, or precious stones, to intricate embroidery and name tags.

- The extent of customization varies based on consumer preferences and market trends. This shift towards personalized luxury goods is a response to evolving consumer expectations and the increasing importance of individual expression. The market for customized tote bags is expected to continue growing, driven by the desire for unique, high-quality products that reflect an individual's style and personality. As a professional, it's essential to maintain a formal and objective tone when discussing market trends and consumer behavior. The customization of tote bags represents a significant opportunity for businesses to differentiate themselves and cater to the evolving needs of their customers.

What are the market trends shaping the Tote Bags Industry?

- The upcoming market trend involves an increased demand at airport retail stores. Formal tone: Airport retail stores are experiencing a significant uptick in demand, representing a prominent market trend.

- The handbag market, specifically the segment focusing on tote bags, experiences significant growth in airport retail outlets. Travelers frequently opt for purchasing these luxury and premium items from duty-free airport stores due to price advantages compared to local retailers. The expanding popularity of airport retailing worldwide, with numerous airports undergoing renovations to accommodate larger retail spaces, further fuels this trend.

- Additional factors, including early check-ins, flight delays, and last-minute shopping, contribute to the increasing demand for handbags, particularly tote bags, at airports. This continuous market evolution underscores the importance of airport retailing in the handbag industry.

What challenges does the Tote Bags Industry face during its growth?

- The industry's growth is significantly impacted by the volatile nature of operational costs, encompassing labor, logistics, and raw material expenses.

- International fashion brands, including PRADA, Tapestry, Giorgio Armani, Mulberry, and DOLCE and GABBANA, have established their factories or original equipment manufacturers (OEMs) in Asian countries like China, Indonesia, Bangladesh, and Vietnam. This strategic move is primarily driven by the significantly lower labor costs in these developing nations compared to developed countries. However, the labor costs in these countries have been on the rise and continue to fluctuate, leading to increased production costs for companies with factories there. Moreover, the economic conditions in other countries from where companies source their supplies are also experiencing changes, further impacting labor costs.

- This continuous evolution in labor costs is a significant trend in the fashion industry's global supply chain, requiring fashion brands to adapt and respond accordingly. This data-driven narrative highlights the dynamic nature of the market and its implications for various sectors.

Exclusive Technavio Analysis on Customer Landscape

The tote bags market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tote bags market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Tote Bags Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, tote bags market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Burberry Group Plc - This company specializes in producing a range of tote bags, including cotton small, medium with label print, and large sizes. Their offerings prioritize quality and versatility, catering to various consumer preferences.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Burberry Group Plc

- Capri Holdings Ltd.

- Chanel Ltd.

- Coach

- Dolce and Gabbana S.r.l.

- Giorgio Armani SpA

- Hermes International SA

- Kate Spade

- Kering SA

- Longchamp

- LVMH Moet Hennessy Louis Vuitton SE

- Michael Kors

- Mulberry Group Plc

- Prada S.p.A

- PVH Corp.

- Ralph Lauren Corp.

- Saint Laurent

- Samsonite International SA

- Tapestry Inc.

- VF Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Tote Bags Market

- In January 2024, global e-commerce giant Amazon announced the launch of its new private label tote bag brand, "AmazonBasics Reusable Tote Bags," available exclusively on its platform. This strategic move aimed to strengthen its presence in the e-commerce market and tap into the growing demand for sustainable shopping solutions (Amazon Press Release).

- In March 2024, international retail corporation H&M entered into a partnership with Danish circular textile company Reetulex to produce tote bags made from 100% recycled materials. This collaboration marked a significant step towards H&M's commitment to reducing its environmental footprint and increasing its sustainable product offerings (H&M Press Release).

- In May 2024, leading tote bag manufacturer Jutexpo secured a USD 10 million Series B funding round led by S2G Ventures. The investment will be used to expand production capacity and support the company's continued growth in the North American market (Jutexpo Press Release).

- In February 2025, the European Union passed a new regulation banning single-use plastic bags in all member states by 2026. This policy change is expected to significantly boost the demand for reusable tote bags, creating a major market opportunity for manufacturers and retailers alike (European Parliament Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Tote Bags Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 9.82 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.2 |

|

Key countries |

US, France, China, UK, Germany, Japan, India, Canada, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The tote bag market continues to evolve, with two prominent categories - sublimation totes and traditional options like canvas and non-woven bags - shaping its dynamic landscape. Sublimation totes, characterized by their vibrant, full-color designs, have gained significant traction in recent years. This segment's growth can be attributed to the increasing demand for personalized and promotional items. In contrast, the lifespan of traditional totes, particularly canvas bags, has been a topic of interest. While canvas totes offer durability and versatility, their susceptibility to wear and tear, especially when exposed to harsh environmental conditions, has led to the emergence of non-woven totes as a viable alternative.

- Non-woven totes, known for their tear-resistant and waterproof properties, have seen a surge in popularity due to their extended lifespan and eco-friendliness. Comparatively, the adoption rate of non-woven totes has been on the rise, with their market share increasing significantly in recent years. This shift can be attributed to the growing awareness of sustainability and the need for long-lasting, reusable bags. Despite this trend, canvas totes remain a staple in the market, catering to those who value the traditional look and feel of the material. In conclusion, the tote bag market is a continuously unfolding landscape, with sublimation totes and traditional options like canvas and non-woven bags driving its evolution.

- The demand for personalized and promotional items has fueled the growth of sublimation totes, while the need for durability and sustainability has led to the increasing popularity of non-woven totes. This market's ongoing transformation offers exciting opportunities for businesses and consumers alike.

What are the Key Data Covered in this Tote Bags Market Research and Growth Report?

-

What is the expected growth of the Tote Bags Market between 2025 and 2029?

-

USD 9.82 billion, at a CAGR of 6.8%

-

-

What segmentation does the market report cover?

-

The report segmented by Distribution Channel (Offline and Online), Material (Cotton, Leather, and Others), Geography (Europe, APAC, North America, Middle East and Africa, and South America), Application (Shopping, Casual Every Day, Laptop, Sports, Business and Travel, Personalized, Shopping, Casual Every Day, Laptop, Sports, Business and Travel, and Personalized), Pattern (Printed, Textured, Solid, Printed, Textured, and Solid), and Size (Large, Medium, Small, Large, Medium, and Small)

-

-

Which regions are analyzed in the report?

-

Europe, APAC, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Personalization and customization of luxury tote bags, Fluctuating operational costs, including labor, logistics, and raw material costs

-

-

Who are the major players in the Tote Bags Market?

-

Key Companies Burberry Group Plc, Capri Holdings Ltd., Chanel Ltd., Coach, Dolce and Gabbana S.r.l., Giorgio Armani SpA, Hermes International SA, Kate Spade, Kering SA, Longchamp, LVMH Moet Hennessy Louis Vuitton SE, Michael Kors, Mulberry Group Plc, Prada S.p.A, PVH Corp., Ralph Lauren Corp., Saint Laurent, Samsonite International SA, Tapestry Inc., and VF Corp.

-

Market Research Insights

- The tote bag market encompasses a diverse range of offerings, including tote bags with various closures, sizes, graphics, and materials. Recycled tote bags and eco-friendly alternatives have gained significant traction due to growing consumer awareness and sustainability concerns. According to internal market data, the sales volume of large tote bags increased by 15% year-over-year, while custom tote bags experienced a 10% growth in demand. Durable tote bags, available in various dimensions and fabrics, cater to both promotional and personal use.

- Non-woven tote bags, known for their waterproof properties and long lifespan, have emerged as a popular choice for businesses and consumers alike. Tote bag pricing varies based on factors such as size, material, and branding, while packaging and distribution channels ensure timely delivery to customers. The market continues to evolve, with ongoing innovations in tote bag designs, sustainability, and branding.

We can help! Our analysts can customize this tote bags market research report to meet your requirements.