Unplasticized Polyvinyl Chloride Windows Market Size 2024-2028

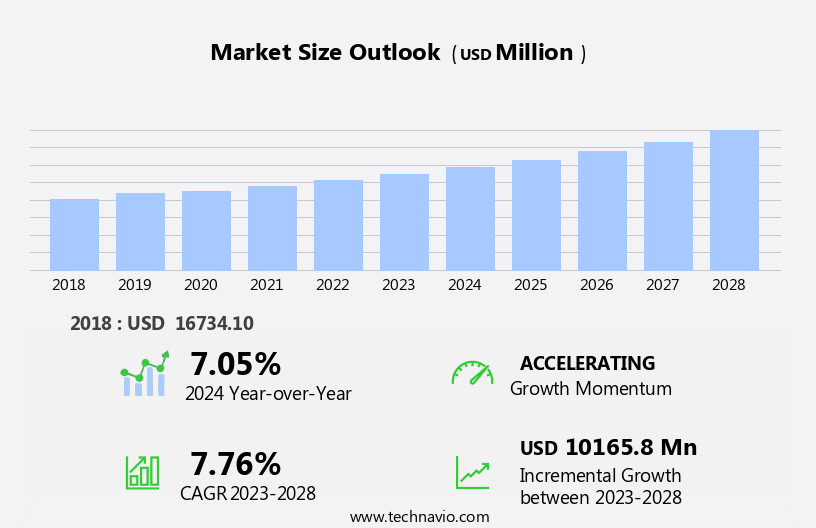

The unplasticized polyvinyl chloride windows market size is forecast to increase by USD 10.17 billion at a CAGR of 7.76% between 2023 and 2028.

- The UPVC windows market is growing rapidly, driven by the expansion of the construction sector. This trend is especially strong in North America, where demand for energy-efficient, low-maintenance windows is rising. Another key shift is the adoption of cellular PVC windows, which offer better insulation and durability than traditional options that use PVC.

- However, challenges persist, including fluctuating raw material prices, particularly for PVC resin, which threatens profitability. Additionally, growing environmental concerns and regulations are pushing the industry toward more sustainable solutions. Overall, the UPVC windows market presents both opportunities and challenges, requiring strategic planning and adaptability for construction.

What will be the Size of the Unplasticized Polyvinyl Chloride Windows Market During the Forecast Period?

- The market encompasses the production and supply of energy-efficient, insulating, and advanced building materials in the form of UPVC windows. These windows, made from unplasticized polyvinyl chloride, offer several advantages over traditional materials. They provide excellent thermal insulation, reducing energy consumption and utility bills. UPVC windows are also known for their low maintenance requirements, as they do not rot, warp, or require painting.

- The residential and commercial sectors drive demand for UPVC windows due to their cost-effectiveness, recyclability, and sustainability. UPVC windows offer various glazing options, including double and triple glazed, providing enhanced soundproofing and weather resistance. Additionally, UPVC windows offer UV resistance, preventing fading and discoloration.

- Manufacturers continue to innovate, developing UPVC windows and thermal insulation materials with advanced features such as thermal insulation, impact resistance, and enhanced durability. Retrofitting existing buildings with UPVC windows is also gaining popularity due to their energy efficiency and cost savings. Overall, the UPVC windows market is expected to grow due to increasing awareness of energy efficiency and the benefits of low maintenance building materials.

How is this Unplasticized Polyvinyl Chloride Windows Industry segmented and which is the largest segment?

The UPVC windows industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Residential

- Commercial

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Application Insights

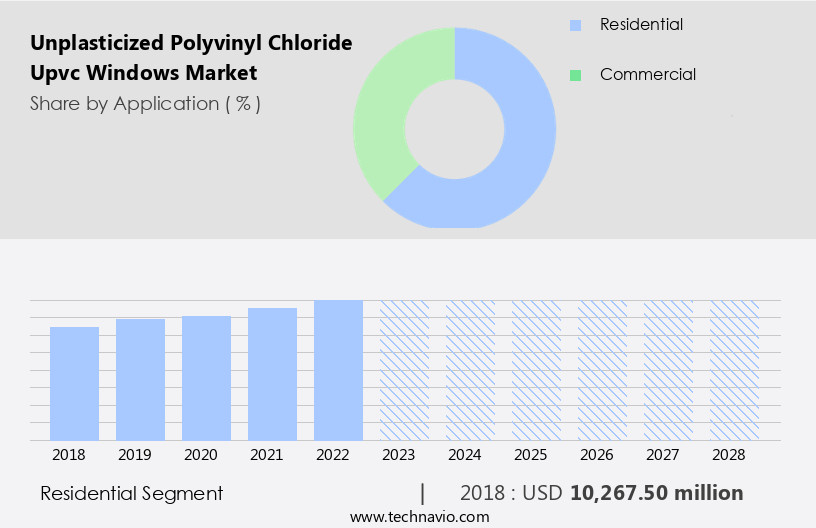

- The residential segment is estimated to witness significant growth during the forecast period.

UPVC windows, a type of unplasticized polyvinyl chloride construction material, have gained significant traction in both residential and commercial sectors due to their energy efficiency and insulation properties. The construction industry's focus on sustainable and cost-effective building materials has fueled the demand for UPVC windows. Consumers prioritize high-performance windows, such as triple-glazed and soundproof options such as acoustic damping tiles, for their homes. Additionally, UPVC windows offer durability, low maintenance, and resistance to weather, UV rays, and impact. With regulations emphasizing energy efficiency and sustainability, UPVC windows' demand continues to rise. The market caters to various designs, aesthetics, and customization options, ensuring a perfect fit for diverse projects. Installation, replacement, and renovation projects also benefit from UPVC window frames, glazing, hardware, profiles, and extrusion technologies. The industry's commitment to certifications, warranties, and adherence to regulations further enhances consumer trust and confidence.

Get a glance at the Unplasticized Polyvinyl Chloride (Upvc) Windows Industry report of share of various segments Request Free Sample

The Residential segment was valued at USD 10.27 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

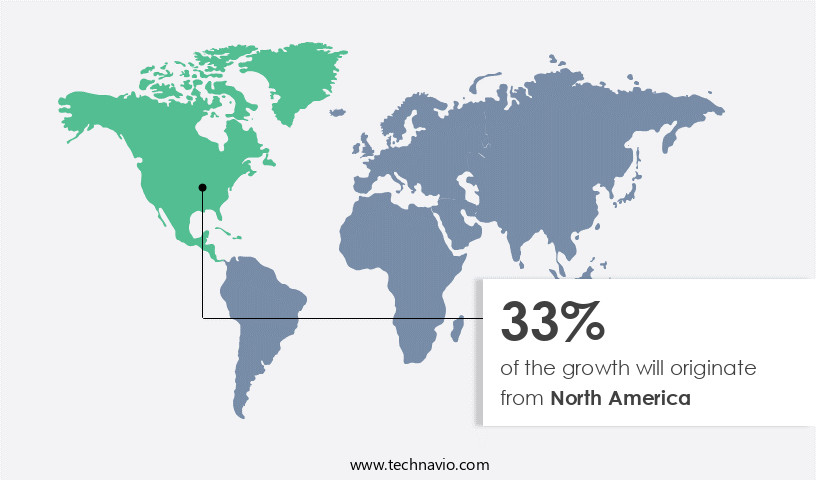

- North America is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The construction industry in Asia Pacific (APAC) is witnessing notable expansion due to the increasing demand for industrial structures, warehouses, and infrastructure. Favorable government policies and initiatives, including India's Smart City Mission and Housing For All, are driving investments In the sector from both public and private entities. UPVC windows, an energy-efficient building material, are gaining popularity In the region's residential construction market due to their insulation properties, durability, low maintenance, and sustainability. Rapid urbanization in major economies and rising disposable income are expected to fuel construction activities further. UPVC windows offer additional benefits such as thermal insulation, impact resistance, soundproofing, weather resistance, UV resistance, and are recyclable and cost effective. Their customizable designs, easy installation, and long-lasting hardware make them a preferred choice for both residential and commercial projects, including retrofitting, double-glazed, and triple-glazed applications. The market for UPVC windows is subject to various regulations, standards, and certifications to ensure quality and safety, including fire resistance and security features.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Unplasticized Polyvinyl Chloride Windows Industry?

Growth in housing construction sector is the key driver of the market.

- The market is experiencing significant growth due to their increasing adoption in both residential and commercial construction projects. UPVC, a type of Polyvinyl Chloride (PVC) that remains unplasticized, is a popular choice for window frames due to its energy efficiency, insulation properties, durability, and low maintenance requirements. The demand for UPVC windows is driven by the housing sector's expansion, with income growth and population increase being key factors. The rising population and disposable income have led to an increase in housing construction, resulting in a subsequent increase in demand for UPVC windows. UPVC windows offer several advantages over traditional materials such as wood and aluminum.

- They provide excellent thermal insulation, soundproofing, and weather resistance. UPVC windows are also UV resistant, ensuring they do not fade or deteriorate over time. Moreover, they are recyclable, sustainable, and cost-effective, making them an attractive option for both residential and commercial applications. The UPVC windows market caters to various window designs, including double-glazed and triple-glazed options. These windows offer enhanced energy efficiency and insulation, making them an ideal choice for regions with extreme climates. UPVC windows are also customizable, with various profiles, extrusion, glazing, hardware, and locking systems available to meet specific design and functionality requirements. Installation, replacement, and renovation projects also contribute to the UPVC windows market's growth.

- The ease of installation and replacement, along with the availability of various window profiles and designs, make UPVC windows a popular choice for retrofitting existing buildings. Additionally, UPVC windows offer excellent security features, including fire resistance, regulations, and standards compliance, and certification and warranty options, making them a reliable and long-term investment for building owners. In conclusion, the UPVC windows market is poised for growth due to the increasing demand for energy-efficient, durable, and low-maintenance window solutions. The housing sector's expansion, driven by income growth and population increase, is a significant factor contributing to the market's growth. UPVC windows offer several advantages, including thermal insulation, soundproofing, weather resistance, UV resistance, recyclability, sustainability, cost-effectiveness, and customization options, making them a popular choice for both residential and commercial applications.

What are the market trends shaping the UPVC Windows Industry?

Evolution toward cellular PVC windows is the upcoming market trend.

- Unplasticized Polyvinyl Chloride (UPVC) windows have gained significant traction In the construction and building material industry due to their numerous advantages. UPVC, a type of PVC that remains unplasticized, is the primary material used in manufacturing these energy-efficient windows. The unique cellular structure of UPVC, which features a foam or cell structure inside, sets it apart from extruded hollow vinyl windows. Manufactured through a solid process, UPVC windows offer superior durability and low maintenance, making them an ideal choice for both residential and commercial applications. These windows are not only aesthetically pleasing, with designs that mimic the look of wood, but also offer excellent insulation, weather resistance, and UV resistance.

- UPVC windows are available in various types, including double-glazed and triple-glazed options, which provide enhanced soundproofing and thermal insulation. Impact resistance is another essential feature of UPVC windows, making them a preferred choice in regions prone to extreme weather conditions. Moreover, UPVC windows are recyclable, sustainable, and cost-effective, making them an eco-friendly and economical alternative to traditional wood or aluminum windows. The manufacturing process of UPVC windows involves the use of profiles, extrusion, sealing, gaskets, locking systems, and hardware, ensuring a high level of customization and precision. UPVC windows offer a long lifespan, requiring minimal maintenance, and come with warranties to ensure customer satisfaction.

- Regulations and standards, including fire resistance and certification, further add to their appeal. Overall, UPVC windows provide a cost-effective, sustainable, and energy-efficient solution for window replacement, renovation, or new construction projects.

What challenges does the Unplasticized Polyvinyl Chloride Windows Industry face during its growth?

Volatility in raw material prices is a key challenge affecting the industry growth.

- Unplasticized Polyvinyl Chloride (UPVC) is a popular choice for window manufacturing due to its energy efficient, insulation, durability, and low maintenance properties. The primary component of UPVC is polyvinyl chloride polymer, which is derived from ethylene and chlorine. To make it suitable for window production, specific heat and UV stabilizer additives are incorporated. The production, processing, and sales of UPVC's raw materials are subject to stringent regulations due to their petroleum origin. As regulations to reduce greenhouse gas emissions intensify, price volatility for petroleum, increased energy costs, and decreased production levels could impact the pricing of these raw materials.

- UPVC windows offer excellent thermal insulation, weather resistance, and UV resistance, making them an attractive option for both residential and commercial applications. They are available in various designs, including double and triple glazed options, providing excellent soundproofing and impact resistance. UPVC windows are also recyclable and sustainable, aligning with the growing trend towards eco-friendly building materials. Their cost-effectiveness, combined with customization options for window frames, glazing, hardware, profiles, extrusion, sealing, gaskets, locking systems, and security features, make UPVC windows a popular choice for renovation and replacement projects. UPVC windows meet various fire resistance regulations and standards, ensuring safety and certification.

- Proper installation and maintenance are crucial for maximizing their lifespan and performance.

Exclusive Customer Landscape

The unplasticized polyvinyl chloride windows market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the UPVC windows market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, unplasticized polyvinyl chloride windows market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADOPEN Plastik Sanayi AS

- AIS Glass Solutions Ltd.

- Aluplast GmbH

- Aparna Enterprises Ltd.

- Canadian Choice Windows and Doors

- China Lesso Group Holdings Ltd.

- Dalian Shide Plastic Building Materials Co. Ltd.

- Deceuninck Group

- Duroplast Extrusions Pvt. Ltd.

- Encraft India Pvt. Ltd.

- Everest 2020 Ltd.

- Fenesta

- Internorm International GmbH

- Karl Lingel Fensterbau Gmbh and Co. KG

- Malplas Ltd.

- Munster Joinery

- profine GmbH

- REHAU Ltd.

- VEKA AG

- Welltech Systems

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Unplasticized Polyvinyl Chloride (UPVC) windows have gained significant traction In the global construction industry due to their numerous advantages over traditional window materials. These windows, made from a type of PVC that remains unplasticized during processing, offer superior insulation, durability, and low maintenance. UPVC windows are renowned for their energy efficiency. The material's excellent insulation properties help maintain consistent indoor temperatures, reducing the need for excessive heating or cooling. This not only results in cost savings for building owners but also contributes to a reduced carbon footprint. Moreover, UPVC windows provide excellent thermal insulation, which is crucial for both residential and commercial buildings.

The material's ability to prevent heat transfer makes it an ideal choice for regions with extreme temperatures. Additionally, UPVC windows offer excellent soundproofing, ensuring a quiet and comfortable living or working environment. Durability is another significant advantage of UPVC windows. They are resistant to weathering, UV radiation, and impact, making them a long-lasting investment. Furthermore, UPVC windows require minimal maintenance, as they do not rust, rot, or peel. This reduces the overall cost of ownership and the frequency of repairs or replacements. UPVC windows are also recyclable and sustainable, making them an attractive option for environmentally-conscious consumers. The material's versatility allows for customization in terms of design, aesthetics, and size, catering to various architectural styles and building requirements.

The manufacturing process of UPVC windows involves extrusion, where the material is heated and forced through a die to create the desired shape. The windows can be customized with various profiles, glazing options, hardware, and locking systems to meet specific project needs. Installation and replacement of UPVC windows are relatively straightforward processes. The windows come with sealing systems and gaskets that ensure a tight fit, preventing air and water infiltration. Additionally, UPVC windows offer excellent fire resistance, making them a popular choice for buildings in fire-prone areas. Regulations and standards play a crucial role In the UPVC windows market.

Certification and warranty are essential factors that influence consumer confidence and purchasing decisions. Compliance with industry regulations and adherence to recognized standards ensure the quality and safety of UPVC windows. In conclusion, UPVC windows offer numerous advantages, including energy efficiency, insulation, durability, low maintenance, recyclability, and customization. Their versatility and adaptability make them a popular choice for both residential and commercial buildings, and their manufacturing process ensures consistent quality and performance. Regulations and standards play a vital role in maintaining the integrity of the UPVC windows market, providing consumers with peace of mind and confidence In their investment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.76% |

|

Market growth 2024-2028 |

USD 10.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.05 |

|

Key countries |

US, China, India, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Unplasticized Polyvinyl Chloride (Upvc) Windows Market Research and Growth Report?

- CAGR of the Unplasticized Polyvinyl Chloride (Upvc) Windows industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the unplasticized polyvinyl chloride (upvc) windows market growth of industry companies

We can help! Our analysts can customize this unplasticized polyvinyl chloride (upvc) windows market research report to meet your requirements.