Transcranial Doppler Market Size 2025-2029

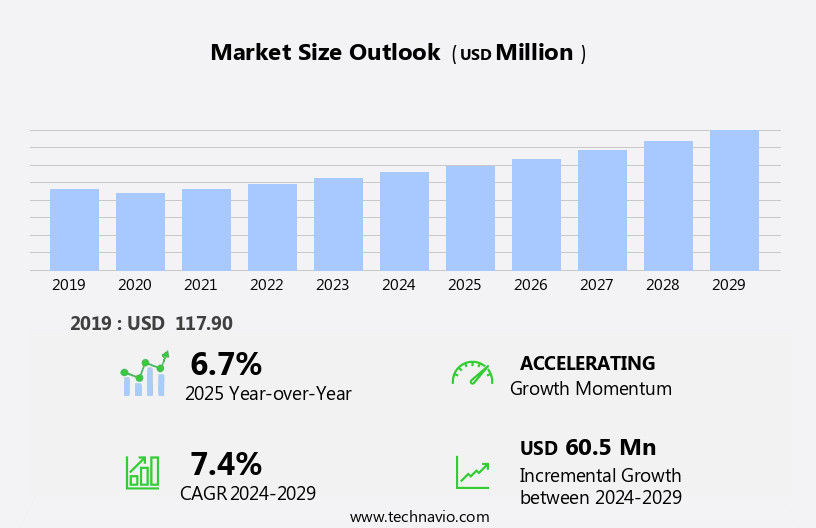

The transcranial doppler market size is forecast to increase by USD 60.5 million, at a CAGR of 7.4% between 2024 and 2029.

- The Transcranial Doppler (TCD) market is experiencing significant growth due to the increasing utilization of TCD systems in diagnosing and monitoring sickle cell disease. This application area is gaining traction as TCD offers non-invasive, real-time monitoring capabilities, enabling early detection and effective management of complications. Concurrently, technological advancements in TCD systems are driving market expansion. Innovations such as portable and handheld devices, improved imaging capabilities, and integration with electronic health records enhance the diagnostic accuracy and accessibility of these systems. However, the market faces challenges, primarily stemming from the limitations of TCD technology. These include the dependence on skilled operators for accurate readings, the inability to provide a complete picture of cerebral blood flow, and the potential for artifacts that may affect the accuracy of the results.

- Addressing these challenges through continuous research and development efforts will be crucial for market participants seeking to capitalize on the opportunities presented by this dynamic market.

What will be the Size of the Transcranial Doppler Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The transcranial doppler (TCD) market continues to evolve, driven by advancements in medical imaging technology and the growing demand for cerebral blood flow assessment in various sectors. Neurocritical care settings are at the forefront of this evolution, with a focus on improving quality of care and enhancing patient outcomes. Software applications and healthcare professionals are increasingly adopting TCD for real-time monitoring of vascular diseases, including carotid artery stenosis and cerebral vasospasm. Regulatory approvals and health economics are shaping the market dynamics, influencing the adoption of TCD for disease management and cost-effective treatment planning. TCD technology is being integrated into healthcare systems to optimize workflows and streamline brain injury assessment.

Vascular surgery and hemodynamic monitoring applications are gaining traction, with TCD providing valuable insights into cerebral autoregulation and mean flow velocity. Diagnostic accuracy and clinical guidelines are being refined to ensure standardization and consistency in TCD usage. Meanwhile, advances in signal processing and data management are enabling more sophisticated analysis of TCD data, leading to improved diagnostic accuracy and better patient outcomes. The ongoing unfolding of market activities underscores the continuous role of TCD in addressing the complexities of neurological disorders and contributing to the advancement of healthcare technology.

How is this Transcranial Doppler Industry segmented?

The transcranial doppler industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Hospitals

- Diagnostic laboratories

- Others

- Type

- Imaging devices

- Non-imaging devices

- Product Type

- M-mode display

- B-mode display

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

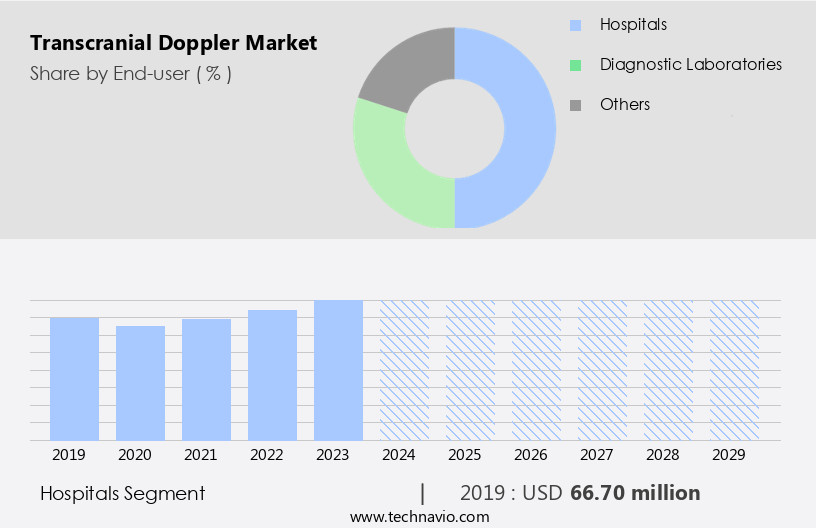

The hospitals segment is estimated to witness significant growth during the forecast period.

Transcranial Doppler (TCD) ultrasound technology plays a pivotal role in neurocritical care, particularly in assessing cerebral blood flow and diagnosing neurological disorders such as carotid artery stenosis, cerebral vasospasm, and subarachnoid hemorrhage. Hospitals represent the largest market segment due to their well-equipped facilities, employing skilled healthcare professionals, and the availability of advanced diagnostic tools like magnetic resonance transcranial doppler systems. The increasing prevalence of neurological disorders necessitates early diagnosis and prevention, driving market growth. Regulatory approvals, healthcare economics, and clinical guidelines ensure the adoption of TCD monitoring in disease management. Continuous wave and pulsed wave doppler technologies, along with signal processing and data analysis software applications, facilitate accurate diagnostic imaging.

Medical training and workflow optimization enable efficient patient monitoring, while intracranial pressure and hemodynamic monitoring provide valuable insights into cerebral autoregulation and cerebral perfusion. In critical care medicine, TCD monitoring plays a crucial role in treatment planning for vascular diseases and head injuries, contributing to improved patient outcomes. Healthcare technology advancements, such as data management and data visualization, enhance the overall quality of care. Pulsatility index, mean flow velocity, pulse wave velocity, and resistance index are essential diagnostic parameters in TCD monitoring. Clinical trials and ongoing research contribute to refining diagnostic accuracy and expanding TCD applications. Despite the capital-intensive nature of TCD equipment, healthcare technology investments and favorable reimbursement policies facilitate its adoption.

Vascular surgery and patient monitoring remain significant areas of application for TCD technology.

The Hospitals segment was valued at USD 66.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

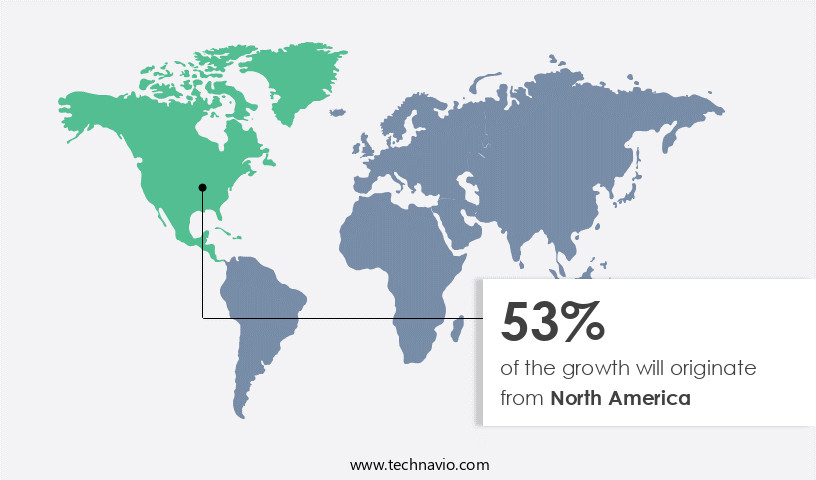

North America is estimated to contribute 53% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Transcranial Doppler (TCD) market is significantly shaped by advancements in medical imaging technology and the growing focus on cerebral blood flow assessment in neurocritical care. TCD ultrasound, which uses pulsed or continuous wave Doppler to measure blood flow velocity and pulsatility index in the intracranial vessels, plays a crucial role in disease management for various neurological disorders, including carotid artery stenosis, cerebral vasospasm, and subarachnoid hemorrhage. Healthcare professionals rely on TCD monitoring for real-time assessment of brain injury and intracranial pressure, enabling effective treatment planning and hemodynamic monitoring. Regulatory approvals and healthcare technology innovations continue to drive market growth, with software applications and signal processing techniques enhancing diagnostic accuracy and workflow optimization.

In the US, the market is dominated by the presence of major medical device manufacturers and the high prevalence of cerebrovascular diseases, such as stroke, which affects approximately 795,000 people annually. The economic burden of these conditions is substantial, with healthcare costs estimated at about USD34 billion per year. Clinical trials and clinical guidelines contribute to the advancement of TCD technology and the improvement of patient outcomes in critical care medicine and vascular surgery. Meanwhile, the adoption of TCD technology continues to expand, with data management and data analysis playing increasingly important roles in the assessment of resistance index, pulse wave velocity, and mean flow velocity for diagnostic purposes.

Medical training and standardization are essential for ensuring the accuracy and reliability of TCD measurements and maintaining the quality of care in this field.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market represents the growing demand for non-invasive diagnostic tools used to assess blood flow and cerebral hemodynamics in various neurological conditions. This market encompasses ultrasound systems, probes, transducers, and related accessories. Transcranial doppler ultrasound technology offers advantages such as real-time monitoring, portability, and non-invasiveness, making it an essential tool for neurophysiologists, neurologists, and researchers. Key applications include cerebrovascular diseases, traumatic brain injury, and neurointensive care. Market drivers include an aging population, increasing prevalence of neurological disorders, and technological advancements in transcranial doppler systems. Additionally, government initiatives, research grants, and collaborations fuel market growth. The market is segmented by end-users, applications, and geographies. Global trends include miniaturization, wireless connectivity, and integration with other diagnostic tools.

What are the key market drivers leading to the rise in the adoption of Transcranial Doppler Industry?

- The increasing utilization of transcranial doppler systems in diagnosing sickle cell disease is the primary market driver, reflecting the significant role these technologies play in improving diagnostic accuracy and patient care.

- Transcranial Doppler (TCD) ultrasound technology has gained significant traction in healthcare for the diagnosis and management of neurological disorders, particularly sickle cell disease (SCD). The increasing prevalence of SCD, which affects millions of people worldwide, primarily in Sub-Saharan Africa, South America, Central America, Saudi Arabia, India, and Mediterranean countries, is driving market growth. SCD patients are at an elevated risk of stroke and intracranial stenosis, which can be identified using TCD systems. Regulatory approvals and health economics are crucial factors influencing the market. TCD monitoring is cost-effective compared to other diagnostic methods, making it an attractive option for disease management.

- The technology's non-invasive nature and ease of use contribute to its growing adoption. Pulsed wave Doppler signal processing plays a vital role in TCD technology, enabling the measurement of blood velocity and pulsatility index. These parameters are essential in evaluating intracranial pressure and cerebrovascular conditions. The advancements in image acquisition techniques and signal processing algorithms have improved the accuracy and reliability of TCD systems. In the healthcare sector, TCD monitoring is increasingly being used for stroke prevention and disease management. For instance, the Stroke Prevention Trial in Sickle Cell Anemia (STOP) study demonstrated the effectiveness of transcranial ultrasonography systems in screening for complications of SCD.

- This trial marked a significant milestone in the application of TCD technology in healthcare.

What are the market trends shaping the Transcranial Doppler Industry?

- Transcranial doppler systems are experiencing significant technological advances, making them the current market trend in healthcare technology. This innovation offers improved diagnostic capabilities and potential for non-invasive brain monitoring.

- Transcranial Doppler (TCD) systems have gained significant traction in the medical field due to their ability to assess brain injuries and vascular diseases. Companies are innovating to provide advanced, portable, and ergonomic TCD systems for medical professionals. Rimed's offerings include easy-to-use TCD systems, while Digi-One provides a portable, digital solution with intuitive connectivity. These devices offer diagnostic capabilities for modern neurovascular laboratories and neurosonography, enabling measurement of blood flow velocity in the brain and detection of stenosis and emboli. Digi-One's optional add-on imaging probe, Digi-Lite IP, allows physicians to perform comprehensive diagnostic studies of intracranial and transcranial blood vessels.

- Data management and analysis are crucial aspects of TCD systems, with workflow optimization essential for critical care medicine. Pulse wave velocity measurement is another important feature for assessing vascular diseases and patient outcomes. Companies focus on providing user-friendly systems to ensure accurate and efficient diagnostic processes.

What challenges does the Transcranial Doppler Industry face during its growth?

- The growth of the transcranial doppler systems industry is constrained by the limitations of this diagnostic technology, which poses a significant challenge for industry professionals.

- Transcranial Doppler (TCD) systems are essential tools for monitoring cerebral blood flow and diagnosing central nervous system disorders. These systems utilize Doppler shift and resistance index to assess mean flow velocity, cerebral perfusion, and cerebral autoregulation. Despite their benefits, TCD systems face challenges in developing countries due to limited adoption, particularly in rural areas where skilled neurologists are scarce or alternative diagnostic procedures like magnetic resonance imaging are more prevalent. TCD systems are subject to certain limitations. The procedure can be affected by motion, as even minor movements can hinder the examination process and impact the accuracy of readings.

- Additionally, individuals with high body mass index may experience weaker sound waves due to adipose tissue, affecting the diagnostic accuracy of the TCD system. Data visualization and technological advancements are driving improvements in TCD systems, enhancing their clinical utility. Clinical guidelines emphasize the importance of hemodynamic monitoring and early diagnosis of vascular surgery indications, making TCD systems increasingly valuable in various healthcare settings. By addressing the challenges and optimizing the technology, TCD systems can continue to contribute significantly to the diagnostic and therapeutic management of cerebrovascular diseases.

Exclusive Customer Landscape

The transcranial doppler market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the transcranial doppler market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, transcranial doppler market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Atys Medical - Transcranial Doppler Holter TCD X is an advanced medical device, recording cerebral blood flow signals for extended hours. Ideal for athletes and those engaged in daily activities, it enhances diagnostic insights, enabling comprehensive assessments of cerebrovascular health.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atys Medical

- B.Braun SE

- Compumedics Ltd.

- ELCAT GmbH

- General Electric Co.

- Integra LifeSciences Holdings Corp.

- Konica Minolta Inc.

- Moor Instruments Ltd.

- Multigon Industries Inc.

- Natus Medical Inc.

- NovaSignal Corp.

- Recorders and Medicare Systems Pvt Ltd.

- Rimed Ltd.

- Shenzhen Delica Medical Equipment Co. Ltd.

- SMT Medical Technology GmbH

- Spencer Technologies

- Viasonix Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Transcranial Doppler Market

- In January 2024, Medtronic, a leading medical technology company, announced the FDA approval of its new Transcranial Doppler (TCD) system, the NeuroLogica Transcranial Doppler 3000 Series. This advanced TCD system offers improved image quality and user interface, enhancing the diagnostic experience for healthcare professionals (Medtronic Press Release, 2024).

- In March 2024, Philips and GE Healthcare, two major players in the healthcare industry, joined forces to co-develop a next-generation TCD system. Their collaboration aims to integrate Philips' clinical expertise with GE Healthcare's technology, potentially leading to innovative solutions and increased market competition (Philips and GE Healthcare Press Release, 2024).

- In May 2024, Masimo, a global leader in noninvasive monitoring, raised USD200 million in a funding round to expand its product portfolio and invest in research and development, including its Transcranial Doppler technology (Business Wire, 2024).

- In February 2025, the European Commission approved the use of Transcranial Doppler technology for stroke diagnosis and monitoring in Europe, expanding its application beyond research purposes. This regulatory approval is expected to boost the market growth in the region (European Commission Press Release, 2025).

Research Analyst Overview

- In the dynamic Transcranial Doppler (TCD) market, advancements in healthcare informatics and big data are driving the integration of predictive analytics to enhance cerebral hemodynamics assessment. Medical ethics and data security remain crucial considerations in this context, ensuring patient privacy and regulatory compliance. Neurovascular ultrasound, a non-invasive monitoring technique, is gaining popularity in medical research and drug development for outcome prediction and real-time monitoring. Machine learning and artificial intelligence are transforming TCD by enabling personalized medicine and therapeutic intervention. Mobile health and point-of-care testing are further expanding accessibility, while continuing medical education and professional development cater to the evolving needs of healthcare professionals.

- Service agreements and quality control ensure reliable and effective implementation of these technologies. Early detection and remote monitoring are key trends, offering significant benefits in various therapeutic areas. Data analytics plays a pivotal role in optimizing TCD applications, enabling efficient research methods and improving patient care.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Transcranial Doppler Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 60.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.7 |

|

Key countries |

US, Germany, China, Canada, France, India, Japan, UK, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Transcranial Doppler Market Research and Growth Report?

- CAGR of the Transcranial Doppler industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the transcranial doppler market growth of industry companies

We can help! Our analysts can customize this transcranial doppler market research report to meet your requirements.