Personal Luxury Goods Market Size 2025-2029

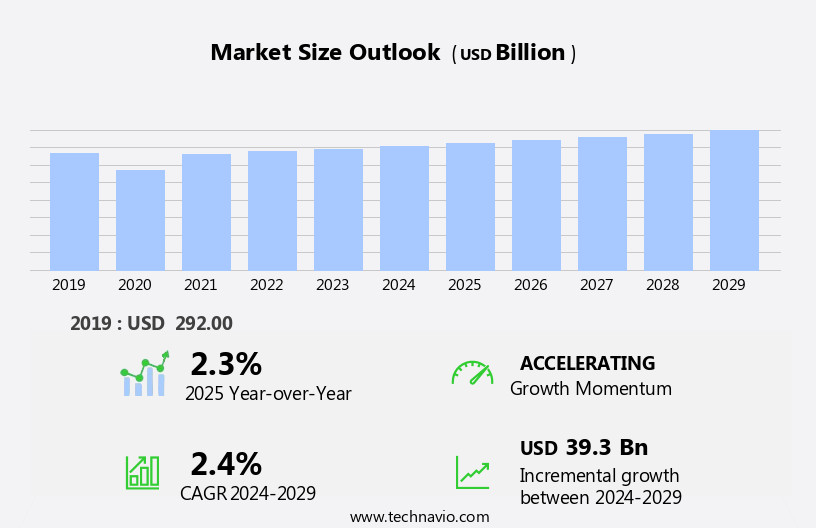

The personal luxury goods market size is forecast to increase by USD 39.3 billion at a CAGR of 2.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by several key trends. One of the primary factors fueling market expansion is the increased demand for premium beauty products and cosmetics. Consumers are increasingly seeking high-quality, luxurious items to enhance their appearance and self-image. Bags, purses, and other leather goods remain staples, offering both functionality and style. Another trend shaping the market is the integration of technology, with brands utilizing advanced technologies to enhance the customer experience and differentiate their offerings.

- However, the market also faces challenges, including rising labor costs and fluctuating raw material prices, which can impact profitability. To remain competitive, players In the market must stay abreast of these trends and adapt to the changing market landscape.

What will be the Personal Luxury Goods Market Size During the Forecast Period?

- The market encompasses a diverse range of premium products, including watches, jewelry, cosmetics, clothing, bags, and various other items. This market is characterized by its continuous evolution, driven by changing lifestyles, technology integration, and a rising consciousness towards sustainability. Consumers increasingly seek luxury experiences and status symbols that align with their values, leading to a growing demand for technology-embedded products. Premium watches and jewelry continue to be popular choices, with consumers drawn to their timeless appeal and craftsmanship. Cosmetics and clothing, too, have seen significant growth, as people prioritize self-care and personal expression.

- The market is not limited to traditional luxury items, with an expanding range of offerings such as champagne trucks, crystal bathtubs, eco-friendly beds, and even high-end smartphones. The British auction house and luxury brands continue to shape the market with their innovative offerings. However, the market is not exclusive to high-income groups; there is a growing trend towards accessible luxury, with brands catering to a wider audience. In summary, the market is dynamic and diverse, driven by changing consumer preferences, technology integration, and a growing awareness of sustainability. It offers a wide range of premium products, from traditional items like watches and jewelry to more innovative offerings like eco-friendly beds and technology-embedded products.

How is this Personal Luxury Goods Industry segmented and which is the largest segment?

The personal luxury goods industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Hard luxury

- Apparel

- Cosmetics and perfumes

- Accessories

- Others

- Geography

- Europe

- Germany

- UK

- France

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- Brazil

- Europe

By Distribution Channel Insights

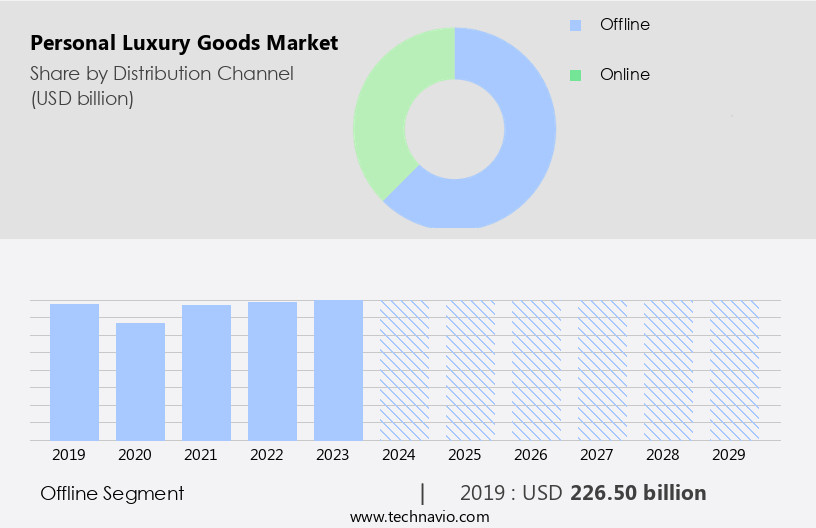

The offline segment is estimated to witness significant growth during the forecast period. Personal luxury goods, such as watches, jewelry, cosmetics, clothing, bags, and other premium items, are sold through various channels. Offline distribution includes specialty stores, including brand-owned and multi-brand outlets, apparel stores, fashion accessory stores, sports equipment stores, hypermarkets, supermarkets, and department stores. Revenues from this segment have been decreasing due to the growing trend of online shopping. To boost sales, companies are increasing their store presence in local and regional markets. Luxury brands sell their merchandise through both specialty stores and other retail formats, leading to heightened competition. Consumers from the low-income group are increasingly drawn to these items due to changing lifestyles, modern culture, and rising consciousness.

Marketing strategies, competitive advantages, and sales channels continue to evolve, with online luxury shopping gaining popularity among younger consumers. Eco-friendly products and sociopolitical issues are also influencing commercial policies. The market for personal luxury goods encompasses a wide range of items, from watches and jewelry to cosmetics, clothing, bags, and even eco-friendly beds and crystal bathtubs. Brands like OMEGA, Burberry, Reliance, and others cater to diverse target audiences. The market landscape is dynamic, with trends such as technology-embedded products and second-hand brand products gaining traction. Sales channels continue to evolve, with trucks and shopping malls emerging as innovative platforms.

Get a glance at the various segments. Request Free Sample

The offline segment was valued at USD 226.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Personal luxury goods, including watches, jewelry, cosmetics, clothing, bags, and other premium items, witness continuous innovation through new product launches and extensions In the European market. The increasing high per capita income and disposable income among European consumers fuel the demand for these luxury items. companies are capitalizing on this trend by offering personal luxury goods online through their websites and third-party sellers. This online expansion will significantly contribute to the growth of the European market In the coming years.

As modern culture, changing lifestyles, and rapid urbanization influence consumer behavior, quality brands are adapting to marketing strategies that cater to their target customers. Technology-embedded products and eco-friendly offerings are gaining popularity among younger consumers, addressing their socio-political concerns and commercial policies. The market for second-hand brand products is also on the rise, reflecting the segmentation analysis and sales channel diversification.

Market Dynamics

Our personal luxury goods market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Personal Luxury Goods Industry?

Increased demand for premium beauty products and cosmetics is the key driver of the market.

- The market encompasses a range of premium products, including watches, jewelry, cosmetics, clothing, bags, and more. This market is experiencing significant growth due to changing lifestyles, rapid urbanization, and the rising consciousness of consumers towards quality brands. Watches and jewelry continue to be popular choices, with consumers seeking out prestigious brands such as OMEGA and Rolex. In the cosmetics sector, there is a trend towards eco-friendly and technology-embedded products, with a focus on skin care. Consumers, particularly the aging population, are willing to invest in premium skincare products to maintain a youthful appearance. Brands are differentiating themselves from pharmaceutical companies by investing in innovative ingredients and technologies.

- Meanwhile, clothing brands like Burberry and Reliance are targeting younger consumers with modern designs and marketing strategies. The sales channel for personal luxury goods is evolving, with online shopping becoming increasingly popular. However, there is also a growing market for second-hand brand products. As consumers become more environmentally conscious, there is a demand for eco-friendly products, from crystal bathtubs to eco-friendly beds and even fridges. Other items, such as Man t-shirts, sandals, Champagne trucks, boxes of chocolates, and even smartphones, are also considered personal luxury goods. The market dynamics are influenced by sociopolitical issues and commercial policies, making it essential for brands to adapt and innovate to maintain their competitive advantages.

What are the market trends shaping the Personal Luxury Goods Industry?

Integration of technology is the upcoming market trend.

- The market: Premium Brands Innovate with Technology the market is witnessing significant changes as leading brands invest heavily in research and development, focusing on technology integration to cater to changing lifestyles and rising consumer consciousness. Luxury brands are no longer just about exclusivity and status symbols; they are evolving to offer functional and eco-friendly products that align with modern culture. For instance, RALPH LAUREN's polo tech shirt incorporates wearable technology, streaming real-time biometric data to the wearer's smartphone. Swarovski Crystal Online, in collaboration with Misfit, has introduced an activity-tracking crystal that blends functionality and craftsmanship. British auction houses like Sotheby's and Christie's have ventured into the online luxury market, offering a wider reach to target customers.

- However, brands like OMEGA, Burberry, and Reliance are adopting marketing strategies that focuses on quality, sustainability, and innovation. Segmentation analysis reveals that younger consumers are increasingly drawn to eco-friendly products. Luxury brands are responding by offering a range of sustainable and recycled materials, from Mecanique Collection's recycled metal watches to Clive Christian's eco-friendly perfumes. Sales channels are expanding beyond traditional retail stores, with brands partnering with commercial policies to offer second-hand brand products at affordable prices. The market is witnessing a shift towards technology-embedded products, such as crystal bathtubs, champagne trucks, and tea, that cater to the rising consciousness of health and wellness. In summary, the market is evolving to meet the demands of a tech-savvy and eco-conscious consumer base. Brands are focusing on innovation, sustainability, and functionality to stay competitive, offering a diverse range of products from watches and jewelry to clothing, bags, and cosmetics.

What challenges does the Personal Luxury Goods Industry face during its growth?

Increasing labor costs and fluctuating raw material prices are key challenges affecting the industry growth.

- The market encompasses a range of premium products, including watches, jewelry, cosmetics, clothing, bags, and more. Brands like OMEGA, Burberry, and Reliance offer these items at high price points, catering to target customers with disposable income. The Mecanique Collection from OMEGA, for instance, showcases intricate watch mechanisms, while Printemps offers a wide selection of designer clothing. Changing lifestyles, rapid urbanization, and modern culture have fueled the demand for luxury goods. However, the rising consciousness towards eco-friendliness has led to an increased interest in sustainable and technology-embedded products. This shift is evident In the production of eco-friendly beds, crystal bathtubs, and even smartphones.

- The increasing popularity of online luxury shopping has also influenced market dynamics. Younger consumers, in particular, prefer the convenience and accessibility of shopping from home. companies are adapting to this trend by enhancing their digital presence and implementing effective marketing strategies. Despite these opportunities, the market faces challenges, such as sociopolitical issues and commercial policies. The availability and pricing of second-hand brand products also impact sales. Segmentation analysis and the selection of appropriate sales channels are crucial for companies to maintain their competitive advantages. companies are investing in new technologies, collaborations, and automation to reduce production costs and increase profits.

Exclusive Customer Landscape

The personal luxury goods market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the personal luxury goods market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, personal luxury goods market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Calvin Klein USA - The company offers modern and minimalist apparel, undergarments, fragrances, and accessories, all characterized by timeless designs and superior quality. These items cater to consumers seeking premium experiences and enduring style. The focus on classic aesthetics and fine craftsmanship distinguishes this sector from mass-market offerings. By prioritizing elegance and sophistication, the personal luxury goods industry continues to captivate consumers worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Calvin Klein USA

- Chow Tai Fook Jewellery Group Ltd.

- Compagnie Financiere Richemont SA

- Coty Inc.

- Dolce and Gabbana S.r.l.

- Giorgio Armani SpA

- Harry Winston Inc.

- Hermes International SA

- Kering SA

- LOreal SA

- LVMH Moet Hennessy Louis Vuitton SE

- Michael Kors Switzerland GmbH

- Prada S.p.A

- Ralph Lauren Corp.

- Rolex SA

- Safilo Group S.p.A

- Shiseido Co. Ltd.

- Swarovski AG

- Tapestry Inc.

- The Estee Lauder Co. Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Personal luxury goods have experienced significant growth in recent years, driven by changing lifestyles, technology-embedded products, and a rising consciousness towards sustainability. This market encompasses a wide range of items, including watches, jewelry, cosmetics, clothing, bags, and more. The demand for personal luxury goods is influenced by various factors. Modern culture and rapid urbanization have led to an increased appreciation for quality brands and the desire for unique, expressive items. Target customers are no longer limited to the affluent class, as the market expands to include younger consumers and those with changing income levels. Marketing strategies for personal luxury goods have evolved to meet the needs of this diverse consumer base.

Furthermore, brands are leveraging technology to enhance the shopping experience, with online luxury shopping platforms becoming increasingly popular. Social media and influencer marketing are also key channels for reaching consumers and building brand awareness. Competitive advantages for personal luxury goods brands include their ability to offer exclusive, high-quality products and experiences. Technology embedded products, such as smartwatches and eco-friendly gadgets, are also attracting consumers looking for innovative, functional items. However, the market is not without challenges. Sociopolitical issues and commercial policies, such as import taxes and trade restrictions, can impact sales and profitability. Additionally, the rise of second-hand brand products and segmentation analysis has led to increased competition and pressure on pricing.

Thus, despite these challenges, the future of the market looks promising. Consumers continue to seek out unique, high-quality items that reflect their personal style and values. Brands that can adapt to changing consumer preferences and market conditions will be well-positioned for success. In summary, the market is a dynamic and evolving industry, shaped by changing lifestyles, technology, and consumer preferences. Brands that can offer quality products, innovative marketing strategies, and a commitment to sustainability will be well-positioned to succeed in this competitive market.

|

Personal Luxury Goods Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.4% |

|

Market growth 2025-2029 |

USD 39.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.3 |

|

Key countries |

US, Germany, China, France, Canada, UK, Japan, Saudi Arabia, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Personal Luxury Goods Market Research and Growth Report?

- CAGR of the Personal Luxury Goods industry during the forecast period

- Detailed information on factors that will drive the Personal Luxury Goods growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the personal luxury goods market growth of industry companies

We can help! Our analysts can customize this personal luxury goods market research report to meet your requirements.