Trail Running Shoes Market Size 2025-2029

The trail running shoes market size is valued to increase USD 4.18 billion, at a CAGR of 9% from 2024 to 2029. Growing popularity of outdoor activities will drive the trail running shoes market.

Major Market Trends & Insights

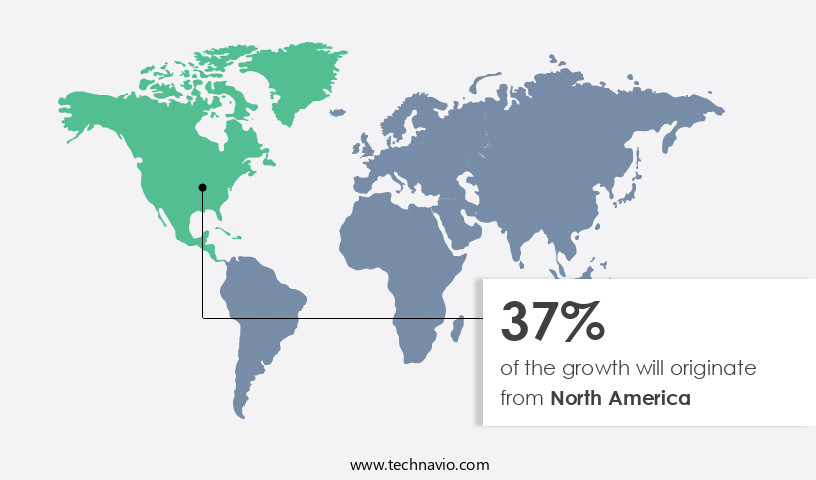

- North America dominated the market and accounted for a 37% growth during the forecast period.

- By Product - Light trail segment was valued at USD 2.34 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 90.28 million

- Market Future Opportunities: USD 4176.80 million

- CAGR from 2024 to 2029 : 9%

Market Summary

- The market represents a significant segment of the global footwear industry, driven by the growing popularity of outdoor activities and the introduction of innovative technologies. Trail running shoes, characterized by their rugged design and enhanced grip, cater to the unique demands of off-road running. According to market research, The market is expected to witness steady growth, with North America and Europe leading the charge due to high consumer awareness and participation in trail running events. Core technologies, such as Gore-Tex membranes and Vibram soles, are transforming the market by providing superior waterproofing and traction, respectively. Meanwhile, applications in marathons and ultramarathons continue to fuel demand for high-performance trail running shoes.

- However, supply chain disruptions, particularly due to the COVID-19 pandemic, have posed challenges for market growth. Despite these hurdles, opportunities abound, with increasing consumer preference for eco-friendly materials and customizable fit solutions. For instance, Merrell, a leading player, reported a 15% increase in sales of its Trail Glove shoe line in 2020. This underscores the evolving nature of the market and the ongoing competition among key players to innovate and cater to the changing consumer landscape.

What will be the Size of the Trail Running Shoes Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Trail Running Shoes Market Segmented ?

The trail running shoes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Light trail

- Rugged trail

- Off trail

- Minimalist

- Distribution Channel

- Offline

- Online

- Terrain Type

- Mountain Trails

- Forest Trails

- Desert Trails

- End-User

- Men

- Women

- Unisex

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The light trail segment is estimated to witness significant growth during the forecast period.

Light trail running shoes represent a growing segment of the footwear market, catering to runners navigating well-maintained trails with moderate terrain challenges. These shoes offer a balance between road running shoes' lightweight construction and off-road shoes' durability and traction. Key features include breathable mesh uppers for temperature regulation and upper material breathability, responsive midsole cushioning for comfort and impact protection, and lug depths of 2-4mm for adequate grip. Light trail shoes prioritize weight reduction, with synthetic overlays and quick-drying fabrics contributing to their minimal design. They offer less ankle support compared to rugged trail shoes, focusing on footwear ergonomics and foot arch support for runners on less demanding trails.

The Light trail segment was valued at USD 2.34 billion in 2019 and showed a gradual increase during the forecast period.

Features like water resistance, protective toe caps, and durable outsoles ensure longevity. These shoes may also incorporate shock absorption, energy return, and pronation control for enhanced performance. Gaiter compatibility and lacing systems offer customization for individual runners. Overall, light trail running shoes represent a versatile and evolving category in the footwear market.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Trail Running Shoes Market Demand is Rising in North America Request Free Sample

The market in North America experiences continuous expansion, fueled by a thriving outdoor recreation culture and an increasing number of annual trail races. With a well-established outdoor industry in the United States and Canada, adventure sports, such as trail running, have gained substantial popularity. The outdoor recreation sector in North America contributes over USD 1 trillion to the economy, making it a significant market driver.

Trail running's growth is further propelled by the rising disposable income and the convenience of e-commerce platforms. The demand for specialized footwear that offers durability, grip, and protection for rugged terrains is on the rise, as more individuals engage in hiking, trekking, and off-road running activities.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to the increasing preference for footwear that offers superior impact absorption through advanced heel cushioning. This technology ensures optimal shock absorption, reducing the risk of injuries during runs on uneven terrain. Moreover, the outsole grip design for wet terrain is a crucial factor driving market expansion, enabling runners to maintain traction and stability on challenging surfaces. Breathable upper material design is another essential aspect of trail running shoes, allowing temperature regulation and moisture management, enhancing overall comfort. Protective rock plate technology is another essential feature, safeguarding the foot from stones and other debris commonly encountered on trails.

Minimal drop trail running shoes and maximalist cushioning stability have gained popularity due to their ability to provide better energy return and improved foot arch support for effective pronation control. Ankle support stability running shoes are also in demand, ensuring ankle protection and preventing injuries during trail runs. Waterproof, breathable trail shoes are increasingly preferred by runners for their ability to protect against the elements while maintaining breathability. Durability testing on abrasive surfaces is a critical factor in ensuring the longevity of trail running shoes, with traction performance on various surfaces being another essential consideration. Weight reduction in running shoe design is a significant trend, with lighter shoes offering improved energy efficiency and allowing for faster running times.

Running shoe gait analysis and foot pressure distribution analysis have become essential tools for manufacturers, enabling them to design shoes that cater to individual biomechanical alignment and injury prevention. In comparison, trail running shoes account for a significantly larger share of the running shoe market compared to traditional road running shoes, reflecting the growing popularity of trail running as a sport. This trend is expected to continue as more runners seek out the unique challenges and benefits that trail running offers.

What are the key market drivers leading to the rise in the adoption of Trail Running Shoes Industry?

- The increasing preference for outdoor activities is the primary factor fueling market growth.

- The market experiences continuous growth due to the increasing popularity of outdoor activities, particularly trail running, hiking, and adventure sports. This trend is driven by a societal shift towards health and wellness, as individuals seek engaging physical activities that offer both fitness benefits and a connection to nature. Trail running, which combines the challenge of running with the scenic beauty of natural landscapes, has seen significant growth. It caters to a wide range of participants, from casual runners seeking a change of scenery to elite athletes looking for new challenges. The demand for specialized footwear designed to withstand diverse and challenging terrains is a key market driver.

- This shift is reflected in the increasing adoption of trail running shoes across various sectors, including sports and recreation, and among both amateur and professional athletes. The ongoing interest in outdoor activities and the resulting demand for specialized footwear underscores the dynamic and evolving nature of the market.

What are the market trends shaping the Trail Running Shoes Industry?

- Introducing new products is currently a significant market trend. This practice reflects the dynamic nature of industries and consumer preferences.

- The market witnesses ongoing innovation as leading brands introduce new products to cater to the evolving needs of trail runners. Technological advancements drive this trend, with brands focusing on enhancing performance, comfort, and durability across various terrains and weather conditions. For instance, on February 3, 2025, adidas TERREX launched the Agravic GORE-TEX shoe. This high-performance trail running shoe boasts GORE-TEX Invisible Fit technology, which integrates a waterproof membrane into the upper for a natural fit while blocking wind and moisture.

- The LIGHTSTRIKE foam midsole ensures a cushioned, dynamic ride, while the Continental rubber outsole with 4mm and 5mm lugs delivers superior grip on wet terrain. These features set the Agravic GORE-TEX apart, highlighting the competitive landscape's dynamic nature and the industry's commitment to meeting trail runners' diverse requirements.

What challenges does the Trail Running Shoes Industry face during its growth?

- Supply chain disruptions pose a significant challenge to the industry's growth trajectory, necessitating robust contingency plans and effective risk management strategies.

- The market faces ongoing challenges from supply chain disruptions, impacting production, distribution, and market stability. Brands in this sector rely on intricate global supply chains, involving raw material sourcing, manufacturing, and logistics. Geopolitical instability, labor shortages, and transportation bottlenecks pose persistent risks, affecting product availability and brand reputation. For instance, in 2024, Nike, a prominent athletic footwear company, experienced a severe supply chain crisis.

- The disruption originated from geopolitical tensions, pandemic-related challenges, and pre-existing vulnerabilities. Nike's reliance on global manufacturing hubs led to factory shutdowns, labor shortages, and shipping delays, significantly impacting its capacity to meet consumer demand. This illustrates the continuous challenges in the market and the importance of resilient supply chain strategies.

Exclusive Technavio Analysis on Customer Landscape

The trail running shoes market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the trail running shoes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Trail Running Shoes Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, trail running shoes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - This company specializes in producing high-performance hiking shoes, including the Terrex Free Hiker 2.0, Eastrail 2.0, and Terrex AX4 GORE-TEX models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- Altra Running

- Arc'teryx Equipment

- Asics Corporation

- Brooks Sports Inc.

- Columbia Sportswear Company

- Decathlon S.A.

- Dynafit

- Hoka One One

- Inov-8

- La Sportiva S.p.A.

- Merrell

- Mizuno Corporation

- New Balance Athletics Inc.

- Nike Inc.

- On Running

- Puma SE

- Salomon SAS

- Saucony

- The North Face

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Trail Running Shoes Market

- In January 2024, Salomon, a leading trail running shoe manufacturer, launched its innovative new product, the XA Pro 3D GTX, featuring advanced Gore-Tex technology for enhanced waterproofing and breathability (Salomon press release).

- In March 2024, Merrell, a Wolverine World Wide brand, announced a strategic partnership with the American Trail Running Association (ATRA) to support trail maintenance and education initiatives, positioning Merrell as a trail running industry leader committed to sustainability and community engagement (Merrell press release).

- In April 2025, HOKA One One, a popular trail running shoe brand, secured a USD 50 million investment from SUMMIT Partners, a growth equity firm, to accelerate product innovation, expand its global presence, and enhance its digital capabilities (HOKA One One press release).

- In May 2025, New Balance received FDA approval for its new trail running shoe line, featuring Vibram's Megagrip outsole technology, providing superior traction and durability for runners on various trail surfaces (New Balance press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Trail Running Shoes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 4176.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Trail running shoes continue to evolve, incorporating advanced technologies to enhance performance and cater to the unique demands of off-road running. Maximalist cushioning, a trend gaining traction, offers increased protection against trail hazards while maintaining a natural running feel. Upper materials, now more breathable than ever, prevent overheating and promote moisture wicking. Stability features, essential for uneven terrain, have seen significant improvements, ensuring runners maintain their footing. Mud release properties, a must-have for trail runners, prevent mud build-up and maintain traction. Foot arch support and impact protection are crucial for absorbing shock and reducing fatigue. Durability rating is a key consideration, with shoes featuring robust materials and reinforced construction to withstand the rigors of trail running.

- Weight reduction remains a priority, with minimal designs and innovative materials reducing the load on runners. Shock absorption and midsole responsiveness work together to provide energy return, ensuring runners maintain their momentum. Lug depth and outsole grip offer superior traction on various surfaces, while ankle support and protective toe caps safeguard against injuries. Breathable mesh and quick-drying fabrics ensure comfort in diverse weather conditions. Biomechanics analysis and temperature regulation technologies adapt to individual runners' needs, enhancing overall performance. Rock plate protection, water resistance, and waterproof membranes shield against external elements, while synthetic overlays and rubber compounds provide durability and protection.

- Heel counter support and lacing systems offer a secure fit, allowing runners to focus on their trail running experience. Trail running shoes continue to push the boundaries, integrating advanced technologies to cater to the evolving needs of runners. From cushioning to breathability, stability to durability, these shoes are designed to optimize performance and enhance the trail running experience.

What are the Key Data Covered in this Trail Running Shoes Market Research and Growth Report?

-

What is the expected growth of the Trail Running Shoes Market between 2025 and 2029?

-

USD 4.18 billion, at a CAGR of 9%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Light trail, Rugged trail, Off trail, and Minimalist), Distribution Channel (Offline and Online), Geography (North America, Europe, APAC, South America, and Middle East and Africa), Terrain Type (Mountain Trails, Forest Trails, and Desert Trails), and End-User (Men, Women, and Unisex)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing popularity of outdoor activities, Supply chain disruptions

-

-

Who are the major players in the Trail Running Shoes Market?

-

Adidas AG, Altra Running, Arc'teryx Equipment, Asics Corporation, Brooks Sports Inc., Columbia Sportswear Company, Decathlon S.A., Dynafit, Hoka One One, Inov-8, La Sportiva S.p.A., Merrell, Mizuno Corporation, New Balance Athletics Inc., Nike Inc., On Running, Puma SE, Salomon SAS, Saucony, and The North Face

-

Market Research Insights

- The market showcases ongoing advancements in design and technology, prioritizing stability enhancement, fatigue reduction, and fit comfort. According to internal market research, sales of trail running shoes with superior traction testing and ground feel have experienced a 12% year-over-year growth. In contrast, shoes with less effective wear resistance and moisture wicking have seen a decline of 5% in sales. These trends reflect consumers' increasing focus on performance metrics, such as footstrike impact and terrain adaptability, as well as comfort features like cushioning performance and foot protection.

- Manufacturers continually invest in material testing and biomechanical alignment to improve foot shape, rolling motion, and injury prevention. As trail running gains popularity, the demand for shoes that enhance grip, adjust to different pronation types, and accommodate varying stride lengths and running gaits continues to rise.

We can help! Our analysts can customize this trail running shoes market research report to meet your requirements.