Turbine Oil Market Size 2024-2028

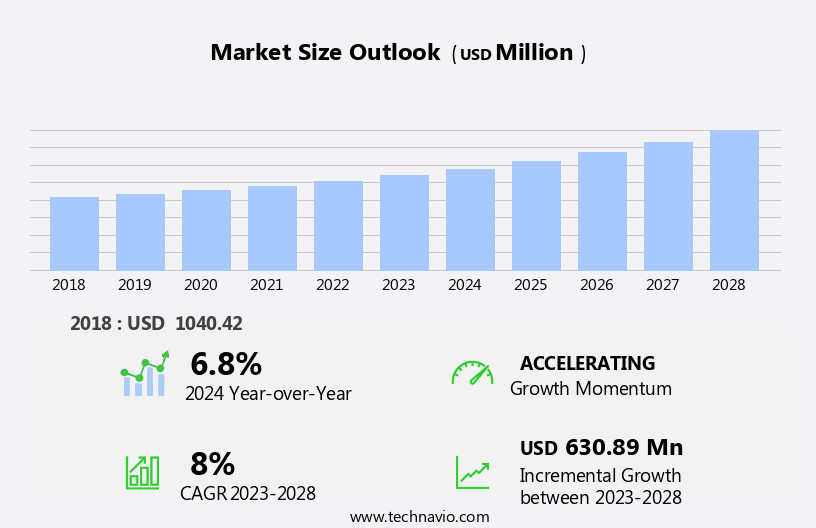

The turbine oil market size is forecast to increase by USD 630.89 million at a CAGR of 8% between 2023 and 2028.

- The market is witnessing significant growth due to the surge in global electricity demand, driving the need for efficient power generation. The growth of combined-cycle power plants (CCPPs) is another key factor fueling market expansion. However, the marine industry's slowdown is posing a challenge to market growth. Increasingly stringent regulations on emissions and the shift towards low-emission fuels are compelling marine industries to adopt new technologies, which may impact the demand for turbine oil. Additionally, the increasing adoption of renewable energy sources and advancements in alternative lubricants are potential threats to the market. Nevertheless, the market's growth prospects remain promising, given the ongoing global electrification trend and the continuous demand for reliable and efficient power generation solutions.

What will be the Size of the Turbine Oil Market During the Forecast Period?

- The market is a critical segment of the global lubricants industry, primarily serving the energy sector. This market is driven by the increasing economies of scale in energy consumption and the expansion of renewable energy sources, such as wind and hydroelectric power generation. Turbine lubricating oils, including mineral-based and biobased varieties, play a vital role in ensuring the efficient operation of turbines in power generation and various industrial applications. External contamination and oxidation are significant challenges In the turbine oil industry. To address these issues, manufacturers continue to innovate, developing advanced lubrication solutions with oxidation inhibitors, corrosion inhibitors, defoamants, and demulsifiers.

- The market is also influenced by trends in wind energy investment, policy interventions, and the growing adoption of hybrid vehicles, electric motors, and battery parity. As the demand for cleaner and more sustainable energy sources increases, the role of turbine oils in wind turbines, hydroelectric power generation, tidal power generation, and other renewable energy applications will continue to evolve.

How is this Turbine Oil Industry segmented and which is the largest segment?

The turbine oil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type

- Mineral oil

- Synthetic oil

- Application

- Steam turbine

- Gas turbine

- Others

- Geography

- APAC

- China

- India

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Product Type Insights

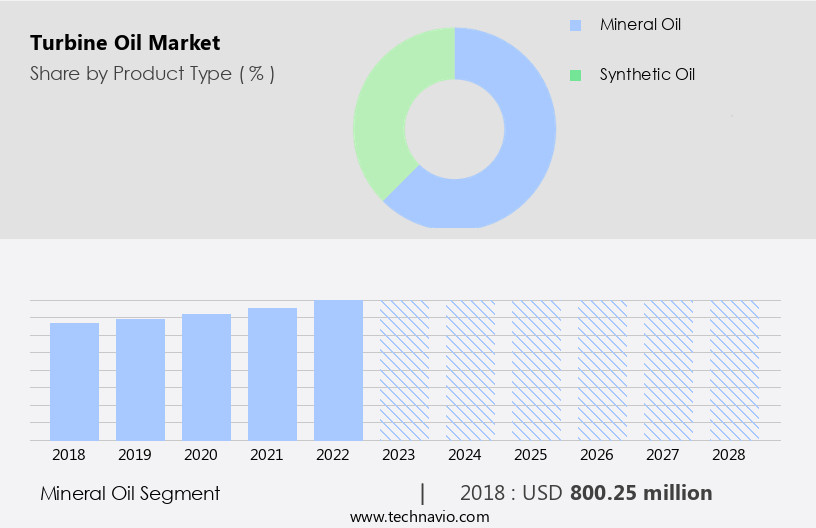

- The mineral oil segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the economies with high energy consumption and the increasing investment in renewable energy sources. Turbine lubricating oils, including mineral-based and synthetic types, play a crucial role In the efficient operation of turbines in various industries, such as energy generation from wind, hydroelectric power, and tidal power. Mineral oil segment dominates the turbine oil industry due to its affordability and wide applicability in different turbine types and operational conditions. However, external contamination and oxidation products pose significant challenges to the performance and longevity of turbine oils. To address these issues, manufacturers develop advanced formulations with oxidation inhibitors, corrosion inhibitors, defoamants, demulsifiers, and other additives.

The market is expected to grow due to the rising demand for renewable energy sources, particularly in wind energy, and the increasing adoption of advanced lubrication technologies. The major end-use sectors include automotive, energy generation, aviation, and manufacturing. The increasing income levels and the expanding airline sector, including commercial airplanes and military aeronautics, are also contributing to the market growth. The high heat temperature and operational costs In these sectors necessitate the use of high-performance turbine oils with excellent viscosity, anti-corrosion, anti-rust, stability against oxidation, filterability, and water-separating properties. The transition to new energy vehicles, such as electric motor and hybrid vehicles, and the implementation of battery parity are also expected to impact the market.

The lack of technologies and the high-cost capital required for direct-drive technology and slowdown In the wind turbine market may pose challenges to the market growth.

Get a glance at the Turbine Oil Industry report of share of various segments Request Free Sample

The Mineral oil segment was valued at USD 800.25 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

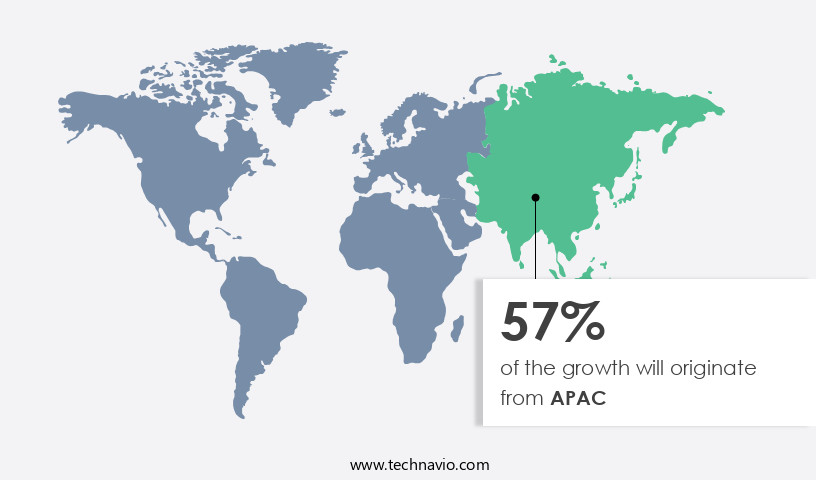

- APAC is estimated to contribute 57% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing significant growth due to the increasing demand for efficient and cleaner energy sources in developing economies, particularly in India and China. To reduce carbon emissions and promote sustainable energy production, these countries are investing in advanced technologies such as combined-cycle gas turbines (CCGT). The rising adoption of CCGTs is anticipated to fuel the demand for turbine oils in APAC. Additionally, the region's investment in renewable energy sources, including wind and solar power, presents another lucrative market for turbine oils. As wind turbines and other renewable energy systems rely on turbines for operation, the market is poised for expansion.

The turbine oil industry caters to various end-use sectors, including energy generation, automotive, aviation, and hydroelectric power generation. Turbine lubricating oils offer essential properties such as oxidation inhibitors, corrosion inhibitors, defoamants, demulsifiers, and base oil with water-separating properties. Manufacturers focus on formulating high-performance turbine oils to cater to diverse applications and meet the evolving industry demands. The market is driven by factors such as the increasing use of renewable energy sources, policy interventions, and the growing popularity of new energy vehicles like electric and hybrid vehicles. The high-cost capital requirements and slowdown in some industries, such as aviation, may present challenges to market growth.

However, the potential for technological advancements, such as direct-drive technology and high-temperature formulations, offers opportunities for market expansion.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Turbine Oil Industry?

Increase in global electricity demand is the key driver of the market.

- The market plays a crucial role In the Economies' Energy Consumption as turbine lubricating oils are essential for the smooth operation and longevity of turbines used in various industries, including power generation and aerospace. Gas turbines, such as those used in combined cycle power plants, require high-quality turbine oils for electricity generation. Steam turbines, on the other hand, are commonly employed In thermal power plants. Proper lubrication with advanced turbine oils, including oxidation inhibitors, corrosion inhibitors, defoamants, demulsifiers, and base oils with water-separating properties, is vital for maintaining the efficiency and reliability of these systems. The expansion of economies and infrastructure worldwide will fuel the growth of the Turbine oil industry.

- The increasing demand for electricity due to rising income levels and the shift towards renewable energy sources, such as wind, hydroelectric power generation, and tidal power generation, will drive the need for more power generation, leading to an increase In the number of new installations and the maintenance of existing turbines. Moreover, the market will also benefit from the Wind energy investment and Policy interventions, including incentives for renewable energy sources, as wind turbines require specialized turbine oils for their operation. The market will also experience growth due to the increasing adoption of hybrid vehicles, electric motor-driven systems, and new energy vehicles, such as passenger cars and commercial airplanes, which use turbine oils In their propulsion systems, bearings, and engines.

- However, the market faces challenges such as the high heat temperature, formulation complexities, and the high-cost capital required for the production of advanced turbine oils. Additionally, the lack of technologies for VR solution placement and the slowdown in some industries, such as the aviation sector due to the COVID-19 pandemic, may impact the market's growth. In conclusion, the market will continue to grow as the demand for electricity and the adoption of renewable energy sources increase. Proper maintenance, inspection, and operational costs will remain crucial factors in ensuring the efficient and reliable operation of turbines, driving the need for high-quality turbine oils.

What are the market trends shaping the Turbine Oil Industry?

Growth of combined-cycle power plant (CCPP) is the upcoming market trend.

- The market is experiencing significant growth due to the increasing demand for energy consumption and the expansion of various economies. The energy generation sector, particularly Combined Cycle Power Plants (CPPs), is a major end-use sector driving the market. CPPs utilize both gas and steam turbines for electricity generation, with gas turbines serving as the primary power source. These turbines operate under high temperatures and speeds, necessitating the use of specialized turbine oils for lubrication and cooling. The growing number of CPP installations increases the demand for turbine oils to support these gas turbine systems. In CPPs, steam turbines are also employed to utilize the waste heat generated by the gas turbines.

- Turbine lubricating oils, including mineral-based lubricants and synthetic oil types, play a crucial role in ensuring the efficient operation of turbines. They provide essential properties such as oxidation inhibitors, corrosion inhibitors, defoamants, demulsifiers, and base oil with water-separating properties. Advanced lubrication technologies, such as high-cost capital direct-drive technology, are also contributing to the market's growth. The increasing popularity of renewable energy sources, including wind energy investment and hydroelectric power generation, is another significant factor. However, challenges such as external contamination, high heat temperature, and the lack of technologies for hybrid vehicles, electric motor lubricants, and battery parity are hindering market growth.

- Despite these challenges, the turbine oil industry is expected to continue growing due to the rising income levels and the increasing demand for maintenance, inspection, and operational costs in various industries, including aerospace, aviation, and automotive. The market is also expected to benefit from the slowdown In the wind turbine industry due to VR solution placement and the lack of technologies for high-cost capital projects.

What challenges does the Turbine Oil Industry face during its growth?

Slowdown of the marine industry is a key challenge affecting the industry growth.

- The market is significantly influenced by economies and energy consumption. As economies grow, the demand for energy increases, leading to a higher requirement for turbine oil in various industries, particularly energy generation. Turbine lubricating oils, including mineral-based and biobased types, play a crucial role in ensuring the efficient operation of wind turbines, hydroelectric power generation systems, and gas turbine engines in aerospace and power generation sectors. External contamination and oxidation are major challenges In the turbine oil industry. To mitigate these issues, manufacturers incorporate oxidation inhibitors, corrosion inhibitors, defoamants, demulsifiers, and other additives In the base oil. The formulation of advanced lubrication solutions is essential to meet the evolving needs of various end-use sectors, such as wind energy, automotive, aviation, and hydroelectric power generation.

- Wind energy investment and policy interventions are driving factors for the growth of the market. The increasing adoption of renewable energy sources, such as wind energy, and the development of new energy vehicles, including hybrid vehicles and electric motor-driven systems, are expected to boost the demand for turbine oils. However, operational costs, shortage of capacity, and the lack of technologies for VR solution placement and high heat temperature are some challenges that need to be addressed. The mineral oil segment dominates the market due to its widespread use in various applications. Synthetic oil types, such as polyalphaolefin (PAO) and ester-based oils, are gaining popularity due to their superior performance in extreme operating conditions.

- The rising income levels and the increasing demand for passenger cars and commercial airplanes In the automotive and aviation sectors, respectively, are expected to fuel the growth of the market. In conclusion, the market is a critical component of various industries, including energy generation, automotive, aviation, and aerospace. The market dynamics are influenced by factors such as economies, energy consumption, technological advancements, and regulatory policies. Manufacturers are focusing on developing advanced lubrication solutions to cater to the evolving needs of various end-use sectors and address the challenges of external contamination, oxidation, and high heat temperature.

Exclusive Customer Landscape

The turbine oil market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the turbine oil market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, turbine oil market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Apar Industries Ltd. - The company provides a range of turbine oils, including POWEROIL Turbo AW and POWEROIL Turbo Super AW, catering to the demands of various industries. These high-performance turbine oils ensure optimal machinery efficiency and reliability, meeting international standards for turbine oil applications. The company's offerings are designed to protect against oxidation, corrosion, and foaming, ensuring extended equipment life and reduced maintenance costs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apar Industries Ltd.

- Axel Christiernsson International AB

- Behran Oil Co.

- Castrol Ltd.

- Chevron Corp.

- CHS Inc.

- Eastman Chemical Co.

- Eni SpA

- FUCHS PETROLUB SE

- Growmark Inc.

- Hindustan Petroleum Corp. Ltd.

- Lubrication Engineers Inc.

- Matrix Specialty Lubricants BV

- Miguez Fuel and Lubricants

- Petroleos de Venezuela SA

- Phillips 66

- Pure Lubricants Chennai Pvt. Ltd.

- Savita Oil Technologies Ltd.

- Shell plc

- Sinopec Shanghai Petrochemical Co. Ltd.

- Tide Water Oil Co. India Ltd.

- Valvoline Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad spectrum of lubricants designed specifically for use in turbine systems. These oils play a crucial role in ensuring the efficient operation and longevity of various turbine applications, including those in energy generation, aerospace, and automotive industries. Economies with increasing energy consumption continue to drive the demand for turbine oil. Renewable energy sources, such as wind, hydroelectric, and tidal power generation, are major end-use sectors for turbine oils. The growth In these sectors is attributed to various factors, including government incentives, technological advancements, and rising income levels. Turbine oil industry dynamics are influenced by several factors.

Mineral-based lubricants have long been the industry standard due to their cost-effectiveness and proven performance. However, the trend towards advanced lubrication technologies, such as synthetic oils, is gaining momentum. Synthetic oils offer enhanced properties, including better resistance to external contamination, oxidation products, and high heat temperatures. Biobased turbine oils are an emerging segment In the market. These oils offer sustainability benefits and are gaining popularity In the renewable energy sector. The wind energy industry, in particular, is witnessing significant investment, leading to increased demand for biobased turbine oils. Policy interventions and technological advancements are shaping the market. For instance, the shift towards electric vehicles and battery parity is impacting the demand for turbine oils In the automotive sector.

Similarly, the development of direct-drive technology and the slowdown In the aviation industry due to the COVID-19 pandemic are influencing the demand In the aerospace sector. Turbine oil manufacturers are focusing on formulating products with superior properties, such as high stability against oxidation, anti-corrosion, anti-rust, and filterability. These properties are essential for maintaining the efficiency and longevity of turbine systems. The market is characterized by high-cost capital and a lack of technologies to address the shortage of capacity. To address these challenges, virtual reality (VR) solution placement is gaining popularity. VR technology enables manufacturers to simulate turbine system conditions and optimize lubrication strategies, reducing operational costs and improving efficiency.

In conclusion, the market is a dynamic and evolving industry, influenced by various factors, including energy consumption trends, technological advancements, and policy interventions. The demand for turbine oils is driven by the need for efficient and reliable turbine systems in energy generation, aerospace, and automotive industries. Manufacturers are focusing on formulating products with superior properties to meet the evolving demands of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8% |

|

Market growth 2024-2028 |

USD 630.89 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.8 |

|

Key countries |

US, Saudi Arabia, China, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Turbine Oil Market Research and Growth Report?

- CAGR of the Turbine Oil industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the turbine oil market growth of industry companies

We can help! Our analysts can customize this turbine oil market research report to meet your requirements.