Unmanned Aerial Vehicle (UAV) Ground Control Station (GCS) Market Size 2025-2029

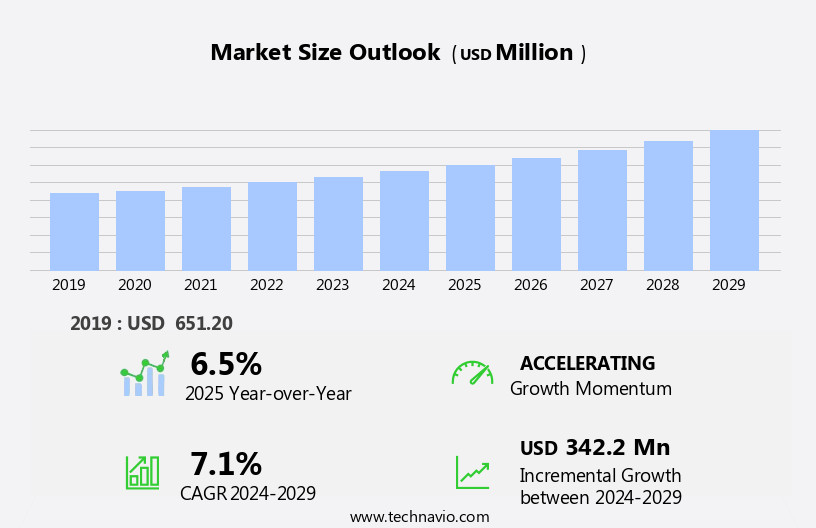

The unmanned aerial vehicle (UAV) ground control station (GCS) market size is forecast to increase by USD 342.2 million, at a CAGR of 7.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by increasing defense spending on unmanned technologies and the rising focus on the development of autonomous GCS. This trend reflects the growing importance of UAVs in various industries, including defense, agriculture, and infrastructure inspection. However, the market faces challenges, primarily the high susceptibility of cyber-attacks. As UAVs and their GCS become more integrated into critical infrastructure and defense systems, the risk of cyber-attacks and data breaches increases. This concern necessitates the implementation of robust cybersecurity measures, creating an opportunity for technology providers to offer advanced security solutions.

- Companies seeking to capitalize on market opportunities must stay abreast of technological advancements and invest in research and development to address the evolving needs of their customers. Navigating the challenges of cybersecurity will be crucial for market success.

What will be the Size of the Unmanned Aerial Vehicle (UAV) Ground Control Station (GCS) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic interplay of technological advancements and diverse applications across various sectors. Seamlessly integrated solutions are reshaping the industry landscape, with data interoperability, 3D model generation, cloud-based solutions, real-time data streaming, and deep learning gaining significant traction. UAV GCS providers are focusing on enhancing their offerings by incorporating advanced features such as automated mission planning, artificial intelligence (AI), and machine learning (ML) to optimize flight paths and improve operational efficiency. High-performance computing and software-as-a-service (SaaS) models are enabling remote sensing, environmental monitoring, and infrastructure inspection, while ensuring airworthiness certification and regulatory compliance.

Moreover, the integration of advanced technologies like power management systems, network security, computer vision, and user interface design is enhancing the overall user experience. UAV GCS solutions are also being employed in logistics and delivery, film and television, and precision agriculture, further expanding the market's reach. Battery technology, remote control interfaces, and data sharing are other essential components that are continuously being refined to cater to the evolving needs of the UAV industry. Technical support, training simulators, and mission control software are crucial elements that ensure seamless integration and effective implementation of these advanced technologies. As the UAV market continues to unfold, the ongoing integration of weather data integration, payload management, satellite communication, and field deployment is expected to further expand the market's potential.

The future of the UAV GCS market lies in the continuous development of autonomous flight control, surveillance and security, and collision detection, among other advanced features.

How is this Unmanned Aerial Vehicle (UAV) Ground Control Station (GCS) Industry segmented?

The unmanned aerial vehicle (UAV) ground control station (GCS) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Defense UAV GCS

- Commercial UAV GCS

- Component

- Hardware

- Software

- Type

- Fixed ground control stations

- Portable ground control stations

- Vehicle-mounted ground control stations

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

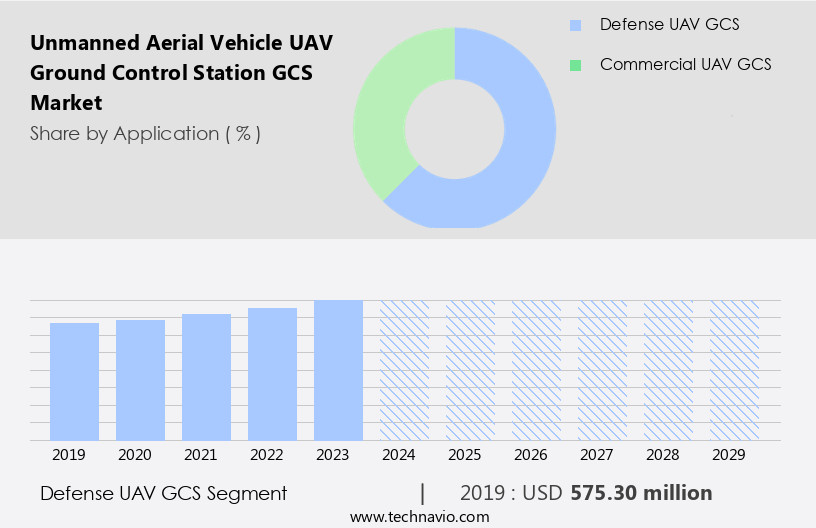

By Application Insights

The defense UAV GCS segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant advancements due to the increasing adoption of UAVs in various industries, including defense, logistics and delivery, film and television, precision agriculture, and infrastructure inspection. The integration of technologies such as data encryption, automated mission planning, artificial intelligence, machine learning, and computer vision is revolutionizing the UAV GCS market. In the defense sector, UAVs are increasingly being used for Intelligence, Surveillance, and Reconnaissance (ISR) and target acquisition operations to minimize risks to human lives. The development of miniaturized UAV GCSs with high-performance computing capabilities, long-range data link technology, and real-time data streaming is enabling military organizations to upgrade their systems for enhanced operational efficiency.

The logistics and delivery industry is leveraging UAV GCSs for optimizing flight paths, managing payloads, and ensuring regulatory compliance. The integration of satellite communication and weather data integration is facilitating seamless delivery operations in remote areas. The film and television industry is using UAVs for aerial photography and video analytics to create immersive content. The adoption of cloud-based solutions and 3D model generation is enabling real-time data sharing and collaboration among teams. Precision agriculture is utilizing UAVs for mapping and surveying, object detection, and sensor integration to optimize crop yields and improve farm management. The integration of machine learning algorithms and data interoperability is facilitating automated mission planning and real-time data analysis.

The infrastructure inspection industry is using UAVs for terrain mapping, infrastructure inspection, and collision detection to ensure safety and efficiency. The adoption of human-machine interfaces and mission control software is enabling operators to manage complex inspection tasks with ease. The UAV GCS market is also witnessing the integration of advanced technologies such as power management systems, network security, and obstacle avoidance to enhance the capabilities of UAVs and ensure safe and reliable operations. The development of training simulators, technical support, and software updates is enabling operators to acquire the necessary skills and knowledge to effectively manage UAVs. In conclusion, the UAV GCS market is experiencing significant growth due to the increasing adoption of UAVs in various industries and the integration of advanced technologies such as data encryption, automated mission planning, artificial intelligence, machine learning, and computer vision.

The development of miniaturized and high-performance UAV GCSs is enabling organizations to optimize their operations and enhance their capabilities.

The Defense UAV GCS segment was valued at USD 575.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic UAV ground control station (GCS) market, North America is leading the charge with advanced innovations. Modernized GCSs incorporate enhanced safety systems and remote split operations (RSO) networks, enabling multiple operators to manage missions from distinct locations. This network enhances mission flexibility and efficiency. The US, with its expansive border, necessitates extensive surveillance operations for national security. Consequently, there is a growing demand for long-endurance UAVs within the US border patrol forces. To cater to this requirement, the market offers long-endurance UAVs with extended operational capabilities. Furthermore, high-performance computing, software-as-a-service (SaaS), and data link technology facilitate real-time data streaming and mission planning.

Airworthiness certification, regulatory compliance, and network security are essential considerations, ensuring safe and secure operations. Advancements in artificial intelligence (AI), machine learning (ML), and computer vision are transforming GCSs. These technologies enable automated mission planning, obstacle avoidance, object detection, and image processing. Moreover, 3D model generation, data interoperability, and collision detection are essential for efficient data management. Logistics and delivery, precision agriculture, infrastructure inspection, and environmental monitoring are significant applications driving market growth. Power management systems, spare parts supply, and training simulators support operational readiness. The integration of sensors, payload management, and satellite communication enhances mission capabilities.

Mission control software, user interface design, and human-machine interface (HMI) are crucial for effective operator interaction. Weather data integration and autonomous flight control ensure optimal flight performance. The market continues to evolve, with cloud-based solutions, deep learning, and battery technology shaping future developments.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Unmanned Aerial Vehicle (UAV) Ground Control Station (GCS) Industry?

- Unmanned technology defense spending is the primary market growth driver, with increasing investments in this area.

- Unmanned Aerial Vehicles (UAVs), also known as drones, have gained significant traction in various industries due to their versatility and advanced capabilities. The UAV Ground Control Station (GCS) market is witnessing substantial growth as a result. FAA regulations continue to evolve, enabling wider applications for UAVs in sectors such as film and television, power management systems, environmental monitoring, precision agriculture, and mapping and surveying. In these applications, mission control software, user interface design, data link technology, and radio frequency communications are crucial components. Network security and computer vision technologies are essential to ensure data privacy and object detection capabilities.

- UAV maintenance and obstacle avoidance systems are also vital for safe and efficient operations. Powerful UAVs are increasingly being used for film and television production, providing aerial perspectives that were previously unattainable. In the power sector, drones are employed for inspecting power lines and wind turbines, reducing the need for manual inspections and improving efficiency. In agriculture, UAVs are used for precision farming, allowing farmers to monitor crop health and optimize irrigation and fertilization. Environmental monitoring is another significant application for UAVs, with drones being used to survey natural disasters, monitor wildlife populations, and assess environmental damage.

- In mapping and surveying, UAVs provide accurate and detailed data, enabling professionals to create precise maps and models. As the UAV industry continues to evolve, advancements in technology will further expand their applications and capabilities. UAVs are poised to revolutionize industries and provide valuable insights and efficiencies.

What are the market trends shaping the Unmanned Aerial Vehicle (UAV) Ground Control Station (GCS) Industry?

- The development of autonomous Ground Control Systems (GCS) is gaining significant attention and priority in the current market. It is an emerging trend in the industry, mandating increased focus and investment.

- Unmanned Aerial Vehicle (UAV) Ground Control Stations (GCS) are essential components for effective UAV operation. However, the limitations of human involvement in UAV operations, particularly during field missions, have led to the development of advanced automated GCS. These systems enable UAV launching, landing, and maintenance without human intervention. Data interoperability is a critical factor in UAV GCS, allowing seamless data exchange between various systems. Cloud-based solutions and real-time data streaming facilitate efficient data processing and analysis using deep learning algorithms. Battery technology advancements extend UAV flight times, while remote control interfaces ensure easy and intuitive operation. Data sharing, training simulators, technical support, image processing algorithms, flight planning software, weather data integration, and regulatory compliance are essential features of modern UAV GCS.

- Video analytics adds value by providing real-time insights and enhancing situational awareness. The focus on automation and advanced features is driving the evolution of UAV GCS, making them more effective and efficient tools for various industries.

What challenges does the Unmanned Aerial Vehicle (UAV) Ground Control Station (GCS) Industry face during its growth?

- The heightened susceptibility to cyber-attacks poses a significant challenge to the industry's growth trajectory. Companies must invest in robust cybersecurity measures to mitigate this risk and safeguard their digital assets.

- Unmanned Aerial Vehicles (UAVs) have gained significant traction in various industries due to their versatility and capabilities. The UAV Ground Control Station (GCS) market is witnessing growth as a result. Autonomous flight control is a crucial aspect of UAV operations, which is managed through the GCS. Surveillance and security, infrastructure inspection, construction and engineering, and aerial photography are some sectors that extensively use UAVs, necessitating advanced GCS features. Payload management, sensor integration, and collision detection are essential functionalities of a robust GCS. Satellite communication and terrain mapping enhance the operational capabilities of UAVs. Field deployment and operator certification are critical considerations for GCS selection.

- Human-machine interface (HMI) plays a significant role in ensuring effective communication between the operator and the UAV. Software updates are necessary to maintain the GCS's functionality and compatibility with the latest UAV technologies. However, the increasing use of UAVs exposes them to cybersecurity threats. The reliance on virtual cyber networks and embedded computational systems for UAV operation makes them susceptible to cyber-attacks. Such attacks may result in corrupted information, improper control loop operation, and denial of service. The growing use of personal smart devices for remote communication with UAVs or the GCS further increases the risk of cybersecurity vulnerabilities.

- Ensuring adequate cybersecurity safeguards is essential to mitigate these risks and protect critical mission data.

Exclusive Customer Landscape

The unmanned aerial vehicle (UAV) ground control station (GCS) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the unmanned aerial vehicle (UAV) ground control station (GCS) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, unmanned aerial vehicle (UAV) ground control station (GCS) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acecore Technologies JL B.V. - The company specializes in advanced UAV ground control station solutions, including Beyond Visual Line of Sight ground networks.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acecore Technologies JL B.V.

- Aerialtronics DV B.V.

- Aeroscout GmbH

- AiDrones GmbH

- Alpha Unmanned Systems, S.L.

- ALTI UAS PTY LTD.

- Asseco Poland SA

- BAE Systems Plc

- Bluebird Aero Systems

- Delft Dynamics B.V.

- Elbit Systems Ltd.

- General Atomics

- Israel Aerospace Industries Ltd.

- L3Harris Technologies Inc.

- Lockheed Martin Corp.

- Mavtech Srl

- Northrop Grumman Corp.

- Textron Inc.

- Thales Group

- The Boeing Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Unmanned Aerial Vehicle (UAV) Ground Control Station (GCS) Market

- In February 2023, Lockheed Martin Corporation announced the integration of its MQ-9B SkyGuardian UAV with the L3Harris Wescam MX-15 Electro-Optic/Infrared (EO/IR) sensor system, which was successfully tested using the Aeryon SkyRanger GCS [1]. This collaboration represents a significant technological advancement in UAV capabilities, enhancing surveillance and reconnaissance applications.

- In May 2024, Elbit Systems of America signed a multi-year agreement with the United States Army to provide its Skylark Edge UAV system, including the accompanying GCS, for training purposes [2]. This strategic partnership marks a major expansion in Elbit's market presence within the military sector, positioning them as a key supplier for UAV training solutions.

- In July 2024, Autodesk, a leading design software company, released its new ReCap UAV photogrammetric software, enabling users to process UAV data directly within their AutoCAD environment [3]. This new product launch signifies a significant shift towards more integrated and streamlined UAV data processing solutions, catering to various industries such as construction, engineering, and surveying.

Research Analyst Overview

- The market is witnessing significant growth due to the increasing adoption of UAVs in various industries, particularly in agriculture, construction, and infrastructure inspection. UAVs equipped with multispectral and thermal imaging sensors are revolutionizing farming practices by enabling risk assessment and real-time data analysis. Cloud storage and data backup solutions facilitate efficient data management and ensure data security standards. Moreover, the integration of GPS navigation, Lidar sensors, and predictive analytics in GCS software enhances flight operations, while data visualization tools provide valuable insights for decision-making. UAV licensing, emergency procedures, and flight permitting are crucial components of UAV flight operations, ensuring safe and compliant operations.

- Hybrid UAVs and multi-rotor UAVs offer varying flight speeds and payload capacities, catering to diverse application requirements. Flight logbooks, maintenance schedules, and drone insurance are essential for managing UAV fleets effectively. Network penetration testing and software vulnerability assessment are vital for securing GCS systems from cyber threats. Fixed-wing UAVs and GIS integration offer advanced capabilities for large-scale projects, while data analytics platforms enable real-time processing and analysis of vast amounts of data. Edge computing and real-time data analysis further enhance the efficiency and effectiveness of UAV operations. Overall, the UAV GCS market is evolving rapidly, driven by technological advancements and growing industry demands.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Unmanned Aerial Vehicle (UAV) Ground Control Station (GCS) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 342.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Canada, China, Japan, India, UK, Mexico, South Korea, Germany, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Unmanned Aerial Vehicle (UAV) Ground Control Station (GCS) Market Research and Growth Report?

- CAGR of the Unmanned Aerial Vehicle (UAV) Ground Control Station (GCS) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the unmanned aerial vehicle (uav) ground control station (gcs) market growth of industry companies

We can help! Our analysts can customize this unmanned aerial vehicle (uav) ground control station (gcs) market research report to meet your requirements.