Urethane Adhesives Market Size 2024-2028

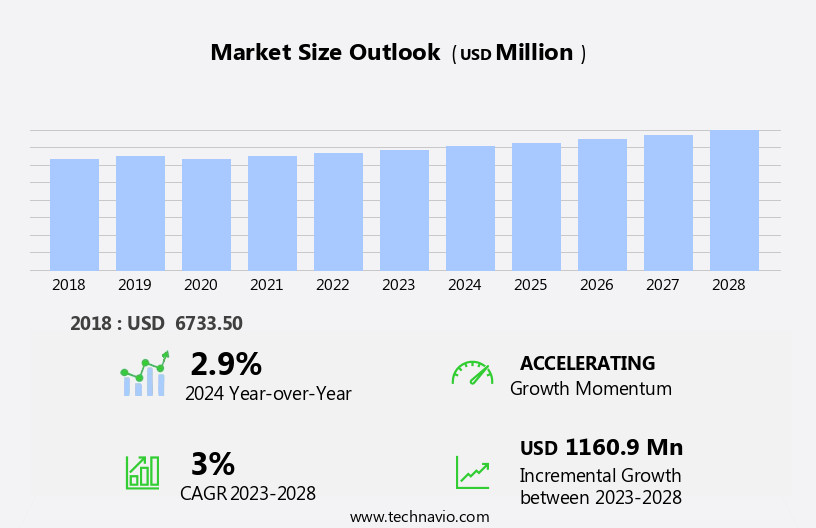

The urethane adhesives market size is forecast to increase by USD 1.16 billion at a CAGR of 3% between 2023 and 2028.

What will be the Size of the Urethane Adhesives Market During the Forecast Period?

How is this Urethane Adhesives Industry segmented and which is the largest segment?

The urethane adhesives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Solvent-based

- 100 percentage solids

- Dispersion

- Others

- Geography

- Europe

- Germany

- France

- North America

- US

- APAC

- China

- Middle East and Africa

- South America

- Europe

By Technology Insights

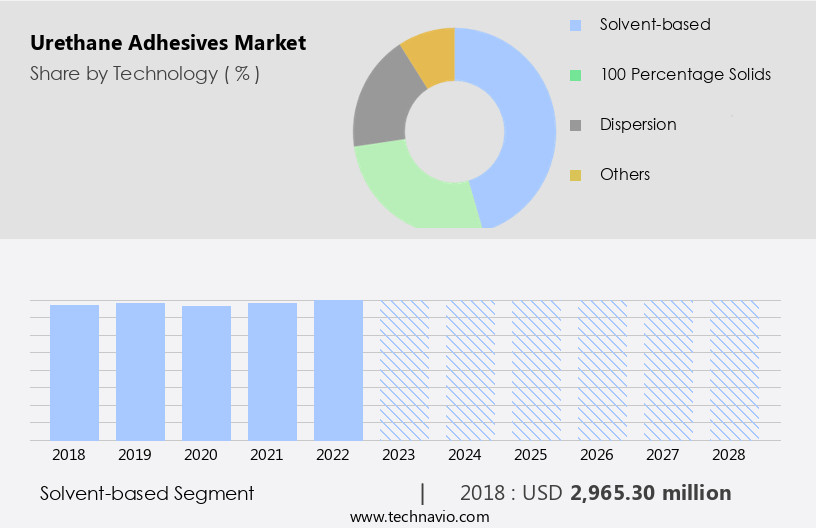

- The solvent-based segment is estimated to witness significant growth during the forecast period.

Urethane adhesives, specifically solvent-based types, exhibit strong bonding capabilities due to their resistance to plasticizers and high adhesion to various materials. These adhesives are manufactured from high-molecular-weight hydroxyl-terminated polyurethane dissolved in a solvent. Isocyanates, such as toluene diisocyanate (TDI) and diphenylmethane isocyanate (MDI), are commonly used In their production. Urethane adhesives are available as one-component and two-component grades, catering to diverse industrial and construction applications. Substrates like rubber, leather, fabrics, metal, paper, wood, and plastics adhere well to these adhesives. Urethane adhesives are integral to industries such as building and construction, leather and footwear, furniture and decoration, electronics, renovation activities, and original equipment manufacturing.

Their properties include high cohesive strength, elasticity, and resistance to solvents, making them suitable for container packaging, end-of-line packaging, functional barrier applications, metal packaging, smart packaging, and more. Urethane adhesives contribute to various sectors, including housing units, infrastructure development, green buildings, low-carbon energy economy, and urban cities.

Get a glance at the Urethane Adhesives Industry report of share of various segments Request Free Sample

The Solvent-based segment was valued at USD 2.97 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Urethane adhesives, derived from polyurethane (PU) and isocyanates, exhibit superior properties such as high cohesive strength, elasticity, and adhesion. These adhesives are widely used in various industries, including construction, electronics, furniture and decoration, and leather and footwear, due to their functional barrier applications, solvent resistance, and curing capabilities. In Europe, countries like Germany, France, Spain, Russia, and Italy are experiencing growth In the construction sector, driving the demand for urethane adhesives. Germany, in particular, is a significant consumer of these adhesives, with industries such as construction, electrical and electronics, packaging, automotive, and aerospace contributing to the demand. In Germany, the growing economy and urbanization have led to a rise in demand for housing units, especially in non-residential and commercial buildings.

The high population density in urban areas and limited urban space have created a need for efficient and space-saving packaging solutions, further boosting the demand for urethane adhesives. The use of urethane adhesives also offers environmental benefits, such as low VOC emissions and carbon dioxide foaming, making them an attractive choice for green buildings and the low-carbon energy economy.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Urethane Adhesives Industry?

Growing demand from building and construction industry is the key driver of the market.

What are the market trends shaping the Urethane Adhesives Industry?

Increasing adoption of sustainable products is the upcoming market trend.

What challenges does the Urethane Adhesives Industry face during its growth?

Volatile raw material price is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The urethane adhesives market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the urethane adhesives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, urethane adhesives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

3M Co. - Urethane adhesives, marketed under the Scotch-Weld brand, represent a significant product category for the company. These high-performance adhesives offer superior bonding capabilities across various industries, including automotive, construction, and electronics. Urethane adhesives are known for their versatility, providing resistance to moisture, heat, and chemicals. The Scotch-Weld brand's commitment to innovation ensures continuous improvement in product offerings, catering to evolving industry requirements. Urethane adhesives' ability to bond dissimilar materials and provide strong, long-lasting bonds makes them an essential component in numerous applications. The company's extensive expertise in adhesive technology and commitment to quality underpIn the success of its urethane adhesive product line.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Akzo Nobel NV

- Anabond Ltd.

- Arkema

- Ashland Inc.

- Avery Dennison Corp.

- DELO Industrie Klebstoffe GmbH and Co. KGaA

- Dow Inc.

- H.B. Fuller Co.

- Henkel AG and Co. KGaA

- Huntsman Corp.

- Illinois Tool Works Inc.

- Jowat SE

- KLEBCHEMIE MG Becker GmbH and Co. KG

- Parker Hannifin Corp.

- Pidilite Industries Ltd

- Scott Bader Co. Ltd.

- Sika AG

- Wacker Chemie AG

- Yokohama Rubber Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Urethane adhesives, a type of polyurethane, are widely used in various industries due to their superior bonding properties. These adhesives offer excellent cohesion and elasticity, making them suitable for applications requiring high adhesive strength and flexibility. The market for urethane adhesives is driven by several factors, including the growing demand for construction projects, increasing renovation activities, and the expanding electronics industry. Isocyanates, the primary building blocks of urethane adhesives, undergo a chemical reaction with alcohol functionalities to form uretonimine linkages. This reaction results In the formation of urethane adhesives with desirable properties such as hydrogen bonding, solvent resistance, and long shelf life.

Urethane adhesives find extensive applications In the building and construction sector, particularly In the production of thermoset and thermoplastic materials. In this industry, they are used to bond various materials, including concrete, wood, and metals, In the construction of housing units and infrastructure. The increasing demand for green buildings and low-carbon energy economies has further boosted the market for urethane adhesives in this sector. The electronics industry is another significant end-user of urethane adhesives. These adhesives are used extensively In the manufacturing of electronic devices, electrical equipment, and medical devices due to their excellent bonding properties and ability to withstand high temperatures and harsh environments.

The automotive and footwear industries also utilize urethane adhesives due to their high cohesive strength and elasticity. In the automotive industry, they are used for bonding various components, including body panels and glass, while in footwear production, they are used for attaching soles to uppers. Urethane adhesives are also used in various packaging applications, including container packaging, end-of-line packaging, and functional barrier applications. These adhesives offer excellent resistance to solvents and moisture, making them ideal for use in various types of packaging, including metal and smart packaging. The market for urethane adhesives is expected to grow significantly due to the increasing demand for housing units, construction activities, and electronics manufacturing.

Additionally, the growing trend towards e-commerce and the need for space-saving and dissolvable packaging are also expected to drive the market for urethane adhesives. Urethane adhesives offer several advantages over traditional adhesives, including faster cure times, longer pot life, and lower VOC emissions. These advantages make them a popular choice for various industries, particularly those requiring high-performance adhesives with quick turnaround times. In conclusion, the market for urethane adhesives is driven by several factors, including the growing demand for construction projects, increasing renovation activities, and the expanding electronics industry. These adhesives offer several advantages over traditional adhesives, including excellent bonding properties, fast cure times, and long shelf life.

The market for urethane adhesives is expected to grow significantly In the coming years due to the increasing demand for housing units, construction activities, and electronics manufacturing.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3% |

|

Market growth 2024-2028 |

USD 1160.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.9 |

|

Key countries |

US, Germany, France, China, and Switzerland |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Urethane Adhesives Market Research and Growth Report?

- CAGR of the Urethane Adhesives industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the urethane adhesives market growth of industry companies

We can help! Our analysts can customize this urethane adhesives market research report to meet your requirements.