Trocars Market Size 2024-2028

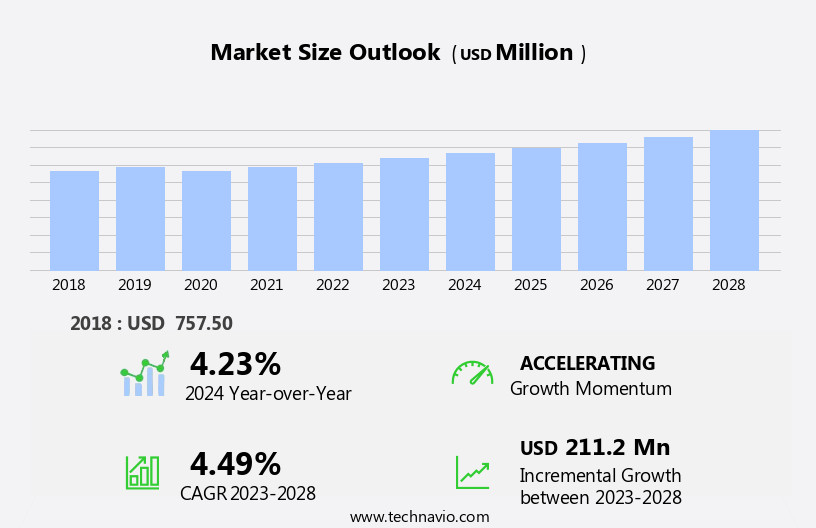

The trocars market size is forecast to increase by USD 211.2 million, at a CAGR of 4.49% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing volume of laparoscopic procedures, which rely on trocars for accessing the surgical site. This trend is driven by the advantages of minimally invasive surgeries, including reduced recovery time, minimal scarring, and improved patient outcomes. Another key driver is the emergence of balloon-assisted trocars, also known as balloon-tipped trocars (BTTs), which offer enhanced sealing and insufflation capabilities, leading to fewer complications and better surgical outcomes. However, the market faces challenges, primarily related to the risks associated with trocar use, such as trocar site infections, injury to adjacent organs, and hernia formation.

- These complications necessitate the development of advanced trocar designs and improved surgical techniques to mitigate risks and ensure patient safety. Companies in the market must focus on addressing these challenges while capitalizing on the growing demand for minimally invasive procedures to maintain a competitive edge.

What will be the Size of the Trocars Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in surgical techniques and the growing demand for minimally invasive procedures. Validation testing plays a crucial role in ensuring the safety and efficacy of needle drivers, gamma irradiation, veress needles, and other essential components. Stainless steel, a biocompatible material, is widely used in the production of surgical clips and access ports. Surgical training and quality control are paramount in maintaining the highest standards of patient safety. Plasma sterilization and ethylene oxide are common sterilization methods used to prevent surgical site infections. Surgical planning and irrigation systems are integral to the success of laparoscopic surgery, while pain management and energy sources are essential for patient comfort.

Reusable trocars and tissue graspers are being replaced by single-use devices to minimize the risk of cross-contamination. Surgical adhesives, sealants, and surgical site infection control are crucial components of postoperative care. The use of camera heads, surgical incisions, and access ports in cardiothoracic, gynecologic, bariatric, and general surgery continues to expand. Material science plays a significant role in the development of advanced surgical instruments, including trocar cannulas and gas flow control systems. Patient safety remains a top priority, with a focus on infection control and surgical outcomes. Urologic surgery and energy sources are also gaining prominence in the market.

The ongoing evolution of the market is shaped by continuous innovation in surgical planning, minimally invasive surgery, and pain management. The integration of advanced technologies and biocompatible materials is transforming the landscape of surgical instruments and access ports.

How is this Trocars Industry segmented?

The trocars industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Cutting trocars

- Dilating trocars

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Rest of World (ROW)

- North America

By Product Insights

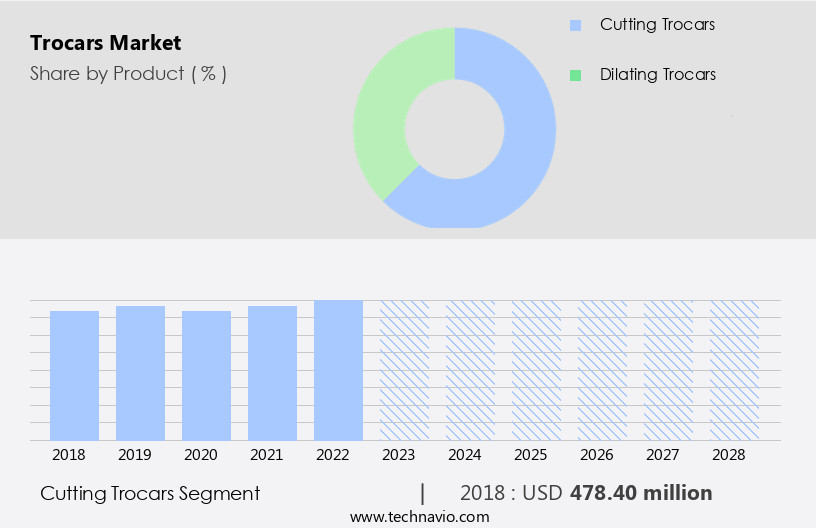

The cutting trocars segment is estimated to witness significant growth during the forecast period.

The market is experiencing notable growth due to the increasing number of laparoscopic procedures and the rising preference for robot-assisted laparoscopic surgeries. This trend is driven by continuous technological advancements, including improvements in tip design for safer access to the body cavity. The market is further boosted by the shift towards minimally invasive surgeries, which has increased the demand for cutting trocars. Laparoscopic surgeons' enhanced expertise plays a significant role in market growth. Bladed trocars, with their sharp flat blades and pointed shields, facilitate easy insertion and minimize fascial trauma. These features have driven market expansion. Material science innovations have led to the development of biocompatible materials for manufacturing trocars, ensuring patient safety.

Additionally, advancements in energy sources, surgical planning, and irrigation systems have further propelled market growth. Preoperative assessment, infection control, and postoperative care are crucial aspects of surgical procedures, and trocars play a vital role in these processes. Surgical instruments, including tissue graspers, surgical clips, and access ports, are integral components of surgical procedures, and the demand for these instruments is increasing. The market caters to various surgical specialties, such as gynecologic, urologic, bariatric, and cardiothoracic surgeries. Single-use devices and reusable trocars are available, with gas flow control and plasma sterilization being essential considerations for maintaining optimal surgical conditions. Surgical training and quality control are essential to ensure optimal surgical outcomes.

The market also focuses on infection control and wound healing, with surgical sealants and surgical adhesives playing crucial roles. In conclusion, the market is witnessing significant growth due to the increasing number of laparoscopic procedures, the shift towards minimally invasive surgeries, and continuous technological advancements. The market is driven by the demand for safe and effective surgical instruments that facilitate optimal surgical conditions and contribute to positive surgical outcomes.

The Cutting trocars segment was valued at USD 478.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

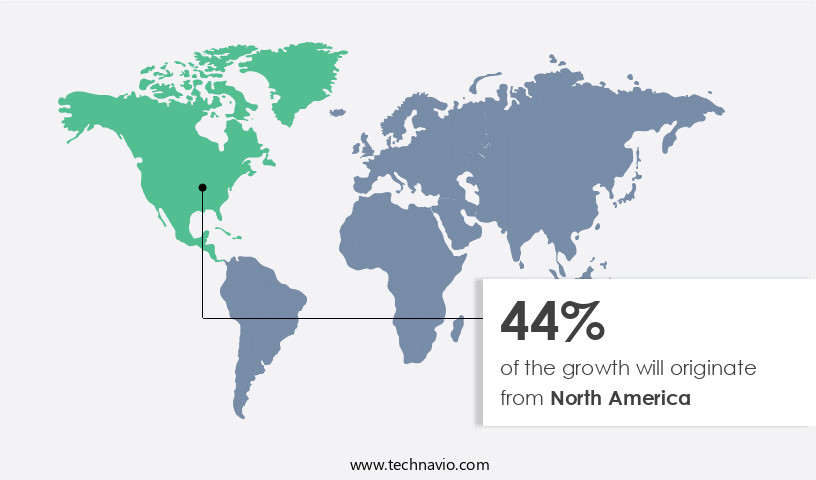

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing notable growth due to the increasing number of laparoscopic procedures, particularly in gynecology. companies are focusing on introducing advanced technologies to enhance surgical efficiency and patient safety. For instance, the adoption of veress-pneumoperitoneum trocars to mitigate entry-related complications is gaining traction. Additionally, the development of direct and optical trocars, closed entry and open technique trocars, and radially expanding trocars has expanded the product portfolio. The market's growth is further fueled by the demand for disposable trocars, which offer benefits such as reduced risk of infection and improved patient outcomes. Minimally invasive surgeries, including bariatric and cardiothoracic procedures, are also contributing to market expansion.

Quality control measures, such as gamma irradiation and plasma sterilization, ensure the biocompatibility and safety of trocars. Infection control, surgical planning, and pain management are other crucial factors driving market growth. Material science advancements have led to the use of stainless steel and other biocompatible materials in trocar manufacturing. The market's evolution is further characterized by the integration of energy sources, surgical adhesives, access ports, irrigation systems, and surgical instruments to streamline surgical procedures. Surgical training and postoperative care are essential aspects of the market, ensuring optimal surgical outcomes. Urologic surgeries and single-use devices are emerging trends in the market.

Overall, the North American the market is witnessing robust growth, driven by technological advancements, increasing demand for minimally invasive surgeries, and a focus on patient safety.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Trocars Industry?

- The significant increase in the number of laparoscopic procedures is the primary market driver, given the growing preference for minimally invasive surgical procedures among patients and healthcare providers.

- Laparoscopic procedures, which utilize surgical instruments such as trocar cannulas, have gained popularity among surgeons due to their superior post-surgical outcomes. Compared to traditional open surgeries, laparoscopic procedures offer several advantages, including reduced postoperative complications like pain, collapsed lungs, blood clots, fatigue, muscle atrophy, and infections. Anesthesia-related complications such as nausea, sore throat, confusion, and sleepiness are also minimized. Healthcare facilities prefer laparoscopic procedures due to their affordability, shorter hospital stays, lower risk of postoperative infections, quick recovery, and efficient treatment of gastrointestinal and urological disorders through MI surgeries like robot-assisted hysterectomy and proctosigmoidectomy.

- Surgical sealants and single-use devices ensure infection control and contribute to the success of laparoscopic procedures. In conclusion, the use of trocar cannulas and laparoscopic procedures in general surgery, urologic surgery, and other medical interventions enhances wound healing, patient comfort, and surgical outcomes.

What are the market trends shaping the Trocars Industry?

- The emergence of balloon shaped Bluetooth Tracking Tags (BTTs) represents a significant market trend in the technology industry. These innovative devices offer enhanced functionality and design, making them an attractive option for consumers seeking advanced tracking solutions.

- In the field of laparoscopic surgery, the demand for advanced trocars continues to grow due to the potential complications associated with traditional methods. These complications, such as damage to the peritoneal cavity during cholecystectomy, have led to a focus on innovation in trocar design and material science. companies are investing in research and development to create trocars that offer improved clinical outcomes. One such advancement is the use of balloon-assisted trocars, which facilitate smoother laparoscopic procedures and minimize complications. For example, B. Braun's Hernia Balloon Herloon is a laparoscopic trocar featuring rounded and non-rounded tips and a balloon, making it ideal for hernia surgery.

- This design offers advantages like easy adoption of the balloon shaft to the trocar body, ensuring a harmonious and immersive surgical experience. Quality control measures such as gamma irradiation, plasma sterilization, and validation testing are essential in the manufacturing process to maintain the highest standards of safety and effectiveness. Needle drivers and surgical clips are also crucial components of the trocar system, ensuring precise and efficient surgical incisions. Overall, the market for trocars is driven by the need for enhanced safety, efficiency, and clinical outcomes in laparoscopic procedures.

What challenges does the Trocars Industry face during its growth?

- The growth of the medical device industry is significantly impacted by the complexities and challenges posed by the use of trocars in surgical procedures.

- Laparoscopic surgery, a minimally invasive procedure, has gained significant popularity in the US due to its numerous benefits, including improved surgical outcomes, quick recovery, low morbidity, and reduced pain. With over two million laparoscopic procedures performed annually in the US, the demand for trocars, essential tools for accessing the peritoneal cavity during these surgeries, is on the rise. During laparoscopic procedures, creating pneumoperitoneum is crucial for enhancing visualization. This process involves insufflating the abdominal cavity with carbon dioxide to create a space between the abdominal wall and the viscera. Once the pneumoperitoneum is established, a trocar is inserted into the body to access the surgical site.

- The precise insertion of trocars is vital, as incorrect placement can result in complications, such as injury to intra-abdominal viscera or intra and retroperitoneal vessels. Trocars come in various forms, including reusable and disposable ones. Some trocars are equipped with irrigation systems, which facilitate the removal of debris and gases during the procedure. Additionally, tissue graspers are often attached to trocars to help surgeons manipulate and remove tissues. In the context of gynecologic surgery, trocars play a pivotal role in facilitating minimally invasive procedures, leading to better patient outcomes and reduced pain.

Exclusive Customer Landscape

The trocars market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the trocars market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, trocars market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ackermann Instrumente GmbH - This company specializes in providing a comprehensive range of trocars and obturators, essential tools for creating small, incision-like openings in outer tissue layers during laparoscopic procedures and other minimally invasive surgeries. These instruments facilitate efficient access to surgical sites, enhancing the overall effectiveness and safety of the procedures.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ackermann Instrumente GmbH

- B.Braun SE

- BNR Co.Ltd.

- Changzhou Ankang Medical Instrument Co. Ltd.

- Conmed Corp.

- Eberle GmbH and Co. KG

- GENICON Inc.

- Johnson and Johnson Services Inc.

- LaproSurge Ltd.

- LocaMed Ltd.

- Medtronic Plc

- Novatech

- Peters Surgical

- Purple Surgical

- Seemann Technologies GmbH

- SURKON MEDICAL

- The Cooper Companies Inc.

- UNIMAX MEDICAL SYSTEMS Inc.

- Victor Medical Instruments Co.Ltd.

- XION GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Trocars Market

- In January 2024, Medtronic plc, a global healthcare solutions company, announced the launch of its new Harmonic Acelity Surgical System, an advanced energy platform designed to enhance the efficiency and precision of laparoscopic surgeries. This innovation was a significant addition to the market, as it offered improved tissue coagulation and sealing capabilities (Medtronic Press Release, 2024).

- In March 2024, Ethicon, a subsidiary of Johnson & Johnson, entered into a strategic collaboration with Verily Life Sciences, an Alphabet company, to develop a connected surgical system. The collaboration aimed to integrate Ethicon's surgical devices, including trocars, with Verily's health data analytics and machine learning capabilities, aiming to improve patient outcomes and surgical efficiency (Johnson & Johnson Press Release, 2024).

- In May 2024, Smiths Medical, a leading medical device manufacturer, completed the acquisition of the surgical business of B.Braun Melsungen AG, significantly expanding its presence in the market. The acquisition added B.Braun's extensive product portfolio, including its range of disposable and reusable trocars, to Smiths Medical's offerings (Smiths Medical Press Release, 2024).

- In April 2025, the U.S. Food and Drug Administration (FDA) granted 510(k) clearance to Stryker Corporation for its new ValuPlast XL Trocar System. This system featured a larger diameter and improved sealing mechanism, offering surgeons greater access and control during laparoscopic procedures (Stryker Press Release, 2025).

Research Analyst Overview

- The market encompasses innovative technologies such as 3D imaging, image-guided surgery, and surgical simulation software, propelling precision engineering in healthcare. Optical systems and high-definition video are integral components, enabling real-time visualization during minimally invasive procedures. FDA approval and CE marking are crucial regulatory milestones for market access. Distribution channels and supply chain optimization are essential for reaching healthcare providers, while continuing medical education and professional development foster surgical expertise. Robotic surgery, fiber optics, and surgical robotics are transforming surgical techniques, enhancing patient outcomes. Medical imaging, medical device regulations, and regulatory affairs are critical aspects of the market landscape.

- Haptic feedback, virtual reality training, and advanced surgical training are revolutionizing healthcare IT and computer-assisted surgery. Data analytics, surgical navigation, endoscopic cameras, and augmented reality are shaping the future of clinical trials and surgical procedures. Surgical skills, healthcare economics, and clinical outcomes are key performance indicators, driving the adoption of these advanced technologies. Biomedical engineering and light sources are pivotal in the development of next-generation trocars and surgical instruments. Data analysis and data-driven insights are redefining market trends and shaping the future of the market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Trocars Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.49% |

|

Market growth 2024-2028 |

USD 211.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Canada, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Trocars Market Research and Growth Report?

- CAGR of the Trocars industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the trocars market growth of industry companies

We can help! Our analysts can customize this trocars market research report to meet your requirements.