Construction Adhesives Market Size 2024-2028

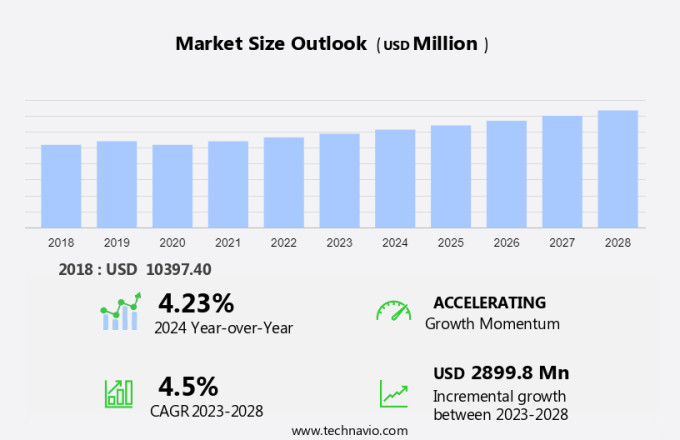

The construction adhesives market size is forecast to increase by USD 2.9 billion, at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth, driven by several key factors. Firstly, increased government spending on infrastructure projects worldwide is leading to a surge in demand for construction adhesives. Secondly, there is a rising trend towards the adoption of eco-friendly adhesives due to growing environmental concerns. This shift is expected to drive the market for sustainable adhesive solutions. Additionally, the price of construction adhesives has been on the rise due to increasing raw material costs and supply chain disruptions. Despite these challenges, the market is expected to continue its growth trajectory, fueled by the ongoing demand for durable and high-performance adhesives in the construction industry.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market is evolving with diverse products tailored for various applications. The industry features solvent-based adhesives and water-based adhesives, including acrylic adhesives, polyvinyl acetate, and epoxy adhesives. A significant focus is on low-VOC adhesives and VOC-free adhesives for eco-friendly solutions. Wood, metal, plastic, and concrete bonding are well-represented, with solutions in the residential, commercial construction, and nonresidential sector. The industrial segment benefits from innovations like VC shield technology and epoxies. Polyurethane adhesives and reactive adhesives are key players, with advancements in water-based technology. Eco-friendly construction adhesives such as OSI Green Series and Titebond GREENchoice highlight the push towards green products. The market caters to infrastructure, nonresidential, and residential needs, embracing green products for sustainable growth.

Key Market Driver

Increased government spending on infrastructure is notably driving market growth. The construction adhesives industry is experiencing significant growth due to the increasing demand from both the residential and nonresidential sectors. In the industrial segment, the use of construction adhesives is prevalent in applications such as carpet laying, tile installation, and wallpapers. Epoxies and polyurethane adhesives are popular choices in industrial settings due to their high bonding strength and durability. In the nonresidential sector, reactive adhesives are commonly used for construction applications. The rise in government spending on infrastructure projects is driving the demand for construction adhesives, as these projects require strong and long-lasting adhesives for various applications.

Additionally, there is a growing trend towards the use of ecofriendly construction adhesives, such as the OSI Green Series and Titebond GREENchoice, due to increasing concerns about sustainability and the environment. These green products offer similar performance to traditional adhesives while reducing the carbon footprint of construction projects. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The rise in adoption of eco-friendly adhesives is the key trend in the market. The construction adhesives industry is witnessing significant growth, particularly in the nonresidential sector and industrial segment. Epoxies and polyurethane adhesives continue to dominate the market due to their superior bonding strength and durability. However, the trend is shifting towards solvent-free and reactive adhesives, which emit fewer volatile organic compounds (VOCs) and contribute to a healthier work environment. In response to the increasing demand for eco-friendly construction adhesives, manufacturers are producing green products that use low VOC-emitting materials, such as recycled denim or cellulose insulation.

Moreover, these eco-friendly adhesives are gaining popularity in applications like carpet laying, tile installation, and wallpaper hanging, as they help reduce solvent emissions and airborne particles. Some notable brands in this space include the OSI Green Series and Titebond GREENchoice. The future of the market lies in the production of adhesives from renewable, plant-based, and animal-based materials, such as starch, mussels, oysters, and others. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

The rise in the price of construction adhesives is the major challenge that affects the growth of the market. The Construction Adhesives industry is experiencing notable growth in both the Residential and Nonresidential sectors. The Industrial segment, specifically, is witnessing a considerable increase in demand due to its extensive use in applications such as carpet laying, tile installation, and wallpapers. Epoxies and Polyurethane adhesives dominate the market, with Solvent-based products and Reactive adhesives following closely. However, the market growth is challenged by the high cost of construction adhesives, particularly in developing economies. The production of these adhesives relies on raw materials sourced from crude oil and petrochemicals, including silicone, polyurethane, ethylene vinyl acetate, and others.

Further, the unpredictability of crude oil prices may impact the cost of raw materials, potentially affecting market vendors' profitability. For instance, the global crude oil price escalated from USD50 per barrel to USD86 per barrel between January 2021 and October 2021. In response to environmental concerns, the demand for Ecofriendly construction adhesives, such as OSI Green Series and Titebond GREENchoice, is on the rise. Green products are gaining popularity due to their reduced carbon footprint and sustainability. Hence, the above factors will impede the growth of the market during the forecast period

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - The company offers polyurethane construction sealant 525 which is designed to seal construction expansion joints.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ARDEX GmbH

- Arkema SA

- Avery Dennison Corp.

- Custom Building Products

- DAP Global Inc.

- Dow Inc.

- Dribond Construction Chemicals

- DURA PRO

- FLEXTILE LTD.

- Franklin International

- H.B. Fuller Co.

- Henkel AG and Co. KGaA

- Illinois Tool Works Inc.

- JMH International Ltd.

- LATICRETE International Inc.

- Mapei SpA

- Saint Gobain Weber

- Sika AG

- Terraco Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

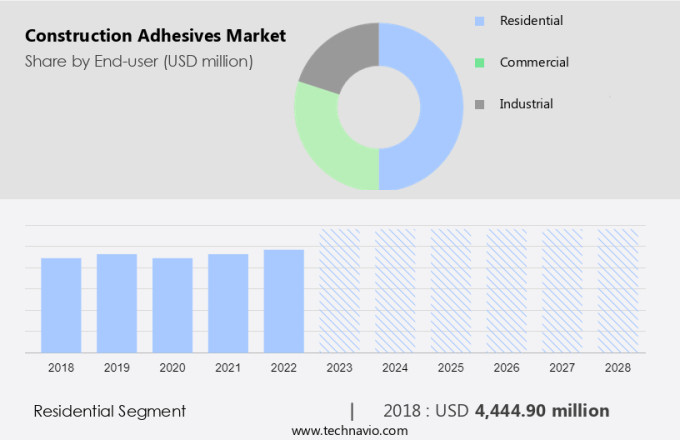

By End-user

The residential segment is estimated to witness significant growth during the forecast period. Construction adhesives play a crucial role in various applications within the construction industry, including bonding wood, metal, plastic, concrete, foam boards, shingles, tiles, membranes, vinyl, carpet, and diverse materials used in flooring installation, baseboards installation, crown molding installation, drywall bonding, and infrastructure projects. The market for construction adhesives encompasses several types, such as solvent-based adhesives, water-based adhesives, acrylic adhesives, polyvinyl acetate, epoxy adhesives, low VOC adhesives, and VOC-free adhesives.

Get a glance at the market share of various regions Download the PDF Sample

The residential segment was the largest and was valued at USD 4.44 billion in 2018. Solvent-based adhesives, known for their high bonding strength, are widely used in applications requiring high abrasion resistance, like road construction, bridge repair, and tunnel installation. Water-based adhesives, on the other hand, offer energy efficiency and are preferred for applications like roofing installation, wall paneling, insulation installation, and residential construction due to their eco-friendly properties. Advancements in technology have led to the development of reactive technology, such as VC shield technology and water-based technology, which provide enhanced performance and durability. Epoxy adhesives, known for their excellent strength and chemical resistance, are commonly used in commercial and industrial construction and infrastructure projects. The demand for low VOC and VOC-free adhesives is increasing due to environmental concerns and regulations.

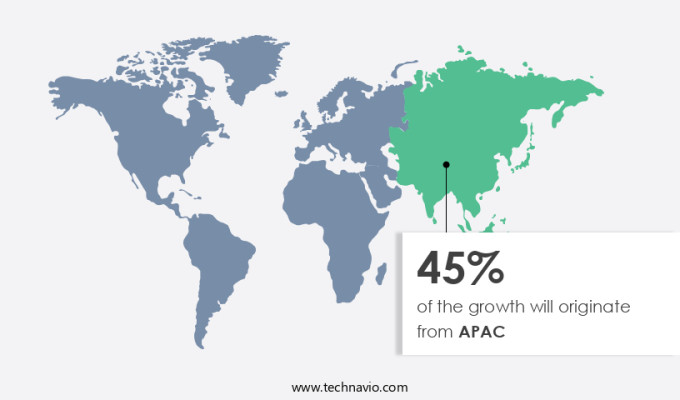

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Construction adhesives play a crucial role in various applications within the construction industry, including bonding wood, metal, plastic, concrete, foam boards, shingles, tiles, membranes, vinyl, carpet, and other materials for flooring installation, baseboards installation, crown molding installation, drywall bonding, and infrastructure projects. The market for construction adhesives encompasses various types, such as solvent-based adhesives, water-based adhesives, acrylic adhesives, polyvinyl acetate, epoxy adhesives, low-VOC adhesives, and VOC-free adhesives. Solvent-based adhesives offer high bonding strength and fast curing, while water-based adhesives provide energy efficiency and lower VOC emissions.

However, acrylic adhesives offer excellent bonding strength and water resistance, making them suitable for applications like roofing installation and wall paneling. Epoxy adhesives provide superior abrasion resistance and chemical resistance, making them ideal for bridge repair, tunnel installation, and industrial construction. Construction adhesives are used extensively in residential, commercial, and industrial construction, as well as infrastructure projects. The latest advancements in technology include VC shield technology, water-based technology, reactive technology, and solvent-based technology, which offer enhanced performance and durability. These adhesives contribute significantly to energy efficiency, infrastructure development, and the overall success of construction projects.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- End-user Outlook

- Residential

- Commercial

- Industrial

- Application Outlook

- Large Enterprise

- Small and Medium Enterprise

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

- Adhesives and Sealants Market by Technology, End-user, and Geography - Forecast

- Industrial Adhesives Market Analysis APAC, North America, Europe, Middle East and Africa, South America - US, China, Japan, Germany, UK - Size and Forecast

- Adhesive Market Analysis APAC, North America, Europe, South America, Middle East and Africa - China, US, Germany, India, UK - Size and Forecast

Market Analyst Overview

Construction adhesives refer to specialized bonding agents used in the construction industry for joining various materials such as wood, metal, plastic, concrete, foam boards, shingles, tiles, membranes, vinyl, carpet, and more. Two common types of construction adhesives are solvent-based and water-based adhesives. Solvent-based adhesives, including acrylics and epoxies, offer strong bonding capabilities but can emit volatile organic compounds (VOCs), requiring proper ventilation during application. In response, the market has seen a shift towards low VOC and VOC-free adhesives, such as polyvinyl acetate and acrylics. Construction adhesives play a crucial role in various applications, including flooring installation, baseboards installation, crown molding installation, drywall bonding, road construction, bridge repair, tunnel installation, roofing installation, wall paneling, insulation installation, residential construction, commercial construction, industrial construction, and infrastructure projects. Advanced technologies like VC shield technology and water-based technology enhance the performance and sustainability of construction adhesives. Key features include energy efficiency, abrasion resistance, and compatibility with diverse materials.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 2.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 45% |

|

Key countries |

US, China, India, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., ARDEX GmbH, Arkema SA, Avery Dennison Corp., Custom Building Products, DAP Global Inc., Dow Inc., Dribond Construction Chemicals, DURA PRO, FLEXTILE LTD., Franklin International, H.B. Fuller Co., Henkel AG and Co. KGaA, Illinois Tool Works Inc., JMH International Ltd., LATICRETE International Inc., Mapei SpA, Saint Gobain Weber, Sika AG, and Terraco Holdings Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies