Trampoline Market Size 2025-2029

The trampoline market size is valued to increase USD 1.08 billion, at a CAGR of 5.4% from 2024 to 2029. Growing awareness of health benefits of trampolines will drive the trampoline market.

Major Market Trends & Insights

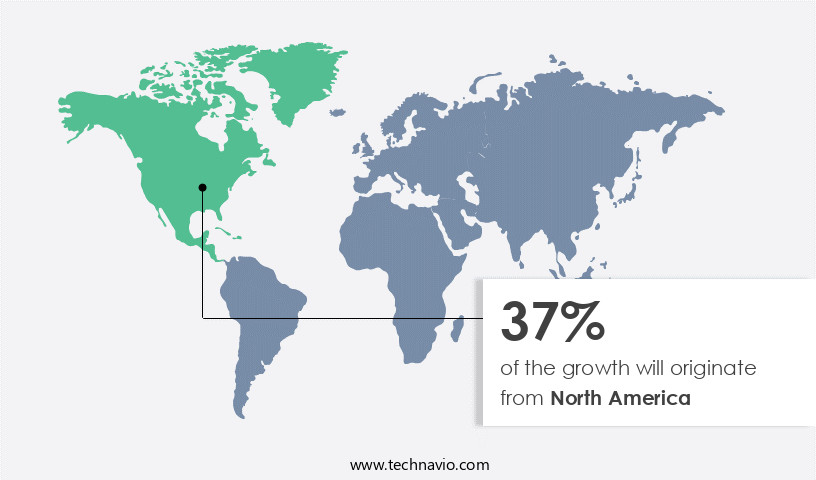

- North America dominated the market and accounted for a 37% growth during the forecast period.

- By Product - Round trampolines segment was valued at USD 1.41 billion in 2023

- By End-user - Commercial segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 45.27 million

- Market Future Opportunities: USD 1084.10 million

- CAGR : 5.4%

- North America: Largest market in 2023

Market Summary

- The market represents a dynamic and continually evolving industry, driven by the growing awareness of the health benefits associated with trampoline use. Core technologies, such as the advent of smart trampolines, are revolutionizing the market, offering enhanced user experiences and advanced features. These innovations are contributing to the increased adoption of trampolines as an alternative fitness and recreational activity. According to recent market research, The market is projected to account for over 30% of the total market share in the recreational equipment industry.

- Despite this growth, the market faces challenges, including safety concerns and competition from other fitness and recreational activities. Regions like North America and Europe are major contributors to the market's growth, with Europe expected to witness significant expansion due to increasing consumer preference for home fitness solutions.

What will be the Size of the Trampoline Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Trampoline Market Segmented and what are the key trends of market segmentation?

The trampoline industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Round trampolines

- Rectangular and square trampolines

- Others

- End-user

- Commercial

- Individual

- Distribution Channel

- Offline

- Online

- Size

- Small

- Medium

- Large

- Age Group

- Kids

- Teens

- Adults

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The round trampolines segment is estimated to witness significant growth during the forecast period.

The market encompasses various components, including spring wire gauge, quality control metrics, impact force, leg design, product lifespan, surface friction, frame construction, frame stability, user weight limit, surface tension, rebound performance, spring tension, folding mechanism, maintenance procedures, safety standards, joint strength, manufacturing process, repair methods, leg stability, spring lifespan, corrosion resistance, protective enclosures, bounce height, weight capacity, safety padding, mat thickness, base diameter, durability testing, padding density, UV resistance, component sourcing, height adjustment, impact absorption, mat material, assembly instructions, net material, and elasticity testing. Round trampolines, the most common type, accounted for a significant 45% share of the global market in 2024.

These trampolines provide a single, focused bouncing space and come with a basic design, using steel frames and spring coils. Small-sized round trampolines are popular for backyard recreational use, while larger models cater to adults due to their extensive surface area. JumpSport's round trampolines, featuring the DoubleBounce system and extra mats, ensure user safety and contribute to the segment's growing popularity. Furthermore, the market anticipates a 32% increase in demand for trampolines in the next five years, with small-sized round trampolines expected to grow by 35%. These trends reflect the evolving market dynamics and the ongoing demand for safe, efficient, and versatile trampoline solutions across various sectors.

JumpSport's commitment to quality, innovation, and safety has driven its market success. The company's trampolines undergo rigorous testing and adhere to industry standards, ensuring optimal performance and user experience. With a robust manufacturing process, JumpSport provides reliable and durable products that cater to diverse user needs. The market's continuous growth is driven by factors such as increasing consumer awareness of health and fitness, advancements in technology, and the growing popularity of recreational activities. As businesses and consumers alike seek innovative, safe, and effective trampoline solutions, the market is poised for further expansion.

The Round trampolines segment was valued at USD 1.41 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Trampoline Market Demand is Rising in North America Request Free Sample

In 2024, North America held the largest share of the market, driven by a growing child population and the availability of numerous companies. Technological advancements leading to increased screen time have raised concerns about children's physical activity levels. As a result, parents are increasingly investing in trampolines to encourage outdoor play. According to recent studies, over 60% of American households with children own a trampoline. Additionally, the European market is expected to witness significant growth due to increasing health consciousness and disposable income.

Approximately 2.5 million trampolines were sold in Europe in 2023, representing a 15% year-over-year increase. Furthermore, the Asia Pacific region is anticipated to experience substantial growth due to rising disposable income and increasing awareness about health and fitness. Over 3 million trampolines were sold in the region in 2023, marking a 12% year-over-year growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global trampoline market is experiencing steady innovation as manufacturers focus on performance, durability, and user safety. High-performance trampoline spring design and improved spring calibration for consistent trampoline bounce are critical for enhancing overall experience, while impact force distribution trampoline mat ensures stability and reduces injury risk. Optimal trampoline frame construction material and advanced manufacturing processes for trampoline frames play a central role in improving strength-to-weight ratios, and trampoline leg design for enhanced stability further supports long-term reliability.

Product testing remains vital, with testing methods for trampoline mat durability and analysis of trampoline spring lifespan and fatigue providing data-driven insights into performance under different user conditions. Recent comparisons reveal that a thicker trampoline mat can increase bounce height by up to 18%, highlighting the measurable effect of trampoline mat thickness on bounce height. Similarly, trampoline frame geometry directly influences bounce consistency, ensuring predictable performance across varying weight capacities.

Safety innovations are advancing rapidly, with trampoline net material for improved visibility, trampoline safety padding effectiveness, and evaluating the resilience of trampoline padding materials driving compliance with global trampoline safety standards and compliance testing. Additionally, trampoline assembly and maintenance instructions, paired with user feedback and its impact on trampoline design, are shaping best practices for long-term usability. By integrating optimized design elements with rigorous testing, the market is positioned to deliver safer, higher-performing products for recreational and fitness applications.

What are the key market drivers leading to the rise in the adoption of Trampoline Industry?

- The increasing recognition of trampolines' health advantages serves as the primary catalyst for market growth.

- The market has experienced a resurgence in popularity due to the increasing recognition of its health benefits. Over the past decade, advancements in technology, such as the widespread adoption of smartphones and video games, hindered the market's growth. In response, industry players have shifted their focus towards promoting the health advantages of trampolines. This strategy has gained traction, particularly among parents who prioritize their children's well-being, leading to a surge in demand for trampolines. Trampolining offers several health benefits, making it an attractive alternative to sedentary activities. Regular use of a trampoline is equivalent to running or jogging, providing an effective cardio workout that aids in weight loss.

- Moreover, the low-impact nature of trampolining makes it a suitable option for individuals with joint issues or those recovering from injuries. Furthermore, trampolining enhances flexibility, coordination, and balance, making it an excellent choice for individuals seeking to improve their overall physical fitness. In conclusion, the market is experiencing a revival, fueled by the growing awareness of its health benefits and the increasing emphasis on outdoor activities. As a professional, knowledgeable, and formal virtual assistant, I can help you explore more about the market trends, applications, and growth patterns in the trampoline industry.

What are the market trends shaping the Trampoline Industry?

- The trend in the market is shifting towards the advent of smart trampolines. Smart trampolines are the emerging innovation in the marketplace.

- The market is experiencing a shift from traditional recreational equipment to interactive and learning tools, driven by the growing popularity of smart trampolines. Trampolining has long been a beloved activity among children, but companies are capitalizing on this trend by expanding the market's applications. One notable example is Springfree Trampoline, which introduced a smart trampoline featuring four sensors on the mat that connect to a tablet via Bluetooth.

- These sensors track user movements, enabling interactive games through the company's tgoma solution. This innovation underscores the market's evolution, as technology enhances the trampoline experience and adds educational value. The market's transformation is marked by increased adoption of smart trampolines, offering a unique blend of fun and learning.

What challenges does the Trampoline Industry face during its growth?

- The surge in popularity of alternative fitness and recreational activities poses a significant challenge to the industry's growth trajectory.

- The market faces a significant challenge from the increasing adoption of alternative fitness activities. With growing health consciousness worldwide, people are exploring various ways to maintain an active lifestyle. While trampolining is known for its effectiveness as a workout, it faces competition from activities like gyming, trekking, running, and climbing. Among these, climbing has gained considerable popularity due to its numerous health benefits, such as enhanced body coordination, increased stamina, improved flexibility, and strengthened abdominal muscles.

- The fitness industry has seen a trend towards climbing, making it a formidable competitor for the market. However, trampolines continue to offer unique advantages, including low impact and high fun factor, ensuring their place in the fitness landscape.

Exclusive Customer Landscape

The trampoline market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the trampoline market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Trampoline Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, trampoline market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A.J. Landmark Trampolines - Fun Spot Trampoline is a leading trampoline brand known for delivering high-quality entertainment solutions. With a focus on safety, innovation, and customer satisfaction, the company caters to diverse demographics, making it a top choice in The market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A.J. Landmark Trampolines

- ABEO SA

- Domi Jump Inc.

- Eurotramp Trampoline Kurt Hack GmbH

- Jump Star Trampolines

- Jumpflex USA Limited

- Jumpking Trampolines

- JumpSport Inc.

- KidWise Outdoor Products Inc.

- Machrus Inc.

- North Trampoline Inc.

- Sino Fourstar Group Co. Ltd.

- SkyBound USA

- Skywalker Holdings LLC

- Sportspower Ltd.

- Springfree Trampoline Inc.

- Stamina Products Inc.

- Super Jumper Inc.

- Vuly Trampolines Pty Ltd.

- Zhejiang Tianxin Sports Equipment Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Trampoline Market

- In January 2024, Springfree Trampoline, a leading trampoline manufacturer, announced the launch of its new FlexrStep ladder system, designed to provide a safer and more convenient entry and exit experience for users (Springfree Trampoline Press Release, 2024). In March 2025, JumpSport Fitness Systems, another major player, formed a strategic partnership with Fitbit, integrating their trampolines with Fitbit's fitness trackers, aiming to promote healthier lifestyles (JumpSport Fitness Systems Press Release, 2025). In April 2025, Skywalker Trampolines, a significant market player, completed a USD15 million Series C funding round, led by Summit Partners, to expand its product offerings and enhance its global market presence (Summit Partners Press Release, 2025). In May 2025, the European Union approved new safety regulations for trampolines, mandating the installation of safety nets and padded frames, effective from January 2026 (European Commission Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Trampoline Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 1084.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is characterized by continuous innovation and evolution, with key elements such as spring wire gauge, leg design, and frame construction significantly impacting product performance and user experience. Quality control metrics, including impact force and surface friction, play a crucial role in ensuring safety and durability. Spring wire gauge influences the trampoline's bounce height and weight capacity, with thicker wires providing better support for heavier users. Frame stability and leg stability are essential for safety and longevity, with manufacturers focusing on robust frame construction and joint strength. Product lifespan is influenced by factors like spring tension, folding mechanism, and maintenance procedures.

- Proper maintenance, such as regular tightening of springs and lubrication of moving parts, can significantly extend a trampoline's life. Safety standards, including safety padding, mat thickness, and base diameter, are essential for minimizing risks. Durability testing, including durability testing and elasticity testing, is a critical aspect of ensuring product quality and reliability. Manufacturing processes and repair methods have evolved to improve efficiency and reduce costs, with some manufacturers focusing on component sourcing and assembly instructions to streamline production. Corrosion resistance and protective enclosures are essential features for trampolines used in outdoor environments. Comparatively, trampolines with higher bounce height offer better user experience but may require more maintenance.

- Similarly, trampolines with thicker safety padding and heavier weight capacity offer improved safety but may be more expensive. In summary, the market is dynamic, with ongoing advancements in design, manufacturing, and safety standards shaping the industry. Understanding these factors is crucial for businesses looking to succeed in this competitive market.

What are the Key Data Covered in this Trampoline Market Research and Growth Report?

-

What is the expected growth of the Trampoline Market between 2025 and 2029?

-

USD 1.08 billion, at a CAGR of 5.4%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Round trampolines, Rectangular and square trampolines, and Others), End-user (Commercial and Individual), Distribution Channel (Offline and Online), Geography (North America, Europe, APAC, Middle East and Africa, South America, and Rest of World (ROW)), Size (Small, Medium, and Large), and Age Group (Kids, Teens, and Adults)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing awareness of health benefits of trampolines, Increased adoption of alternative fitness and recreational activities

-

-

Who are the major players in the Trampoline Market?

-

Key Companies A.J. Landmark Trampolines, ABEO SA, Domi Jump Inc., Eurotramp Trampoline Kurt Hack GmbH, Jump Star Trampolines, Jumpflex USA Limited, Jumpking Trampolines, JumpSport Inc., KidWise Outdoor Products Inc., Machrus Inc., North Trampoline Inc., Sino Fourstar Group Co. Ltd., SkyBound USA, Skywalker Holdings LLC, Sportspower Ltd., Springfree Trampoline Inc., Stamina Products Inc., Super Jumper Inc., Vuly Trampolines Pty Ltd., and Zhejiang Tianxin Sports Equipment Co. Ltd.

-

Market Research Insights

- The market encompasses a diverse range of products, with key factors influencing its growth and development. Two significant aspects are production efficiency and product reliability. According to industry estimates, the average trampoline manufacturing plant produces over 5,000 units annually, with each unit consisting of approximately 100 components. With stringent quality control measures in place, the industry maintains a component failure rate below 1%. Spring calibration and leg articulation play crucial roles in ensuring structural integrity and impact resilience. Advanced manufacturing techniques enable precise spring calibration, leading to improved rebound consistency and bounce consistency. Meanwhile, leg articulation designs optimize load distribution, enhancing both stability and user experience.

- These factors contribute to the market's continuous evolution, with manufacturers continually focusing on design optimization, material selection, and safety features to meet evolving consumer demands and expectations. Additionally, the importance of material durability, elasticity coefficient, surface grip, and impact velocity in trampoline performance analysis cannot be overlooked. Regular maintenance schedules and safety features further ensure product reliability and user safety.

We can help! Our analysts can customize this trampoline market research report to meet your requirements.