Urban Planning Software Market Size 2024-2028

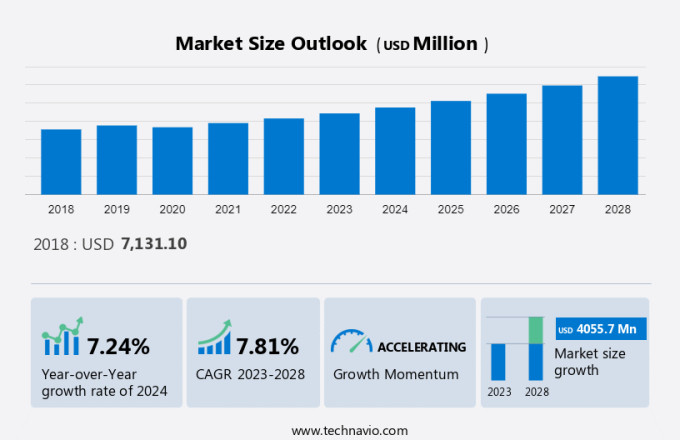

The Urban Planning Software Market size is estimated to grow by USD 4.05 billion at a CAGR of 7.81% between 2023 and 2028. Infrastructure development is a priority area for many governments and organizations worldwide, driven by increasing investments and a growing focus on building smart cities. This trend is fueled by several factors, including the expanding middle-class population and the need for efficient, modern infrastructure to support economic growth and improve quality of life. Infrastructure projects encompass various sectors, such as transportation, energy, water supply, and telecommunications, and require significant capital investment and advanced technology. As a result, the infrastructure industry is poised for continued growth and innovation, offering opportunities for businesses and investors alike.

What will be the size of the Market During the Forecast Period?

To learn more about this report, View the Report Sample

Market Dynamics

The market is witnessing significant growth due to the increasing number of non-residential construction projects and infrastructure development activities in response to the growing urban population. City planners are leveraging technology to efficiently manage and design urban spaces. The market is segmented into components, which include software and services, and segments, such as the cloud-based segment and web-based segment. Government bodies are also investing in urban planning software to optimize budgets and implement smart city technologies. Emerging countries are leveraging technology advancements and cloud software to enhance construction processes and infrastructure development, with a focus on designing residential buildings, roads, bridges, and rail systems, supported by skilled professionals and real estate companies, while government agencies and service companies implement training programs and resource management solutions to optimize engineering and architectural plans. The latest trends include the integration of 5G technology and data centers to enhance the functionality and efficiency of these tools. Open-source software is gaining popularity due to its cost-effectiveness and flexibility. The United Nations (UN) has emphasized the importance of urban planning to address the challenges of urbanization and sustainability. Urban planning software plays a crucial role in this regard, enabling city planners to create harmonious and livable urban spaces. The market is expected to continue its growth trajectory in the coming years, driven by the increasing demand for efficient and technologically advanced urban planning solutions.

Key Market Driver

One of the key factors driving the market growth is the growing middle-class population. The increasing middle-class population in developing countries in APAC, South America, and MEA is expected to significantly contribute to the market growth. In addition, there is an increase in per capita income due to the rapidly increasing economic activities in developing economies such as China, India, Argentina, Indonesia, and South Africa.

Moreover, the rise in the gross domestic product (GDP) per capita in these countries is also fuelling the rise in the disposable income of the population. In addition, a majority of the population is opting for long-term investment opportunities due to factors such as rapid industrial, manufacturing, and economic developments in these countries, fuelled by urbanization. As a result, there is an increasing adoption of software for different real-estate projects. Hence, such factors are positively impacting the market which, in turn, will drive the growth during the forecast period.

Significant Market Trend

A key factor shaping the market growth is the use of blockchain technology in software. There is a rapid advancement in technologies that can resolve the challenges associated with the openness of data and procedures in the market. The advent of blockchain technology enables transparency at all levels of activity in urban planning making it effective.

Moreover, the main advantage of using blockchain in urban planning is that there is a reduction in fraud and transaction duplication as every record is encrypted. Furthermore, the implementation of blockchain offers smooth and quick transactions by doing away with the necessity for a middleman. Hence, such factors are positively impacting the market trends which in turn will drive the market growth during the forecast period.

Major Market Challenge

The threat of open-source urban planning software is one of the key challenges hindering growth. There is a growing popularity for open-source software which poses a significant threat to the market. There is an increasing preference for open-source software as it is widely available on the Internet and can be downloaded easily.

Moreover, open-source software provides cost benefits and scalability in addition to transparency. There is increasing adoption of open-source software among organizations with limited budgets instead of paid software. Hence, such factors are negatively impacting the market which in turn will hinder the growth during the forecast period.

Market Segmentation

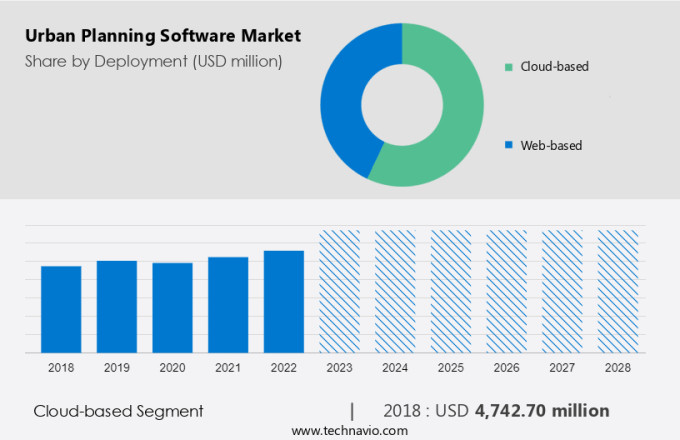

By Deployment

The cloud-based segment is estimated to witness significant growth during the forecast period. There is an increasing adoption of cloud-based urban planning software across enterprises and governments in order to meet the growing demand for customization, agility, and scalability. The main advantage of this segment is that it provides all the related processes on a single interactive screen, which enables a productive and collaborative development process.

Get a glance at the market contribution of various segments View Free PDF Sample

The cloud-based segment was the largest segment and was valued at USD 4.74 billion in 2018. In addition, the cloud-based segment essentially lowers the risk of data incongruency and increases the availability of real-time data thereby enabling more efficient resource use and management. Therefore, such benefits of the cloud-based segment are fuelling its adoption and significantly contributing to the growth of this segment. Factors such as operational demands, an increase in resource management, responsiveness toward current strategies, the implementation of new business strategies, and an increase in various government and military programs are expected to fuel the growth of this segment which in turn will drive the growth during the forecast period.

By End-user

The growing demand for urban planning software in the government segment will increase the market growth. There is an increasing focus by government organizations on services including building operations and control, coupled with legislative buildings, embassies, and smart cities. For instance, in the US, the federal government focuses on using sustainable building design to achieve the energy efficiency of buildings. There is a major role for management in the management of cities and airports, and urban planners have a vital responsibility in ensuring the seamless operation of facilities. Hence, such factors are expected to fuel the growth of this segment which in turn will drive the growth during the forecast period.

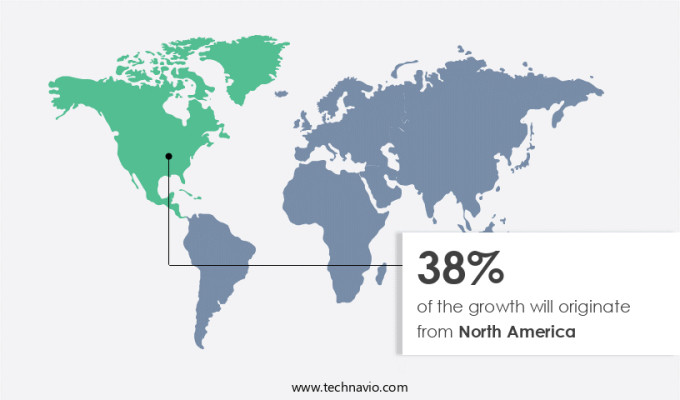

By Region

For more insights on the market share of various regions Download PDF Sample now!

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. One of the main factors that are significantly contributing to the growth of the market in North America is the early adoption of technologies in the region. Several factors, such as the growing adoption of smart cities, the adoption of digital technologies, and connected infrastructure to the existing megacities in the region, are positively impacting the market growth in the region.

Moreover, there is an increasing adoption of software due to the expansion of cities in several regions of North America such as Chicago, New York City, Los Angeles, Calgary, Vancouver, Seattle, Toronto, Boston, and Mexico City. Furthermore, the maturity of the sector results in an abundance of use cases that eventually lead to a faster rate of technology adoption. Hence, such factors are expected to drive growth in North America during the forecast period.

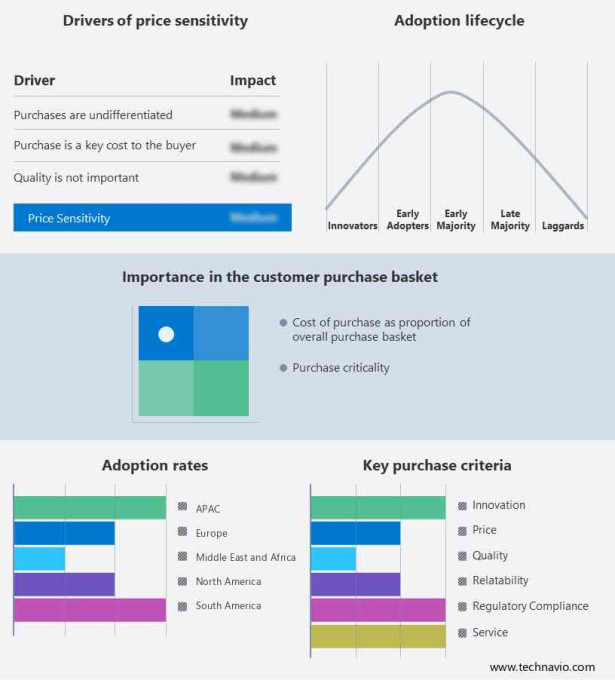

Market Customer Landscape

The market growth analysis report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market forecasting report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3IXAM SOFTWARE LLC: The company offers 3IXAM, a comprehensive suite of features to design and visualize futuristic cityscapes.

AgiliCity d.o.o: The company offers Modelur for architects, urban designers, and planners with all the essential tools needed to easily test multiple urban massing options in the 3D modeling environment.

Alphabet Inc: The company offers Sidewalk Labs LLC namely Delve which empowers real estate teams to design better, faster, with less risk.

The market growth and forecasting report also includes detailed analyses of the competitive landscape of the market and information about 17 market companies, including:

- Autodesk Inc.

- Bentley Systems Inc.

- CityCAD Technologies Ltd.

- Esri Global Inc.

- Lumion

- Nextsense

- Savannah Simulations AG

- Strategis Groep BV

- Trimble Inc.

- UrbanFootprint Inc.

- UrbanSim Inc.

- Urpla Pty Ltd.

- Sasaki Associates Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment Outlook

- Cloud-based

- Web-based

- End-user Outlook

- Government

- Real estate

- Infrastructure companies

- Geography Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in the below market reports

-

Building Information Modeling (BIM) Software Market: Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, UK, Japan, France - Size and Forecast

-

Architectural Rendering Software Market: Analysis North America, Europe, APAC, Middle East and Africa, South America - US, China, Singapore, Germany, UK - Size and Forecast

-

GIS Market: Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, Canada, Germany, UK - Size and Forecast

Market Analyst Overview

Urban planning software plays a crucial role in managing and designing the built environment of cities and towns, catering to the needs of urban population growth and infrastructure development activities. These tools are essential for city planners in managing non-residential construction projects, housing, transportation, economic development, and sustainable communities. The compound annual growth rate of real estate and infrastructure companies is expected to increase significantly due to the new infrastructure initiative, driven by advancements in computers technology. The software market is witnessing the latest trends, including the integration of smart city technologies, data centers, and 5G technology, to enhance urban design projects. Components of urban planning software include both software and services. Software solutions offer features such as land use planning, transportation modeling, and economic analysis, while service offerings provide consulting and implementation support.

Furthermore, the capital-intensive nature of urban planning projects necessitates efficient tools for maintenance and construction activities. Government budgets and new infrastructure initiatives are significant drivers for the market. The software caters to various sectors, including residential and commercial buildings, and addresses economic disparity and urbanization challenges. Climate change and sustainable communities are also key considerations in urban planning, making the software an essential component of the built environment. Urban planners rely on these tools to create livable communities that balance economic development and infrastructure needs while addressing the challenges of urbanization and climate change. The market for urban planning software is expected to grow significantly in the coming years, offering numerous opportunities for developers and service providers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.81% |

|

Market growth 2024-2028 |

USD 4.05 billion |

|

YoY growth 2023-2024(%) |

7.24 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 38% |

|

Key countries |

US, UK, Canada, China, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3IXAM SOFTWARE LLC, AgiliCity d.o.o., Alphabet Inc., Autodesk Inc., Bentley Systems Inc., CityCAD Technologies Ltd., Esri Global Inc., Lumion, Nextsense, Sasaki Associates Inc., Savannah Simulations AG, Strategis Groep BV, Trimble Inc., UrbanFootprint Inc., UrbanSim Inc., and Urpla Pty Ltd. |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.